What Is The Role Of State Health Departments In Car Insurance Claims

Exploring the Intersection of State Health Departments and Car Insurance Claims

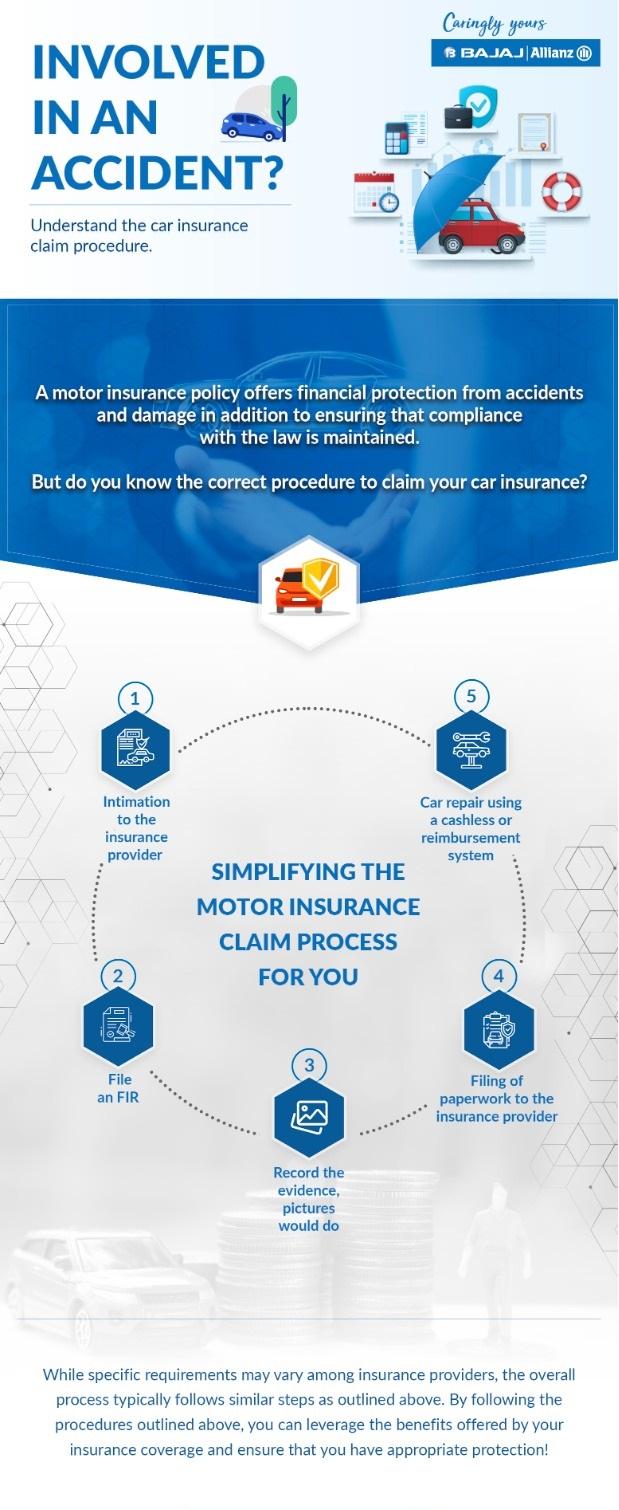

The journey of understanding the role of state health departments in the nuanced world of car insurance claims starts with acknowledging the structured chaos that often follows a vehicle accident. In these tumultuous moments, where emotions run high and health concerns take precedence, the last thing most victims consider are the intricate bureaucratic webs binding state health departments and insurance providers. Yet, this is precisely where the clarity and operational efficiency facilitated by these departments can play a pivotal role.

State health departments, with their established guidelines and resources, serve as the unseen architects of order in the immediate aftermath of road accidents. They are crucial in ensuring injured parties receive timely and adequate medical attention, while simultaneously laying down a framework that aids insurance companies in processing claims efficiently and accurately. But how precisely do they do this? What are the mechanisms and protocols through which they influence and interact with car insurance providers?

To appreciate the involvement of these departments, we must delve into their multifaceted responsibilities which stretch beyond their primary remit of maintaining public health. From facilitating access to emergency medical services to dictating the standards of care that impact insurance payouts, state health departments are deeply interwoven with the claims process, albeit in ways not immediately visible to the average claimant. Additionally, their role in data collection and regulation shapes how insurance companies assess risk and coverage policies, ultimately affecting premium calculations and payout rates.

Within the following sections of this blog, we will explore how state health departments play a key regulatory, advisory, and logistical role in car insurance claims. We will unravel the protocols they oversee, the databases they maintain, and the partnerships they forge with medical facilities and insurance adjusters to ensure that any medical expenses linked to vehicular accidents are justly and swiftly addressed. Weâll also examine how this partnership impacts policyholders and shapes a stateâs health insurance climate.

Furthermore, understanding this dynamic can empower consumers by highlighting the importance of being informed about their stateâs health department policies and how these can affect their coverage options and obligations. As we decode these complex interactions, readers will gain insights into not just the operational facets but also the strategic implications of these departments on broader insurance landscapes.

So, whether youâre a policyholder wanting to understand your rights, an insurer aiming to streamline claims processing, or merely a curious reader yearning to comprehend the behind-the-scenes operations that ensure a coherent claims process, this article provides a comprehensive guide. We promise an enlightening journey that dissects the pivotal interactions often taken for granted but fundamentally essential to the efficacy of car insurance claims.

Join us as we dive deeper into this intriguing alliance, and discover just how pivotal a role state health departments play in the world of car insurance.

The Synergy Between State Health Departments and Car Insurance Claims

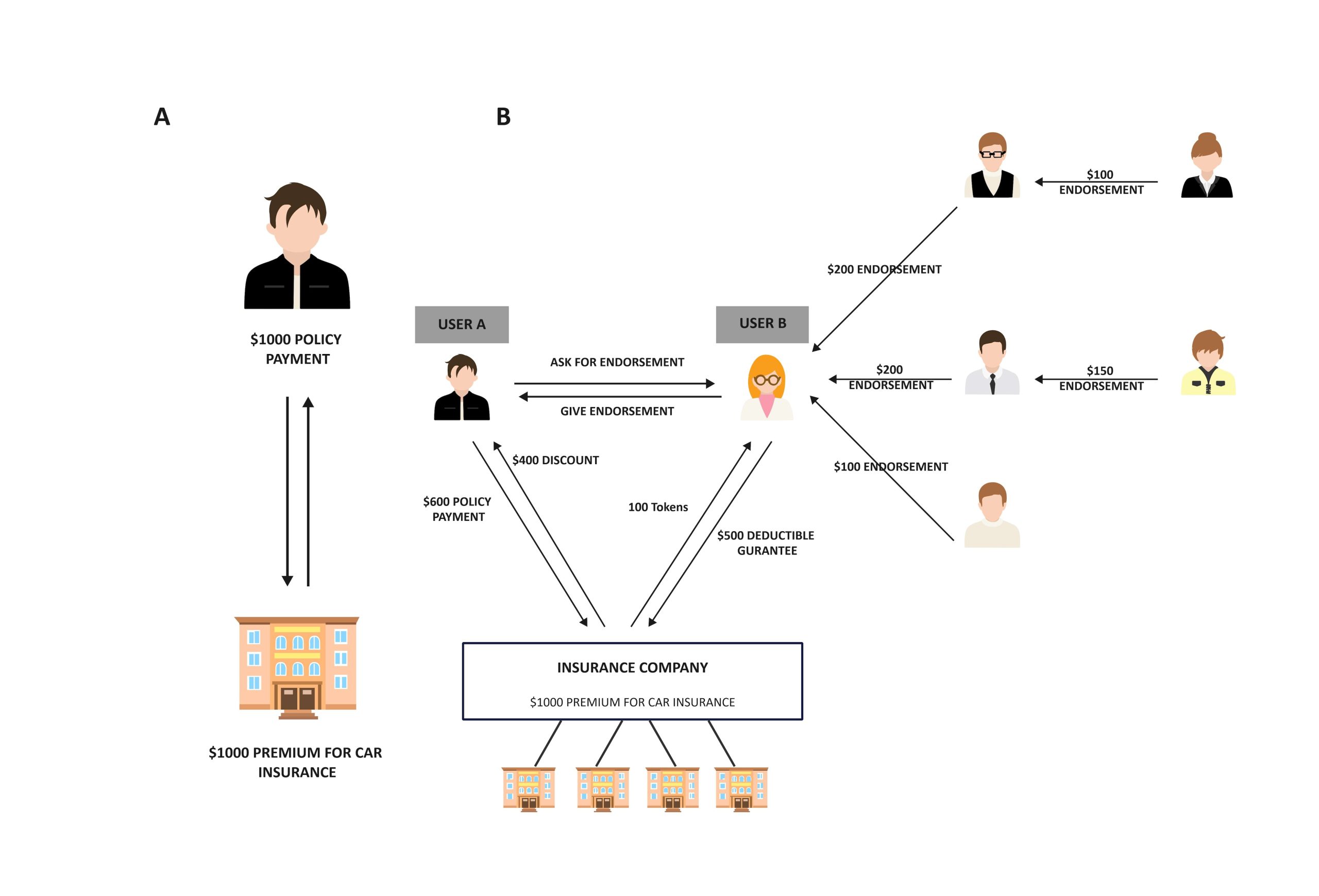

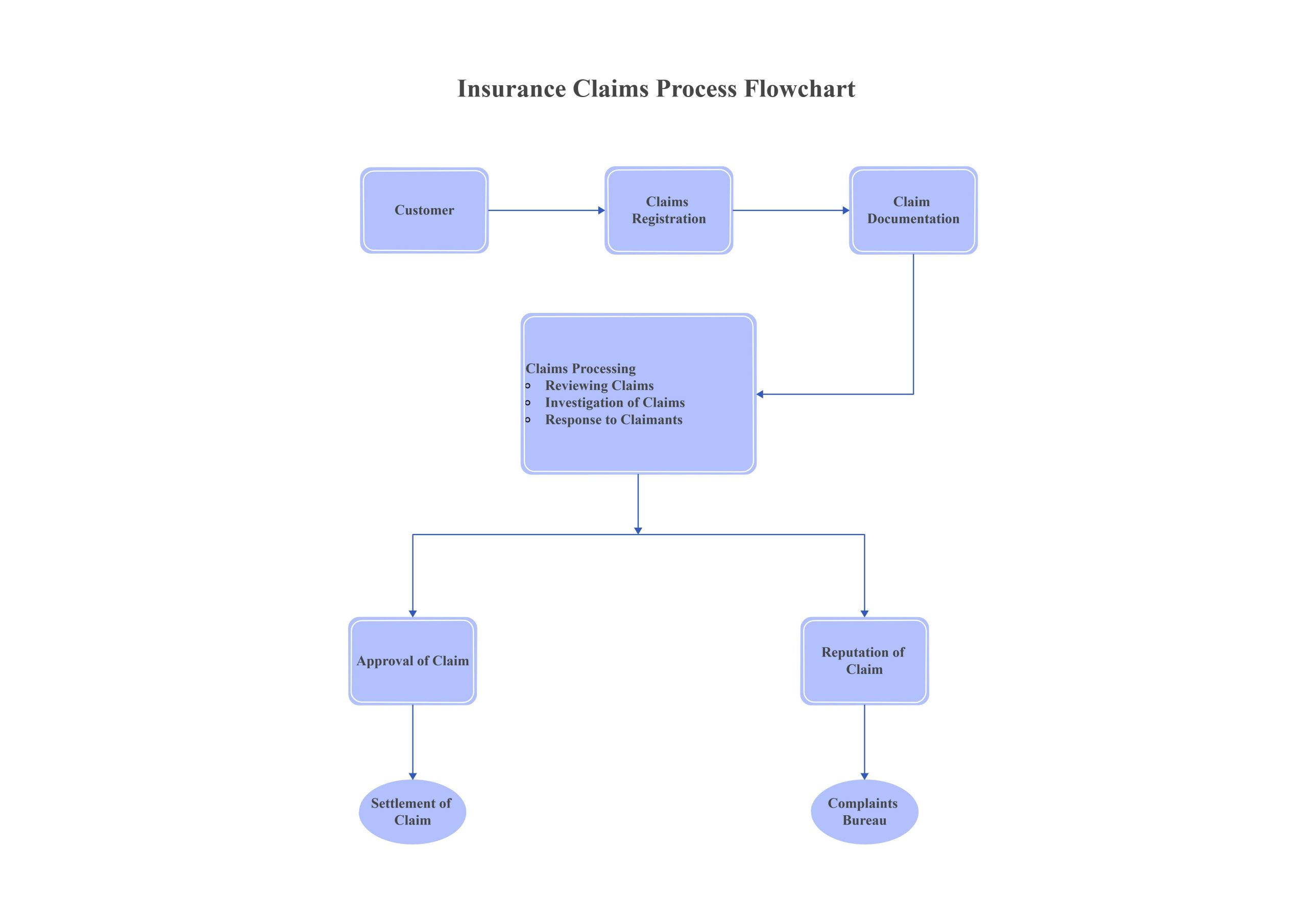

While state health departments primarily focus on maintaining and improving public health, their involvement in car insurance claims is an intricate yet vital aspect of their operations. This role can be appreciated through their functions in regulation, data sharing, and resource provision. Their work ensures the bridging of gaps between healthcare providers, insurers, and policyholders.

Regulation and Policy Implementation

State health departments hold significant regulatory power. They establish policies and guidelines that indirectly influence car insurance claims, particularly those involving injuries. By setting health standards and regulations for healthcare providers, state health departments ensure that healthcare services rendered after auto accidents adhere to quality standards. This impacts the cost and validity of claims.

- Accreditation of Medical Facilities: By accrediting medical facilities and professionals, state health departments assure insurers and policyholders that care provided is reliable and necessary.

- Guidelines for Medical Billing: They issue guidelines on acceptable billing practices for accident-related medical services. Insurers rely on these to verify claims.

Data Collection and Analysis

Data is crucial in forming effective health policies and making informed decisions in car insurance claims. State health departments collect and analyze data on road accidents and associated health outcomes, which aids insurers in risk assessment and premium determination.

- Accident and Health Statistics: Compiled data helps in understanding common injuries and health trends resulting from motor vehicle accidents.

- Electronic Health Records (EHR): These records, often regulated and managed at the state level, facilitate efficient communication between healthcare providers and insurers, speeding up the claims process.

Coordination with Healthcare Providers

Another critical role of state health departments is their function as coordinators. They streamline processes between healthcare entities and insurance companies to ensure smooth and timely resolution of claims.

- Network Management: State health departments assist in the formation and maintenance of networks that connect hospitals, clinics, and pharmacy providers with insurance firms.

- Emergency Response Protocols: They develop and distribute protocols that healthcare providers follow during emergencies, influencing initial care and subsequent claims.

Promoting Public Health and Safety Initiatives

The emphasis on prevention cannot be overstated; state health departments spearhead public health campaigns aimed at reducing road incidents, indirectly curtailing the burden on car insurers.

Educational Programs

State health departments launch educational programs that focus on safe driving, understanding insurance policies, and appropriate responses to accidents. These initiatives help reduce claim frequencies by promoting road safety.

- Driversâ Education: Targeting different age groups, these programs reinforce the importance of obeying traffic laws and using safety features.

- Policy Awareness: Workshops and seminars demystify the insurance process, helping consumers become informed and proactive claimants.

Road Safety Regulations

From setting speed limits to enforcing sobriety checkpoints, state health departments collaborate with other agencies to implement laws that minimize accidents. These regulations directly affect how claims are filed and processed by lowering the incidence of accidents.

- Vision Zero Strategies: Many states have adopted broad strategies aimed at eliminating road deaths and serious injuries, aligning public health objectives with insurers’ interests.

- Technology Integration: The use of technology for tracking and analyzing vehicular speeds and patterns has been promoted by state departments, maximizing safety on the roads.

Support for Policyholders and Providers

State health departments provide indispensable support services that benefit both patients and healthcare providers during the insurance claim process.

Consumer Assistance

They offer resources to consumers to help understand their rights and responsibilities when dealing with insurance claims. This support can include:

- Helplines and Online Resources: Many states provide helplines and websites where consumers can obtain information and guidance.

- Mediation Services: In cases of disputes between insurers and claimants, state health departments may offer mediation to facilitate amicable resolutions.

Technical Support for Providers

To ensure compliance with health and billing standards, state health departments provide ongoing technical support to healthcare providers. This includes:

- Training and Workshops: Regular training sessions help healthcare facilities maintain high levels of care and stay updated with billing standards.

- Compliance Checks: State health departments perform audits to ensure adherence to health and safety regulations.

Collaboration with Insurance Regulatory Bodies

The close collaboration between state health departments and insurance regulatory agencies can significantly influence the car insurance claims process.

Joint Committees and Task Forces

These collaborations often manifest as joint committees and task forces that work on issues affecting both health and insurance landscapes, such as:

- Health Reforms: Considering the impact of health reforms on insurance, these committees develop guidelines that balance public health and insurance needs.

- Fraud Prevention: They develop strategies to identify and prevent fraudulent claims, ensuring the integrity of insurance systems.

Legislative Feedback

State health departments often furnish insights and feedback on proposed legislation affecting auto insurance, ensuring that the laws enacted reflect current health data and trends.

- Policy Advocacy: They advocate for policies that align public health objectives with insurance outcomes, influencing legislative processes.

Conclusion

As we draw to a close on our discussion about the involvement of state health departments in the intricate process of car insurance claims, let’s revisit the essential points highlighted in our exploration. This analysis has underscored the multifaceted role these departments play, which extends far beyond mere oversight. They’ve become pivotal in the landscape of ensuring that public health considerations are harmonized with financial and regulatory frameworks that govern car insurance.

First, we delved into the historical context of state health departments’ intersection with car insurance claims. We recognized that although not traditionally associated with car insurance, these departments have increasingly become significant players in addressing the repercussions of car accidents, particularly from a public health perspective. This intersection embraces both the preventative stance against injuries resulting from car accidents and the subsequent roles in claim evaluations.

Secondly, we examined how state health departments contribute to setting safety standards and regulations that influence the terms and conditions of car insurance policies. By advocating for stringent safety measures, they indirectly impact premium calculations and claim assessments. Their involvement ensures that health-related concerns, such as injuries sustained in vehicular accidents, are mitigated through proactive policy frameworks.

Moreover, another critical role identified was the data analytics capabilities that state health departments bring to the table. Through the collection and analysis of health data related to traffic accidents, these departments facilitate the development of more accurate risk assessment models. Such models are invaluable to insurance companies as they work to calibrate premiums and payouts while simultaneously fostering robust protocols for reducing accident-related injuries.

The cooperative interface between state health departments and insurance companies was another focal point. We discussed how enhanced collaborations have resulted in improved practices for processing claims related to personal injury protection. Through these partnerships, both entities can more effectively manage claims while minimizing fraudulent activities and optimizing the claims process for victims who need swift resolutions.

In addition, the educational outreach spearheaded by state health departments cannot be overstated. Public awareness campaigns about health and safety not only aid in reducing accident rates but also help consumers understand their rights and responsibilities when filing insurance claims. This education facilitates a more informed public, capable of engaging with insurers in a more substantive way, fostering a healthier dynamic in the insurance claim process.

Of special note was the department’s role during public health emergencies, which can drastically affect the claims landscape. Whether dealing with pandemics or large-scale accidents, the integration of health departments in the operational strategies of insurers provides a seamless method to address claims and public safety concerns simultaneously.

As we summarize the comprehensive examination of the roles played by state health departments in car insurance claims, it becomes apparent that their influence is both profound and essential. They serve as a crucial link in ensuring that the well-being of the public is adequately protected by the insurance mechanisms in place, promoting a balance between financial and health-related considerations.

Looking ahead, it is crucial for policy-makers, insurance companies, and health departments to continue fostering open channels of communication and cooperation. There is an ever-present need to refine and improve the systems in place to ensure that they are adaptable to future challenges, including technological advancements in vehicles, evolving traffic safety norms, and the specter of climate change impacting driving conditions.

Call to Action

In light of this extensive review, we urge you, our readers, to engage with this pivotal topic further. Understanding the intricate roles that state health departments play in car insurance claims is crucial not just for industry professionals, but for consumers as well. Here’s how you can make a difference:

- Stay Informed: Keep abreast of changes in traffic safety regulations and public health policies that could affect your car insurance claims.

- Participate in Discussions: Engage with local initiatives or online forums focused on the intersection of health and car insurance to voice your opinion and learn from others.

- Advocate for Transparency: Encourage your local representatives to support transparency and collaboration between health departments and insurance providers.

- Educate Yourself: Understanding the insurance claim process and what it involves can empower you when dealing with your policies.

- Support Safety Initiatives: By participating in community safety programs, you can contribute to reducing accident rates and improving overall public health.

Your involvement can drive the industry’s evolution towards a more integrated approach where public health and financial well-being function symbiotically. Let us commit to pushing forward this dialogue, ensuring that we are informed advocates for systems that prioritize both our health and our security.

Thank you for joining us in this exploration. We hope this has broadened your understanding and encouraged you to think critically about the unseen networks that form the backbone of our insurance systems. We look forward to exploring these intersections further in our upcoming posts. Don’t forget to follow our blog for more insights and updates in this evolving field.

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology