Otto Car Insurance Reviews/feed

Otto Car Insurance Reviews: Unpacking the Best and Worst of Coverage Options

In an era where every drive could put you on the winding road of financial risk, auto insurance is your seatbelt, turning potential catastrophe into a manageable inconvenience. Whether you are a seasoned driver or the fresh owner of a sparkling set of wheels, deciphering which insurance provider can truly deliver the peace of mind you’re seeking is no small task. Enter Otto Car Insurance—a name that echoes in driver-friendly forums and whispers through the grapevine of industry insiders. But is Otto as effective as its reputation suggests, or just another cleverly marketed choice in a crowded conflux of coverage companies? Our exploration into Otto Car Insurance could shed some much-needed light on this vital decision.

If you’re new to our blog or considering a change in your current coverage, you’ve landed in the perfect spot. This post delves into Otto Car Insurance by scrutinizing user feedback, examining industry standings, and uncovering the complete package of services Otto offers. Benefit from insights and evaluations gathered from multiple sources, all aimed at giving you a solid understanding of how this provider fits into the larger landscape of automotive insurance.

Why Otto? Perhaps you’ve seen their ads during your favorite streaming show: a charismatic spokesperson assuring you that Otto not only understands drivers but also meets their evolving needs in an unpredictable world. Such confidence is compelling—but remains hollow without closer inspection. Thus, for this review, we’ve gathered honest feedback from customers, weighed Otto’s coverage flexibility, pricing, and customer service against the promises made in their glossy brochures.

What’s Covered? One of the pivotal focuses of this review will be to look deeply into what Otto covers and, equally important, what it doesn’t. Does it prioritize customer claims with the fierceness of a lioness protecting her cubs, or do users lament slow processes, unfriendly staff, and rejected claims? Which factors in its range of services make Otto Car Insurance a prudent choice for modern-day drivers? As the old adage goes, “the devil is in the details,” and we’ll be uncovering exactly what those details reveal about Otto’s claim handling.

Additionally, the winds of change are strong in the automotive insurance industry. New challenges regarding digitalization and automation demand that companies, like Otto, must adapt to offer more than standard services. Our blog isn’t just looking at present offerings. It evaluates how Otto is evolving its platforms with innovative technologies to serve you better. Through this discussion, we aim to project Otto’s trajectory towards becoming your next policy provider—or not.

Moreover, we acknowledge that affordability remains paramount for consumers. How does Otto stack up to competitors in terms of value? With a financial landscape that continues shifting, your ability to find a cost-effective and comprehensive insurance package holds extra swathes of importance. We delve into Otto’s pricing strategies, analyzing premium costs in contrast to its competitors while considering customer satisfaction stories to glean the unadulterated truth.

Let us not forget one of the most persuasive elements of any service review: customer interaction. In today’s era, where anyone can voice opinions on social media platforms, reviews do more than inform. They build expectations. This post draws from a compendium of user experiences and customer service anecdotes to bring you clarity about what Otto Insurance might bring to your driving experience.

To punctuate this review, we’ll briefly peer into the environmental and ethical practices Otto employs to determine how these initiatives might influence your decision in aligning with their brand. Are they truly looking at a greener future, and how does that translate into value for you, the eco-conscious consumer?

By the end of this post, we hope you will be well-equipped with comprehensive insights and answers on whether Otto Car Insurance warrants a “yay” or “nay” from those who take to the roads daily, trusting such a significant part of their lives to an insurance provider.

Understanding Otto Car Insurance Coverage

Otto Car Insurance provides an array of coverage options tailored to meet diverse customer needs. Whether you’re a seasoned driver or a new car owner, Otto offers customizable policies designed to provide peace of mind. Let’s delve into the specific types of coverage available.

Liability Coverage

Liability coverage is essential for every car insurance policy, and Otto offers robust options in this category. It covers damages and legal fees if you’re at fault in an accident, ensuring you’re protected from significant financial burdens. Typically, liability coverage from Otto includes both bodily injury and property damage aspects.

- Bodily Injury Liability: Covers medical expenses for injuries to others if you’re at fault.

- Property Damage Liability: Pays for damages to other vehicles or property resulting from an accident you caused.

Collision and Comprehensive Coverage

For drivers seeking more extensive protection, Otto offers collision and comprehensive coverage. These options shield you from out-of-pocket expenses arising from various scenarios beyond mere traffic collisions.

- Collision Coverage: Helps pay for repairs to your vehicle regardless of who is at fault.

- Comprehensive Coverage: Protects against non-collision-related incidents like theft, vandalism, natural disasters, and even hitting an animal.

Additional Coverage Options

Otto Car Insurance also provides additional coverage options for enhanced security:

- Uninsured/Underinsured Motorist Coverage: Critical for covering damages and medical costs when the at-fault driver lacks sufficient insurance.

- Medical Payments Coverage: Assists with medical expenses for you and your passengers, regardless of fault.

- Roadside Assistance: Provides crucial services like towing, flat tire changes, and battery jumps, ensuring you’re never stranded.

The Cost of Otto Car Insurance

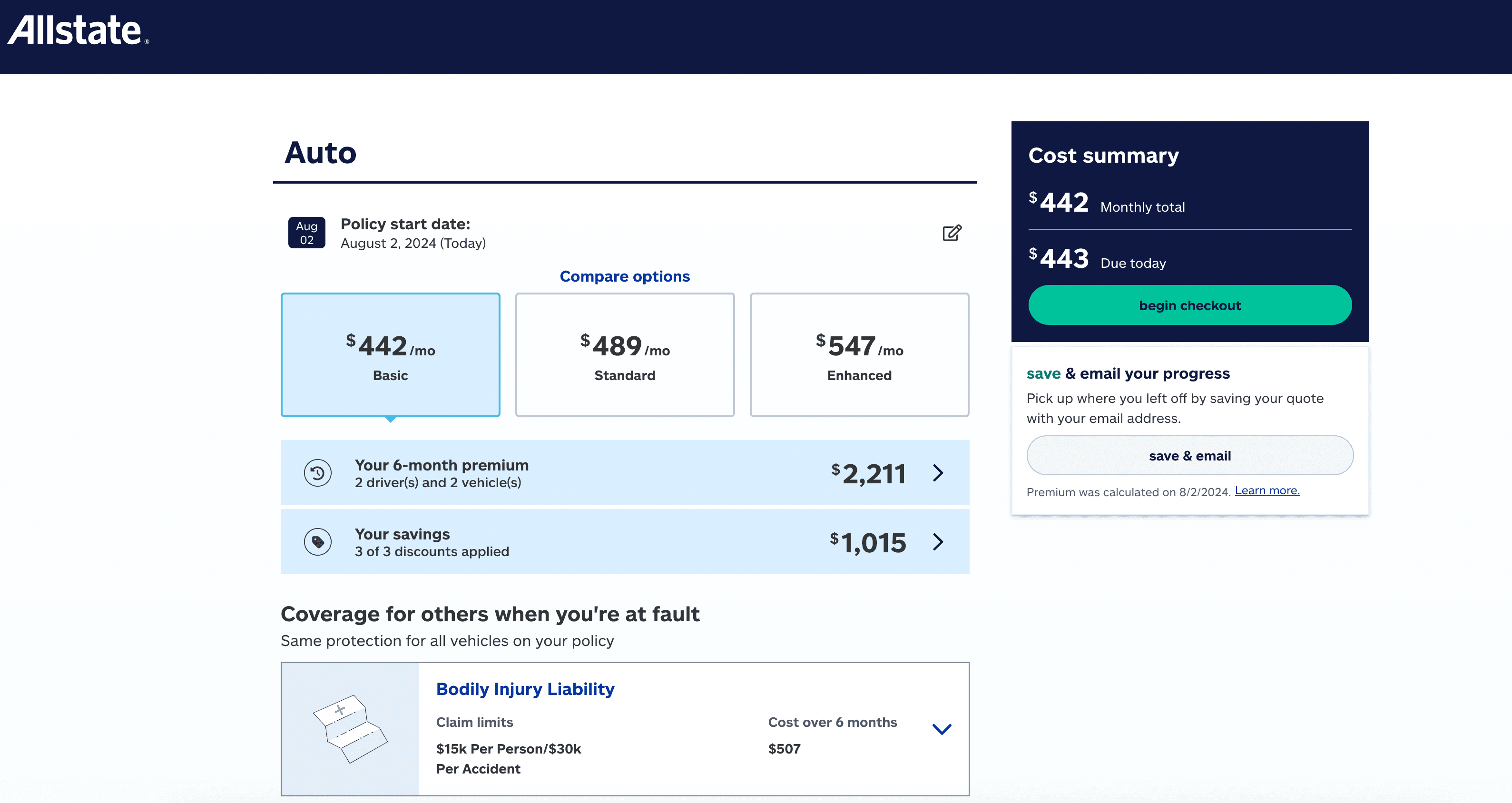

Otto Car Insurance is known for its competitive pricing, offering great value across different coverage options. However, several factors influence the overall cost. Understanding these can help you tailor your policy to suit your budget while ensuring comprehensive protection.

Factors Affecting Pricing

Here’s what typically affects Otto insurance premiums:

- Driver’s Age and Driving History: Younger drivers or those with a history of accidents may face higher premiums.

- Vehicle Type: The make, model, and age of your car can impact the cost of your policy. Luxury and sports cars usually incur higher rates due to more expensive repair or replacement costs.

- Location: Urban areas with higher traffic and accident rates can lead to higher premiums compared to rural areas.

- Credit Score: Your credit history may also play a role in determining your insurance rates.

Discount Opportunities

Otto provides various discount opportunities to help bring down your insurance costs:

- Multi-Policy Discount: Save money when you combine home and auto insurance policies.

- Good Driver Discount: Rewards for maintaining a clean driving record.

- Safety Features Discount: Vehicles equipped with alarm systems or anti-theft features might qualify for additional savings.

- Loyalty Discount: Long-term customers can enjoy reduced rates as a reward for their loyalty.

Customer Experience with Otto Car Insurance

Customer experience is a critical factor when selecting an insurance provider. Otto Car Insurance has built a reputation for delivering quality service and support, which we’ll examine in further detail below.

Claims Process

The claims process is often a key determinant of customer satisfaction. Otto’s streamlined claim submission procedures are tailored to minimize hassle and delay for its policyholders. Customers typically praise:

- Easy Online Claims: Otto offers an intuitive online platform for filing claims, providing efficiency and convenience.

- Responsive Customer Service: Highly rated customer support ready to assist and guide you through the claims process.

- Fast Payouts: Prompt settlement of claims ensures drivers can quickly get back on the road.

Customer Reviews and Feedback

Feedback from existing customers provides valuable insight into the service quality of Otto Car Insurance. Reviews often mention:

- Competitive Rates: Many customers appreciate the balance between cost and coverage, finding Otto’s rates affordable compared to the broader market.

- Flexibility in Policies: The ability to easily customize policies to fit individual needs is frequently highlighted.

- Exceptional Support: Otto’s reputation for attentive and knowledgeable customer service representatives enhances the overall experience.

Issues and Areas for Improvement

While Otto Car Insurance receives considerable praise, some areas for improvement are noted by customers:

- Limited Physical Locations: Some customers prefer face-to-face interactions, which may be limited depending on where you are located.

- Specialized Coverage Needs: Potential for more specialized coverage options or bespoke insurance solutions for unique cases.

Overall, customers often find Otto to deliver a good balance of comprehensive choices and competitive pricing, making it a compelling option for many drivers.

Synthesizing Key Takeaways and Final Thoughts on Otto Car Insurance

As we draw our discussion on Otto Car Insurance to a close, it’s important to revisit and synthesize the insights garnered from our examination of this unique insurance option. Throughout this post, we’ve dissected various facets of Otto Car Insurance, balancing both its strengths and areas where it perhaps falls short. Now, let’s encapsulate these key takeaways and ponder on what they collectively signify for potential policyholders like you.

Key Takeaways

First and foremost, Otto Car Insurance stands out in the crowded field of automobile insurance providers thanks to its commitment to offering personalized coverage plans. By focusing on individual needs and driving habits, Otto aims to tailor policies that align specifically with the expectations and realities of each driver. Our deep dive into their offerings demonstrated a flexible, user-centric approach that can be highly beneficial to drivers seeking customized solutions rather than one-size-fits-all packages.

Furthermore, Otto distinguishes itself with competitive pricing strategies, leveraging technology to bring down costs. Through the integration of telematics and data analysis, Otto offers usage-based premiums, allowing meticulous drivers the opportunity to be rewarded for their diligent habits. This transparent pricing mechanism not only demystifies premium calculations but also incentivizes safer driving.

We also explored the digital-first experience that Otto provides, including a robust app and online interface. The convenience and accessibility of managing policies, filing claims, and accessing support via digital tools cannot be understated, especially in today’s fast-paced, tech-savvy world. This shift towards a comprehensive digital experience reflects broader industry trends and consumer preferences for streamlined services.

On the flip side, we examined areas where Otto might not perfectly meet every customer’s needs. While their personalized approach is commendable, it might also mean that those seeking very traditional or complex coverage options may find limitations within Otto’s scope. Additionally, their heavy reliance on technology could potentially alienate users who prefer interpersonal interactions and traditional customer service models.

Final Thoughts

Ultimately, Otto Car Insurance exemplifies the ongoing transformation in the car insurance industry. By embracing innovative technological solutions and putting the customer at the forefront, Otto is contributing to a larger narrative of change—where insurance is not just a mandatory purchase but a beneficial and transparent service that evolves with user needs and expectations. However, as with any service, it is critical for potential customers to meticulously analyze their personal circumstances and needs before choosing a policy. This ensures that the chosen insurance partner, Otto or otherwise, truly aligns with their lifestyle, budget, and future planning.

While Otto presents a compelling proposition for those interested in a digital-first, usage-based insurance model, it is vital to weigh these benefits against the potential downsides. Careful consideration of personal preferences, driving habits, and individual insurance needs should guide your decision-making process.

Call to Action

As we conclude, I invite you to consider these insights as you evaluate your current or future car insurance needs. Reflect on what aspects of Otto’s offerings resonate with you or highlight areas for further question. To facilitate deeper understanding and help you make informed decisions, I encourage you to:

- Research Further: Dive deeper into customer reviews, expert analyses, and comparisons with other insurance companies to get a comprehensive view of how Otto stands in the overall market, and to uncover if it truly aligns with your specific requirements.

- Engage with Others: Join online forums or insurance-related discussion groups to hear first-hand accounts from current or former Otto policyholders. Their experiences can provide valuable, real-world insights that you might not find through official channels.

- Consider a Quote: Even if you’re not immediately considering switching or opting for new insurance, getting a personalized quote from Otto could be a beneficial step in understanding potential cost benefits and coverage options that suit your profile.

Finally, remember that insurance is a personal choice that requires time, understanding, and consideration of your unique driving needs. I hope this guide has aided you in your quest for the most suitable car insurance option and sparked a curiosity to explore Otto Car Insurance further. Stay informed, make educated choices, and drive safely!

Thank you for accompanying me on this exploration of Otto Car Insurance. Your engagement in such conversations is the first step toward ensuring the best protection for your vehicle and peace of mind on the road. Feel free to share this article with others who might find it helpful, and don’t hesitate to leave your thoughts or questions in the comments below!

Happy and safe driving!

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology