Metromile Car Insurance

The Future of Car Insurance: Unveiling the Potential of Metromile

It’s a brisk morning and you’re preparing for another day at the office when suddenly you realize you haven’t driven your car at all this week. You ponder over the monthly insurance bill that seems to mock you for spending more time on foot or public transportation than behind your own steering wheel. In today’s fast-paced, ever-evolving digital landscape, traditional car insurance can feel like a relic of the past. This is where Metromile, a revolutionary company, is steering the car insurance industry into uncharted territory. Welcome to the world of pay-per-mile car insurance, where you only pay for the miles you actually drive.

Founded with the mission to make car insurance fairer and more convenient, Metromile is a beacon for those who believe in “better insurance through technology”. As we navigate through the myriad of insurance options, Metromile emerges as a refreshing alternative that promises not only to cut down costs for low-mileage drivers but also to enhance the overall insurance experience through technological advancements.

Think of Metromile as your insurance-savvy co-pilot, helping you save money while delivering cutting-edge features that cater to the modern driver’s needs. But how exactly does this innovative model work, and why should it matter to you? Let’s delve into the intricacies of Metromile’s pay-per-mile approach and how it’s redefining what it means to safeguard your vehicle.

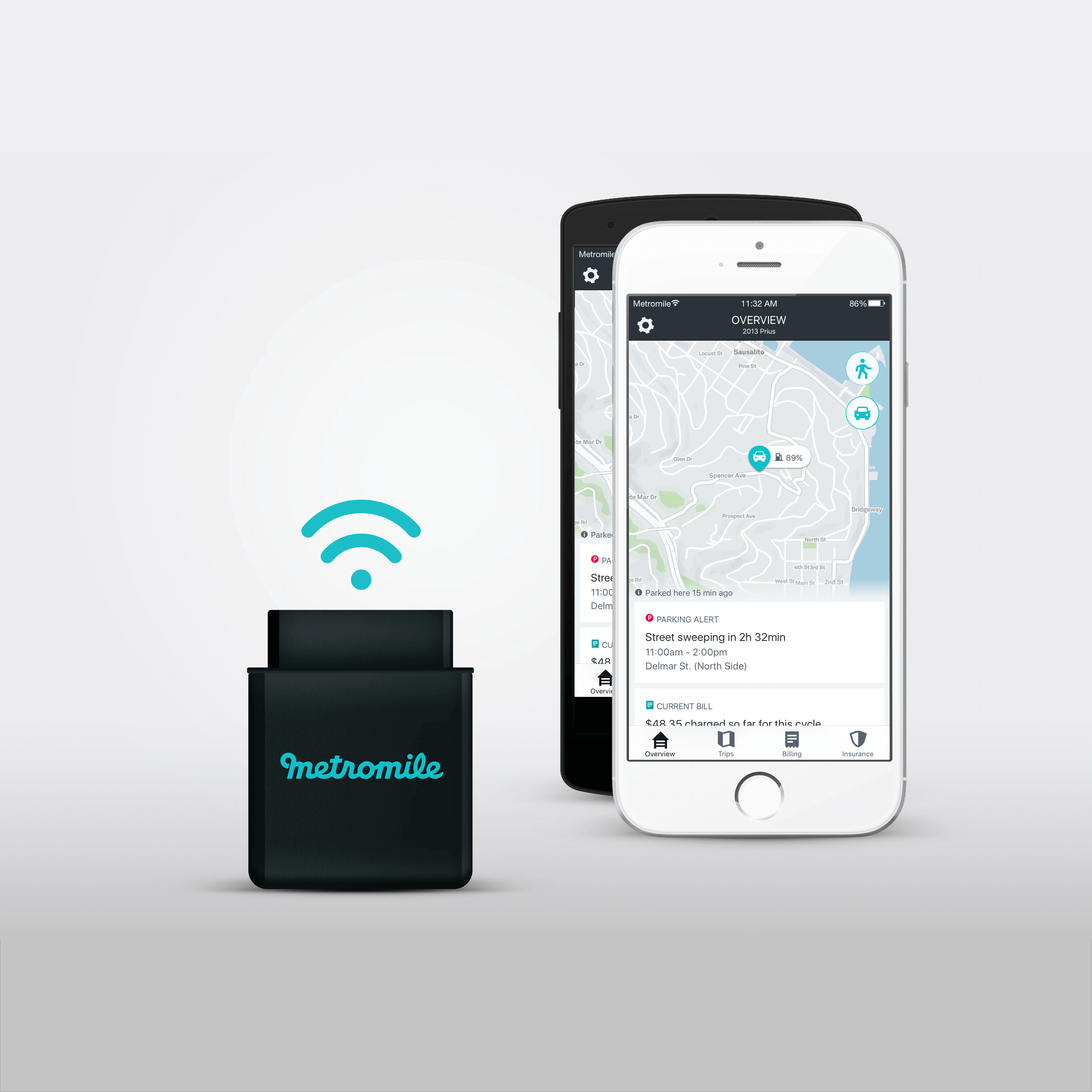

This introductory guide will explore the foundational principles behind Metromile’s unique business approach and its benefits for different types of drivers, especially in urban environments where driving frequency can vary significantly. We’ll discuss the technological backbone supporting Metromile’s model — from its pioneering telematics devices to sophisticated mobile apps that keep customers informed and engaged. Moreover, we’ll look into potential drawbacks and the type of driver profile best suited for this insurance model.

Additionally, we’ll provide insights into the customer experience, review savings and costs, and forecast the potential growth and adoption of this innovative insurance solution. Whether you’re a city dweller who only drives occasionally or someone seeking more control over your insurance expenses, Metromile might just be the key to unlocking substantial savings and peace of mind.

So, buckle up and join us as we unfold the story behind Metromile, a company that is challenging the status quo and paving the way for a more personalized and transparent insurance experience. In the sections that follow, you’ll find detailed insights into how Metromile is not just a car insurance provider, but a catalyst for industry-wide change.

The Traditional Car Insurance Model

For years, car insurance has operated on a ‘one-size-fits-all’ model. Traditional policies often base premiums on generalized data points like age, gender, location, and credit score. While these factors provide a broad estimate of risk, they inaccurately capture the distinct driving habits of individuals. This can result in higher rates for low-mileage drivers who pose less risk on the road. As frustration with these blanket policies grows, the insurance industry has begun to explore more personalized solutions.

A Paradigm Shift: Introducing Pay-Per-Mile Insurance

Enter Metromile — a pioneer in the pay-per-mile insurance model that is swiftly reshaping the car insurance landscape. This innovative approach calculates premiums based on actual miles driven, rewarding drivers who use their vehicles infrequently or for shorter distances. The concept is straightforward: the less you drive, the less you pay. By fundamentally changing how insurance costs are determined, Metromile offers a refreshing level of fairness and transparency, aligning premiums more closely with individual driving behaviors.

How Metromile Works

Metromile’s model is centered around a simple yet powerful tool: the Metromile Pulse device. This small, plug-in device connects to the vehicle’s OBD-II port, tracking mileage and providing customers with insights into their driving patterns. It’s not a GPS tracker — privacy is a priority, and Metromile ensures that only necessary mileage data are collected.

- Base Rate: Every Metromile customer pays a low monthly base rate, which essentially covers basic risk factors such as location and vehicle type.

- Per-Mile Rate: On top of the base rate, customers pay a nominal fee for each mile driven. This per-mile fee can vary depending on the policyholder’s risk profile.

- Monthly Bill: The monthly insurance cost is the sum of the base rate and the number of miles driven multiplied by the per-mile rate.

Advantages for Policyholders

Metromile’s pay-per-mile strategy offers numerous benefits that extend beyond cost savings. Key advantages include:

- Cost Efficiency: For infrequent drivers, the savings can be substantial compared to traditional insurance models. Individuals who drive less frequently benefit from lower premiums, making pay-per-mile insurance an appealing choice.

- Transparency: There’s a clear understanding of insurance costs and how they are incurred. With Metromile, customers receive real-time data on their monthly mileage and can easily predict their insurance expenses.

- Encouragement of Responsible Driving: Knowing that driving less results in lower costs is a strong incentive for policyholders to drive more consciously, potentially decreasing road congestion and reducing carbon footprints.

- Adaptability: Whether a customer temporarily increases their mileage or alters their driving patterns, their insurance costs adjust accordingly, ensuring they only ever pay for their actual usage.

The Impact on the Insurance Industry

The ripple effects of Metromile’s revolutionary model extend across the insurance industry. As traditional insurers face pressure to adopt more consumer-friendly policies, many are beginning to integrate similar usage-based insurance options. This shift encourages innovation and competition, ultimately benefiting consumers through more tailored and cost-effective solutions.

Technological Innovation

Metromile’s approach underscores the growing importance of technology in modernizing insurance. By leveraging data analytics and IoT (Internet of Things) solutions, insurers are now better equipped to assess risk accurately and offer personalized coverage options. Such technological integration also enhances customer engagement, providing policyholders with actionable insights regarding their driving habits and vehicle health.

Consumer Empowerment

As the pay-per-mile model gains traction, consumers gain greater control over their insurance expenses. A more informed customer base can better advocate for products and practices that suit their individual needs. This empowerment drives a shift towards more transparent business practices and highlights the demand for accountability within the insurance sector.

Potential Challenges and Considerations

Despite its advantages, pay-per-mile insurance has its considerations. With Metromile, drivers who have high annual mileage may find that the model isn’t as beneficial as it is for low-mileage drivers. Additionally, certain factors like adverse weather conditions, personal lifestyle changes, or job requirements might lead to varied mileage usage that could unpredictably affect monthly costs.

Furthermore, the integration of technology and data tracking raises privacy concerns, even though Metromile does not involve GPS tracking. Ensuring that customers feel their data is safe and being used ethically is critical to maintaining trust.

Metromile’s Broader Vision

Beyond its core insurance offerings, Metromile is keen to expand its influence and innovation within the automotive industry. Their vision includes utilizing the technology behind Metromile Pulse to offer additional value-added services such as diagnostic alerts, parking reminders, and stolen vehicle tracking, positioning themselves not just as an insurer, but as a partner in vehicle management and ownership.

Partnerships and Expansion

Metromile is actively exploring partnerships with various OEMs (original equipment manufacturers) and tech companies to further integrate digital services and broaden their reach. Such collaborations are likely to expand the scope of pay-per-mile insurance and introduce enhanced benefits that cater to modern drivers’ interconnected lifestyles.

Looking Towards the Future

The insurance landscape is on the cusp of significant change, with pay-per-mile models offering a glimpse of what’s to come. Consumers increasingly demand insurance that aligns with their unique lifestyles, and Metromile is at the forefront of meeting these expectations. As drivers continue to prioritize flexibility, efficiency, and personalization, it’s likely that models like Metromile’s will become the norm rather than the exception.

The Transformative Potential of Pay-Per-Mile Insurance with Metromile

As we bring our discussion on Metromile and the transformative potential of pay-per-mile insurance to a close, it is essential to revisit the key points we’ve explored and consider their implications for the evolving landscape of car insurance. When we began our journey, we posed several questions about the sustainability and customization of traditional auto insurance models and whether they truly serve the diverse needs of modern drivers. Through our exploration of Metromile’s innovative approach, it has become evident that pay-per-mile insurance not only challenges the status quo but also aligns with contemporary demands for personalization, cost-efficiency, and smart technology.

Key Takeaways

Firstly, we examined how Metromile redefines insurance costs by tying them directly to the miles driven. This approach starkly contrasts with flat-rate policies where low-mileage drivers end up subsidizing higher-mileage counterparts. By leveraging this usage-based model, Metromile offers an attractive alternative for individuals who drive less than the national average, often resulting in significant savings. This model acknowledges that fewer miles on the road logically equate to lower risks and, therefore, lower insurance premiums.

Additionally, personalization emerges as a core advantage of Metromile’s approach. Traditional car insurance policies offer limited flexibility, often generalized to fit broad demographics rather than individual circumstances. In contrast, Metromile harnesses advanced technology, including telematics, to gather real-time data, enabling precisely tailored policies that reflect actual usage patterns. As discussed, this direct relationship between technology and personalization empowers consumers to make more informed and beneficial choices regarding their car insurance needs.

Our analysis also delved into the environmental benefits associated with pay-per-mile insurance. By incentivizing lower driving mileage, Metromile indirectly contributes to reducing carbon footprints. With climate change concerns pushing industries towards more sustainable practices, insurance models promoting responsible driving and less fuel consumption align well with broader environmental goals. As such, Metromile’s model indirectly supports a move towards a greener future.

Moreover, we highlighted how smart technology plays a pivotal role in Metromile’s business model. Integration of telematics not only helps in accurate mileage tracking but also enhances customer experience through features like claims filing, theft alerts, and access to driving data, all managed through an intuitive mobile application. This technological layer not only offers transparency and control to policyholders but also signifies a shift towards a more interactive and connected insurance experience.

Finally, our exploration into the cost implications revealed that pay-per-mile insurance could transform the financial landscape of car ownership. With driving costs directly correlated to usage, individuals can exercise more control over their monthly expenses, which can lead to better budgeting and financial autonomy. This financial transparency is particularly beneficial for city dwellers, remote workers, retirees, and those who utilize alternative transportation methods.

Looking Forward

The potential of pay-per-mile insurance extends beyond immediate financial savings. It represents a vision for a more equitable, efficient, and environmentally conscious future. This shift requires a collective movement towards embracing innovations that disrupt traditional systems in favor of greater personalization and sustainability.

For consumers, this shift means re-evaluating how they view car insurance. No longer bound by blanket policies, drivers now have the option to align their insurance more closely with their actual driving habits. It invites individuals to become active participants in their insurance journey, optimizing costs, and reducing unnecessary expenditures.

For the insurance industry, pay-per-mile models like Metromile offer a blueprint for adapting to a changing world. By prioritizing data-driven insights and customer-centric offerings, companies can address the growing demand for transparency and tailored services. This evolution could inspire further innovations across other insurance domains, pushing the industry towards a more technologically integrated future.

Join the Conversation

As we conclude, it is important to recognize that the exploration of pay-per-mile insurance is part of a broader discussion on the future of how we consume services. The transformation of car insurance by players like Metromile illustrates a growing trend towards adaptable, IoT-driven consumer products that can revolutionize old paradigms.

We invite you to share your thoughts and experiences with pay-per-mile insurance. Have you used Metromile or a similar service? How has it impacted your driving habits and financial planning? Your insights can contribute to a valuable discourse that helps guide this burgeoning shift.

If this topic resonates with you, consider conducting further research on pay-per-mile models and their long-term societal impacts. Whether you are rethinking your insurance model or are intrigued by the possibilities of IoT innovations, there are many avenues for exploration and engagement.

Let us stay connected to keep the conversation going on how disruptive innovations like pay-per-mile insurance can pave the way for a more personalized and sustainable future.

Thank you for joining us on this exploration of Metromile and pay-per-mile insurance. Together, let’s continue to drive the conversation forward.

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology