SoftBank Investment Advisers Shaping the Tech Landscape

SoftBank Investment Advisers is a global investment firm known for its significant investments in technology companies, particularly in the early stages of their development. Founded by Masayoshi Son, the firm has a long history of backing innovative companies that have gone on to become industry leaders.

SoftBank Investment Advisers’ investment strategy is driven by a belief in the transformative power of technology and its potential to disrupt traditional industries. The firm has a reputation for making bold bets on companies with ambitious goals, often investing large sums of money in high-growth sectors like artificial intelligence, robotics, and e-commerce.

SoftBank Investment Advisers

SoftBank Investment Advisers is a global investment firm that manages the SoftBank Vision Funds, a series of technology-focused investment funds. The firm invests in a wide range of companies, from early-stage startups to established businesses, across various sectors, including technology, healthcare, and consumer goods.

Overview

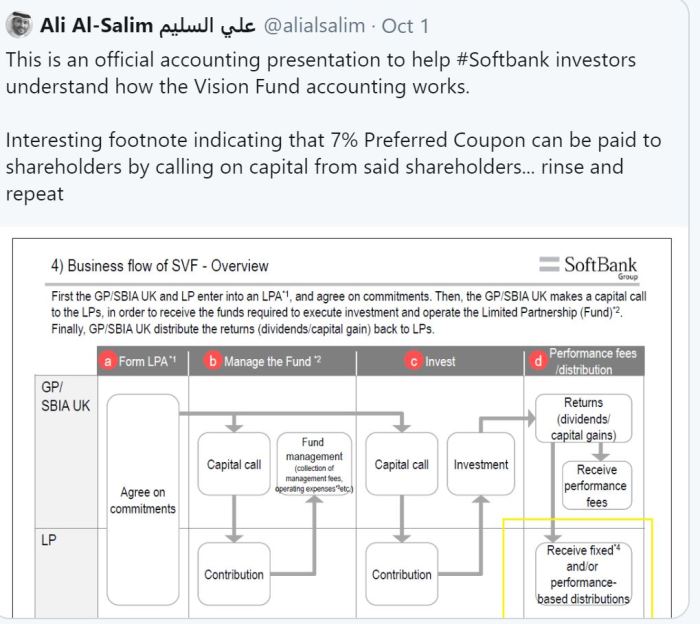

SoftBank Investment Advisers is a subsidiary of SoftBank Group, a Japanese multinational conglomerate with a diverse portfolio of investments. The firm was established in 2017 to manage the SoftBank Vision Fund, which was launched with an initial capital commitment of $93 billion. Since then, the firm has raised additional capital and expanded its investment activities, launching the SoftBank Vision Fund 2 in 2019 with a target size of $108 billion.

Key Areas of Focus

SoftBank Investment Advisers focuses on investing in companies that are disrupting traditional industries and creating new markets. The firm’s investment strategy is based on the following key areas of focus:

- Technology: SoftBank Investment Advisers invests in companies that are developing innovative technologies, such as artificial intelligence, robotics, and cloud computing. Examples include:

- Arm: A leading provider of semiconductor technology.

- Nvidia: A leading manufacturer of graphics processing units (GPUs).

- Uber: A ride-hailing and transportation network company.

- Healthcare: SoftBank Investment Advisers invests in companies that are developing new healthcare technologies, such as telemedicine, personalized medicine, and digital therapeutics. Examples include:

- Guardant Health: A leading provider of liquid biopsy cancer diagnostics.

- Teladoc Health: A leading provider of telehealth services.

- 23andMe: A leading provider of personal genomics services.

- Consumer Goods: SoftBank Investment Advisers invests in companies that are developing new consumer goods and services, such as e-commerce, online entertainment, and food delivery. Examples include:

- Coupang: A leading e-commerce company in South Korea.

- DoorDash: A leading food delivery company in the United States.

- TikTok: A leading social media platform for short-form videos.

History

SoftBank Investment Advisers has a relatively short history, having been established in 2017. However, the firm has made a significant impact on the global investment landscape, with its investments playing a role in shaping the future of technology and innovation.

- 2017: SoftBank Investment Advisers was established to manage the SoftBank Vision Fund, which was launched with an initial capital commitment of $93 billion. The fund quickly became one of the largest technology-focused investment funds in the world.

- 2019: SoftBank Investment Advisers launched the SoftBank Vision Fund 2, with a target size of $108 billion. The fund continued the firm’s focus on investing in disruptive technologies and innovative companies.

- 2020: SoftBank Investment Advisers made several high-profile investments, including in DoorDash, Coupang, and Opendoor. The firm also began to explore new investment areas, such as sustainable energy and artificial intelligence.

Structure and Organization

SoftBank Investment Advisers is a global investment firm with offices in Tokyo, London, and Silicon Valley. The firm is led by a team of experienced investment professionals with expertise in technology, finance, and operations. The firm’s investment process is rigorous and involves a thorough due diligence process, including financial analysis, market research, and technology assessment. SoftBank Investment Advisers also has a strong track record of working with its portfolio companies to help them grow and succeed.

“We believe that technology has the power to transform industries and improve lives. We are committed to investing in companies that are driving innovation and creating a better future.” – Masayoshi Son, Founder and CEO of SoftBank Group

Investment Strategies and Approach

SoftBank Investment Advisers employs a multifaceted investment strategy, focusing on identifying and supporting high-growth companies with the potential to disrupt their respective industries. This approach combines a deep understanding of emerging technologies and market trends with a long-term investment horizon.

Investment Criteria

SoftBank Investment Advisers meticulously evaluates potential investment opportunities based on a comprehensive set of criteria. These criteria are designed to ensure that investments align with the firm’s overarching strategy and have the potential to generate significant returns.

- Market Size and Growth Potential: The firm prioritizes investments in industries with large and rapidly growing markets, indicating significant potential for expansion and profitability.

- Disruptive Innovation: SoftBank Investment Advisers seeks companies that are developing innovative technologies or business models that have the potential to disrupt existing markets and create new value propositions.

- Strong Management Team: The firm believes that a capable and experienced management team is crucial for successful execution and scaling of a business.

- Competitive Advantage: SoftBank Investment Advisers focuses on companies that possess a clear and sustainable competitive advantage, such as proprietary technology, strong brand recognition, or a unique business model.

- Alignment with Strategic Objectives: Investments are carefully chosen to align with SoftBank Investment Advisers’ strategic objectives and long-term vision.

Types of Investments

SoftBank Investment Advisers makes a variety of investments, each tailored to specific opportunities and investment objectives. The following table provides a breakdown of the different types of investments made by the firm:

| Investment Type | Description | Examples |

|---|---|---|

| Early-Stage Venture Capital | Investments in companies in the early stages of development, often pre-revenue. | Arm Holdings, Alibaba Group, Coupang |

| Growth Equity | Investments in established companies with strong growth potential. | DoorDash, Slack, Guardant Health |

| Public Market Investments | Investments in publicly traded companies, often through strategic partnerships or acquisitions. | Uber, Zoom Video Communications, Beyond Meat |

| Strategic Acquisitions | Acquisitions of companies that complement existing portfolio holdings or provide access to new markets. | Sprint Corporation, Boston Dynamics, WeWork |

Industries of Focus

SoftBank Investment Advisers has a significant presence in a diverse range of industries, including:

- Technology: Artificial intelligence, cloud computing, cybersecurity, e-commerce, fintech, software, and semiconductors.

- Healthcare: Biotechnology, pharmaceuticals, medical devices, and digital health.

- Consumer: Food delivery, ride-hailing, online travel, and e-commerce.

- Energy and Sustainability: Renewable energy, energy storage, and sustainable agriculture.

- Robotics and Automation: Robotics, automation, and advanced manufacturing.

Notable Investments and Portfolio Companies

SoftBank Investment Advisers boasts a diverse portfolio of companies across various sectors, many of which have become global giants. These investments have significantly impacted the companies’ growth and development, showcasing SoftBank’s ability to identify and nurture promising ventures.

Prominent Portfolio Companies

SoftBank Investment Advisers’ portfolio includes several prominent companies that have achieved remarkable success. Here are some notable examples:

- Alibaba: SoftBank’s early investment in Alibaba, a Chinese e-commerce giant, has been a significant contributor to its success. SoftBank’s investment played a pivotal role in Alibaba’s growth, enabling it to become one of the world’s largest online retailers.

- Arm Holdings: SoftBank’s acquisition of Arm Holdings, a leading semiconductor design company, has expanded its reach in the technology sector. Arm’s technology is widely used in smartphones and other devices, making it a crucial player in the global chip industry.

- Coupang: SoftBank’s investment in Coupang, a South Korean e-commerce platform, has fueled its rapid expansion. Coupang’s focus on fast delivery and customer service has made it a dominant player in the Korean market.

- DoorDash: SoftBank’s investment in DoorDash, a food delivery platform, has helped it become one of the leading players in the industry. DoorDash’s focus on convenience and reliability has made it a popular choice for consumers.

- Guardant Health: SoftBank’s investment in Guardant Health, a cancer diagnostics company, has supported its development of innovative cancer screening technologies. Guardant Health’s technology has the potential to revolutionize cancer detection and treatment.

- Uber: SoftBank’s investment in Uber, a ride-hailing company, has played a significant role in its global expansion. Uber’s innovative approach to transportation has disrupted the traditional taxi industry.

Impact of SoftBank Investment Advisers’ Investments

SoftBank Investment Advisers’ investments have had a profound impact on its portfolio companies. These investments have provided the companies with:

- Financial Resources: SoftBank’s significant investments have provided its portfolio companies with the financial resources they need to expand their operations, develop new products, and enter new markets.

- Strategic Guidance: SoftBank’s investment team provides strategic guidance to its portfolio companies, helping them navigate complex business challenges and make informed decisions.

- Global Network: SoftBank’s extensive global network has opened doors for its portfolio companies, allowing them to access new markets, partnerships, and talent.

Timeline of Major Investments

SoftBank Investment Advisers has a long history of making strategic investments in promising companies. Here is a timeline of some of its major investments:

| Year | Company | Investment | Impact |

|---|---|---|---|

| 2000 | Alibaba | $20 million | Early investment that fueled Alibaba’s growth into a global e-commerce giant. |

| 2016 | Uber | $1 billion | Significant investment that supported Uber’s global expansion and market dominance. |

| 2017 | Arm Holdings | $32 billion | Acquisition of Arm Holdings, a leading semiconductor design company, expanding SoftBank’s reach in the technology sector. |

| 2018 | Coupang | $2 billion | Investment that helped Coupang become a dominant player in the South Korean e-commerce market. |

| 2020 | Guardant Health | $1.2 billion | Investment that supported Guardant Health’s development of innovative cancer screening technologies. |

Performance of SoftBank Investment Advisers’ Investments

SoftBank Investment Advisers’ investment performance has been a subject of debate. While some investments have generated significant returns, others have faced challenges.

“SoftBank’s investments have been both a blessing and a curse for its portfolio companies. While the company’s financial backing has helped many companies grow rapidly, its involvement has also led to scrutiny and criticism.”

The performance of SoftBank’s investments has been compared to various industry benchmarks. However, due to the complexity and diversity of its portfolio, it is challenging to provide a definitive assessment of its performance.

Impact and Influence on the Tech Industry

SoftBank Investment Advisers has played a significant role in shaping the global tech landscape, making substantial investments in various sectors, including artificial intelligence, robotics, and e-commerce. Their influence extends beyond financial capital, driving innovation, fostering collaboration, and influencing industry trends.

SoftBank Investment Advisers’ Influence on Technological Innovation

SoftBank Investment Advisers’ investments have been instrumental in driving technological innovation by providing critical funding for startups and established companies developing groundbreaking technologies. This financial support enables these companies to scale their operations, accelerate research and development, and bring their innovations to market faster.

Trends in the Tech Industry that SoftBank Investment Advisers is Focusing On

SoftBank Investment Advisers has identified several key trends in the tech industry that it is actively investing in. These include:

- Artificial Intelligence (AI): AI is transforming various industries, from healthcare to finance. SoftBank Investment Advisers has invested in several AI companies, including SenseTime, a leading AI company in China, and Nvidia, a global leader in AI hardware and software.

- Robotics: Robotics is another area of focus for SoftBank Investment Advisers. They have invested in companies like Boston Dynamics, known for its advanced robots, and SoftBank Robotics, which develops and commercializes robots for various applications.

- E-commerce: The rise of e-commerce has created significant opportunities for technology companies. SoftBank Investment Advisers has invested in companies like Coupang, a South Korean e-commerce platform, and Alibaba, a Chinese e-commerce giant.

- Cloud Computing: Cloud computing is essential for businesses of all sizes. SoftBank Investment Advisers has invested in companies like ARM, a leading provider of semiconductor technology for cloud computing, and Snowflake, a cloud-based data warehousing platform.

Examples of SoftBank Investment Advisers’ Investments Fostering Collaboration and Growth

SoftBank Investment Advisers’ investments have fostered collaboration and growth within the tech ecosystem by connecting companies, facilitating knowledge sharing, and creating new opportunities for innovation.

- Collaboration between Portfolio Companies: SoftBank Investment Advisers has facilitated collaborations between its portfolio companies, allowing them to leverage each other’s strengths and expertise. For example, SenseTime, an AI company, has collaborated with SoftBank Robotics to develop robots with advanced AI capabilities.

- Knowledge Sharing and Mentorship: SoftBank Investment Advisers provides mentorship and support to its portfolio companies, helping them navigate the challenges of scaling and growth. This includes access to a network of experienced entrepreneurs, investors, and industry experts.

- Creation of New Opportunities: SoftBank Investment Advisers’ investments have created new opportunities for innovation by providing funding for research and development and fostering partnerships between companies. For example, their investment in Boston Dynamics has allowed the company to develop advanced robots that have applications in various industries.

Challenges and Future Outlook

SoftBank Investment Advisers, like any other investment firm, faces a dynamic and constantly evolving landscape. The current market environment presents a unique set of challenges that require strategic adaptation and a forward-looking approach. These challenges are intertwined with potential future trends that could significantly impact SoftBank’s investment strategies.

Impact of Economic Uncertainty

Economic uncertainty, fueled by factors such as inflation, rising interest rates, and geopolitical tensions, presents a significant challenge. The impact of these factors on the technology sector is multifaceted. High inflation can erode consumer spending, impacting demand for technology products and services. Rising interest rates can make it more expensive for tech companies to access capital, potentially slowing down growth. Geopolitical instability can disrupt supply chains and create volatility in global markets.

Competition and Valuation Pressures

The technology investment landscape is increasingly competitive, with numerous venture capital firms and private equity players vying for promising startups. This intense competition drives up valuations, making it challenging for SoftBank to secure attractive investment opportunities. Moreover, the recent decline in public market valuations for tech companies has put pressure on private market valuations, potentially impacting the returns on SoftBank’s investments.

Regulatory Scrutiny

Regulatory scrutiny of the technology sector is intensifying globally. Antitrust concerns, data privacy regulations, and cybersecurity requirements are becoming increasingly stringent. SoftBank Investment Advisers needs to navigate these evolving regulatory landscapes to ensure compliance and minimize potential risks.

Adaptation to Evolving Tech Landscape

The technology landscape is constantly evolving, with new trends emerging and disrupting existing industries. SoftBank Investment Advisers must be agile and adapt its investment strategies to capitalize on emerging opportunities. This includes identifying and investing in companies operating in areas such as artificial intelligence, cloud computing, and renewable energy.

Future Trends and Their Impact

Several future trends could significantly impact SoftBank’s investment strategies:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are transforming various industries, from healthcare to finance. SoftBank is actively investing in companies developing innovative AI and ML solutions. This trend is expected to continue, presenting significant opportunities for investment.

- Cloud Computing: Cloud computing is becoming increasingly prevalent, with businesses migrating their operations to the cloud. SoftBank is investing in companies providing cloud infrastructure, software, and services. The growth of cloud computing is expected to continue, driving further investment opportunities.

- Sustainability and Renewable Energy: Sustainability is a growing concern, with investors seeking companies that are environmentally responsible. SoftBank is investing in companies developing clean energy solutions, such as solar and wind power. This trend is expected to accelerate, creating significant investment opportunities in the renewable energy sector.

- Metaverse and Web3: The metaverse and Web3 technologies are emerging as potential disruptors, with applications in gaming, social media, and commerce. SoftBank is exploring investment opportunities in these areas, recognizing the potential for significant growth and innovation.

SoftBank Investment Advisers’ influence on the tech industry is undeniable. The firm’s investments have helped to fuel the growth of numerous startups and have played a significant role in shaping the technological landscape. As technology continues to evolve at a rapid pace, SoftBank Investment Advisers is well-positioned to continue to play a major role in the development of the next generation of innovative companies.

Essential FAQs

What is the investment philosophy of SoftBank Investment Advisers?

SoftBank Investment Advisers invests in companies that have the potential to disrupt traditional industries and create new markets. They focus on companies with strong leadership teams, innovative products or services, and a clear path to growth.

What are some of the challenges facing SoftBank Investment Advisers?

SoftBank Investment Advisers faces challenges like competition from other venture capital firms, the need to manage a large and diverse portfolio, and the potential for regulatory changes to impact their operations.

What are some of the future trends that could impact SoftBank Investment Advisers’ investment strategies?

Future trends that could impact SoftBank Investment Advisers’ investment strategies include advancements in artificial intelligence, the rise of the metaverse, and the growing importance of sustainability.

SoftBank Investment Advisers, known for their bold investments in diverse sectors, might consider diversifying their portfolio with property investments. For those looking for inspiration in naming their property investment ventures, property investment names offer a wealth of creative options. A well-chosen name can enhance brand recognition and attract investors, which aligns with SoftBank’s strategic approach to building successful ventures.

SoftBank Investment Advisers, known for their strategic investments, might be interested in the growing real estate market in Florida. The Sunshine State offers a diverse range of investment opportunities, from luxury condos in Miami to charming single-family homes in Orlando. Investment property in Florida can be a lucrative avenue for investors, especially those seeking long-term returns, and SoftBank Investment Advisers, with their keen eye for promising ventures, could be well-positioned to capitalize on this trend.

SoftBank Investment Advisers, known for their diverse portfolio, have a keen eye on sectors with strong growth potential. One such area is industrial investment property, which has seen increasing demand in recent years. As businesses expand and e-commerce thrives, the need for modern, efficient warehouse and logistics facilities is paramount. This makes industrial investment property an attractive option for SoftBank Investment Advisers, who are always seeking out innovative and high-growth opportunities.