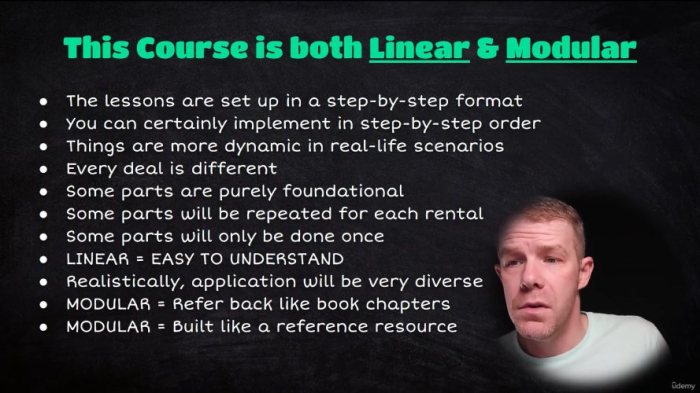

Real Estate Investment Property Exit Strategy Planning for Success

Real estate investment property exit strategy is the roadmap for navigating the end of your investment journey. It’s not just about selling; it’s about maximizing your return, minimizing risk, and achieving your financial goals. Whether you’re a seasoned investor or just starting, having a clear exit strategy is essential for making informed decisions and ensuring a smooth transition.

This guide delves into the intricacies of different exit strategies, providing insights into factors such as market analysis, tax implications, and risk management. We’ll explore various approaches, from holding for long-term appreciation to strategic refinancing and even the 1031 exchange, empowering you to choose the best path for your unique investment goals.

Understanding Exit Strategies

An exit strategy is a crucial aspect of any real estate investment plan. It Artikels how and when you plan to sell your property to realize your investment goals. A well-defined exit strategy helps you make informed decisions, manage risk, and maximize your returns. It acts as a roadmap, guiding your investment journey and ensuring a successful outcome.

Types of Exit Strategies

There are several common exit strategies employed by real estate investors. Understanding these options allows you to choose the most suitable strategy for your investment goals and market conditions.

- Sell the property for a profit: This is the most straightforward exit strategy, where you sell the property at a higher price than you bought it. This strategy is often used by investors who are looking for a quick return on their investment.

- Refinance the property: This strategy involves taking out a new mortgage on the property at a lower interest rate. This can help you reduce your monthly payments and free up cash flow. You can then use this cash flow to invest in other properties or for personal use.

- Rent out the property: This strategy involves renting out the property to tenants and generating passive income. It is a popular choice for investors who are looking for long-term rental income.

- 1031 Exchange: This strategy allows you to defer capital gains taxes by reinvesting the proceeds from the sale of one investment property into another. It is a complex strategy that requires careful planning and execution.

- Hold the property long-term: This strategy involves holding the property for an extended period, often for several years or even decades. This can be a good option for investors who are looking for long-term appreciation and passive income.

Successful Exit Strategy Examples

- Flipping a property: A common exit strategy is flipping properties. Investors purchase undervalued properties, renovate them, and then sell them at a profit. This strategy requires knowledge of local markets, construction, and renovation.

- Holding a rental property for appreciation: Investors can hold a rental property for several years to benefit from appreciation in the property’s value. This strategy can be particularly effective in markets with strong long-term growth potential.

- Using a 1031 exchange to defer capital gains taxes: Investors can use a 1031 exchange to defer capital gains taxes by reinvesting the proceeds from the sale of one investment property into another. This strategy is often used by investors who are looking to scale their real estate portfolio.

