Investment Property Interest Only A Strategic Approach

Investment property interest only mortgages offer a unique approach to real estate financing, allowing investors to potentially maximize cash flow and accelerate equity growth. This strategy involves paying only the interest on the loan each month, deferring principal repayment until the end of the loan term. While this can lead to significant savings on monthly payments, it’s crucial to understand the intricacies and implications before diving in.

This guide will explore the advantages and disadvantages of interest-only mortgages, delve into the financial planning aspects, and examine the legal and tax implications. We’ll also analyze current real estate market trends and their impact on this financing strategy, providing insights into the potential risks and rewards associated with investment property interest-only mortgages.

Understanding Interest-Only Mortgages

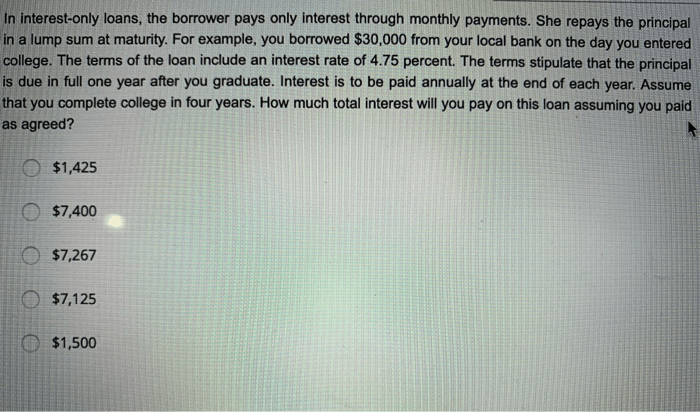

An interest-only mortgage is a type of loan where you only pay the interest on the loan each month, rather than paying down the principal as well. This means that your monthly payments will be lower than those of a traditional mortgage, but you will not be building equity in your property as quickly. Interest-only mortgages are often used for investment properties, as they can help to maximize cash flow and reduce the initial cost of borrowing.

Differences Between Interest-Only and Traditional Mortgages

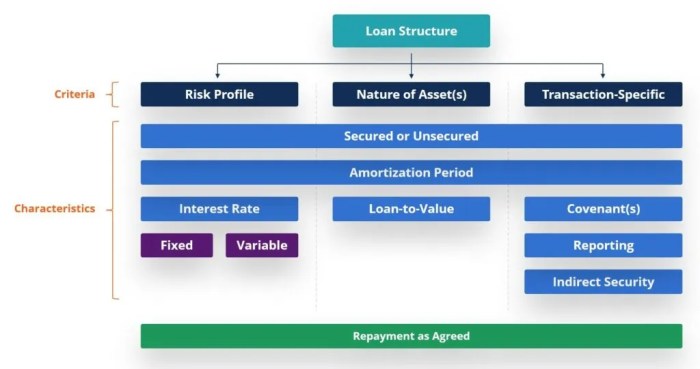

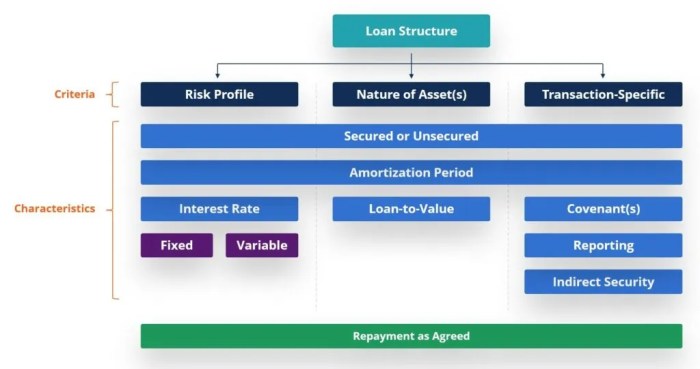

An interest-only mortgage differs from a traditional mortgage in several key ways. Here’s a breakdown:

- Payment Structure: With a traditional mortgage, your monthly payments include both principal and interest, gradually paying down the loan over time. Interest-only mortgages only require you to pay the interest on the loan each month, leaving the principal untouched.

- Equity Growth: Traditional mortgages allow you to build equity in your property as you pay down the principal. Interest-only mortgages don’t contribute to equity growth, as you are only paying interest.

- Loan Term: Traditional mortgages typically have a fixed term, such as 15 or 30 years. Interest-only mortgages can have shorter terms, often lasting for a set period before requiring a lump sum repayment of the principal.

- Interest Rates: Interest rates on interest-only mortgages can be higher than those on traditional mortgages, as lenders perceive them as riskier.

