Section 8 Investment Property A Guide to Rental Income

Section 8 investment property offers a unique opportunity to generate stable rental income while making a positive impact on the community. The Housing Choice Voucher Program, commonly known as Section 8, provides financial assistance to low-income families to help them afford safe and decent housing. By becoming a Section 8 landlord, you can contribute to a vital social program while enjoying the benefits of a consistent rental stream and potential tax advantages.

This guide delves into the intricacies of Section 8 investment property, exploring the program’s structure, the benefits for landlords, and the practical steps involved in finding, acquiring, and managing these properties. We’ll also discuss the legal considerations and common challenges, providing valuable insights and resources to help you make informed decisions.

Understanding Section 8 Housing

Section 8 housing is a federal program that helps low-income families, the elderly, and people with disabilities afford safe and decent housing. It is a crucial part of the nation’s affordable housing landscape, providing financial assistance to eligible individuals and families to secure housing in the private market.

The Housing Choice Voucher Program

The Housing Choice Voucher Program, commonly known as Section 8, is the primary component of the Section 8 program. It provides rental assistance to eligible households through vouchers that can be used to pay for a portion of their rent in privately owned housing. The program empowers individuals and families to choose their own housing options, offering them greater flexibility and control over their living arrangements.

Eligibility Criteria for Tenants

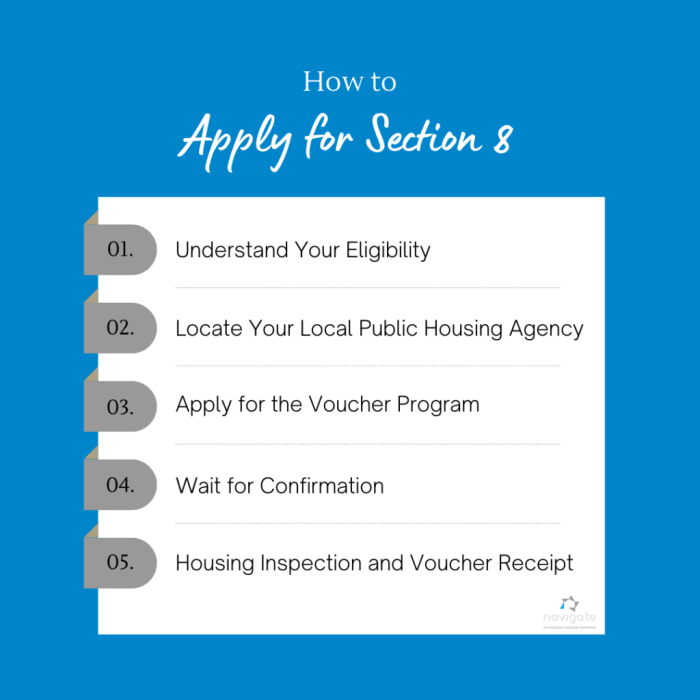

To be eligible for Section 8 housing, tenants must meet specific criteria based on their income, family size, and citizenship status. The eligibility requirements are:

- Income: Households must have an income that falls below a certain limit, which varies depending on the location and family size. This income limit is typically set at 50% of the Area Median Income (AMI).

- Family Size: The program considers the number of people living in the household when determining eligibility.

- Citizenship: Applicants must be U.S. citizens or legal permanent residents.

- Criminal History: While not a universal requirement, some landlords or housing authorities may consider criminal history when determining eligibility.

Eligibility Criteria for Landlords

Landlords who participate in the Section 8 program must meet certain requirements, including:

- Compliance with Fair Housing Laws: Landlords must comply with all applicable fair housing laws, ensuring that they do not discriminate against tenants based on race, color, religion, national origin, sex, familial status, or disability.

- Housing Quality Standards: The housing offered must meet minimum quality standards, including safety, sanitation, and habitability requirements.

- Rental Agreement: Landlords must enter into a rental agreement with the tenant, outlining the terms of the lease.

Types of Section 8 Housing

Section 8 housing is available in various forms, including:

- Traditional Section 8: This is the most common type of Section 8 housing, where tenants receive vouchers to pay for rent in privately owned housing.

- Project-Based Section 8: This type of housing involves rental assistance provided directly to landlords for specific apartment complexes or buildings. Tenants living in these properties receive rental assistance through the project.

- Public Housing: This is a form of government-owned and operated housing, typically available to low-income families.

Investment Benefits of Section 8 Properties: Section 8 Investment Property

Investing in Section 8 properties can offer unique benefits for landlords, making them a potentially attractive investment option. While there are risks associated with this type of investment, the potential rewards can be significant.

Higher Rental Income Potential

Section 8 tenants are guaranteed to pay their rent on time, as long as they adhere to the program’s guidelines. This can provide landlords with a more stable and predictable income stream. The Section 8 program pays a portion of the tenant’s rent, ensuring landlords receive a minimum amount, even if the tenant’s income fluctuates.

- Guaranteed Rent Payments: The Section 8 program guarantees rent payments, minimizing the risk of late or non-payment from tenants.

- Higher Rent Rates: Section 8 landlords can often charge higher rent rates compared to traditional rentals, as the program supplements the tenant’s contribution.

- Increased Occupancy Rates: Section 8 properties tend to have higher occupancy rates due to the program’s availability and tenant eligibility requirements.

Stable Rental Payments

The Section 8 program provides financial assistance to tenants, ensuring they can afford their rent. This creates a more stable and predictable income stream for landlords, reducing the risk of tenant turnover and vacancy periods.

- Reduced Risk of Eviction: With the program’s support, tenants are more likely to pay their rent on time, decreasing the likelihood of eviction proceedings.

- Consistent Cash Flow: The guaranteed rent payments from the program provide a consistent cash flow, enabling landlords to plan their finances effectively.

- Lower Vacancy Rates: Section 8 properties typically experience lower vacancy rates, as the program attracts tenants who are actively seeking housing.

Tax Advantages

Investing in Section 8 properties can offer tax advantages, including depreciation deductions and potential tax credits. These benefits can help landlords reduce their tax liability and increase their overall return on investment.

- Depreciation Deductions: Landlords can deduct a portion of the property’s value each year for depreciation, reducing their taxable income.

- Tax Credits: Certain Section 8 properties may qualify for tax credits, further reducing a landlord’s tax burden.

- Lower Property Taxes: Some jurisdictions offer lower property taxes for properties participating in the Section 8 program.

Finding and Acquiring Section 8 Properties

Finding the right Section 8 property requires careful consideration and a strategic approach. You’ll need to identify properties that meet specific criteria, negotiate effectively with landlords or sellers, and ensure you have the necessary financing in place.

Identifying Suitable Section 8 Properties

To begin, it’s crucial to understand the requirements for Section 8 properties. These properties must meet specific standards set by the Housing Choice Voucher Program, including minimum size, safety, and accessibility requirements. You can find detailed information on the HUD website or contact your local Public Housing Agency (PHA) for guidance.

Negotiating with Landlords or Sellers

Once you’ve identified potential properties, you’ll need to negotiate with landlords or sellers. Here are some strategies:

- Understand their motivations: Determine why they are selling or renting the property. Are they looking for a quick sale, or are they seeking a long-term tenant? Understanding their needs can help you tailor your offer.

- Highlight the benefits of Section 8: Explain that Section 8 tenants are typically reliable and have a steady income source, making them desirable tenants. Emphasize the guaranteed rent payments and the reduced risk of vacancy.

- Be prepared to negotiate: Don’t be afraid to negotiate on price or other terms. Be respectful, but firm in your negotiations.

Essential Considerations Before Purchasing

Before making an offer on a Section 8 property, there are several essential considerations:

- Property condition: Thoroughly inspect the property for any potential issues, including structural problems, plumbing, electrical, and heating/cooling systems. Consider hiring a professional inspector to assess the property’s condition.

- Neighborhood safety: Research the neighborhood to ensure it’s safe and meets your standards. Consider factors such as crime rates, schools, and proximity to amenities.

- Rental market analysis: Conduct a thorough market analysis to determine the potential rental income and vacancy rates for the property. This will help you estimate the property’s profitability.

- Local regulations: Ensure you understand the local regulations regarding Section 8 properties, including zoning, building codes, and landlord-tenant laws.

Securing Financing for Section 8 Properties

Obtaining financing for a Section 8 property may require a different approach than traditional financing. Here are some tips:

- Research lenders: Many lenders specialize in financing Section 8 properties. Research and contact lenders who have experience in this area.

- Demonstrate your financial stability: Prepare a strong financial package, including your credit score, income documentation, and a detailed business plan.

- Explore government programs: Investigate government programs and incentives that may be available to support Section 8 property investments.

Managing Section 8 Properties

Managing Section 8 properties requires a different approach than managing traditional rental properties. Landlords must navigate the unique requirements and regulations associated with the program, while also ensuring the well-being of their tenants. This section will discuss the responsibilities of landlords, the importance of communication, procedures for handling tenant issues, and resources for effective property management.

Landlord Responsibilities

Landlords of Section 8 properties have specific responsibilities Artikeld in the Housing Choice Voucher Program. These responsibilities ensure fair housing practices, tenant safety, and compliance with program guidelines.

- Following Fair Housing Laws: Landlords must adhere to fair housing laws, ensuring that all tenants are treated equally regardless of race, religion, national origin, disability, or family status.

- Maintaining Safe and Habitable Housing: Landlords are responsible for maintaining the property in a safe and habitable condition. This includes regular inspections, repairs, and addressing any health or safety concerns.

- Complying with Program Requirements: Landlords must comply with all program requirements, including tenant selection, rent payments, and inspections. They must also participate in the Housing Authority’s inspection process and adhere to the program’s guidelines for rent increases.

- Communicating with the Housing Authority: Landlords must communicate with the Housing Authority regarding any issues or changes related to the property or tenants. This includes reporting any changes in tenancy, property conditions, or rent payments.

Importance of Communication

Maintaining open and effective communication with tenants is crucial for successful Section 8 property management. This fosters trust, addresses concerns, and promotes a positive living environment.

- Promptly Responding to Tenant Requests: Landlords should promptly respond to tenant requests for repairs, maintenance, or other concerns. This demonstrates responsiveness and respect for the tenant’s needs.

- Clear Communication of Expectations: Landlords should clearly communicate expectations regarding rent payments, lease terms, and property maintenance responsibilities. This helps prevent misunderstandings and ensures both parties are aware of their obligations.

- Addressing Tenant Concerns: Landlords should actively listen to and address tenant concerns. This shows that their feedback is valued and helps build a positive landlord-tenant relationship.

- Regular Communication: Regular communication with tenants, even if it’s just a brief check-in, can help build rapport and foster a sense of community. It also allows for early detection of potential issues before they escalate.

Handling Tenant Issues and Complaints

Landlords should have a clear process for handling tenant issues and complaints. This ensures fairness, transparency, and timely resolution.

- Establishing a Formal Complaint Process: Landlords should establish a formal complaint process, outlining the steps involved in reporting and resolving tenant issues. This process should be clearly communicated to tenants and should include procedures for documenting complaints, investigating issues, and reaching resolutions.

- Promptly Investigating Complaints: Complaints should be investigated promptly and thoroughly. This involves gathering information from all parties involved, assessing the validity of the complaint, and taking appropriate action.

- Mediation and Resolution: Landlords should strive to resolve complaints through mediation or other alternative dispute resolution methods whenever possible. This helps maintain positive relationships and avoids unnecessary escalation.

- Documentation: Landlords should maintain detailed records of all tenant complaints, investigations, and resolutions. This documentation can be valuable in case of future disputes or legal actions.

Resources and Strategies for Effective Property Management

Landlords can utilize various resources and strategies to enhance their Section 8 property management skills.

- Networking with Other Landlords: Networking with other landlords who manage Section 8 properties can provide valuable insights and support. Sharing experiences and best practices can help landlords learn from each other and stay informed about industry trends.

- Attending Industry Events and Workshops: Attending industry events and workshops focused on Section 8 property management can provide training and updates on program regulations, legal requirements, and best practices. This can help landlords stay current and compliant.

- Utilizing Property Management Software: Utilizing property management software can streamline various aspects of property management, including tenant screening, rent collection, maintenance requests, and communication. This can save time and improve efficiency.

- Hiring a Property Manager: For landlords who lack the time or expertise to manage Section 8 properties themselves, hiring a professional property manager can be a valuable solution. Property managers specialize in managing rental properties and can handle day-to-day operations, tenant issues, and compliance requirements.

Legal and Regulatory Considerations

Investing in Section 8 properties comes with unique legal and regulatory considerations that landlords must be aware of. Understanding these requirements is crucial for ensuring smooth operations, minimizing legal risks, and maintaining compliance with federal and local regulations.

Legal Requirements for Section 8 Landlords

Landlords participating in the Section 8 program are subject to specific legal requirements that ensure fair treatment of tenants and compliance with housing standards.

- Fair Housing Act (FHA): Landlords must adhere to the FHA, prohibiting discrimination based on race, color, national origin, religion, sex, familial status, or disability. This includes advertising, tenant selection, and property management practices.

- Housing Quality Standards (HQS): The HQS Artikel minimum standards for housing conditions, including safety, sanitation, and accessibility. Landlords are responsible for maintaining these standards and addressing any deficiencies identified during inspections.

- Lease Agreements: Section 8 leases must comply with specific requirements, including clear terms regarding rent payment, tenant responsibilities, and landlord obligations. Landlords must ensure these agreements are legally binding and adhere to local regulations.

- Tenant Screening: While landlords can screen tenants, they must comply with fair housing laws and avoid discriminatory practices. This includes verifying income, credit history, and criminal background checks, while ensuring equal opportunity for all applicants.

- Eviction Procedures: Landlords must follow specific legal procedures for evicting tenants, including providing proper notice and pursuing legal action through the court system. Evictions must be justified based on lease violations or non-payment of rent.

Potential Legal Challenges Associated with Section 8 Properties

While Section 8 properties offer investment benefits, landlords should be aware of potential legal challenges that may arise.

- Tenant Disputes: Disputes between landlords and tenants can occur due to lease violations, property maintenance issues, or disagreements over rent payments. It’s crucial to have clear lease agreements, address tenant concerns promptly, and seek legal counsel if necessary.

- Housing Quality Standards Violations: Failure to meet HQS standards can lead to fines, legal action, and even termination from the Section 8 program. Regular inspections and prompt repairs are essential to maintain compliance.

- Fair Housing Lawsuits: Landlords can face lawsuits for discriminatory practices in tenant selection, advertising, or property management. It’s crucial to educate staff on fair housing laws and ensure all practices are non-discriminatory.

- Eviction Challenges: Evicting Section 8 tenants can be more complex than evicting traditional tenants due to legal protections and involvement of the housing authority. Landlords must follow strict eviction procedures and ensure all legal requirements are met.

- Rent Payment Disputes: Disagreements over rent payments, particularly when involving the housing authority’s role in rent subsidies, can lead to legal disputes. Landlords must maintain accurate records, communicate effectively with tenants and the housing authority, and address payment issues promptly.

Importance of Complying with Fair Housing Laws

Compliance with fair housing laws is paramount for Section 8 landlords. Failure to do so can result in significant legal consequences, including fines, lawsuits, and damage to reputation.

- Avoiding Discrimination: Fair housing laws ensure equal housing opportunities for all individuals, regardless of protected characteristics. Landlords must avoid discriminatory practices in tenant selection, advertising, and property management.

- Maintaining Legal Compliance: Adhering to fair housing laws protects landlords from legal challenges and ensures their operations are compliant with federal and local regulations.

- Protecting Reputation: A strong reputation for fairness and compliance is essential for attracting and retaining tenants. Violations of fair housing laws can damage a landlord’s reputation and make it difficult to attract future tenants.

Common Legal Issues and Their Solutions

Landlords should be prepared for common legal issues that may arise with Section 8 properties.

- Lease Violations: Addressing lease violations promptly and fairly is essential. Landlords should document violations, provide written notices, and pursue legal action if necessary.

- Property Maintenance Disputes: Clear communication and prompt repairs are crucial to prevent disputes. Landlords should establish a system for responding to maintenance requests and documenting repairs.

- Rent Payment Disputes: Maintaining accurate records, communicating effectively with tenants and the housing authority, and addressing payment issues promptly can help avoid rent payment disputes.

- Eviction Proceedings: Landlords must follow strict eviction procedures and ensure all legal requirements are met. Seeking legal counsel can ensure proper documentation and compliance with eviction laws.

Case Studies and Examples

Seeing real-world examples of successful Section 8 investments can provide valuable insights and demonstrate the potential of this strategy. These case studies offer a glimpse into the financial benefits, management strategies, and overall experiences of landlords who have chosen to invest in Section 8 properties.

Real-World Examples of Successful Section 8 Investments

Here are some real-world examples of successful Section 8 investments:

| Property Type | Location | Investment Details | Outcomes |

|---|---|---|---|

| Single-Family Home | Atlanta, GA | Purchase price: $150,000, Renovation costs: $20,000, Monthly rent: $1,200 (80% paid by Section 8) | Positive cash flow: $400 per month, Property value appreciation: 5% per year, Tenant satisfaction: High |

| Duplex | Chicago, IL | Purchase price: $250,000, Renovation costs: $30,000, Monthly rent per unit: $1,500 (80% paid by Section 8) | Positive cash flow: $600 per month, Property value appreciation: 4% per year, Tenant satisfaction: High |

| Four-plex | Los Angeles, CA | Purchase price: $400,000, Renovation costs: $40,000, Monthly rent per unit: $2,000 (80% paid by Section 8) | Positive cash flow: $800 per month, Property value appreciation: 3% per year, Tenant satisfaction: High |

Insights from Experienced Landlords

- “Investing in Section 8 properties has been a consistently profitable venture for me. The steady income stream and reliable tenant base have provided me with peace of mind and financial stability.” – John, a seasoned landlord with over 15 years of experience in Section 8 investments.

- “While there are some challenges, such as working with government agencies and managing tenant expectations, the benefits of Section 8 investing far outweigh the drawbacks. The potential for long-term financial success is undeniable.” – Sarah, a landlord who has successfully managed Section 8 properties for over 10 years.

Financial Aspects of Section 8 Investments, Section 8 investment property

- Guaranteed Income Stream: Section 8 vouchers guarantee a portion of the rent, reducing the risk of late payments or vacancies.

- Tax Benefits: Landlords can deduct various expenses, such as mortgage interest, property taxes, and depreciation, from their taxable income.

- Property Appreciation: Section 8 properties tend to hold their value well, offering potential for long-term capital gains.

- Cash Flow: With guaranteed rent payments and tax benefits, Section 8 investments can generate consistent cash flow.

Investing in Section 8 properties requires careful consideration, but it can be a rewarding endeavor. By understanding the program’s requirements, navigating the legal complexities, and establishing effective management practices, you can tap into a reliable rental market and contribute to a crucial social program. Whether you’re a seasoned investor or a newcomer to the real estate world, this guide provides the knowledge and tools to help you make informed decisions about Section 8 investment properties.

Detailed FAQs

What are the risks associated with Section 8 investment properties?

While Section 8 offers stability, there are potential risks like tenant turnover, increased maintenance requirements, and stricter regulations. Thorough tenant screening and careful property management are crucial to mitigating these risks.

How do I find Section 8 properties for sale?

You can work with real estate agents specializing in Section 8 properties, search online listings, or contact local housing authorities for information on available units.

What are the tax benefits of owning Section 8 properties?

Section 8 landlords may be eligible for tax deductions on mortgage interest, property taxes, and depreciation, potentially reducing their overall tax burden.

Section 8 investment properties can be a lucrative venture, providing a steady stream of income and potential for long-term appreciation. However, like any real estate investment, it’s essential to carefully consider the market and explore other business investment opportunities to diversify your portfolio. Understanding the regulations and requirements for Section 8 properties, as well as the potential challenges and rewards, is crucial for making informed decisions.

Section 8 investment properties offer a steady stream of income, but require careful consideration. It’s important to understand the regulations and requirements involved, and it can be beneficial to consult with a reputable firm like Lasalle Investment Management , who have expertise in this area. They can provide valuable insights into managing your Section 8 property and ensuring compliance with all applicable laws.

Section 8 investment properties offer a stable stream of income, but it’s crucial to understand the nuances of the program. For investors seeking guidance in this area, Odyssey Investment Partners is a firm specializing in real estate investment strategies, including those related to Section 8. Their expertise can help you navigate the complexities of this program and ensure your investments are successful.

Section 8 investment properties can offer a steady stream of income, but managing them can be demanding. For investors seeking to streamline their operations, an outsourced chief investment officer can be a valuable asset. They can provide expert guidance on property selection, tenant screening, and financial management, freeing up your time to focus on other aspects of your business.

By leveraging their expertise, you can maximize your returns and minimize risk in the competitive world of Section 8 investment properties.

Investing in Section 8 property can be a rewarding experience, but it’s important to understand the complexities involved. You’ll need to navigate the regulations, manage tenant relationships, and ensure your property meets specific standards. For expert guidance and financial advice, consider consulting with NISA Investment Advisors , who specialize in helping investors understand the intricacies of Section 8 and make informed decisions.

With their support, you can maximize your returns and ensure a smooth and profitable journey in the Section 8 market.