What Are The Medical Implications Of Driving Without Insurance In The Us

The Hidden Health Hazards of Driving Without Insurance: An Indispensable Guide

In the tapestry of American life, driving is woven as a crucial thread. From cross-country adventures to daily commutes, the open road symbolizes freedom, independence, and the lively pulse of society. However, with great freedom comes greater responsibility. One of the critical aspects of this responsibility is ensuring your vehicle is adequately insured. While most states in the U.S. mandate car insurance as a legal requirement, a surprising number of drivers still risk hitting the roads without it. This decision often leads to unforeseen and potentially devastating impacts—chief among them are the medical implications.

Why should you care? The issue of driving without insurance extends far beyond the expected financial burdens and legal consequences. It harbors a silent web of medical challenges that not only affect the uninsured drivers themselves but also ripple across to victims of crashes, healthcare systems, and even the fabric of the community. We are embarking on an exploration of these unseen terrains, where health risks and complex ethical questions loom large.

The subject begs us to consider: What happens when uninsured drivers crash? We delve beyond the statutes and dive into human stories, unraveling the medical chaos and ethical dilemmas that ensue when the unfortunate intersect with lack of foresight, or necessity forces the choice of skipping coverage. From emergency room decisions marked by uncertainty to the long-term care required for severe injuries, the absence of insurance complicates an already fraught situation.

Our exploration will cover various key dimensions:

- The Immediate Medical Consequences: What are the immediate healthcare responses and priorities when an uninsured driver is involved in an accident? We’ll examine the strain on emergency services and the delicate ethical balance healthcare providers must maintain.

- The Economic Implications: How does the absence of insurance affect medical bills, and what mechanisms, if any, exist to mitigate such costs? By understanding the economic burdens, we can appreciate the broader implications on healthcare systems and society.

- Long-term Health Impact: Without insurance, there’s often a dangerous gap in follow-up care. We’ll analyze the long-term effects of this gap, particularly for those with chronic injuries or disabilities resulting from accidents.

- Public Policy and Ethical Considerations: What ethical responsibilities do we owe to drivers and victims alike? Are there policy solutions that better protect individuals and communities?

Our journey through the implications of driving without insurance is not merely a fact-finding mission. It’s a call for awareness, urging readers to reflect on personal decisions, societal structures, and the shared responsibilities we bear as road users. Alongside statistics and policy critiques, we will share human angles, featuring interviews and personal stories from medical professionals, accident survivors, and legal experts who encounter these issues firsthand.

By weaving together legal, medical, and ethical threads, this blog post aims to shine a light on an aspect of driving often veiled in both ignorance and inevitability. Whether you’re reading as a concerned driver, a policymaker, or simply a curious mind, this exploration promises to arm you with insights and understanding crucial to navigating the road ahead safely and consciously. So, buckle up as we embark on this vital odyssey, uncovering truths that are not only critical but necessary for fostering a safer, more equitable driving environment.

Let’s turn the ignition together and drive through the compelling aspects of this often-overlooked issue, unlocking pathways to more informed decisions and better-protected communities.

The Medical Dangers of Driving Without Insurance

Also Read: Cindynal Hexapetide Cream

Driving without insurance in the United States introduces several medical dangers that can have severe consequences. Car accidents are unpredictable, and the injuries that result can range from minor to life-threatening. When a driver is uninsured, the financial and medical implications are substantial, impacting not just the health of the driver but also other parties involved.

