Steps To Take If You Have No Health Insurance After A Car Crash

Steps To Take If You Have No Health Insurance After A Car Crash

Every motorist who hits the road does so with the hope that their journey will be smooth and uneventful. However, despite our best intentions and precautions, car accidents remain unpredictable occurrences. While many people carry some form of health insurance to ease the burden of medical expenses in the aftermath of an accident, the reality is that not everyone is covered. Whether due to high insurance costs, unemployment, or simply an oversight, finding yourself without health insurance after a car crash can be a daunting and frightening experience.

In the blink of an eye, a car accident can thrust individuals into a world of stress and uncertainty. Aside from the immediate physical trauma and emotional upheaval, there’s the pressing question of how to manage healthcare costs without insurance. For many, it can feel like an impossible situation where survival becomes tangled with financial dilemmas. But it’s crucial to remember: having no insurance doesn’t mean you have no options.

In this post, we will explore practical steps and strategies to navigate the complexities of medical care following an automotive accident when you’re uninsured. The goal of this article is to provide you with a detailed roadmap that not only addresses your immediate health needs but also safeguards your financial future. Whether you’re an accident victim or simply seeking to be prepared, the information ahead can be invaluable.

Firstly, it’s essential to seek immediate medical attention, regardless of your insurance status. Navigating the bureaucracy of healthcare can feel overwhelming, especially when bills start appearing. Yet, understanding how to prioritize care for critical injuries is essential for both your well-being and your legal standing. We’ll discuss techniques and resources available to uninsured individuals that might just lighten the financial load.

One key aspect of handling a car accident without insurance is exploring financial aid. Hospitals and clinics often have programs available for those without coverage, and having the right information can make all the difference. We’ll cover various avenues such as applying for Medicaid, negotiating payment terms, and accessing local nonprofit resources.

Legal avenues should not be overlooked either. Depending on the circumstances of the crash, you might qualify for a legal claim that will cover your medical expenses. It’s crucial to understand how to work with a lawyer—potentially at no upfront cost—to pursue the compensation you are entitled to. Tapping into resources such as personal injury attorneys can dramatically change your outcome.

Moreover, alternative treatment options and seeking community support can play pivotal roles in managing an injury sustainably. These are components often underappreciated yet offer viable avenues for recovery and financial relief. We’ll guide you on how to connect with support groups and consider holistic medical options that might help alleviate the burden.

Finally, an often overlooked but vitally important step is using this moment as a catalyst to plan for the future. While dealing with a health crisis without insurance can feel immediate and all-consuming, it is also a clear signal of the need to reassess one’s health coverage situation. We’ll provide insights on how to better position yourself for the next unexpected event, such as applying for affordable insurance plans that cater to various budgets.

Dealing with the aftermath of a car crash without health insurance can be intimidating, but it’s not insurmountable. With the right knowledge and action, you can recover both physically and financially. Join us as we delve deeper into the steps that can safeguard your health and peace of mind.

Understanding Your Immediate Priorities

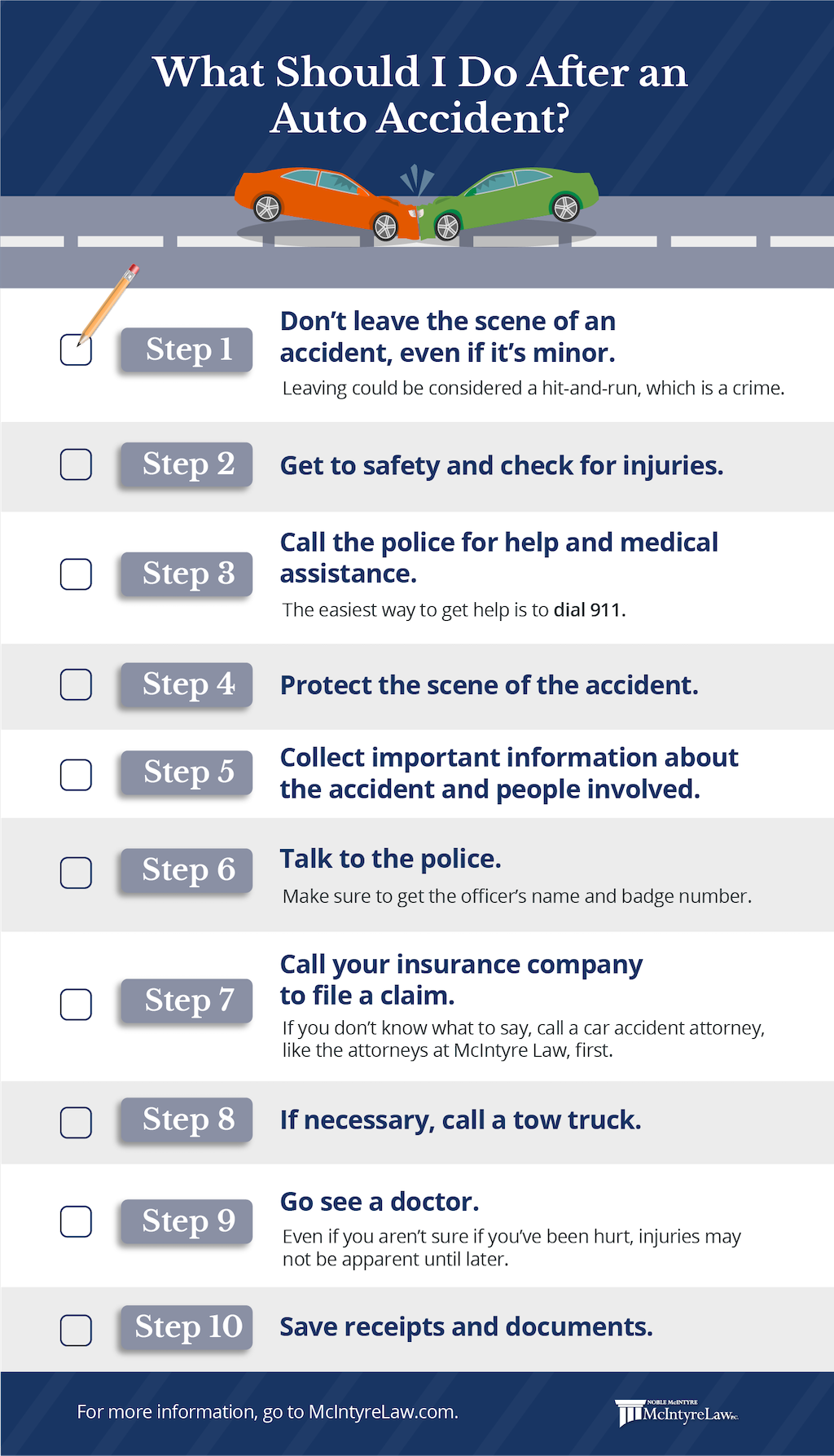

After a car crash, the first and most important priority is your health. Even without health insurance, ensuring that you receive necessary medical attention should come first. Immediately seek any medical help you need, regardless of your insurance status. Many states have laws requiring hospitals to provide emergency medical treatment, so take advantage of these protections to obtain the necessary care.

Seek Medical Care Right Away

Document every medical decision and piece of advice you receive from healthcare professionals. This documentation can be crucial if you need to pursue other avenues for financial help or compensation later on. While navigating the financial implications, prioritize securing a clear, comprehensive assessment of your injuries.

Contact Law Enforcement

Getting an official police report can be beneficial not only for establishing the facts of the accident but also as evidence in potential legal proceedings or insurance claims. Make sure you don’t leave the scene without the contact details of the other driver(s) involved, their insurance details, and any witness contacts.

Explore Financial Support and Low-Cost Health Options

If upfront medical costs are a concern, explore several viable options that might alleviate the financial burden:

Negotiate with Healthcare Providers

- Contact hospitals or medical services you’ve visited and explain your insurance situation. Often, they can offer payment plans or reduced fees for uninsured patients.

- Request itemized bills to ensure that you aren’t being charged for services you didn’t receive.

Find Community Health Resources

Many communities offer free or low-cost clinics that provide healthcare services without the need for insurance. Although these might not cover all your needs, they can be a critical resource for follow-up checks or non-emergency treatment.

Apply for State or Federal Assistance

- Look into government programs like Medicaid, which might be available if your income meets specific criteria.

- During open enrollment periods, explore subsidized health plans via the Affordable Care Act (ACA) Marketplaces.

Pursue Legal and Insurance Avenues

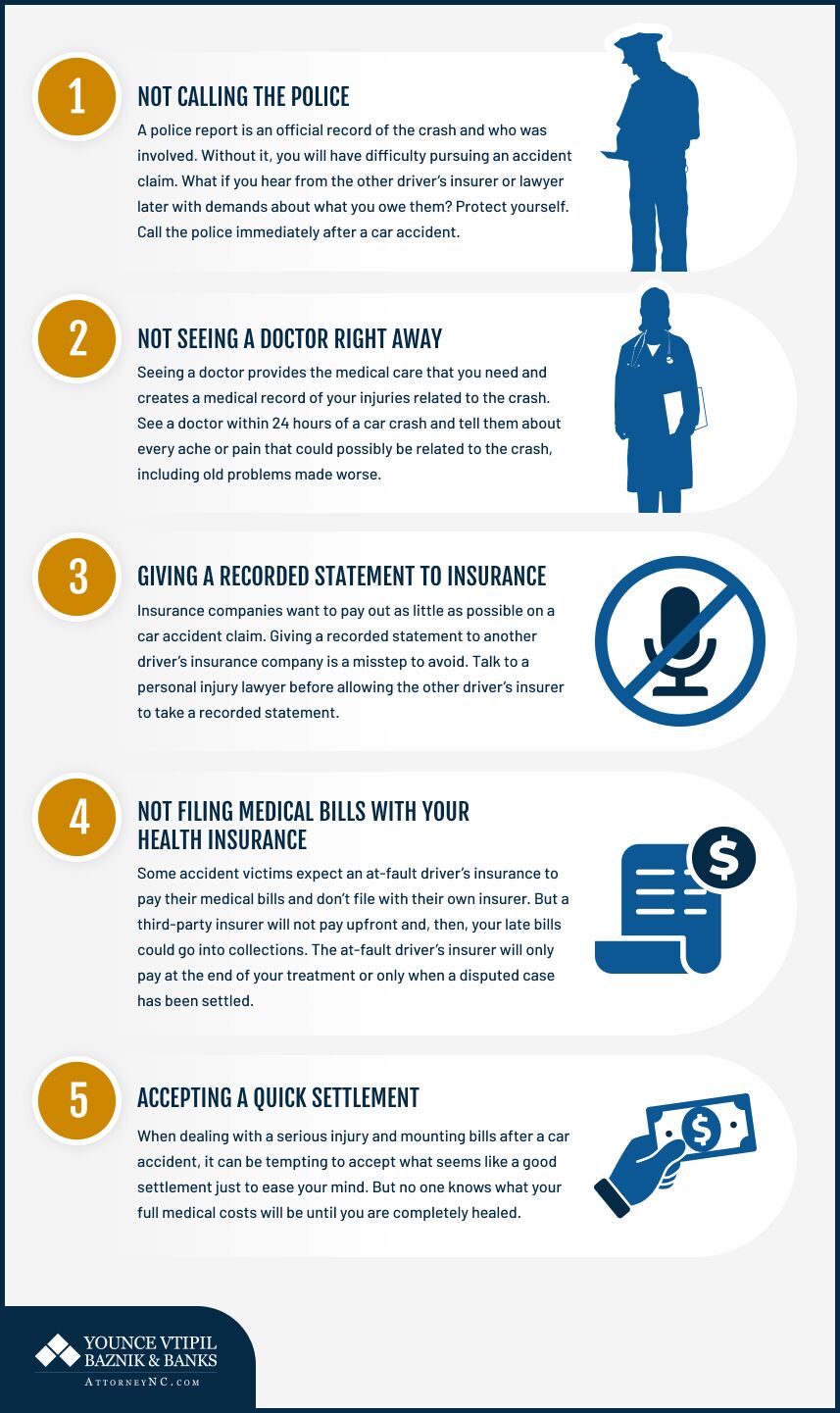

The absence of personal health insurance doesn’t preclude you from seeking compensation for injuries suffered in a car crash. In many cases, other parties or insurance companies can be held responsible:

Liability Car Insurance

- If the other party is at fault, their liability insurance might cover your medical expenses. Submit all necessary documentation promptly to support your claim.

- Enlist the help of a professional if you encounter difficulties in communicating with the insurance company.

Personal Injury Protection (PIP)

In no-fault states, PIP can cover medical expenses regardless of who caused the accident. Review your policy to determine if you have such coverage even if you don’t have comprehensive health insurance.

Consult with an Attorney

A personal injury attorney can provide guidance on pursuing compensation and often works on a contingency basis, meaning they only get paid if you do. This option can provide the legal muscle needed to challenge insufficient payouts or claim denials.

Addressing Long-term Recovery and Rehabilitation

Recovering from a car crash, particularly without health insurance, can be a long road. Consider these strategies to manage ongoing health needs:

Physical Therapy and Rehabilitation Options

- Search for rehabilitation centers that extend sliding scale fees or payment plans for uninsured patients.

- Some community organizations and non-profit services may offer free physical therapy or counseling services post-accident.

Mental Health Support

Emotional and psychological recovery post-crash is as vital as physical healing. Seek out counselors or therapists who offer reduced rates for individuals without insurance. Also, research local support groups that might provide a sense of community and understanding.

Stay Informed and Proactive

Tracking trends and resources in healthcare can provide ongoing opportunities as you navigate your recovery. Whether it’s connecting to new clinic options or legal changes regarding insurance, being informed can mean discovering a lifesaver resource when you need it most.

Building a Robust Support Network

A strong support network can mean the difference between hardship and more manageable recovery:

Seek Community Help and Family Support

Involve family or close friends to help with daily tasks or transportation needs as you focus on recovery. Communicate openly about your needs and limitations.

Utilize Online and Local Community Support Groups

Numerous online forums and local meet-ups connect individuals who have faced similar situations. Sharing experiences can offer practical solutions and emotional solidarity.

By prioritizing these steps, you can significantly mitigate the challenges of handling a car crash aftermath without health insurance, allowing better focus on your recovery journey and reducing the associated stressors.

Concluding Your Path to Recovery After a Car Crash Without Health Insurance

Facing a car crash is daunting enough, but doing so without health insurance adds an overwhelming layer of complexity. Throughout this blog post, we’ve explored several steps you can take to navigate this challenging situation. As we draw to a close, let’s review these crucial actions and contextualize them within your journey toward recovery.

First and foremost, seeking immediate medical care was emphasized as a critical step, even if you lack health insurance. After a car accident, your health should be your number one priority. Many hospitals provide emergency care without requiring immediate payment, and federal law mandates that emergency departments provide assessment and stabilization regardless of insurance status. By seeking prompt medical care, you’re taking a vital step toward safeguarding your well-being.

Following the initial medical assessment, it becomes important to keep detailed records of all medical visits and bills. Doing so not only helps you manage the financial aspects of your care but also strengthens any legal claims related to the accident. Thorough documentation of your injuries and treatments can serve as evidence if you seek compensation from the at-fault driver’s insurance or file a personal injury lawsuit.

An equally significant step discussed was exploring alternative funding options for your medical expenses. Reach out to healthcare providers to inquire about discounts, payment plans, or financial assistance programs. Additionally, consider exploring state and local resources which may offer aid or guidance to uninsured patients. Community health clinics and nonprofit organizations may also have programs designed to alleviate healthcare costs for individuals without insurance.

In the earlier sections, we also addressed the importance of understanding your legal rights and seeking professional legal advice. If the car crash was caused by another party, you might be entitled to compensation through their insurance policy or via a personal injury claim. Consulting with a legal professional can help you understand your rights and options. Attorneys specializing in personal injury cases often work on a contingency fee basis, meaning you won’t have to pay unless you win your case, making this a viable option for those without insurance.

An essential point covered was negotiating with healthcare providers. Many hospitals have financial counselors who can help structure a manageable payment plan. Don’t hesitate to reach out to them, as they may offer reductions in your bill or help you seek charitable aid. Transparency about your financial situation can open doors to resources you might not otherwise discover.

Moreover, consider applying for retroactive insurance coverage if your circumstances allow. Certain states offer special enrollment periods for health insurance following qualifying life events like car accidents. Research whether you’re eligible for these programs or if there are options for government-subsidized health coverage, such as Medicaid, which may not have been previously accessible but could become so following your accident.

Now, as we conclude, it’s crucial to reflect on the broader context of what having no health insurance in a car crash scenario means and how these steps fit into a successful recovery plan. Without insurance, each action you take is a strategic move toward managing both immediate and long-term implications. It requires resourcefulness, advocacy for yourself, and leveraging all possible avenues of support.

Your journey doesn’t have to end here. Implementing these steps can significantly ease the burdens of post-accident recovery without health insurance. Remember, you are not alone, and many resources exist, though they may require persistence to access effectively. This situation provides a poignant reminder of the importance of being proactive about health coverage in advance, as having some form of health insurance can greatly ease stress and financial strain in future incidents.

As you progress, consider the following call to action:

- Educate Yourself Further: Delve deeper into the legal and healthcare systems to arm yourself with knowledge that could be crucial in future situations.

- Engage with Support Networks: Join communities of others who have navigated similar paths. Whether online or in person, these groups offer emotional and practical support.

- Advocate for Change: Use your experience to advocate for improved healthcare policies or insurance access in your community or nationwide.

- Plan Ahead: Consider exploring health insurance options or creating an emergency fund to prepare for any future mishaps.

Ultimately, while the challenge of being in a car accident without insurance is significant, taking the steps outlined above can shape a path not only to recovery but also to empowerment. Your story and actions can inspire others facing similar circumstances to persist, adapt, and overcome.

Thank you for taking the time to read this post and reflect on its insights. We encourage you to share your own experiences and tips in the comments section below. If you’ve found this guide helpful, please share it with others whom it might benefit. Your engagement helps spread vital information and builds a community of support and resilience. Together, we can make a difficult situation manageable and inspire change towards a more accessible healthcare future.

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology