Non-Owners Car Insurance Protecting You When You Drive

Non owners car insurance – Non-owner’s car insurance provides essential coverage for individuals who drive borrowed vehicles or don’t own a car but need liability protection. This unique type of insurance ensures that you’re covered financially if you cause an accident while driving a car you don’t own, safeguarding you from potential legal and financial repercussions.

Imagine you’re borrowing a friend’s car for a weekend trip and you get into an accident. Without non-owner’s car insurance, you could be held personally liable for damages and injuries, potentially facing significant financial burdens. This type of insurance acts as a safety net, offering peace of mind and financial security in such situations.

What is Non-Owner’s Car Insurance?

Non-owner’s car insurance is a type of insurance designed for individuals who do not own a car but frequently drive other people’s vehicles. It provides coverage for liability, medical expenses, and other potential risks associated with driving, even if you don’t own the car you’re driving.

This insurance policy is crucial for individuals who regularly borrow cars, rent vehicles, or drive company cars. It ensures that you have the necessary financial protection in case of an accident or other incident while driving a vehicle you don’t own.

Coverage Typically Included, Non owners car insurance

Non-owner’s car insurance typically includes several types of coverage to protect you financially in the event of an accident or other incident while driving a non-owned vehicle.

- Liability Coverage: This coverage protects you from financial responsibility for injuries or property damage caused to others in an accident. It typically covers bodily injury liability and property damage liability.

- Medical Payments Coverage (MedPay): This coverage helps pay for your medical expenses if you’re injured in an accident, regardless of who is at fault. It covers your medical bills, regardless of fault.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re injured in an accident caused by an uninsured or underinsured driver. It helps cover your medical expenses and lost wages.

Difference Between Non-Owner’s Car Insurance and Standard Car Insurance

Non-owner’s car insurance differs from standard car insurance in several key aspects.

- Coverage Scope: Non-owner’s car insurance only covers you while driving a non-owned vehicle. Standard car insurance covers you while driving your own vehicle.

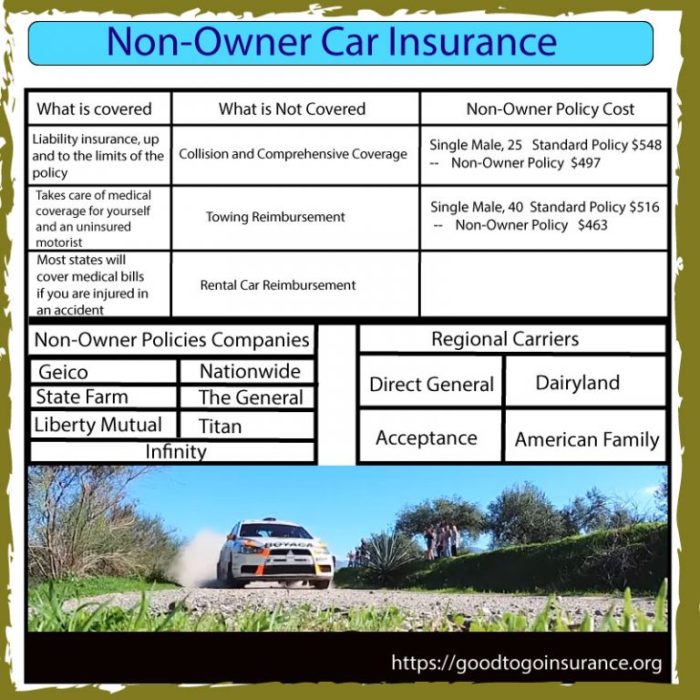

- Cost: Non-owner’s car insurance is typically more affordable than standard car insurance, as it covers a narrower range of risks.

- Comprehensive and Collision Coverage: Non-owner’s car insurance usually doesn’t include comprehensive and collision coverage, which protects your own vehicle from damage caused by incidents like theft, vandalism, or natural disasters.

Benefits of Non-Owner’s Car Insurance

Non-owner’s car insurance offers valuable protection for individuals who don’t own a car but frequently drive borrowed or rented vehicles. This type of insurance provides peace of mind and financial security in various situations.

Financial Protection

Non-owner’s car insurance offers significant financial protection in the event of an accident. It covers your liability for damages to other vehicles or property, as well as injuries to others. This insurance helps protect your finances from potential legal claims and financial burdens.

- Liability Coverage: Non-owner’s car insurance typically includes liability coverage, which pays for damages caused by you to other vehicles or property in an accident. This coverage can help protect you from significant financial losses if you are found at fault.

- Medical Payments Coverage: This coverage pays for medical expenses incurred by you or your passengers in an accident, regardless of who is at fault. This helps alleviate the financial burden of medical bills and ensures access to necessary healthcare.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. It helps compensate for your losses and medical expenses, providing additional security on the road.

Protection in Specific Situations

Non-owner’s car insurance offers valuable protection in various scenarios where you might be driving a borrowed or rented vehicle:

- Driving a Friend’s Car: If you frequently borrow your friend’s car for errands or social outings, non-owner’s insurance provides liability coverage in case of an accident.

- Renting a Car: When renting a car for vacation or business travel, non-owner’s insurance supplements the rental company’s insurance, providing additional coverage and peace of mind.

- Using a Company Car: If you use a company car for work, non-owner’s insurance can provide extra coverage beyond the company’s insurance, protecting you from personal liability.

Comparison with Other Insurance Types

Non-owner’s car insurance offers specific advantages compared to other types of insurance:

- More Affordable than Full Coverage: Non-owner’s insurance is typically less expensive than full coverage car insurance, making it a cost-effective option for those who don’t own a vehicle.

- Targeted Coverage: Unlike full coverage, non-owner’s insurance provides only the essential coverage you need, avoiding unnecessary expenses.

- Flexibility: You can adjust your coverage based on your driving needs and frequency of borrowing or renting vehicles.

Non-Owner’s Car Insurance vs. Other Types of Insurance

Non-owner’s car insurance is a specialized type of insurance designed for individuals who don’t own a car but frequently drive borrowed or rented vehicles. While it shares some similarities with other types of insurance, it’s crucial to understand the distinctions to make the most informed decision for your specific needs.

Comparison with Standard Car Insurance

Standard car insurance is designed for vehicle owners and covers a range of risks, including damage to your own car, liability for accidents, and comprehensive coverage for theft or natural disasters. Non-owner’s car insurance, on the other hand, focuses specifically on providing liability coverage when you’re driving someone else’s car.

- Standard car insurance typically covers your vehicle’s damage, liability for accidents, comprehensive coverage for theft or natural disasters, and medical payments for injuries sustained in an accident.

- Non-owner’s car insurance only covers liability for accidents while driving someone else’s car. It doesn’t cover damage to the borrowed vehicle.

Comparison with Renter’s Insurance

Renter’s insurance protects your personal belongings from damage or theft while living in a rented property. It does not provide coverage for accidents while driving.

- Renter’s insurance covers your personal property in case of theft, fire, or other disasters. It may also provide liability coverage if someone is injured in your rented property.

- Non-owner’s car insurance provides liability coverage for accidents while driving someone else’s car, but it doesn’t cover your personal belongings or liability in your rented property.

Comparison with Umbrella Insurance

Umbrella insurance acts as an additional layer of protection on top of your existing insurance policies. It provides extra liability coverage in case you’re sued for a significant amount exceeding your primary policy limits.

- Umbrella insurance provides extra liability coverage in addition to your existing policies, such as car insurance or homeowner’s insurance. It can cover claims that exceed the limits of your primary policies.

- Non-owner’s car insurance provides liability coverage specifically for accidents while driving someone else’s car. It does not act as an additional layer of protection for other types of insurance.

Non-owner’s car insurance is a vital solution for those who drive without owning a car, ensuring financial protection and peace of mind. By understanding the benefits and coverage options, you can make an informed decision about whether this type of insurance is right for you. Whether you’re a frequent borrower of vehicles or simply need temporary coverage, non-owner’s car insurance provides a crucial safety net for drivers in various situations.

Top FAQs: Non Owners Car Insurance

What is the difference between non-owner’s car insurance and standard car insurance?

Non-owner’s car insurance is designed for individuals who don’t own a car but need coverage while driving borrowed vehicles. Standard car insurance covers your own vehicle and provides liability coverage for accidents you cause. Non-owner’s car insurance only covers you when you’re driving someone else’s car.

How much does non-owner’s car insurance typically cost?

The cost of non-owner’s car insurance varies depending on factors such as your driving record, age, location, and the coverage you choose. However, it’s generally considered more affordable than standard car insurance.

Can I get non-owner’s car insurance if I have a DUI on my record?

It may be challenging to obtain non-owner’s car insurance with a DUI on your record, as insurers may view you as a higher risk. However, you can still explore options and compare quotes from different insurers to find the best coverage for your situation.