Lack of Coverage for Medical Expenses

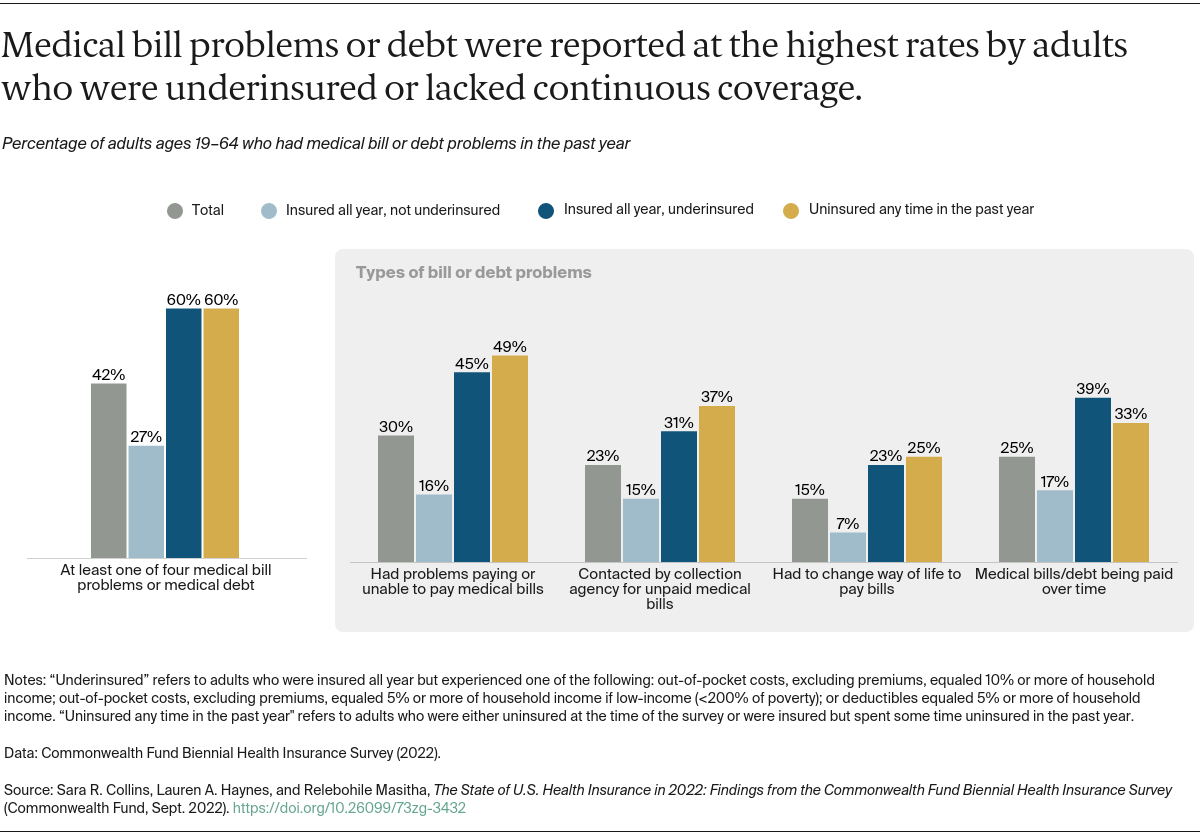

Uninsured drivers lack the essential coverage that insurance provides. In the event of an accident, medical expenses can skyrocket, encompassing emergency room visits, surgeries, hospital stays, follow-up appointments, and rehabilitation services. Without insurance, drivers must pay out of pocket for these unexpected costs, leading to extraordinary financial strain.

Consider a scenario where an uninsured driver suffers a broken leg due to an accident. The cost of emergency treatment, surgery, hospital admission, and physical therapy can easily reach tens of thousands of dollars. For uninsured individuals, this can lead to severe financial hardship, making adequate medical treatment unattainable.

The Ripple Effect on Victims

When an uninsured driver is responsible for an accident, the medical costs for others involved can also become a significant issue. While most drivers carry insurance, the policies may not fully cover the extent of the damages and injuries incurred. This can leave other drivers, passengers, and pedestrians personally liable for covering their expenses, or facing incomplete or inadequate medical care.

Furthermore, the stress of dealing with an uninsured motorist often complicates recovery processes for victims, exacerbating both physical and emotional distress.

The Ethical Complexities of Driving Uninsured

Driving without car insurance not only presents medical risks, but also opens ethical concerns that reflect broader societal issues.

Responsibility and Accountability

One ethical issue is the importance of responsibility and accountability on the road. When drivers choose to forego insurance, they are, in essence, neglecting their responsibility to safeguard not only their well-being but also that of others who share the road. In America, driving is a privilege that comes with legal and moral obligations. Insurance acts as a protective measure, ensuring accountability when accidents occur.

An uninsured driver who causes an accident may evade financial accountability, leaving victims without proper compensation and support. This lack of accountability and responsibility can undermine the trust and safety essential among drivers.

Impact on Healthcare Systems

The presence of uninsured drivers introduces a strain on the healthcare system. When uninsured drivers cannot afford medical bills, they may delay necessary treatments or seek assistance from uninsured motorist funding or hospital payment programs. These shifts can burden hospital resources and redirect funds from other necessary medical programs.

The ethical implications extend to healthcare providers who often face difficult choices between offering uncompensated care or denying services.

Legal Consequences and Medical Outcomes

Beyond medical and ethical considerations, driving without insurance is illegal in most U.S. states, leading to significant legal repercussions which can indirectly affect medical care.

Legal Repercussions

Uninsured drivers caught without insurance face penalties that often include fines, license suspension, and vehicle impoundment. Legal battles following uninsured accidents can create further obstacles to accessing medical care as individuals may prioritize legal debts over health expenditures.

Insurance and Medical Outcomes

The medical outcomes for uninsured drivers may be poor due to delayed treatment and financial inaccessibility to top-tier care. When an individual prioritizes covering legal and financial repercussions, necessary healthcare can be compromised, ultimately leading to prolonged recovery times and lingering health issues.

The Societal Cost of Uninsured Driving

The societal cost of driving without insurance extends beyond affected individuals, trickling down to impact communities at large.

Increased Insurance Premiums

For insured drivers, the risk and costs associated with uninsured drivers translate into increased insurance premiums. Insurance companies adjust rates to mitigate the potential financial loss presented by accidents involving uninsured drivers, thus spreading the economic burden to the broader driving population.

Public Health Implications

Uninsured drivers not only heighten the risk of individual harm but also worsen public health metrics. Streets with heightened incidents of uninsured driving compel local governments to invest more in road safety and medical emergency response, often diverting resources from other public health initiatives.

The Path Forward

The layers of complexity surrounding uninsured driving in America require a nuanced understanding of the linked medical, ethical, and societal factors at play. Solutions must address not only legal enforcement and individual responsibility but broader insurance accessibility and public education efforts.

Navigating the Medical Implications of Driving Without Insurance in the US

As we reach the conclusion of our in-depth exploration into the medical repercussions of driving without insurance in the United States, it is crucial to reflect on the key points we have discussed and emphasize the importance of taking proactive measures to safeguard oneself and others on the road.

In the introductory section of this blog, we delved into an overview of the unsettling statistics around uninsured drivers in the US, highlighting the pervasive nature of this issue that affects millions. This set the stage for our subsequent exploration of how driving without insurance not only violates the law but can also have grave financial and health-related consequences for all parties involved in an accident.

Recap of Key Medical Implications

Throughout the main content, we dissected several critical medical implications associated with driving uninsured. First and foremost, one of the most significant impacts is the potential for uninsured motorists to face substantial medical debts in the aftermath of an accident. Without insurance, medical treatment costs can skyrocket, leading to insurmountable financial burdens and possibly bankruptcy for the at-fault driver.

Another profound issue discussed was the risk of inadequate medical care. Drivers without insurance may hesitate or avoid seeking necessary medical attention due to fear of high out-of-pocket expenses. This can result in untreated injuries, long-term health complications, and ultimately a reduced quality of life.

Moreover, the ripple effect of uninsured driving extends beyond individual health and finances. Hospitals and medical facilities often face increased strain as they provide uncompensated care, driving healthcare costs higher for everyone. Ultimately, the lack of insurance pushes the uninsured individual’s financial burden onto healthcare providers and insured motorists, fostering an unsustainable healthcare system with rising premiums.

Legal and Long-Term Consequences

Beyond immediate medical costs, we also explored the legal repercussions facing uninsured drivers. Legal penalties, such as fines, license suspension, and vehicle impoundment, can exacerbate the already dire situation for uninsured drivers. Furthermore, if involved in a serious accident, an uninsured driver may face lawsuits from injured parties seeking to cover their medical expenses and lost wages, adding substantial legal fees to the financial burden.

In discussing these various downsides, we underscored the ethical dimensions of driving uninsured. Strikingly, the decision to drive without insurance affects not only the driver but also innocent parties, who may endure significant physical, financial, and emotional trauma from accidents caused by uninsured individuals.

Moving Forward: A Call to Action

Armed with a thorough understanding of the medical and legal implications of driving without insurance, it is imperative that we act decisively to mitigate these risks. For those who are uninsured, obtaining even the most basic coverage can considerably reduce the potential for catastrophic financial and health-related consequences.

Beyond personal responsibility, advocating for broader community awareness and policy reform is vital. Governments, insurance companies, and community organizations must collaborate to create affordable insurance options and promote education programs highlighting the critical importance of insurance coverage.

To every reader, consider this not only an informational piece but a clarion call to action. Discuss the implications shared here with family, friends, and colleagues who might be uninsured or unaware of the gravity of driving without coverage. Share this post on your social networks to amplify the message and reach more individuals who can benefit from understanding the seriousness of this issue.

Finally, engage with your local legislators about insurance reform, supporting measures that ensure more Americans have access to affordable auto insurance. Doing so will not only protect individual drivers but will also contribute to a safer and more responsible driving environment for everyone.

In summary, while driving without insurance continues to be a pressing and multifaceted issue, by acknowledging its medical implications, we can collectively strive toward resolving it. Through awareness, education, and actionable steps, we can work to diminish the number of uninsured motorists on the road, thereby enhancing the safety and well-being of our communities.

Join the Conversation

For those who wish to delve deeper, we invite you to join the conversation by leaving comments below, sharing personal experiences, or proposing potential solutions. Your insights and stories are invaluable in further illuminating this issue and fostering a comprehensive dialogue on the impact of driving without insurance in the US.

Your voice matters, and together, we can drive change!

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology