Investment Property in Florida A Guide to Success

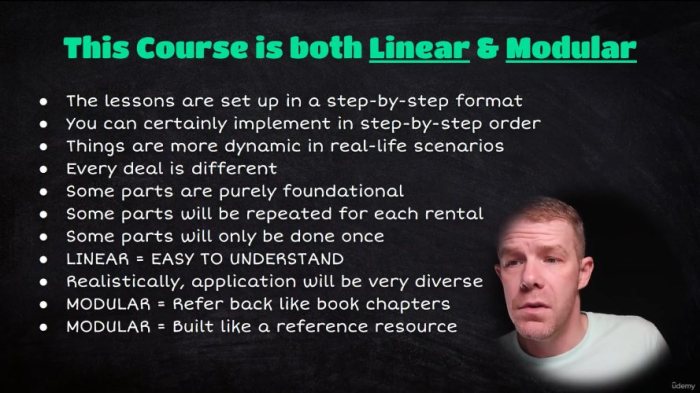

Investment property in Florida has long been a popular choice for real estate investors, offering a blend of sunshine, beaches, and strong rental demand. The Sunshine State boasts a diverse landscape of investment opportunities, from single-family homes to sprawling commercial properties, each with its own unique set of advantages and challenges. Whether you’re a seasoned investor seeking to expand your portfolio or a first-timer dipping your toes into the world of real estate, understanding the intricacies of the Florida market is key to maximizing your returns.

This comprehensive guide will delve into the various aspects of investing in Florida real estate, from analyzing market trends and exploring different property types to navigating legal regulations and implementing effective management strategies. We’ll also examine the risks and rewards associated with each investment approach, providing you with the knowledge and tools to make informed decisions and achieve your financial goals.

Investment Property Management: Investment Property In Florida

Effective property management is crucial for maximizing returns and minimizing headaches when investing in Florida real estate. It ensures your property is well-maintained, tenants are reliable, and your investment is protected.

Tenant Screening

Tenant screening is essential for protecting your investment and ensuring a smooth rental experience. It involves verifying potential tenants’ financial stability, rental history, and criminal background.

- Credit Checks: Assess a tenant’s credit score and payment history to determine their financial responsibility.

- Background Checks: Verify a tenant’s criminal history and any past evictions.

- Rental History: Contact previous landlords to confirm a tenant’s rental history and payment patterns.

- Employment Verification: Ensure a tenant has a stable income source to cover rent payments.

Rent Collection

Efficient rent collection is vital for maintaining a steady cash flow. A property manager can handle rent collection, ensuring timely payments and reducing the risk of late or missed payments.

- Automated Payment Systems: Property managers often use online payment platforms for convenient and secure rent collection.

- Lease Enforcement: They enforce lease agreements, ensuring tenants adhere to payment terms and responsibilities.

- Legal Action: If necessary, property managers can pursue legal action to recover unpaid rent.

Maintenance

Regular maintenance is crucial for preserving your property’s value and preventing costly repairs. Property managers handle maintenance requests, ensuring timely repairs and addressing issues before they escalate.

- Routine Inspections: They conduct regular inspections to identify and address potential problems before they become major issues.

- Emergency Repairs: They respond promptly to emergency repairs, minimizing damage and inconvenience.

- Contractor Coordination: They manage and coordinate with contractors for repairs and renovations, ensuring quality work and reasonable costs.

Finding and Working with Reputable Property Managers

Choosing the right property manager is crucial for the success of your investment.

- Professional Affiliations: Look for property managers who are members of professional organizations, such as the National Association of Residential Property Managers (NARPM).

- Experience and Expertise: Choose a manager with experience in managing rental properties, especially in Florida.

- Client References: Request references from previous clients to gauge their satisfaction and experience.

- Communication and Transparency: Ensure the manager is responsive, transparent, and provides regular updates.

Tax Considerations

Investing in Florida real estate comes with a unique set of tax considerations that can significantly impact your overall returns. Understanding these tax implications and leveraging available deductions is crucial for maximizing your investment potential.

