Non-Owner Car Insurance Protection Without Ownership

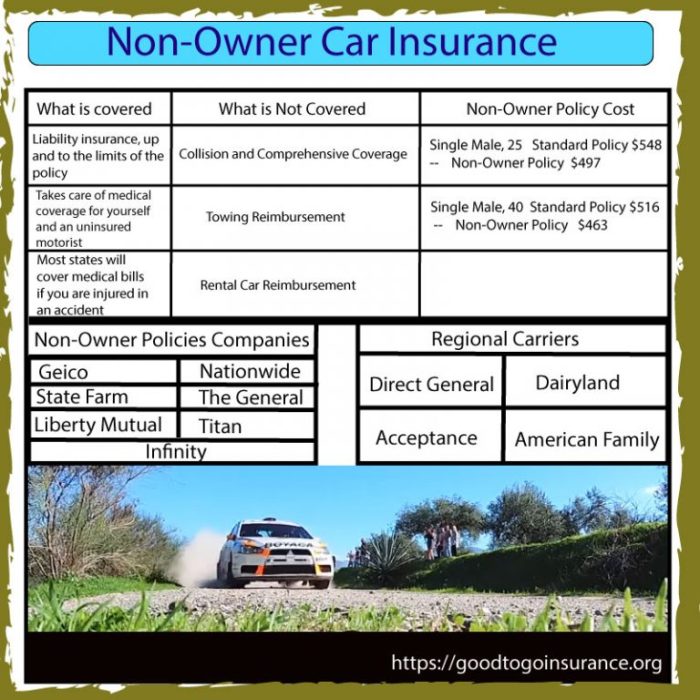

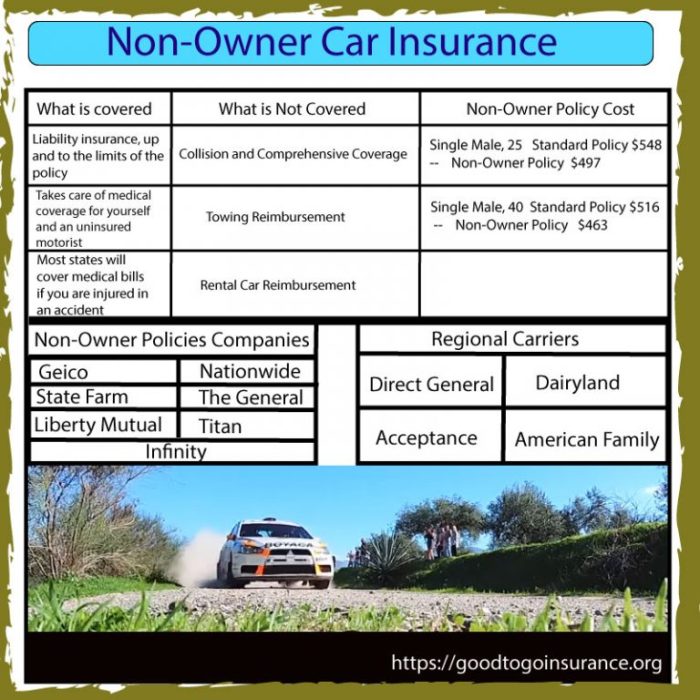

Non owner car insurance – Non-owner car insurance provides a safety net for individuals who drive but don’t own a vehicle. This specialized coverage offers protection against liability and other risks associated with driving, even if you’re behind the wheel of a borrowed or rented car.

Imagine yourself borrowing a friend’s car for a weekend getaway or renting a vehicle during a vacation. Accidents can happen, and without proper insurance, you could face significant financial consequences. This is where non-owner car insurance comes in, offering peace of mind and financial security for those who drive without owning a car.

What is Non-Owner Car Insurance?

Non-owner car insurance is a type of insurance policy that provides coverage for drivers who don’t own a car but need liability coverage when they drive someone else’s vehicle. It’s designed to protect you financially if you’re involved in an accident while driving a borrowed or rented car.

Non-owner car insurance is different from standard car insurance because it doesn’t cover your own vehicle. Instead, it provides liability coverage for bodily injury and property damage to others in the event of an accident while driving a non-owned vehicle.

Examples of Situations Where Non-Owner Car Insurance is Necessary

Here are some examples of situations where non-owner car insurance is essential:

- Occasional Drivers: If you only drive a car occasionally, for instance, when borrowing a friend’s car or renting a vehicle for a trip, non-owner car insurance provides liability coverage.

- Drivers Without a Car: If you don’t own a car but frequently borrow a vehicle from family or friends, non-owner car insurance ensures you’re protected in case of an accident.

- Young Drivers: Young drivers often don’t own a car but may need coverage when driving a parent’s or guardian’s vehicle. Non-owner car insurance can provide them with the necessary liability protection.

- Individuals with Suspended Licenses: If your driver’s license is suspended, you might not be able to obtain standard car insurance. Non-owner car insurance can offer liability coverage while you’re waiting for your license to be reinstated.

Who Needs Non-Owner Car Insurance?

Non-owner car insurance is designed for individuals who don’t own a vehicle but still need coverage. This type of insurance can be beneficial for various situations, including those who regularly drive borrowed or rented vehicles, operate a company car, or have limited driving needs.

Individuals Who May Benefit from Non-Owner Car Insurance

Non-owner car insurance can provide valuable protection for several groups of people. Here are some common scenarios where it can be advantageous:

- Individuals who drive borrowed vehicles frequently: This includes those who regularly borrow a family member’s car, rent vehicles for personal use, or use a company car for work-related purposes.

- Drivers who have recently sold their car: If you’ve recently sold your car but still need coverage while you’re in the process of purchasing a new one, non-owner car insurance can provide temporary protection.

- Individuals who have had their driver’s license suspended or revoked: If you’ve lost your driving privileges due to a DUI or other offense, non-owner car insurance can still offer liability coverage if you’re driving a borrowed or rented vehicle.

- Teenagers who are learning to drive: Non-owner car insurance can provide coverage for teenage drivers who are practicing with a parent’s or guardian’s vehicle.

- Individuals who only drive occasionally: If you don’t drive often but still need coverage for the occasional trip, non-owner car insurance can be a cost-effective solution.

Scenarios Where Non-Owner Car Insurance is Mandatory

In some situations, non-owner car insurance is required by law. Here are a few examples:

- States with mandatory financial responsibility laws: Some states require all drivers, even those who don’t own a car, to have proof of financial responsibility. This can be fulfilled by obtaining non-owner car insurance.

- Renting a vehicle: Many rental car companies require renters to have proof of insurance, which can be provided by non-owner car insurance.

- Driving a company car: Some employers require employees who drive company vehicles to have non-owner car insurance to cover potential liabilities.

Benefits of Having Non-Owner Car Insurance, Non owner car insurance

Non-owner car insurance offers several benefits, including:

- Liability coverage: This protects you from financial losses if you’re responsible for an accident while driving a borrowed or rented vehicle. This coverage can help pay for the other driver’s medical expenses, property damage, and legal fees.

- Peace of mind: Knowing that you’re covered financially in case of an accident can give you peace of mind while driving. It can also protect you from potential financial ruin.

- Cost-effective: Non-owner car insurance is typically more affordable than standard car insurance, as it only covers you when you’re driving someone else’s vehicle.

Getting a Non-Owner Car Insurance Quote: Non Owner Car Insurance

Getting a quote for non-owner car insurance is a straightforward process that usually involves providing some basic information about yourself and your driving history.

Obtaining a Quote

To get a non-owner car insurance quote, you’ll need to contact insurance companies directly. You can do this online, over the phone, or by visiting an insurance agent in person. Here’s what you can expect during the quoting process:

- Provide personal information: You’ll be asked for your name, address, date of birth, and contact information.

- Share driving history: You’ll need to provide details about your driving record, including any accidents, violations, or suspensions.

- Specify coverage needs: You’ll need to let the insurance company know the type of coverage you need, such as liability, medical payments, or uninsured/underinsured motorist coverage.

- Confirm vehicle details: You’ll need to provide information about the vehicle you plan to drive, such as the make, model, and year.

Finding the Best Insurance Rates

Once you’ve provided the necessary information, the insurance company will calculate your premium. To find the best rates, it’s essential to compare quotes from multiple insurers. Here are some tips:

- Use online comparison tools: Several websites allow you to compare quotes from multiple insurers simultaneously. This can save you time and effort.

- Contact insurance agents: An independent insurance agent can help you compare quotes from different companies and find the best coverage for your needs.

- Ask about discounts: Many insurers offer discounts for good driving records, safe driving courses, and other factors. Be sure to ask about any available discounts.

- Consider your needs: When comparing quotes, it’s essential to consider the coverage you need. Don’t choose the cheapest policy if it doesn’t offer the protection you require.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is crucial for finding the best rate and coverage. By shopping around, you can ensure you’re getting the most competitive price and the right protection for your needs.

“Don’t settle for the first quote you get. Take the time to compare quotes from multiple insurers to find the best deal.”

Non-owner car insurance is a crucial aspect of responsible driving, ensuring you’re protected regardless of vehicle ownership. By understanding the nuances of this coverage, you can make informed decisions about your insurance needs and navigate the roads with confidence, knowing you have a safety net in place.

FAQ Resource

Is non-owner car insurance mandatory?

While not mandatory in all states, non-owner car insurance is often required in certain situations, such as when driving a leased vehicle or if you’re operating a car for your employer.

What are the benefits of non-owner car insurance?

Non-owner car insurance provides financial protection against liability claims, medical expenses, and damage to other vehicles in the event of an accident. It can also cover your own injuries if you’re not at fault.

How much does non-owner car insurance cost?

The cost of non-owner car insurance varies based on factors like your driving history, age, location, and the coverage levels you choose. It’s generally more affordable than standard car insurance.

What happens if I have non-owner car insurance and get into an accident?

If you’re in an accident while driving a borrowed or rented car, your non-owner car insurance will cover you for damages and injuries up to the policy limits. You’ll need to file a claim with your insurer, and they will handle the process.