Investment Property Mortgage Calculator Your Guide to Smart Financing

Investment Property Mortgage Calculator: Navigating the world of real estate investment can be both exciting and complex. One of the most crucial aspects is securing a suitable mortgage for your investment property. This guide will explore the intricacies of investment property mortgages, empowering you to make informed decisions and achieve your financial goals.

Whether you’re a seasoned investor or just starting your real estate journey, understanding the nuances of investment property mortgages is paramount. This guide will provide you with the tools and knowledge to navigate the mortgage landscape confidently, helping you secure the best possible financing terms for your investment property.

Understanding Investment Property Mortgages

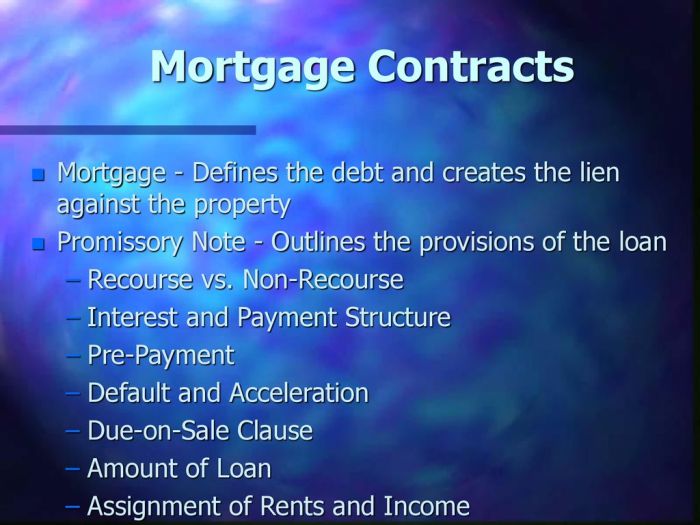

An investment property mortgage is a loan specifically designed to finance the purchase of a property that will be used for rental income or other investment purposes. It differs from a traditional residential mortgage in several key ways.

Differences Between Residential and Investment Property Mortgages

Investment property mortgages typically have stricter requirements and higher interest rates compared to residential mortgages. This is because lenders perceive investment properties as riskier than owner-occupied homes.

Key Considerations for Investment Property Mortgages

- Loan Terms: Investment property mortgages often have shorter loan terms, typically 15 or 30 years, compared to residential mortgages, which may offer longer terms.

- Interest Rates: Investment property mortgages usually have higher interest rates than residential mortgages due to the higher perceived risk.

- Down Payment Requirements: Lenders may require a larger down payment for investment properties, often 20% or more, compared to the minimum 3.5% down payment for residential mortgages.

Types of Investment Property Mortgages, Investment property mortgage calculator

Investment property mortgages can be obtained through various lending options, including conventional, FHA, and VA loans.

- Conventional Loans: These are the most common type of investment property mortgage and are offered by private lenders. They typically require a higher credit score and down payment compared to other loan types.

- FHA Loans: These loans are insured by the Federal Housing Administration (FHA) and are designed to make homeownership more accessible. FHA loans for investment properties have lower down payment requirements and more lenient credit score requirements compared to conventional loans.

- VA Loans: These loans are guaranteed by the Department of Veterans Affairs (VA) and are available to eligible veterans, active-duty military personnel, and surviving spouses. VA loans for investment properties typically have no down payment requirement and offer competitive interest rates.

Using an Investment Property Mortgage Calculator

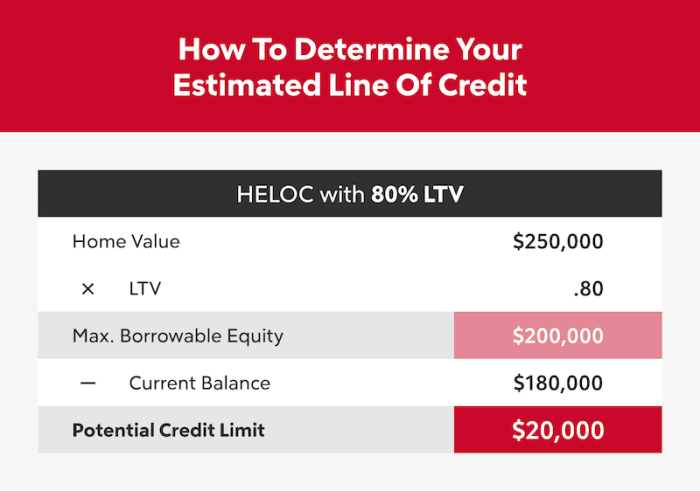

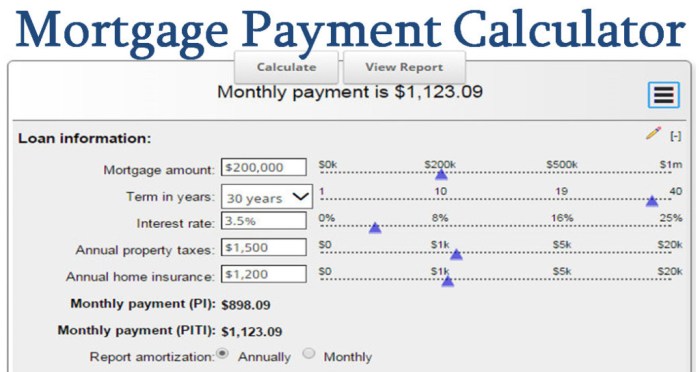

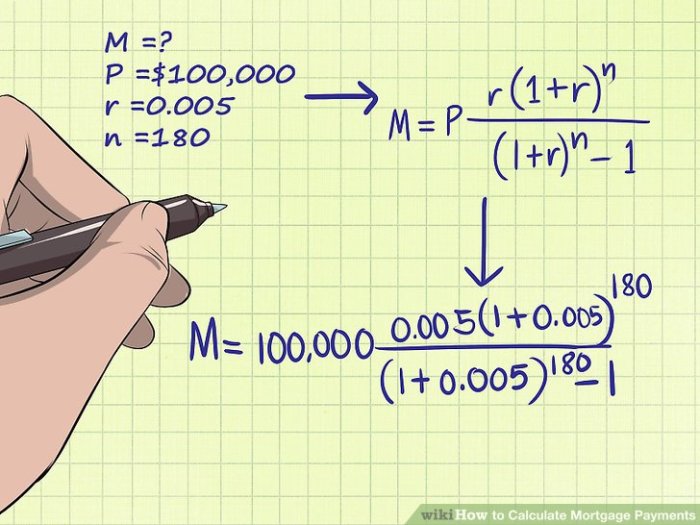

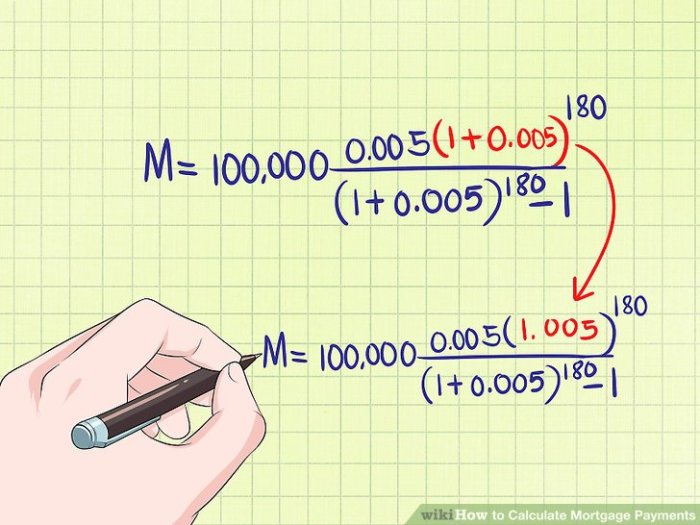

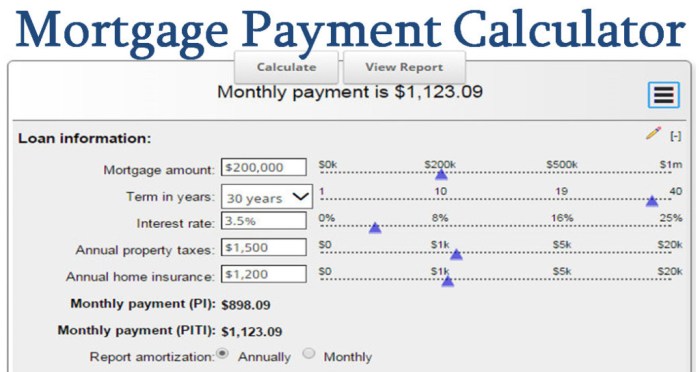

An investment property mortgage calculator is a valuable tool for real estate investors. It helps you estimate your monthly payments, total interest paid, and loan-to-value ratio (LTV) for your investment property. This information can help you make informed decisions about your investment, such as whether to purchase a property, how much to borrow, and what type of mortgage to get.

Understanding the Features of an Investment Property Mortgage Calculator

An investment property mortgage calculator typically requires you to input several pieces of information, including the purchase price of the property, the down payment amount, the interest rate, and the loan term. Once you have entered this information, the calculator will then calculate your estimated monthly payment, total interest paid, and LTV.

Some calculators may also provide additional features, such as:

- The ability to adjust the interest rate or loan term to see how it affects your monthly payments and total interest paid.

- The ability to factor in property taxes and insurance premiums into your monthly payments.

- The ability to calculate your return on investment (ROI) based on your estimated rental income and expenses.

Comparing Investment Property Mortgage Calculators

There are many different investment property mortgage calculators available online. The following table compares the features and functionalities of a few popular calculators:

| Calculator Name | Features | Pros | Cons |

|---|---|---|---|

| Calculator 1 | Monthly payment, total interest paid, LTV, amortization schedule | Easy to use, provides comprehensive information | Limited customization options |

| Calculator 2 | Monthly payment, total interest paid, LTV, ROI, property tax and insurance calculations | Offers advanced features, customizable | Can be more complex to use |

| Calculator 3 | Monthly payment, total interest paid, LTV, amortization schedule, side-by-side loan comparison | User-friendly interface, allows comparing multiple loan options | May not be as comprehensive as other calculators |

Using an Investment Property Mortgage Calculator: A Step-by-Step Guide

This step-by-step guide will walk you through using a specific investment property mortgage calculator. For this example, we will use Calculator 1 from the table above.

1. Visit the calculator website. The website address will be provided on the calculator’s landing page.

2. Enter the required information. This includes the purchase price of the property, the down payment amount, the interest rate, and the loan term.

3. Select the loan type. This will usually be a fixed-rate mortgage for investment properties.

4. Adjust any additional settings. This may include factors like property taxes and insurance premiums.

5. Click “Calculate” or “Submit.” The calculator will then display your estimated monthly payment, total interest paid, and LTV.

Example: Let’s say you are considering purchasing an investment property for $300,000. You plan to make a down payment of $60,000 and obtain a 30-year fixed-rate mortgage with an interest rate of 5%. Using Calculator 1, you would enter these values into the calculator and click “Calculate.” The calculator would then display your estimated monthly payment, total interest paid, and LTV.

Factors Affecting Investment Property Mortgage Costs

Understanding the factors that influence your investment property mortgage costs is crucial for making informed financial decisions. Factors such as your credit score, the property’s location, and the loan amount can significantly impact your interest rates and monthly payments. Furthermore, various fees associated with the mortgage process, such as origination fees, appraisal fees, and closing costs, add to the overall expense.

Impact of Credit Score, Location, and Loan Amount

Your credit score plays a significant role in determining the interest rate you qualify for. A higher credit score generally leads to lower interest rates, which translates to lower monthly payments and overall mortgage costs. For instance, a borrower with a credit score of 740 or higher might receive an interest rate that is 0.5% to 1% lower than someone with a credit score of 670.

