Real Estate Investment Course Your Path to Financial Freedom

A real estate investment course sets the stage for this enthralling narrative, offering readers a glimpse into a world of financial opportunity and strategic property management. This comprehensive guide delves into the intricacies of real estate investing, equipping individuals with the knowledge and skills necessary to navigate the dynamic market and build a successful portfolio.

From understanding the fundamentals of market analysis and property valuation to mastering the art of negotiation and financing, this course provides a roadmap for success in the world of real estate. It explores diverse investment strategies, such as buy-and-hold, flipping, and rental property management, empowering individuals to make informed decisions that align with their financial goals.

The Importance of Real Estate Investment Education: Real Estate Investment Course

Real estate investing can be a lucrative and rewarding endeavor, but it also comes with its fair share of risks and complexities. A solid foundation in real estate investment education is crucial to navigate these challenges and maximize your chances of success. By investing in your knowledge, you’re equipping yourself with the tools and strategies to make informed decisions, avoid common pitfalls, and ultimately achieve your financial goals.

The Benefits of Taking a Real Estate Investment Course

A real estate investment course can provide you with a comprehensive understanding of the industry, covering various aspects from market analysis and property evaluation to financing and legal considerations. The benefits of such education extend beyond simply acquiring knowledge; it equips you with the skills and confidence to navigate the complex world of real estate investing.

- Enhanced Understanding of the Market: A course will provide you with a deep understanding of market trends, local regulations, and economic factors that influence real estate values. This knowledge empowers you to identify promising investment opportunities and make informed decisions about property selection and pricing.

- Mastering Property Evaluation Techniques: Learn how to accurately assess property values, identify potential risks, and determine the true potential of an investment. This skill is essential for making sound investment decisions and avoiding costly mistakes.

- Understanding Financing Options: Real estate investment often involves significant capital, and a course will help you navigate the complexities of financing options. You’ll learn about mortgages, private lending, and other funding sources, enabling you to secure the necessary capital for your investments.

- Legal and Regulatory Compliance: Real estate transactions involve a complex web of legal and regulatory requirements. A course will provide you with the necessary knowledge to ensure compliance, minimizing legal risks and protecting your investments.

- Developing Effective Investment Strategies: A course will introduce you to various investment strategies, such as buy-and-hold, flipping, and rental properties. This knowledge allows you to tailor your approach to your specific financial goals and risk tolerance.

- Networking Opportunities: Many real estate investment courses offer networking opportunities with experienced investors, mentors, and industry professionals. These connections can provide valuable insights, support, and potential partnerships.

Examples of Successful Real Estate Investors

Numerous successful real estate investors attribute their success to education and continuous learning. Here are some notable examples:

- Grant Cardone: A renowned real estate investor and motivational speaker, Cardone emphasizes the importance of education in building a successful real estate portfolio. He advocates for continuous learning and seeking mentorship from experienced professionals.

- Barbara Corcoran: A self-made millionaire and real estate mogul, Corcoran credits her success to her early investment in education. She emphasizes the importance of understanding market dynamics, property evaluation, and negotiation skills.

- Robert Kiyosaki: Author of the best-selling book “Rich Dad Poor Dad,” Kiyosaki stresses the importance of financial literacy and real estate education. He encourages individuals to invest in their knowledge and develop a strong understanding of the industry.

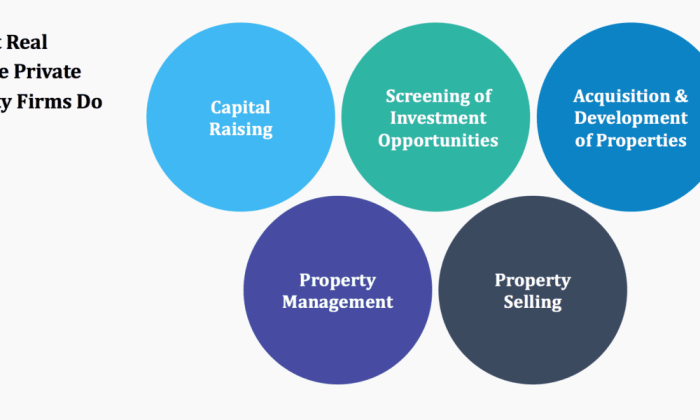

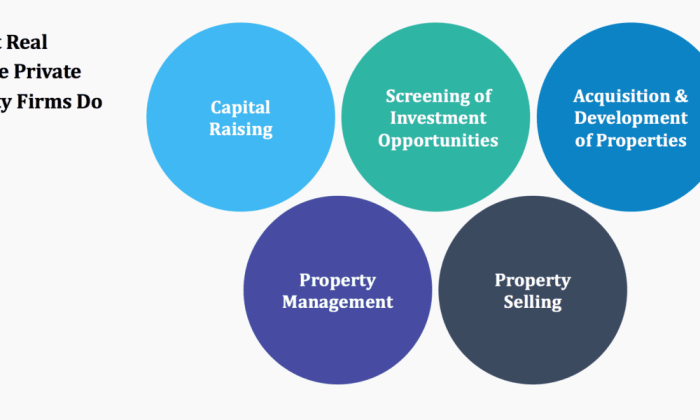

Key Areas Covered in a Comprehensive Real Estate Investment Course

A comprehensive real estate investment course will cover a wide range of topics, providing you with a holistic understanding of the industry. Here are some key areas typically addressed:

- Market Analysis and Research: Understanding market trends, supply and demand dynamics, and local economic factors is crucial for identifying promising investment opportunities.

- Property Evaluation and Due Diligence: Learning how to accurately assess property values, identify potential risks, and conduct thorough due diligence is essential for making sound investment decisions.

- Financing and Capital Acquisition: Navigating the complexities of financing options, securing mortgages, and exploring alternative funding sources is critical for acquiring investment properties.

- Legal and Regulatory Compliance: Understanding real estate laws, zoning regulations, and other legal requirements is essential for minimizing legal risks and ensuring smooth transactions.

- Property Management and Operations: Learn about the intricacies of managing rental properties, tenant screening, maintenance, and other operational aspects.

- Taxation and Investment Strategies: Understanding the tax implications of real estate investments, including depreciation, capital gains, and other tax benefits, is crucial for maximizing returns.

- Negotiation and Deal Structuring: Developing effective negotiation skills and understanding how to structure deals to your advantage is essential for securing favorable terms.

Types of Real Estate Investment Courses

Choosing the right real estate investment course can significantly impact your learning experience and investment success. The type of course you choose will depend on your learning style, budget, and investment goals.

Online Courses

Online courses offer a flexible and convenient way to learn about real estate investing. They are typically self-paced, allowing you to learn at your own convenience. Here are some of the advantages and disadvantages of online courses:

- Advantages:

- Flexibility and convenience: You can learn at your own pace and on your own schedule.

- Cost-effective: Online courses are often more affordable than in-person workshops or mentorship programs.

- Wide range of topics: Online courses cover a wide range of real estate investment topics, from the basics to advanced strategies.

- Access to expert instructors: Many online courses are taught by experienced real estate investors and professionals.

- Disadvantages:

- Lack of personal interaction: You may not have the opportunity to interact with instructors or other students in person.

- Potential for distractions: It can be challenging to stay focused and motivated when learning online.

- Limited practical experience: Online courses may not provide hands-on experience or opportunities to network with other investors.

In-Person Workshops

In-person workshops provide a more interactive and engaging learning experience. They allow you to connect with other investors and receive personalized feedback from instructors. Here are some of the advantages and disadvantages of in-person workshops:

- Advantages:

- Interactive learning: You can ask questions, participate in discussions, and receive feedback from instructors and other participants.

- Networking opportunities: In-person workshops provide opportunities to connect with other investors and build relationships.

- Practical experience: Some workshops offer hands-on activities or simulations that provide practical experience.

- Disadvantages:

- Time commitment: In-person workshops require a significant time commitment, as you need to travel to the location and attend the sessions.

- Costly: In-person workshops can be more expensive than online courses.

- Limited flexibility: You need to attend the workshops at scheduled times and locations.

Mentorship Programs, Real estate investment course

Mentorship programs offer personalized guidance and support from experienced real estate investors. You can learn from their experience and receive tailored advice on your investment journey. Here are some of the advantages and disadvantages of mentorship programs:

- Advantages:

- Personalized guidance: You receive one-on-one support and advice from a mentor who has experience in real estate investing.

- Access to industry connections: Mentors can connect you with other investors and professionals in the industry.

- Practical insights: You can learn from your mentor’s real-world experiences and mistakes.

- Disadvantages:

- Costly: Mentorship programs can be expensive, as they require a significant time investment from the mentor.

- Finding the right mentor: It can be challenging to find a mentor who is a good fit for your needs and goals.

- Time commitment: Mentorship programs require a significant time commitment from both the mentor and the mentee.

Types of Real Estate Investment Courses

The following table Artikels different types of real estate investment courses, including their focus, duration, and cost:

| Type of Course | Focus | Duration | Cost |

|---|---|---|---|

| Basic Real Estate Investing | Fundamentals of real estate investing, including market analysis, property evaluation, financing, and legal considerations. | 1-3 months | $100-$500 |

| Advanced Real Estate Investing | More complex real estate investment strategies, such as flipping, wholesaling, and commercial real estate investing. | 3-6 months | $500-$1,000 |

| Real Estate Development | The process of developing real estate projects, including land acquisition, zoning, construction, and marketing. | 6-12 months | $1,000-$5,000 |

| Real Estate Law | Legal aspects of real estate investing, including contracts, property rights, and taxation. | 1-3 months | $200-$1,000 |

| Real Estate Market Analysis | Analyzing real estate markets to identify investment opportunities and predict future trends. | 1-2 months | $100-$500 |

Choosing the Right Real Estate Investment Course

Choosing the right real estate investment course can be a game-changer for your journey in this field. It can equip you with the knowledge, skills, and connections you need to navigate the complexities of real estate investing. However, with so many options available, it’s crucial to select a course that aligns with your goals, learning style, and budget.

Factors to Consider When Selecting a Real Estate Investment Course

When choosing a real estate investment course, several factors are important to consider. These factors will help you make an informed decision and ensure that you invest your time and money wisely.

- Your Learning Style: Consider whether you learn best through hands-on activities, lectures, online modules, or a combination of these methods. Some courses offer more flexibility, allowing you to learn at your own pace.

- Your Investment Goals: Determine what you hope to achieve through real estate investing. Are you looking to buy and hold rental properties, flip properties, or invest in commercial real estate? Different courses cater to specific investment strategies.

- Your Budget: Real estate investment courses can range in price from a few hundred dollars to several thousand. Consider your budget and choose a course that fits within your financial constraints.

- Course Duration: Decide on the length of time you are willing to commit to a course. Some courses are short and intensive, while others span several months or even years.

- Course Format: Consider whether you prefer online courses, in-person workshops, or a hybrid format. Online courses offer flexibility, while in-person workshops allow for more interaction and networking.

- Instructor Credentials and Experience: Look for instructors with a proven track record in real estate investing. They should have experience in the market you are interested in and a strong understanding of the principles of real estate investment.

- Course Reviews and Testimonials: Read reviews from past students to get an idea of the course’s quality and effectiveness. Look for testimonials from individuals who have achieved success in real estate investing after completing the course.

Assessing the Credibility and Experience of the Course Instructors

It is crucial to evaluate the credibility and experience of the course instructors. This will give you confidence that you are learning from knowledgeable and experienced professionals.

- Industry Certifications and Licenses: Look for instructors who hold relevant industry certifications and licenses, such as the Certified Residential Investment Manager (CRIM) designation or the Certified Commercial Investment Manager (CCIM) designation. These certifications demonstrate expertise and knowledge in real estate investing.

- Real Estate Investing Track Record: Inquire about the instructors’ personal real estate investing experience. Have they successfully invested in properties themselves? What types of properties have they invested in, and what have been their results?

- Industry Affiliations and Networks: Check if the instructors are members of professional real estate organizations, such as the National Association of Realtors (NAR) or the Real Estate Investment Society (REIS). This indicates their commitment to the industry and their involvement in professional development.

- Online Presence and Social Media: Explore the instructors’ online presence and social media profiles. Do they share valuable insights and resources? Are they actively involved in the real estate community?

Evaluating the Curriculum and Learning Materials

A comprehensive curriculum and high-quality learning materials are essential for a successful real estate investment course. Carefully evaluate the course content to ensure it aligns with your learning objectives and provides practical knowledge and skills.

- Course Artikel and Syllabus: Review the course Artikel and syllabus to understand the topics covered and the learning objectives. Look for a structured curriculum that progresses logically from foundational concepts to advanced strategies.

- Learning Materials: Inquire about the learning materials provided. Do they include textbooks, workbooks, case studies, or online resources? Look for materials that are up-to-date, relevant, and easy to understand.

- Real-World Applications: A good real estate investment course should incorporate real-world applications. This could include case studies, simulations, or guest speakers from the industry.

- Networking Opportunities: Consider whether the course offers networking opportunities with other students, industry professionals, or mentors. Building connections within the real estate community can be invaluable.

- Support and Resources: Find out what support and resources are available after the course. Some courses offer ongoing mentorship, access to online forums, or networking events.

Key Concepts Covered in Real Estate Investment Courses

Real estate investment courses cover a wide range of concepts, equipping you with the knowledge and skills needed to navigate the complexities of the real estate market. These courses delve into fundamental principles, explore various investment strategies, and shed light on the legal and regulatory aspects of real estate investing.

Market Analysis and Property Valuation

Understanding the real estate market is crucial for making informed investment decisions. Market analysis involves studying supply and demand dynamics, identifying emerging trends, and assessing the potential for future growth. Property valuation, on the other hand, focuses on determining the fair market value of a property, taking into account factors such as location, size, condition, and comparable sales.

Real Estate Investment Strategies

Real estate investment courses explore different strategies, each tailored to specific goals and risk tolerances.

Buy-and-Hold

This strategy involves acquiring properties with the intention of holding them for an extended period, typically years or even decades. The primary goal is to generate passive income through rental revenue and benefit from long-term appreciation.

Flipping

Flipping involves purchasing properties, making necessary improvements, and then reselling them for a profit within a relatively short timeframe. This strategy requires a strong understanding of market trends, renovation costs, and the ability to identify undervalued properties.

Rental Property Management

This strategy involves acquiring rental properties and managing them to generate consistent cash flow. This includes tasks such as tenant screening, rent collection, maintenance, and legal compliance.

Legal and Regulatory Aspects

Real estate investing is subject to various legal and regulatory frameworks, which are crucial to understand for compliance and risk mitigation.

Zoning Laws

Zoning laws regulate land use within a specific area, dictating what types of development are permitted. Investors must ensure that their intended use complies with local zoning regulations.

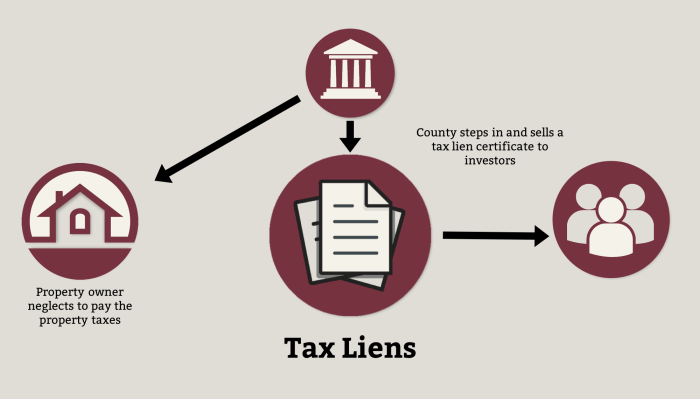

Property Taxes

Property taxes are levied by local governments based on the assessed value of a property. Understanding property tax rates and assessment procedures is essential for budgeting and financial planning.

Insurance

Various types of insurance are crucial for protecting real estate investments. These include property insurance, liability insurance, and title insurance.

Practical Applications of Real Estate Investment Knowledge

Learning about real estate investment principles is one thing, but applying them to real-world scenarios is another. This section delves into practical applications, equipping you with the tools to make informed investment decisions.

Real-World Examples of Applying Real Estate Investment Principles

Understanding real estate investment principles can be applied to a variety of scenarios, from purchasing a single-family home to developing a large commercial property. Here are some examples:

- Analyzing a Rental Property: When considering a rental property, the principle of cash flow analysis is crucial. By estimating rental income, expenses, and potential appreciation, you can determine the property’s profitability. This helps you make informed decisions about pricing, tenant selection, and overall investment strategy.

- Negotiating a Purchase Price: The principle of market analysis helps you negotiate a fair purchase price. By researching comparable properties, understanding market trends, and assessing the property’s condition, you can develop a strong negotiation strategy.

- Managing a Portfolio: Diversification is a key principle for managing a real estate portfolio. By investing in different property types, locations, and risk profiles, you can mitigate risk and potentially increase returns.

Conducting a Feasibility Analysis

A feasibility analysis is a critical step in evaluating any real estate investment opportunity. It helps you determine if the investment is financially viable and aligns with your investment goals.

- Define Investment Objectives: Clearly define your investment goals, including your desired return on investment, holding period, and risk tolerance.

- Market Research: Conduct thorough research on the target market, including demographics, economic trends, and competition.

- Property Analysis: Analyze the property’s condition, potential for appreciation, and any existing or potential issues.

- Financial Projections: Create detailed financial projections, including estimated income, expenses, and cash flow.

- Risk Assessment: Identify and assess potential risks, such as market volatility, vacancy rates, and interest rate fluctuations.

- Sensitivity Analysis: Conduct sensitivity analysis to understand how changes in key variables, such as rental rates or interest rates, could impact your investment.

Using Financial Tools and Calculators

Financial tools and calculators can be invaluable for evaluating real estate investment opportunities. These tools can help you analyze cash flow, calculate return on investment, and assess the financial viability of different investment strategies.

- Cash Flow Analysis: Use cash flow analysis tools to project the net income generated by a property, taking into account rental income, operating expenses, and debt service.

- Return on Investment (ROI) Calculator: Calculate the ROI to measure the profitability of an investment. This is typically expressed as a percentage and represents the profit generated relative to the initial investment.

- Debt Service Coverage Ratio (DSCR): Calculate the DSCR to assess the ability of a property to cover its debt obligations. This ratio compares the property’s net operating income to its annual debt service.

- Cap Rate Calculator: Calculate the capitalization rate (cap rate) to estimate the potential return on a commercial property. This is a measure of the property’s income-generating potential relative to its value.

Building a Successful Real Estate Investment Portfolio

Building a successful real estate investment portfolio requires a well-defined strategy, meticulous planning, and a commitment to ongoing learning. By implementing effective strategies, managing risks, and adapting to market fluctuations, you can create a portfolio that generates consistent returns and achieves your financial goals.

Diversification Strategies

Diversifying your real estate investments across different property types, geographic locations, and rental markets helps mitigate risk and enhance portfolio resilience.

- Property Types: Consider investing in a mix of residential, commercial, and industrial properties. Residential properties offer stable rental income and potential appreciation, while commercial and industrial properties provide opportunities for higher returns but may carry greater risk.

- Geographic Locations: Investing in properties in different cities or regions can help you capitalize on varying market trends and economic conditions. Diversifying your portfolio geographically can reduce the impact of localized economic downturns.

- Rental Markets: Targeting different rental markets, such as student housing, luxury apartments, or affordable housing, allows you to cater to specific demographics and income levels. This can provide a more balanced approach to risk and return.

Developing a Comprehensive Investment Plan

A well-structured investment plan is essential for guiding your investment decisions and tracking your progress toward your financial goals.

- Define Investment Goals: Clearly define your investment objectives, such as generating passive income, building wealth, or creating a retirement portfolio. This will help you choose the right investment strategies and measure your success.

- Establish a Budget: Determine your investment budget and allocate funds for different property types, acquisition costs, and ongoing expenses. This will ensure you stay within your financial constraints and avoid overextending yourself.

- Set Realistic Goals: Set realistic goals based on market conditions, your risk tolerance, and your investment timeline. Avoid chasing unrealistic returns or expecting quick profits, as real estate investments typically require a long-term perspective.

- Monitor Progress: Regularly monitor your portfolio’s performance and track key metrics such as occupancy rates, rental income, and expenses. This allows you to identify areas for improvement and adjust your investment strategy as needed.

Managing Risk and Mitigating Potential Losses

Real estate investments come with inherent risks, and it’s crucial to have strategies in place to manage those risks and protect your investment.

- Thorough Due Diligence: Before acquiring any property, conduct thorough due diligence to assess its condition, market value, potential risks, and future prospects. This involves reviewing property records, conducting inspections, and consulting with professionals.

- Proper Insurance: Obtain comprehensive insurance coverage for your properties, including property damage, liability, and rental income loss. This safeguards your investment against unexpected events such as fires, natural disasters, or tenant negligence.

- Diversification: As mentioned earlier, diversification across different property types, locations, and rental markets helps spread risk and reduce the impact of any single investment loss.

- Financial Reserves: Maintain a financial reserve to cover unexpected expenses, such as vacancy periods, repairs, or legal fees. This buffer provides a safety net and prevents you from having to liquidate assets during difficult times.

- Professional Management: Consider hiring a professional property manager to handle day-to-day operations, tenant screening, rent collection, and maintenance. This can free up your time and minimize potential risks associated with managing properties yourself.

Embarking on a real estate investment journey can be both exciting and daunting. However, with the right knowledge and guidance, it can become a pathway to financial freedom and a source of lasting wealth. This course serves as a valuable companion, providing the tools and insights needed to navigate the complexities of the real estate market and make informed investment decisions. By equipping individuals with a comprehensive understanding of real estate principles, strategies, and best practices, this course empowers them to confidently pursue their real estate investment aspirations.

FAQs

What are the prerequisites for taking a real estate investment course?

Most real estate investment courses do not have strict prerequisites, making them accessible to individuals with varying levels of experience. However, a basic understanding of financial concepts and a keen interest in real estate investing is recommended.

How much does a real estate investment course typically cost?

The cost of real estate investment courses can vary depending on the format, duration, and instructor. Online courses are generally more affordable than in-person workshops or mentorship programs. Expect to invest anywhere from a few hundred dollars to several thousand dollars for a comprehensive course.

What are the best resources for finding reputable real estate investment courses?

Look for courses offered by established real estate organizations, reputable educational institutions, or experienced real estate professionals. Online platforms like Coursera, Udemy, and edX also offer a variety of real estate investment courses.

Are there any real estate investment courses specifically designed for beginners?

Yes, many real estate investment courses are specifically tailored for beginners, providing a foundational understanding of the market and key investment principles. Look for courses that emphasize the basics and provide practical examples.

A real estate investment course can provide you with the tools and knowledge to make informed decisions, especially when considering unique properties like those found in resort destinations. If you’re interested in learning more about the ins and outs of buying resort investment properties , a comprehensive course can equip you with the strategies and insights needed to navigate this exciting niche market.

A real estate investment course can equip you with the knowledge to navigate the complexities of the market, including the potential benefits of investing in multifamily investment property. These courses often cover topics like property management, financing options, and market analysis, providing you with a solid foundation for making informed investment decisions.

A real estate investment course can equip you with the knowledge and skills to make informed decisions, whether you’re looking for a rental property or a fixer-upper. If you’re interested in the Houston market, you might want to check out investment property for sale in Houston. Once you’ve learned the basics of real estate investing, you’ll be ready to explore opportunities and find the perfect property to fit your goals.