Advantages of Interest-Only Mortgages

Interest-only mortgages offer several potential benefits for investors:

- Lower Monthly Payments: By only paying interest, your monthly outgoings are significantly reduced, freeing up cash flow for other investments or expenses.

- Higher Potential Returns: Lower monthly payments can lead to higher potential returns on your investment property, as you have more cash available for renovations, marketing, or rental income.

- Flexibility: Interest-only mortgages can offer more flexibility, as they often have shorter terms and may allow for early repayment without penalties.

Disadvantages of Interest-Only Mortgages

While offering advantages, interest-only mortgages also come with drawbacks:

- No Equity Growth: Since you’re only paying interest, you won’t build equity in the property, potentially leading to a smaller return on your investment.

- Higher Interest Costs: Interest-only mortgages often come with higher interest rates, resulting in a larger overall interest cost over the life of the loan.

- Lump Sum Repayment: At the end of the term, you’ll need to repay the full principal amount in one lump sum, which can be a significant financial burden.

Financial Planning for Interest-Only Mortgages

Interest-only mortgages offer lower monthly payments, but they come with a significant caveat: you’ll need to have a solid financial plan to ensure you can repay the principal amount when the mortgage term ends. Failing to do so could result in a large balloon payment or even foreclosure.

Importance of Financial Planning

A comprehensive financial plan is crucial for anyone considering an interest-only mortgage. This plan should address several key areas, including debt management, savings, and investment strategies. By creating a well-structured plan, you can increase your chances of successfully managing your mortgage and achieving your long-term financial goals.

Debt Management

- Pay down other high-interest debt: Prioritize paying off credit card debt, personal loans, and other high-interest obligations before focusing on saving for the principal repayment of your interest-only mortgage.

- Consolidate debt: If you have multiple debts with high interest rates, consider consolidating them into a single loan with a lower interest rate. This can help you save money on interest payments and free up cash flow for other financial goals.

- Create a debt repayment plan: Develop a detailed plan for paying off your debts, including a timeline and specific amounts you will allocate to each debt each month. This will help you stay on track and avoid falling behind.

Savings

- Establish an emergency fund: Having an emergency fund can help you weather unexpected financial challenges, such as job loss or medical expenses, without having to tap into your mortgage principal repayment funds.

- Save for the principal repayment: Start saving for the principal repayment of your mortgage as early as possible. You can set up a separate savings account dedicated to this purpose and contribute to it regularly.

- Consider a sinking fund: A sinking fund is a savings account specifically designed to accumulate funds for a future expense, such as the principal repayment of your mortgage. This can help you stay on track and ensure you have the necessary funds when the time comes.

Investment Strategies

- Invest for growth: While you’re saving for the principal repayment, consider investing a portion of your savings in assets that have the potential for growth, such as stocks, mutual funds, or real estate. This can help you build wealth over time and potentially accelerate your principal repayment.

- Diversify your investments: Don’t put all your eggs in one basket. Diversifying your investments across different asset classes can help you reduce risk and potentially increase returns.

- Seek professional advice: Consider working with a financial advisor to develop a personalized investment strategy that aligns with your risk tolerance, time horizon, and financial goals.

Budgeting and Expense Management

- Track your expenses: Monitor your spending habits and identify areas where you can cut back. Use a budgeting app or spreadsheet to track your income and expenses.

- Create a budget: Develop a realistic budget that allocates your income to essential expenses, savings goals, and debt payments. This will help you stay on top of your finances and avoid overspending.

- Reduce unnecessary expenses: Look for ways to reduce your monthly expenses, such as negotiating lower rates for utilities, cutting back on subscriptions, or finding cheaper alternatives for everyday purchases.

Legal and Tax Implications: Investment Property Interest Only

Investing in real estate, especially with an interest-only mortgage, comes with its own set of legal and tax considerations. It’s crucial to understand these implications to make informed decisions and avoid potential pitfalls. This section will delve into the legal aspects and tax implications of interest-only mortgages for investment properties.

Legal Considerations

It’s important to be aware of the legal considerations when dealing with investment properties and interest-only mortgages. These factors can influence your investment strategy and ensure compliance with regulations.

- Loan Agreements: Carefully review the terms of your loan agreement, including interest rates, repayment terms, and any potential penalties for early repayment. This will ensure you understand your obligations and potential costs.

- Property Laws: Familiarize yourself with local property laws, including zoning regulations, building codes, and tenant rights. These laws can impact your investment property’s use and potential rental income.

- Landlord-Tenant Laws: If you plan to rent out your property, understand the landlord-tenant laws in your jurisdiction. These laws cover issues like lease agreements, security deposits, and eviction procedures.

- Property Taxes: Be aware of property taxes, which can vary based on location and property value. These taxes are an ongoing expense for property owners.

- Insurance: Ensure adequate insurance coverage for your investment property, including liability insurance, property damage insurance, and rental income insurance. This protects you from potential financial losses.

Tax Implications

Understanding the tax implications of interest-only mortgages is crucial for managing your investment property’s financial performance. Here’s a breakdown of key tax aspects:

- Interest Deductions: Interest paid on your mortgage is typically deductible from your taxable income. This deduction can significantly reduce your tax liability.

- Property Taxes: Property taxes are also generally deductible on your income taxes. This can further reduce your tax burden.

- Depreciation: You can depreciate the value of your investment property over time, which can be deducted from your income for tax purposes. Depreciation is a way to account for the wear and tear of the property.

- Capital Gains: When you sell your investment property, you’ll likely have to pay capital gains tax on any profit made. The capital gains tax rate can vary depending on the holding period and your income level.

- Rental Income: If you rent out your investment property, you’ll need to report the rental income on your taxes. However, you can deduct expenses related to the rental property, such as mortgage interest, property taxes, insurance, and repairs.

Impact on Property Taxes and Capital Gains

Interest-only mortgages can impact property taxes and capital gains in various ways:

- Property Taxes: While interest-only mortgages don’t directly influence property tax rates, they can impact your ability to pay property taxes. Since you’re only paying interest, you have less money available for other expenses, including property taxes. This can lead to potential financial strain if you cannot afford to pay your property taxes.

- Capital Gains: Interest-only mortgages can indirectly impact capital gains. Because you’re not paying down the principal, you’ll have a larger loan balance when you sell the property. This means you’ll have less profit from the sale, potentially leading to lower capital gains. However, you’ll also have paid less in interest over the life of the loan, which can offset some of the capital gains tax liability.

“It’s essential to consult with a qualified tax advisor to understand the specific tax implications of interest-only mortgages for your investment property.”

Real Estate Market Trends and Interest-Only Mortgages

The real estate market is constantly evolving, and understanding current trends is crucial for anyone considering an interest-only mortgage. These trends directly impact property values, interest rates, and the overall feasibility of this type of financing.

The Relationship Between Interest Rates, Property Values, and Interest-Only Mortgages, Investment property interest only

Interest rates and property values have a significant impact on the success of interest-only mortgages. When interest rates rise, the cost of borrowing increases, making interest-only mortgages less attractive. Conversely, when interest rates fall, borrowing becomes cheaper, potentially making interest-only mortgages more appealing. Property values also play a crucial role. If property values appreciate, the equity in the property grows, potentially offsetting the lack of principal repayment in an interest-only mortgage. However, if property values decline, the borrower may face negative equity, where the outstanding mortgage balance exceeds the property’s value.

“Interest-only mortgages can be a good option for borrowers who expect property values to appreciate significantly, but they can be risky if property values decline or interest rates rise.”

The Impact of Real Estate Market Trends on Interest-Only Mortgages

Current real estate market trends can influence the attractiveness of interest-only mortgages. For example, if the market is experiencing a period of strong growth, with rising property values, interest-only mortgages may be a viable option. However, if the market is stagnant or declining, the risks associated with interest-only mortgages increase.

- Rising Interest Rates: As interest rates rise, the cost of borrowing increases, making interest-only mortgages more expensive. This can reduce their attractiveness, especially if property values are not appreciating at a comparable rate.

- Property Value Fluctuations: If property values decline, borrowers with interest-only mortgages may find themselves in a difficult situation. They may owe more than their property is worth, known as negative equity, which can make it challenging to refinance or sell the property.

- Market Volatility: In volatile markets, where property values are fluctuating significantly, interest-only mortgages can be riskier. This is because it’s harder to predict future property value trends, making it difficult to assess the long-term financial implications of this type of mortgage.

Long-Term Implications of Interest-Only Mortgages in a Changing Real Estate Market

Interest-only mortgages can be a complex financial product with both potential benefits and risks. It’s essential to carefully consider the long-term implications of this type of financing, particularly in a changing real estate market.

- Repayment Strategy: A key consideration is the repayment strategy for the principal. With an interest-only mortgage, the principal remains unchanged throughout the term. Borrowers need to have a clear plan for repaying the principal, whether through lump-sum payments, a subsequent mortgage, or other means.

- Interest Rate Fluctuations: Interest-only mortgages often have variable interest rates, which can fluctuate over time. This means that the monthly payments can increase, potentially making the mortgage more expensive.

- Property Value Growth: The success of an interest-only mortgage is often linked to property value growth. If property values do not appreciate as expected, borrowers may find it difficult to repay the principal and may face negative equity.

Case Studies and Examples

To understand the potential benefits and risks of interest-only mortgages, let’s examine some real-world scenarios involving investment properties. By analyzing different property types, purchase prices, interest rates, and potential returns, we can gain insights into how these mortgages can impact your investment strategy.

Investment Property Scenarios

Here are a few hypothetical scenarios showcasing the potential impact of interest-only mortgages on investment property returns:

| Property Type | Purchase Price | Interest Rate | Monthly Payment (Interest Only) | Potential Return (Annual) | Analysis |

|---|---|---|---|---|---|

| Single-Family Home | $300,000 | 4.5% | $1,125 | 6% (Rental Income) | This scenario demonstrates a positive return on investment. The monthly payment is relatively low, allowing for potential cash flow from rental income. However, it’s crucial to consider the future repayment of the principal, which could impact your overall financial position. |

| Multi-Family Apartment Building | $600,000 | 5% | $2,500 | 8% (Rental Income) | This scenario highlights the potential for higher returns with larger investments. While the initial investment is significant, the higher rental income can offset the monthly interest payments, potentially generating substantial profits. However, managing a multi-family property requires significant time and resources. |

| Commercial Property | $1,000,000 | 4% | $3,333 | 10% (Rental Income) | This scenario emphasizes the potential for high returns in commercial real estate. The interest-only mortgage allows for lower monthly payments, enabling you to invest more in property improvements and potentially increase rental income. However, commercial properties often require specialized expertise and involve higher risks. |

Note: These scenarios are for illustrative purposes only and do not reflect actual market conditions or investment advice. Potential returns and risks vary depending on various factors, including property location, market trends, and individual circumstances. It’s essential to conduct thorough research and consult with financial professionals before making any investment decisions.

By carefully considering the pros and cons, understanding the financial planning requirements, and staying informed about market trends, investors can determine if an interest-only mortgage aligns with their investment goals and risk tolerance. Ultimately, this strategy can be a powerful tool for building wealth through real estate, but it’s essential to approach it with a well-defined plan and a thorough understanding of the intricacies involved.

Essential FAQs

What are the potential risks of an interest-only mortgage?

While interest-only mortgages can offer significant cash flow benefits, they also come with risks. The biggest risk is that you’ll end up owing more than the property is worth if property values decline or interest rates rise. You’ll also have to make a large lump-sum payment at the end of the loan term, which could be challenging if you haven’t planned for it.

How do interest-only mortgages affect my taxes?

The interest you pay on an interest-only mortgage is tax-deductible, just like the interest on a traditional mortgage. However, you may not be able to deduct the principal payments until the end of the loan term.

Is an interest-only mortgage right for everyone?

No, an interest-only mortgage is not right for everyone. It’s a strategy that requires careful planning and a solid understanding of the risks involved. If you’re not sure if it’s right for you, it’s always best to consult with a financial advisor.

Investment property interest only mortgages can be a smart way to minimize upfront costs and maximize cash flow, especially if you’re aiming for long-term growth. To find promising investment opportunities near you, check out this resource: investment opportunities near me. Once you’ve identified a potential property, you can then explore interest-only financing options to see if they align with your investment goals.

Investment property interest only mortgages can be a good option for those looking to minimize their upfront costs and build equity over time. However, it’s crucial to remember that you’ll need to have a plan for eventually paying off the principal, which could involve exploring other investment avenues, like quantum AI investment , to supplement your income.

Ultimately, the success of an interest-only mortgage strategy hinges on careful planning and a sound understanding of your financial goals.

Investment property interest-only mortgages can be a tempting option for investors seeking to minimize initial payments and maximize cash flow. However, it’s important to consider the long-term implications of this strategy, as you’ll eventually need to repay the principal. For insights on navigating the complex world of investing, you might find it beneficial to check out the Jim Cramer Investment Club for their take on current market trends.

Ultimately, the decision to pursue an interest-only mortgage for an investment property should be based on a thorough understanding of your financial goals and risk tolerance.

An investment property interest-only loan can be a great option for investors seeking to maximize cash flow. However, it’s important to remember that you’ll be paying only the interest on the loan, not the principal. This means that you’ll need to have a plan in place for repaying the principal at some point. For those looking for a partner in their investment property journey, companies like hps investment partners offer valuable expertise and resources.

Ultimately, understanding the nuances of interest-only loans and carefully considering your long-term financial goals is crucial for successful real estate investment.

Investment property interest-only loans can be a great way to leverage your capital, but managing the investment portfolio can be a challenge. If you’re looking for professional help, consider an outsourced chief investment officer who can guide you through the complexities of real estate investment and ensure your property portfolio remains profitable.