Va Loan For Investment Property

VA Loan for Investment Property: Unlocking Opportunities for Veteran Investors

The world of real estate investment offers an enticingly diverse pool of opportunities, each promising the potential for financial growth and long-term wealth creation. Among the myriad choices investors can pursue, the notion of leveraging a VA loan to buy investment property, though unconventional, is slowly gaining traction. This might come as a surprise to many, given the general understanding that VA home loans are primarily designed to help veterans, active-duty service members, and certain members of the National Guard or Reserves acquire and retain their own homes.

So, can a veteran legitimately use a VA loan to chart a course through the waters of property investment? The answer is not as straightforward as one might hope, but it is certainly worth exploring. This blog post dives deep into this intriguing subject, aiming to equip you with the knowledge needed to navigate the complexities and potential benefits that a VA loan could offer in the realm of property investment.

First, let’s lay out the foundational understandings of what VA loans are. Rooted in history and fueled by a commitment to our nation’s service members, the VA loan program was established to provide those who have served with a feasible path to homeownership. These loans typically offer zero down payment options, competitive interest rates, and the absence of private mortgage insurance requirements. This unique combination makes VA loans an appealing choice for eligible borrowers looking to purchase a primary residence.

Given these advantageous terms, it’s no wonder that new doors are being considered by veteran investors who are eager to expand their investment portfolios. But how does one reconcile the primary residence requirement of a VA loan with the goal of acquiring investment property? This is where the possibilities and potential challenges of leveraging a VA loan for investment purposes begin to emerge. In our exploration, we’ll look at strategic approaches and the policies surrounding occupancy requirements, which form crucial elements of the topic at hand.

While this may sound complex, it’s important to remember that where there is a will, there is often a way. Some of the tools in this regard include purchasing a multi-unit property for owner occupancy while renting out the other units, or leveraging previously purchased homes into future investments through a process called “house hacking.†These strategies allow veterans to walk a fine line, respecting the intent of a VA loan while dipping a toe into the pool of investment property.

However, there are certain risks and limitations you must consider. The guidelines set by the Department of Veterans Affairs are in place to ensure that the primary focus remains on helping veterans secure a primary residence. That said, the strategic application of VA loans can serve as a stepping stone toward creating lucrative income streams or building wealth in the long term. Understanding eligibility criteria and the financial implications of such a venture will be key to making informed decisions.

As we delve further into this blog post, we’ll tackle several pressing questions:

- What exactly is permitted under the current VA loan regulations?

- How can veterans ethically and effectively use VA loans to initiate their real estate investment journey?

- What potential pitfalls should one be vigilant about, and when is seeking professional advice a wise move?

Prepare yourself for an insightful journey that seeks to unravel the intricacies of using a VA loan for investment property. Whether you’re a seasoned investor or a novice stepping into the world of real estate for the first time, this article will furnish you with practical tips, strategic insights, and expert perspectives to help you make the most of your VA loan benefits. It’s time to explore these untapped avenues and potentially lucrative opportunities that lie at the intersection of veteran benefits and real estate investment.

Ready to dive deeper? Let’s investigate how you can turn your moldable VA loan benefits into a solid pillar of your investment strategy, in a fully compliant and rewarding way.

Understanding VA Loan Basics

VA loans are a significant benefit designed to help U.S. military veterans, service members, and their families achieve homeownership. Backed by the U.S. Department of Veterans Affairs, these loans allow eligible borrowers to purchase homes with little to no down payment and offer competitive interest rates. The hallmark of a VA loan is its affordability and accessibility. However, the prospect of using a VA loan for investment properties presents unique challenges and considerations.

Eligibility Criteria for VA Loans

To qualify for a VA loan, you must meet specific service requirements. Generally, active duty members, veterans, and some members of the National Guard and Reserves are eligible. A key requirement is obtaining a Certificate of Eligibility (COE), which establishes your qualification for a VA-backed loan. Lenders also assess your credit score, income stability, and debt-to-income ratio in order to minimize lending risks.

Can You Use a VA Loan for Investment Properties?

While VA loans boast benefits like no down payment and no private mortgage insurance, they are primarily designed for purchasing a primary residence, not for buying investment properties. However, there are ways to navigate these restrictions creatively while adhering to the guidelines. Here’s how you can legally leverage a VA loan for investment purposes:

House Hacking

House hacking is one of the most talked-about methods in the VA loan landscape when considering investment opportunities. By purchasing a multi-unit property (up to four units) and living in one unit, you can rent out the others. This method allows you to generate rental income while technically still fulfilling the requirement for the property to be your primary residence.

- Benefits: Possible rental income generation and equity growth.

- Challenges: Managing tenant relationships and property maintenance.

Refinancing for Investment Purchases

If you already have a VA loan on your primary residence, you might consider refinancing as a strategy to free up cash or secure better terms. Some veterans use a cash-out refinance to tap into the equity of their primary home, using those funds to finance the purchase of a true investment property. However, it’s crucial to ensure that the financial math supports this move to avoid jeopardizing your primary residence’s financial security.

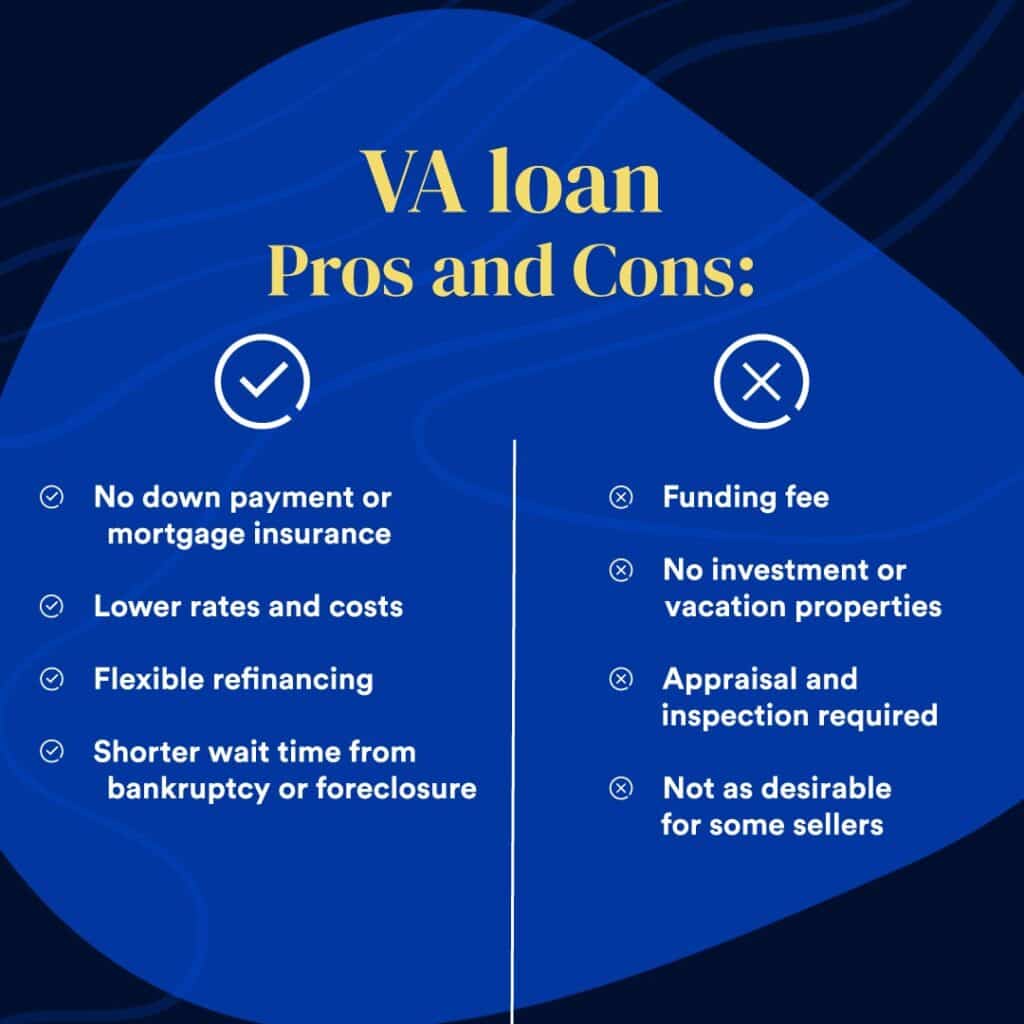

The Pros and Cons of Using a VA Loan for Investment

When thinking about utilizing a VA loan in pursuit of real estate investment, you must weigh the benefits against the potential pitfalls carefully:

Advantages

- Leveraging Low Rates: VA loans typically come with lower interest rates compared to conventional loans, which can decrease overall investment costs.

- No Down Payment: Minimized upfront costs can allow for more liquidity or investment in property improvements.

- Create Cash Flow: House hacking or refinancing can create extra money flow from rental income or saved refinance costs.

Disadvantages

- Primary Residence Requirement: Limitations on property usage necessitate living in the property, which might restrict real investment prospects.

- Potential for Increased Fees: Misuse or inaccurate reporting related to VA benefits could lead to complications or penalties.

- Market Risks: As with all real estate investments, VA-backed properties are subject to market risks, which can affect profitability.

Steps to Secure a VA Loan for Investment Potential

If you’ve decided that using a VA loan for investment purposes aligns with your goals, here are some practical steps to navigate the process:

Step 1: Confirm Eligibility

First, ensure that you meet all necessary service requirements and secure your Certificate of Eligibility. This document is critical to proceed with any lender.

Step 2: Determine Financial Readiness

Assess your financial situation. Understand your credit score, and evaluate your monthly budget to include potential costs for maintenance and unexpected repairs.

Step 3: Select a Suitable Property

Focus on multi-unit properties where possible, considering location and rental demand. Conduct thorough market research to ensure your selected property can generate adequate rental income to cover costs.

Step 4: Choice of Lender

Work with a lender who has experience in handling VA loans, particularly if you are interested in house hacking or refinancing options. A knowledgeable lender can offer guidance and ensure compliance with VA and financial regulations.

Step 5: Plan for Property Management

Consider the practicality of managing a rental property. Will you handle tenant issues and maintenance personally, or is it feasible to hire a property management firm? Factor in these considerations when calculating potential returns.

Legal and Financial Considerations

Understanding applicable laws and regulations is crucial when using a VA loan for investment purposes. There are specific legal implications, such as adhering to occupancy requirements and fair housing laws. It’s vital to consult professionals – often, a real estate attorney and a financial advisor – to avoid legal pitfalls and ensure sound financial planning.

Leveraging VA Loans for Financial Growth

For veterans and active-duty service members, VA loans are a valuable opportunity to secure a home with favorable terms. While designed primarily for primary residences, with strategic planning and due diligence, many have successfully navigated the challenge of using VA loans to enter the investment property market.

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology