Is an Annuity a Good Investment for You?

Is an annuity a good investment? It’s a question that many people ask, especially as they approach retirement. Annuities can offer guaranteed income, tax benefits, and protection from market volatility, but they also come with potential drawbacks, such as high fees, limited liquidity, and potential for loss of principal. Understanding the pros and cons of annuities is crucial to making an informed decision about whether they’re right for you.

Annuities are financial products that provide a stream of income, typically for a specified period or for life. They come in various forms, each with its own set of features and benefits. Fixed annuities offer guaranteed interest rates, while variable annuities allow for investment growth but carry more risk. Indexed annuities offer returns tied to a specific market index, providing some protection against market downturns.

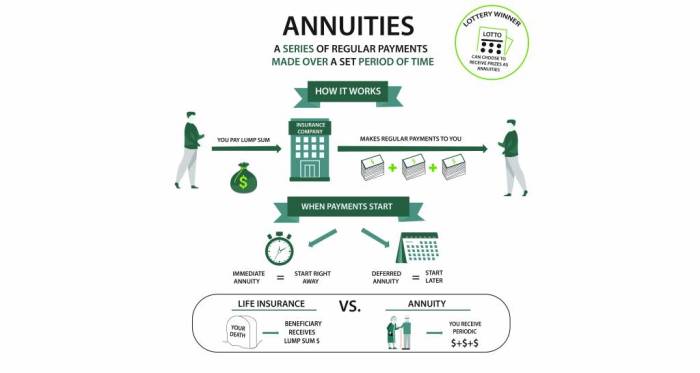

What are Annuities?

Annuities are financial products that provide a stream of payments over a set period of time. They are often used for retirement planning, but they can also be used for other purposes, such as supplementing income during a period of disability or providing a guaranteed income stream for a beneficiary.

Annuities are essentially insurance contracts. You pay a premium to an insurance company, and the insurance company promises to pay you a stream of payments in the future. Annuities can be structured in many different ways, and the specific terms of the contract will determine the amount of the payments, the duration of the payments, and the type of payments.

Types of Annuities

Annuities can be categorized into different types based on how the payments are structured and how the underlying investment grows. Here are some of the most common types of annuities:

Fixed Annuities

Fixed annuities provide a guaranteed rate of return on your investment. The interest rate is fixed for a set period of time, typically for a year or more. Fixed annuities are considered low-risk investments because the principal and interest payments are guaranteed.

Variable Annuities

Variable annuities offer a variable rate of return based on the performance of a sub-account portfolio of mutual funds or other investments. These annuities typically offer the potential for higher returns than fixed annuities, but they also come with a higher risk of losing money.

Indexed Annuities

Indexed annuities link their returns to the performance of a specific market index, such as the S&P 500. They offer the potential for growth similar to variable annuities but with some protection from losses. However, indexed annuities typically have caps on the amount of growth they can achieve.

Features and Benefits of Annuities

Annuities offer several features and benefits that can make them attractive investments, including:

Guaranteed Income

Many annuities provide a guaranteed income stream for life, which can be a valuable source of income during retirement.

Tax Deferral

The growth of your investment in an annuity is typically tax-deferred. This means that you will not have to pay taxes on the earnings until you start receiving payments from the annuity.

Protection from Market Volatility

Some annuities, such as fixed and indexed annuities, offer protection from market volatility. This can be helpful for investors who are concerned about losing money in a downturn.

Flexibility

Annuities can be structured in many different ways to meet your specific needs and goals. For example, you can choose an annuity that provides a lump-sum payment or a stream of payments over a set period of time.

Examples of Annuity Use in Retirement Planning

Annuities can be a valuable tool for retirement planning. Here are some examples of how they can be used:

Income Supplement

Annuities can provide a steady stream of income during retirement, supplementing your Social Security benefits and other retirement savings.

Long-Term Care Protection

Annuities can be used to provide long-term care protection, ensuring that you have the financial resources to cover the costs of assisted living or nursing home care.

Legacy Planning

Annuities can be used to create a legacy for your loved ones, providing them with a guaranteed income stream after your death.

Pros and Cons of Annuities: Is An Annuity A Good Investment

Annuities are a type of insurance product that can provide a stream of income during retirement. They can be a good option for people who want to guarantee a certain level of income in their later years. However, it’s important to understand the pros and cons of annuities before making a decision.

Advantages of Annuities

Annuities offer several advantages, making them a popular choice for retirement planning.

- Guaranteed Income: Annuities can provide a guaranteed stream of income for life, ensuring a steady income stream during retirement. This can be particularly beneficial for those concerned about outliving their savings.

- Tax Benefits: Depending on the type of annuity, you may be able to defer taxes on the growth of your investment until you start receiving payments. This can result in significant tax savings over time.

- Protection from Market Volatility: Annuities can offer protection from market volatility. The principal is guaranteed, and the returns are typically fixed or based on a specific index, offering stability in uncertain market conditions.

Disadvantages of Annuities, Is an annuity a good investment

While annuities offer advantages, they also have potential drawbacks.

- High Fees: Annuities often come with high fees, including surrender charges, administrative fees, and mortality and expense charges. These fees can eat into your returns and reduce the overall value of your investment.

- Limited Liquidity: Annuities are typically illiquid, meaning it can be difficult to access your money before you reach a certain age or without incurring penalties. This can be a problem if you need to access your funds for unexpected expenses.

- Potential for Loss of Principal: While annuities guarantee the principal in some cases, certain types, like variable annuities, involve investments in the market. These can experience losses, potentially leading to a loss of principal.

Comparison with Other Retirement Investment Options

Annuities are not the only option for retirement planning. It’s essential to compare them with other investment options, such as stocks, bonds, and mutual funds.

- Stocks: Stocks offer the potential for higher returns but come with higher risk. They are more volatile than annuities and can lose value in a downturn.

- Bonds: Bonds are considered less risky than stocks but offer lower returns. They are generally more stable than stocks and can provide a consistent income stream.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management but also carry fees.

Annuity Costs and Fees

Annuities, like any financial product, come with associated costs and fees. These fees can significantly impact the overall return of your annuity, so understanding them is crucial before making an investment decision.

Surrender Charges

Surrender charges are penalties levied when you withdraw money from your annuity before a certain period, usually during the early years of the contract. These charges are designed to discourage early withdrawals and protect the insurance company from losing money on the contract.

- Surrender charges typically decrease over time, gradually phasing out after a specific period, such as 10 years.

- They are often expressed as a percentage of the withdrawal amount, ranging from 8% to 10% in the initial years, gradually decreasing to 0% over time.

- Surrender charges can significantly reduce your returns, especially if you need to access your funds early.

Administrative Fees

Administrative fees cover the ongoing costs associated with managing your annuity contract. These fees are usually charged annually and can include expenses for record-keeping, customer service, and other administrative tasks.

- Administrative fees vary depending on the type of annuity and the insurance company.

- They can range from a few dollars to a few hundred dollars per year.

- While these fees may seem small individually, they can accumulate over time and impact your overall return.

Mortality and Expense Charges

Mortality and expense charges are fees embedded within the annuity contract to cover the insurance company’s costs, including the cost of paying out death benefits and administrative expenses.

- These charges are calculated based on the expected lifespan of the annuitant pool and are usually expressed as a percentage of the annuity’s value.

- Mortality and expense charges are typically higher in the early years of the contract and gradually decrease over time.

- These charges can impact the overall growth of your annuity, as they reduce the amount available for investment.

Impact of Fees on Annuity Returns

The fees associated with annuities can significantly impact your overall returns. It is crucial to consider these fees when comparing different annuity options.

Annuity fees can reduce your overall return by 1% to 3% annually, depending on the type of annuity and the fees charged.

For example, if you invest $100,000 in an annuity with a 2% annual fee, you would pay $2,000 in fees each year, reducing your potential returns.

Comparing Annuity Fees

When comparing annuity fees, it is essential to consider the following:

- Surrender charge structure: Compare the surrender charge schedule across different providers, paying attention to the duration of the surrender charge period and the percentage charged.

- Administrative fees: Look for annuities with low administrative fees and understand what services are included in the fee.

- Mortality and expense charges: Compare the mortality and expense charges expressed as a percentage of the annuity value. Look for annuities with lower charges.

- Total annual cost: Consider the total annual cost of the annuity, including all fees and charges, to get a comprehensive picture of the overall expense.

Annuity Risks

Annuities, while offering potential benefits, come with inherent risks that investors should carefully consider. These risks can significantly impact the value of your annuity over time and could potentially diminish your expected returns.

Inflation Risk

Inflation erodes the purchasing power of money over time. As prices rise, the fixed payments you receive from an annuity may not keep pace, diminishing their real value.

- For example, if you purchase an annuity that pays you $50,000 per year, and inflation averages 3% annually, the purchasing power of your payments will decline over time. After 10 years, your $50,000 will only be worth approximately $37,000 in today’s dollars.

Interest Rate Risk

Interest rates fluctuate in the market, and changes can impact the value of your annuity. If interest rates rise after you purchase an annuity, the guaranteed rate you receive may be lower than what you could earn elsewhere.

- If you purchase a fixed annuity with a 3% interest rate, and interest rates rise to 4%, you are effectively earning less than what is currently available in the market. Conversely, if interest rates fall, the value of your annuity may be higher than what you could earn elsewhere.

Longevity Risk

Longevity risk refers to the possibility of living longer than expected. This risk is particularly relevant for fixed annuities, where the payments are guaranteed for a specific period. If you live longer than anticipated, you may outlive your annuity payments, leaving you with limited income.

- For example, if you purchase an annuity that guarantees payments for 20 years, and you live for 25 years, you will receive no income during the last 5 years of your life. This risk is especially relevant for individuals who are concerned about outliving their savings.

When are Annuities a Good Investment?

Annuities can be a good investment option for individuals seeking guaranteed income, those with a high risk tolerance, or those looking for tax-advantaged savings. They offer a variety of features and benefits that can be attractive to different investors.

Situations Where Annuities May Be Suitable

Annuities may be a good investment option in a variety of situations. They can provide guaranteed income streams, tax advantages, and protection against market volatility.

- Individuals Seeking Guaranteed Income: Annuities can provide a steady stream of income for life, which can be especially valuable for retirees or those who are concerned about outliving their savings. Annuities can offer a sense of security knowing that they will receive a predictable income stream, regardless of market conditions.

- Individuals with a High Risk Tolerance: Some annuities, such as variable annuities, offer the potential for higher returns, but they also come with greater risk. Individuals with a high risk tolerance may find these annuities appealing, as they have the potential to grow their investment more rapidly.

- Individuals Looking for Tax-Advantaged Savings: Annuities can offer tax advantages, such as tax-deferred growth and tax-free withdrawals in retirement. This can be particularly beneficial for individuals who are in a high tax bracket or who are seeking to reduce their tax liability.

Scenario for When Annuities Might Be a Good Investment

Imagine a 65-year-old retiree, Sarah, who is concerned about outliving her savings. She has a modest nest egg and wants to ensure a steady stream of income for the rest of her life. Sarah could consider purchasing an immediate annuity, which would provide her with a guaranteed monthly payment for as long as she lives. This would give her peace of mind knowing that she has a reliable source of income, even if her investments experience losses.

Comparing Annuities to Other Retirement Investment Options

| Investment Option | Pros | Cons | Suitability |

|—|—|—|—|

| Annuities | Guaranteed income, tax advantages, protection against market volatility | High fees, limited flexibility, potential for low returns | Individuals seeking guaranteed income, those with a high risk tolerance, or those looking for tax-advantaged savings |

| Stocks | Potential for high returns, liquidity | High risk, volatility | Individuals with a high risk tolerance and a long investment horizon |

| Bonds | Lower risk than stocks, steady income | Lower returns than stocks, interest rate risk | Individuals with a low risk tolerance or those seeking a steady income stream |

| Real Estate | Potential for appreciation, tax advantages | High initial investment, illiquidity | Individuals with a long investment horizon and a high risk tolerance |

Whether an annuity is a good investment for you depends on your individual circumstances, financial goals, and risk tolerance. If you’re looking for guaranteed income in retirement, an annuity can be a valuable tool. However, it’s important to carefully consider the potential risks and fees before making a decision. By understanding the complexities of annuities and comparing them to other investment options, you can make an informed choice that aligns with your retirement planning objectives.

FAQ Resource

How do annuities work?

Annuities work by accumulating funds over time and then providing a stream of income in retirement. You can purchase an annuity with a lump sum payment or through regular contributions. The annuity provider then invests the funds and pays you a predetermined amount of income, either for a fixed period or for life.

What are the tax implications of annuities?

The tax implications of annuities vary depending on the type of annuity and how it’s structured. Generally, the income payments from an annuity are taxed as ordinary income. However, there are some types of annuities, such as qualified longevity annuity contracts (QLACs), that offer tax advantages.

What are some alternatives to annuities?

There are many alternatives to annuities, including stocks, bonds, mutual funds, and real estate. The best alternative for you will depend on your individual circumstances and investment goals. It’s important to carefully consider the risks and rewards of each investment option before making a decision.

Whether an annuity is a good investment depends on your individual financial goals and risk tolerance. If you’re seeking a guaranteed stream of income, an annuity can be a solid option. However, if you’re comfortable with a bit more risk, you might consider exploring alternative investments like real estate. For example, an investment property interest only mortgage can allow you to build equity while enjoying lower monthly payments.

Ultimately, the best investment for you will depend on your unique circumstances and financial objectives.

Annuity investments can offer a steady stream of income, but they’re not without their risks. One factor to consider is the potential for market fluctuations, which can impact the value of your investment. Similar to the risks associated with real estate investment property vacancy , annuities can be affected by economic downturns or changes in interest rates.

Ultimately, the decision of whether an annuity is right for you depends on your individual financial goals and risk tolerance.

Whether an annuity is a good investment depends on your individual circumstances and goals. If you’re looking for a guaranteed stream of income, an annuity can be a solid choice. However, if you’re seeking potential for higher returns, you might consider alternative investments like property development investment , which can offer substantial appreciation over time. Ultimately, the best investment strategy is the one that aligns with your financial objectives and risk tolerance.