The location of the investment property also affects mortgage rates. Properties in areas with strong real estate markets and low risk of default tend to attract lower interest rates. Conversely, properties in less desirable locations or areas with higher risk may result in higher interest rates.

The loan amount is directly proportional to the monthly payments. A larger loan amount will result in higher monthly payments, even if the interest rate is favorable. It’s essential to consider your financial capacity and the potential rental income when determining the appropriate loan amount for your investment property.

Fees Associated with Investment Property Mortgages

In addition to the principal and interest payments, several fees are associated with investment property mortgages. These fees can vary depending on the lender and the specific mortgage terms.

Origination Fees

Origination fees are charged by lenders to cover the costs of processing your mortgage application. These fees are typically a percentage of the loan amount, ranging from 0.5% to 2%. For example, on a $200,000 loan, an origination fee of 1% would amount to $2,000.

Appraisal Fees

Appraisal fees are charged for a professional appraisal of the investment property. The appraisal is required to determine the property’s fair market value and ensure that the loan amount is justified. Appraisal fees typically range from $300 to $500, depending on the property’s size and location.

Closing Costs

Closing costs encompass various expenses associated with finalizing the mortgage transaction. These costs can include title insurance, recording fees, and attorney fees. Closing costs can vary widely, but they typically range from 2% to 5% of the loan amount.

Cost Comparison of Different Mortgage Scenarios

| Scenario | Credit Score | Location | Loan Amount | Interest Rate | Monthly Payment | Total Interest Paid |

|—|—|—|—|—|—|—|

| Scenario 1 | 740 | High-Demand Area | $200,000 | 4.00% | $1,011.84 | $94,441.60 |

| Scenario 2 | 670 | Average Area | $200,000 | 4.50% | $1,049.32 | $107,838.40 |

| Scenario 3 | 740 | High-Risk Area | $250,000 | 4.75% | $1,392.98 | $173,155.20 |

| Scenario 4 | 670 | Average Area | $250,000 | 5.25% | $1,453.25 | $192,790.00 |

The table above illustrates the impact of various factors on mortgage costs. Scenario 1 represents a borrower with a high credit score in a desirable location with a lower loan amount, resulting in a favorable interest rate and lower monthly payments. Scenario 4 reflects a borrower with a lower credit score in an average location with a higher loan amount, leading to a higher interest rate and significantly higher monthly payments.

Evaluating Investment Property Returns

Understanding how much money you can make from an investment property is crucial. Return on investment (ROI) is a key metric used to assess the profitability of an investment. In the context of investment properties, ROI helps you determine if a particular property is worth investing in, and it allows you to compare different investment opportunities.

Calculating ROI for Investment Properties

Several methods can be used to calculate the ROI on an investment property. Two common methods are cash flow analysis and capitalization rate.

Cash Flow Analysis

Cash flow analysis focuses on the net income generated by the property after deducting all expenses. The formula for calculating cash flow is:

Cash Flow = Rental Income – Expenses

Expenses include property taxes, insurance, mortgage payments, maintenance, and management fees. A positive cash flow indicates that the property is generating a profit, while a negative cash flow means the property is losing money.

Capitalization Rate

The capitalization rate (cap rate) is a commonly used metric in real estate to evaluate the profitability of an investment property. It is calculated by dividing the property’s net operating income (NOI) by its purchase price. NOI is the income generated by the property after deducting operating expenses, but before deducting mortgage payments.

Capitalization Rate (Cap Rate) = Net Operating Income (NOI) / Purchase Price

A higher cap rate generally indicates a more profitable investment.

Comparing Investment Property Returns

The following table compares the potential returns of different investment property scenarios:

| Scenario | Purchase Price | Rental Income | Expenses | Cash Flow | Cap Rate |

|—|—|—|—|—|—|

| Scenario 1 | $200,000 | $2,000/month | $1,000/month | $12,000/year | 6% |

| Scenario 2 | $300,000 | $2,500/month | $1,500/month | $12,000/year | 4% |

| Scenario 3 | $400,000 | $3,000/month | $2,000/month | $12,000/year | 3% |

Note: These are just hypothetical scenarios, and actual returns may vary. It is important to conduct thorough research and consider all relevant factors before making an investment decision.

Investment Property Mortgage Strategies

Securing the best possible mortgage terms for an investment property can significantly impact your financial success. By understanding different mortgage types, carefully evaluating your options, and employing strategic approaches, you can minimize borrowing costs and maximize your investment returns.

Fixed-Rate vs. Adjustable-Rate Mortgages

Choosing between a fixed-rate and an adjustable-rate mortgage (ARM) is a crucial decision that depends on your risk tolerance and financial outlook.

- Fixed-Rate Mortgages: Offer predictable monthly payments and interest rates that remain constant throughout the loan term. This provides stability and allows you to budget effectively. However, fixed-rate mortgages may have higher initial interest rates compared to ARMs.

- Adjustable-Rate Mortgages: Start with lower interest rates, but these rates can fluctuate based on market indexes. While ARMs can offer lower initial payments, they come with the risk of higher interest rates in the future, potentially leading to increased monthly payments. This can be a good option for investors who believe interest rates will decline or are planning to sell the property within a shorter timeframe.

Understanding Amortization Schedules

The amortization schedule Artikels how your mortgage payments are allocated towards principal and interest over the loan term. It’s crucial to understand how this schedule impacts your long-term costs.

An amortization schedule demonstrates the gradual reduction of your mortgage principal with each payment, while interest payments decrease over time.

- Impact of Loan Term: Longer loan terms typically result in lower monthly payments but higher overall interest costs. Conversely, shorter loan terms involve higher monthly payments but lower overall interest costs.

- Impact of Interest Rates: Higher interest rates lead to higher monthly payments and overall interest costs. Lower interest rates result in lower monthly payments and overall interest costs.

By understanding the different types of investment property mortgages, the factors that influence costs, and strategies for securing favorable terms, you can position yourself for success in the world of real estate investment. With the right mortgage, you can unlock the potential of your investment property and build a strong foundation for your financial future.

Frequently Asked Questions

What are the main differences between residential and investment property mortgages?

Residential mortgages are designed for primary residences, while investment property mortgages are for properties intended for rental income or resale. Investment property mortgages often have stricter requirements, higher interest rates, and larger down payments.

How does my credit score impact my investment property mortgage?

A higher credit score generally translates to lower interest rates and more favorable mortgage terms. Aim for a credit score of at least 700 to secure the best rates.

What are some common fees associated with investment property mortgages?

Common fees include origination fees, appraisal fees, closing costs, and property taxes.

What are some tips for securing the best possible mortgage terms?

Shop around for rates from different lenders, improve your credit score, and have a substantial down payment ready.

An investment property mortgage calculator can be a valuable tool for assessing your financial capacity, but it’s essential to consider the specific type of property you’re targeting. If you’re considering a multi-family investment property, such as a duplex or triplex, you might want to explore resources like this blog for insightful information on the market. Once you have a clearer picture of your investment goals, you can use a mortgage calculator to determine the best financing options for your multi-family investment.

An investment property mortgage calculator is a valuable tool for anyone considering purchasing a rental property. It can help you determine your monthly payments and overall affordability, especially if you’re looking into multifamily property investment , which often involves larger mortgages. By understanding the potential costs associated with a multifamily property, you can make informed decisions about your investment strategy and ensure you’re comfortable with the financial commitments involved.

An investment property mortgage calculator can be a valuable tool for estimating your monthly payments and determining your overall affordability. When exploring investment opportunities, consider checking out davis investment properties to see if their offerings align with your investment goals. By using a mortgage calculator and researching potential properties, you can make informed decisions about your real estate investments.