Selling the Property: Real Estate Investment Property Exit Strategy

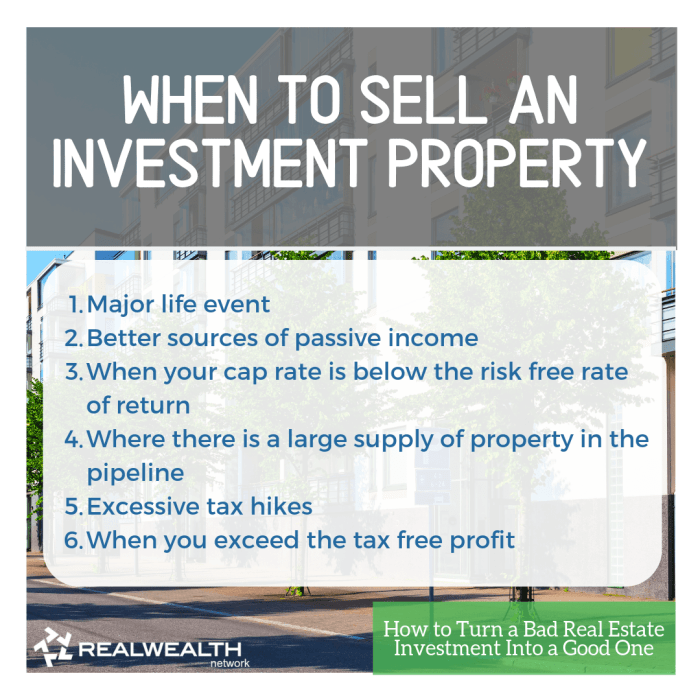

Selling your investment property is a crucial step in your exit strategy. The timing and pricing of the sale significantly impact your overall returns. Understanding the factors that influence these aspects and effectively preparing your property for the market are essential for maximizing your profits.

Factors Influencing Timing and Pricing

The decision to sell your investment property depends on various factors, including market conditions, your financial goals, and the property’s performance.

- Market Conditions: A strong real estate market with high demand and low inventory can result in higher selling prices and faster sales. Conversely, a sluggish market with low demand and high inventory may require lower prices and longer selling times.

- Property Performance: The property’s rental income, vacancy rates, and maintenance expenses influence its value and attractiveness to potential buyers. A property with strong rental income and low expenses is more likely to sell for a higher price.

- Financial Goals: Your financial goals, such as paying off debt, reinvesting in other properties, or generating passive income, influence your desired sale price and timing. If you need to sell quickly to meet a financial obligation, you may have to accept a lower price.

- Tax Implications: Capital gains taxes can impact your net proceeds from the sale. Understanding the tax implications of selling your investment property can help you time the sale strategically to minimize your tax burden.

Preparing the Property for Sale

Preparing your investment property for sale involves a series of steps designed to enhance its appeal to potential buyers.

- Professional Appraisal: Obtain a professional appraisal to determine the property’s fair market value, providing a realistic starting point for pricing.

- Necessary Repairs and Upgrades: Address any major repairs or upgrades that could deter potential buyers, such as fixing leaks, painting, or updating appliances. Focus on improvements that enhance the property’s functionality and appeal.

- Staging: Staging involves strategically arranging furniture and décor to create a welcoming and spacious atmosphere. A professionally staged property can significantly increase its appeal and potentially fetch a higher price.

- Professional Photography and Videography: High-quality photos and videos showcase the property’s best features and attract more potential buyers. Consider hiring a professional photographer and videographer to create captivating visuals.

- Marketing: Effective marketing involves creating a compelling listing description, utilizing online platforms, and potentially running targeted advertisements to reach the right buyers. A strong marketing strategy can maximize the number of potential buyers and increase the chances of a quick sale.

Sales Methods

There are various methods for selling your investment property, each with its advantages and disadvantages.

- Traditional Listings: This involves working with a real estate agent who lists the property on the Multiple Listing Service (MLS) and manages showings and negotiations. Agents have expertise in pricing, marketing, and negotiating, but they also charge commissions.

- Auctions: Auctions can generate competitive bidding and potentially result in a higher selling price. However, they require a shorter timeframe and can be less predictable than traditional listings.

- Private Sales: Selling directly to a buyer without an agent can save on commissions but requires more effort in marketing and negotiating. Private sales are best suited for experienced investors with a strong network.

Holding for Long-Term Appreciation

Holding an investment property for long-term appreciation is a strategy that involves buying a property with the expectation that its value will increase over time. This can be a rewarding strategy, but it requires patience and a careful understanding of market dynamics.

Benefits of Long-Term Holding

Holding an investment property for long-term appreciation can offer several benefits, including:

- Potential for High Returns: Real estate historically has been a good investment, with the potential for significant appreciation over time. As the property value increases, so does your equity, which can be accessed through refinancing or sale.

- Tax Advantages: Holding a property for long-term appreciation can offer tax advantages. For example, you may be able to deduct mortgage interest and property taxes, and you may qualify for capital gains tax exemptions.

- Stable Income Stream: If you rent out your property, you can generate a consistent income stream that can help offset your expenses and contribute to your overall financial goals.

- Inflation Hedge: Real estate can serve as an inflation hedge. As inflation rises, the value of your property tends to increase, helping to preserve your wealth.

- Forced Savings: Owning an investment property can act as a form of forced savings. The monthly mortgage payments encourage you to save consistently, building equity over time.

Risks of Long-Term Holding, Real estate investment property exit strategy

While long-term holding can be beneficial, it also comes with inherent risks:

- Market Volatility: Real estate values are influenced by various market factors, such as economic conditions, interest rates, and local supply and demand. A downturn in the market could lead to a decrease in your property’s value, impacting your investment.

- Property Maintenance Costs: Owning a property involves ongoing maintenance costs, which can vary depending on the age and condition of the property. Unexpected repairs or renovations can significantly impact your returns.

- Tenant Issues: If you rent out your property, you may encounter issues with tenants, such as non-payment of rent, damage to the property, or legal disputes. These situations can be time-consuming and costly to resolve.

- Opportunity Cost: Holding a property for long-term appreciation means tying up your capital, potentially limiting your ability to invest in other opportunities.

Key Market Indicators for Long-Term Growth

Identifying key market indicators can help you assess the potential for long-term growth in a specific location:

- Population Growth: A growing population typically indicates a strong demand for housing, which can drive property values up. Research the area’s population growth trends and projections.

- Economic Growth: A thriving local economy with job creation and rising incomes can fuel demand for housing, leading to property appreciation. Consider the area’s employment rate, industry diversification, and projected economic growth.

- Infrastructure Development: Investments in infrastructure, such as transportation systems, schools, and public amenities, can enhance the desirability of a location and boost property values. Research any planned infrastructure projects in the area.

- Government Policies: Local and national government policies can impact the real estate market. For example, tax incentives for homeownership or regulations on development can influence property values. Stay informed about relevant government policies.

- Local Demand: Analyze the specific demand for housing in the area. Factors such as the availability of affordable housing, the type of housing in demand, and the demographics of the population can all influence property values.

Pros and Cons of Long-Term Holding

| Pros | Cons |

|---|---|

| Potential for High Returns | Market Volatility |

| Tax Advantages | Property Maintenance Costs |

| Stable Income Stream | Tenant Issues |

| Inflation Hedge | Opportunity Cost |

| Forced Savings |

Refinancing or Refinancing and Selling

Refinancing is a strategy that involves replacing an existing mortgage with a new one, often with different terms such as a lower interest rate, a shorter loan term, or a different loan type. This can be a powerful tool for real estate investors looking to improve their cash flow, reduce their monthly payments, or access equity in their property.

Refinancing can be particularly beneficial in situations where interest rates have declined since the initial mortgage was taken out. By refinancing to a lower interest rate, investors can significantly reduce their monthly mortgage payments, freeing up cash flow for other investments or expenses.

Benefits and Drawbacks of Refinancing

Refinancing can offer several benefits, including:

- Lower interest rates: Refinancing to a lower interest rate can result in lower monthly payments, allowing investors to free up cash flow for other purposes. For example, if an investor refinances a $200,000 mortgage with a 5% interest rate to a new mortgage with a 3% interest rate, their monthly payments could decrease by hundreds of dollars.

- Shorter loan term: Refinancing to a shorter loan term can help investors pay off their mortgage faster, potentially saving them significant interest payments over the life of the loan. For instance, refinancing a 30-year mortgage to a 15-year mortgage can lead to faster debt reduction and lower overall interest costs.

- Access to equity: Refinancing can allow investors to tap into the equity they have built up in their property. This can be useful for funding renovations, purchasing additional properties, or covering other investment opportunities.

However, refinancing also comes with certain drawbacks:

- Closing costs: Refinancing involves closing costs, which can include appraisal fees, origination fees, and other expenses. These costs can offset some of the potential savings from a lower interest rate, especially if the investor plans to sell the property soon after refinancing.

- Interest rate risk: If interest rates rise after refinancing, investors may find themselves locked into a higher interest rate than they could obtain with a new mortgage. This could lead to higher monthly payments and potentially lower returns on their investment.

- Tax implications: Refinancing can have tax implications, depending on the specific circumstances. For example, if an investor refinances a mortgage to access equity and uses the funds for personal expenses, the interest paid on the new mortgage may not be tax-deductible.

Refinancing and Selling

Refinancing can be a strategic move when combined with a sale, especially if the investor anticipates selling the property within a few years. By refinancing to a lower interest rate or accessing equity, the investor can improve the property’s cash flow or fund renovations, potentially increasing its market value and leading to a higher sale price.

The decision to refinance before selling depends on several factors, including:

- Current interest rates: If interest rates are currently low, refinancing can be a smart move to lock in a lower interest rate and improve cash flow. However, if interest rates are expected to rise soon, refinancing may not be advisable.

- Time horizon: Refinancing can be a good strategy if the investor plans to sell the property within a few years, as the lower interest rate or access to equity can enhance the sale price. However, if the investor intends to hold the property for a longer period, the closing costs associated with refinancing may outweigh the benefits.

- Market conditions: The real estate market can significantly impact the decision to refinance before selling. If the market is hot, the investor may be able to sell the property quickly and at a higher price, making refinancing less crucial. However, if the market is slow, refinancing may help the investor weather the downturn and potentially attract more buyers.

1031 Exchange

A 1031 exchange, also known as a like-kind exchange, is a powerful tool for real estate investors seeking to defer capital gains taxes when selling an investment property. This strategy allows investors to reinvest the proceeds from the sale of one property into another, similar property without paying capital gains taxes at the time of the sale. This can be a significant advantage for investors, as it allows them to grow their wealth more quickly and efficiently.

How a 1031 Exchange Works

A 1031 exchange involves a series of steps that must be carefully coordinated. A qualified intermediary (QI) is appointed to handle the exchange process. The QI acts as a neutral third party, holding the proceeds from the sale of the old property and using them to purchase the new property. The exchange must meet specific IRS requirements, including:

- The properties must be held for investment or business purposes.

- The properties must be of like-kind, meaning they are similar in nature and use.

- The new property must be identified within 45 days of selling the old property.

- The new property must be acquired within 180 days of selling the old property.

Examples of 1031 Exchange Scenarios

Here are a few examples of how a 1031 exchange can be used to defer capital gains taxes:

- An investor sells a small apartment building and uses the proceeds to purchase a larger apartment building. This would be considered a like-kind exchange, as both properties are used for rental income.

- An investor sells a single-family rental property and uses the proceeds to purchase a commercial property. This would also be considered a like-kind exchange, as both properties are held for investment purposes.

- An investor sells a vacant lot and uses the proceeds to purchase a multi-family property. This would be considered a like-kind exchange, as both properties are used for investment purposes and have similar characteristics.

Steps to Execute a Successful 1031 Exchange

Here are the steps involved in executing a successful 1031 exchange:

- Identify the properties: Determine the properties you want to sell and the properties you want to acquire.

- Hire a qualified intermediary: The QI will handle the exchange process and ensure that it meets IRS requirements.

- Sell the old property: The old property must be sold in accordance with the terms of the 1031 exchange agreement.

- Identify the new property: The new property must be identified within 45 days of selling the old property.

- Acquire the new property: The new property must be acquired within 180 days of selling the old property.

Tax Implications

Understanding the tax implications of your exit strategy is crucial for maximizing your returns and minimizing your tax liability. Different exit strategies can have different tax consequences, so it’s essential to consider these implications before making any decisions.

Tax Implications of Selling

When you sell an investment property, you’ll likely have to pay capital gains tax on the profit. Capital gains tax is calculated as the difference between your selling price and your adjusted cost basis. Your adjusted cost basis includes your initial purchase price, plus any improvements you’ve made to the property, minus any depreciation you’ve taken.

For example, if you bought a property for $100,000, spent $10,000 on improvements, and took $5,000 in depreciation, your adjusted cost basis would be $105,000 ($100,000 + $10,000 – $5,000). If you sold the property for $120,000, your capital gains would be $15,000 ($120,000 – $105,000).

Tax Implications of Refinancing

Refinancing your investment property doesn’t typically trigger any immediate tax liability. However, if you use the refinance proceeds to make improvements, you may be able to deduct the interest on the loan.

You may also need to consider the impact of refinancing on your overall tax liability. For example, if you refinance to a lower interest rate, your monthly payments may be lower, which could reduce your tax deductions. On the other hand, if you refinance to a higher interest rate, your monthly payments may be higher, which could increase your tax deductions.

Tax Implications of 1031 Exchange

A 1031 exchange allows you to defer capital gains taxes when you sell an investment property and reinvest the proceeds in a similar property. This strategy can be beneficial for investors who want to continue investing in real estate but don’t want to pay capital gains taxes.

To qualify for a 1031 exchange, you must meet certain requirements, including:

- The property you sell must be held for investment or business purposes.

- You must reinvest the proceeds from the sale into a similar property within a certain timeframe.

- The replacement property must be of equal or greater value than the property you sold.

It’s important to note that while a 1031 exchange defers capital gains taxes, it doesn’t eliminate them. You will eventually have to pay capital gains taxes when you sell the replacement property.

Tax Implications Comparison Table

| Exit Strategy | Tax Implications |

|---|---|

| Selling | Capital gains tax on the profit |

| Refinancing | No immediate tax liability, but potential impact on deductions |

| 1031 Exchange | Capital gains taxes deferred, but not eliminated |

Market Analysis

Conducting thorough market research is crucial before implementing an exit strategy. Understanding the current market conditions and predicting future trends can significantly impact the success of your investment property exit strategy. This research can help you identify potential challenges, assess the viability of your chosen strategy, and ultimately maximize your returns.

A real estate investment property exit strategy is essential for maximizing your returns. It’s like having a well-defined plan for a business venture, and just like the Jim Cramer Investment Club might analyze a stock, you need to consider different scenarios for your property. Whether you choose to sell, refinance, or hold for long-term appreciation, having a clear exit strategy will help you make informed decisions and achieve your financial goals.

Key Factors Influencing the Real Estate Market

Several factors influence the real estate market, and it is essential to consider them when analyzing market trends. These factors can affect property values, demand, and overall market performance.

When crafting your real estate investment property exit strategy, consider the long-term viability of your investment. One potential avenue to explore is the world of Real Estate Investment Trusts (REITs), is real estate investment trusts a good career path , and how they can factor into your overall plan. Understanding the dynamics of REITs can offer valuable insights into potential avenues for liquidity and diversification within your real estate portfolio.

- Economic Trends: Interest rates, inflation, employment rates, and economic growth directly impact real estate investment. For example, rising interest rates can make borrowing more expensive, potentially decreasing demand and property values.

- Demographics: Population growth, age distribution, and household size influence the demand for different types of housing. For example, an aging population might lead to increased demand for senior living facilities or assisted living communities.

- Government Policies: Regulations, tax policies, and zoning laws can impact real estate investment. For example, changes in property taxes or zoning regulations can affect the value and desirability of certain properties.

- Local Market Conditions: Factors like job market, infrastructure, and local amenities play a crucial role in determining the attractiveness of a specific location. For example, a strong job market in a particular area can drive up demand and property values.

- Supply and Demand: The balance between the number of available properties and the number of buyers in the market directly affects property values. For example, a high supply of properties with low demand can lead to lower prices.

Essential Market Data to Analyze

To gain a comprehensive understanding of the market, it is essential to collect and analyze relevant data. This data can help you make informed decisions regarding your exit strategy.

A well-defined real estate investment property exit strategy is crucial for maximizing returns. This can involve selling the property at a profit, refinancing for cash-out, or even holding onto it for long-term appreciation. A good example of a firm that understands these strategies is HPS Investment Partners , a global investment firm with a strong focus on real estate.

Their expertise in navigating the complex world of real estate investments can be invaluable in formulating a successful exit strategy for your property.

- Property Values: Analyze historical and current property values in your target area to understand price trends and potential appreciation. You can access this information from real estate websites, appraisal reports, and local government records.

- Sales Data: Analyze recent sales data, including the number of transactions, average sale prices, and days on market. This data can help you assess the current market activity and demand for similar properties.

- Rental Market Data: If you are considering a rental strategy, analyze rental rates, vacancy rates, and demand for rental properties in your area. You can find this information from rental websites, property management companies, and local real estate agencies.

- Local Economic Indicators: Analyze economic data, such as employment rates, income levels, and population growth, to understand the long-term prospects of your investment area. You can access this information from government websites and economic research institutions.

- Development Plans: Research any planned development projects or infrastructure improvements in your area, as these can significantly impact property values. You can find this information from local government websites, planning departments, and news sources.

Risk Management

Real estate investment, while potentially lucrative, comes with inherent risks. Understanding and managing these risks is crucial for safeguarding your investment capital and achieving your financial goals.

Identifying Potential Risks

Different exit strategies carry different risks. It’s essential to analyze these risks before choosing a strategy.

- Selling the Property: Market fluctuations, slow sales, and unforeseen property defects can impact your profit margin.

- Holding for Long-Term Appreciation: Economic downturns, interest rate hikes, and changes in property values can affect your returns.

- Refinancing or Refinancing and Selling: Interest rate increases, property value declines, and inability to qualify for refinancing can jeopardize your strategy.

- 1031 Exchange: Meeting strict IRS requirements, identifying suitable replacement properties, and potential market fluctuations can pose challenges.

Strategies for Mitigating Risks

- Thorough Due Diligence: Before investing, conduct comprehensive research on the property, market conditions, and potential risks.

- Diversification: Don’t put all your eggs in one basket. Diversify your investments across different properties, locations, and asset classes.

- Conservative Financing: Secure loans with reasonable terms and interest rates, and consider leaving some equity in the property to buffer against market downturns.

- Contingency Planning: Develop backup plans in case your primary exit strategy fails.

- Professional Advice: Consult with experienced real estate professionals, financial advisors, and tax experts to gain insights and guidance.

Real-World Examples of Risk Management

- Market Downturn: An investor who purchased a property in 2007, just before the housing market crash, might have mitigated losses by refinancing with a lower interest rate or holding the property for long-term appreciation, betting on a market recovery.

- Unforeseen Property Defects: An investor who discovered a hidden foundation issue after purchasing a property could have mitigated the risk by negotiating a price reduction or terminating the contract before closing.

Case Studies

Examining real-world examples of successful exit strategies can provide valuable insights and guidance for your own real estate investment journey. These case studies illustrate how different strategies can be employed effectively, highlighting the factors that contribute to their success.

Successful Exit Strategy: Selling for Profit

The sale of a property for profit is a common and often straightforward exit strategy. This case study examines the successful sale of a single-family home in a growing suburban area.

- Property Details: A three-bedroom, two-bathroom single-family home purchased in 2015 for $250,000 in a rapidly developing suburban area. The property was in good condition but required some minor renovations to increase its market appeal.

- Investment Strategy: The investor focused on enhancing the property’s value through strategic renovations, including updating the kitchen and bathrooms, landscaping, and adding a deck. These improvements were completed within a reasonable budget, ensuring a strong return on investment.

- Market Timing: The investor strategically timed the sale of the property, taking advantage of a strong local real estate market with increasing demand for single-family homes. The property was listed for sale in 2020, when the market was experiencing a significant surge in activity.

- Outcome: The property was sold for $400,000 in 2020, resulting in a gross profit of $150,000. After accounting for renovation costs, closing costs, and other expenses, the investor realized a net profit of $120,000.

Factors Contributing to Success:

- Strategic Property Selection: Choosing a property in a growing area with strong demand and appreciation potential was crucial.

- Value Enhancement: Renovations and improvements were carefully planned and executed to increase the property’s desirability and market value.

- Market Timing: Selling the property during a period of high demand and favorable market conditions maximized the investor’s profit.

Lessons Learned:

- Thorough Due Diligence: Carefully researching the local market, identifying areas with growth potential, and understanding market trends is essential.

- Strategic Renovations: Prioritize renovations that add value and appeal to potential buyers while staying within a reasonable budget.

- Market Timing: Be patient and wait for the right opportunity to sell, taking advantage of favorable market conditions to maximize profit.

Successful Exit Strategy: 1031 Exchange

A 1031 exchange allows investors to defer capital gains taxes when selling investment property by reinvesting the proceeds into another qualifying property. This case study examines a successful 1031 exchange involving a commercial property.

- Property Details: A commercial office building purchased in 2010 for $1 million in a mature business district. The property had experienced a decline in rental income due to changes in the local market.

- Investment Strategy: The investor recognized the need to diversify their portfolio and identified an opportunity to exchange the office building for a larger, more modern industrial property in a rapidly growing area.

- 1031 Exchange Process: The investor worked with a qualified intermediary to facilitate the exchange, ensuring compliance with IRS regulations. The sale of the office building was carefully coordinated with the purchase of the industrial property, minimizing any potential tax liabilities.

- Outcome: The investor successfully exchanged the office building for the industrial property, deferring capital gains taxes. The new property offered higher rental income potential and long-term appreciation prospects.

Factors Contributing to Success:

- Understanding the 1031 Exchange Rules: Thorough knowledge of the IRS regulations and requirements for a 1031 exchange is essential.

- Experienced Intermediary: Working with a qualified intermediary with expertise in 1031 exchanges ensures a smooth and compliant transaction.

- Strategic Property Selection: Identifying a suitable replacement property that meets the investor’s investment goals and complies with 1031 exchange requirements is crucial.

Lessons Learned:

- Consult with Tax Professionals: Seek guidance from qualified tax professionals to understand the tax implications of a 1031 exchange and ensure compliance.

- Plan for the Future: Consider long-term investment goals and how a 1031 exchange can help achieve them.

- Diversify Your Portfolio: Utilize 1031 exchanges to diversify your real estate holdings and mitigate risk.

A well-defined real estate investment property exit strategy is the cornerstone of successful investing. By understanding the various options available, analyzing market trends, and managing risks effectively, you can navigate the complexities of exiting your investment with confidence. Whether you’re seeking immediate liquidity, maximizing long-term gains, or transitioning to new opportunities, a well-crafted exit strategy will ensure your investment journey culminates in a rewarding outcome.

General Inquiries

What is the most common exit strategy for real estate investors?

Selling the property is the most common exit strategy, but it’s not the only option. Other strategies include holding for long-term appreciation, refinancing, and utilizing a 1031 exchange.

When is the best time to sell an investment property?

The ideal time to sell depends on your individual goals and market conditions. Factors to consider include interest rates, property values, and the local real estate market.

What are the tax implications of selling an investment property?

Capital gains taxes are generally applicable when selling an investment property. However, tax deductions and exemptions may be available depending on your holding period and other factors.

How can I mitigate risks associated with real estate investment?

Risk mitigation strategies include thorough market research, diversification, proper insurance coverage, and working with experienced professionals.