Depreciation

Depreciation is a valuable tax deduction for rental property owners, allowing you to write off a portion of your property’s value each year. This deduction is based on the assumption that your property will wear down over time.

- The Internal Revenue Service (IRS) provides a standardized depreciation schedule for residential rental properties, which is typically 27.5 years.

- Depreciation can be claimed on both the building and the land, although the land itself is not depreciable.

- The amount of depreciation you can deduct each year is calculated by dividing the property’s depreciable basis (cost of the property minus land value) by the depreciation period.

For example, if you purchased a property for $200,000, with $50,000 allocated to the land, your depreciable basis would be $150,000. Using the 27.5-year depreciation schedule, your annual depreciation deduction would be approximately $5,455 ($150,000 / 27.5).

Capital Gains, Investment property in florida

When you sell your investment property, you may have to pay capital gains taxes on any profits you realize. Capital gains are taxed at different rates depending on how long you held the property.

- Short-term capital gains, realized from holding the property for less than a year, are taxed at your ordinary income tax rate.

- Long-term capital gains, realized from holding the property for more than a year, are generally taxed at a lower rate.

- The current long-term capital gains tax rates are 0%, 15%, or 20%, depending on your income level.

Property Taxes

Florida property taxes are levied by local governments and are based on the assessed value of your property. These taxes are generally paid annually and can be a significant expense for investment property owners.

- Property taxes are deductible for federal income tax purposes, as long as you use the property for rental purposes.

- Florida also offers a homestead exemption, which can reduce your property taxes if you use the property as your primary residence.

Case Studies and Success Stories

Florida’s real estate market has consistently attracted investors seeking profitable ventures. To illustrate the potential and strategies involved, we present case studies of successful investment property ventures in Florida. These examples highlight the diverse approaches, challenges, and outcomes that can be achieved in this dynamic market.

A Single-Family Home Rental in Tampa

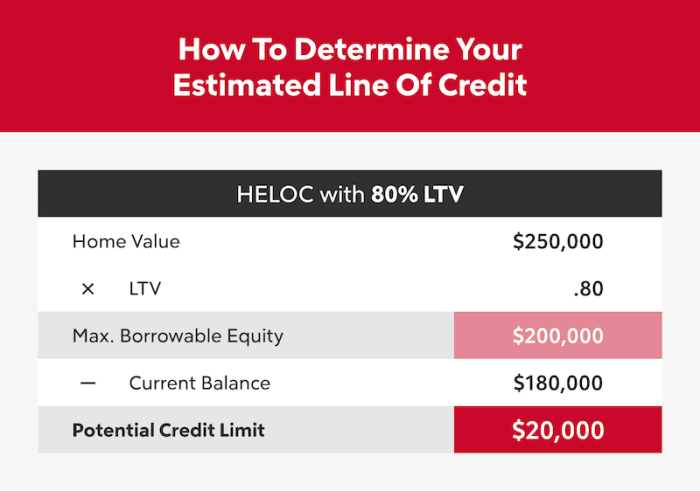

This case study involves a single-family home purchased in Tampa, Florida, in 2018 for $250,000. The investor focused on a property in a rapidly growing area with high rental demand. The property was renovated and listed for rent at $2,000 per month.

- Strategies: The investor employed a combination of strategies, including careful property selection, strategic renovation, and effective marketing. They prioritized a location with strong rental demand and aimed for a property that could be rented for a premium price. They invested in upgrades that enhanced the home’s appeal to tenants and maximized its rental potential. The investor also utilized online platforms and local networks to reach a wider audience of potential renters.

- Challenges: The investor faced challenges such as finding reliable tenants, managing maintenance requests, and navigating local regulations. They encountered instances of tenant turnover and unexpected repair costs, requiring them to adapt their management approach and budget accordingly.

- Outcomes: The investment proved successful, generating a consistent rental income stream and a positive cash flow. The investor was able to cover their mortgage payments, maintenance expenses, and property taxes, while still realizing a healthy profit. The property’s appreciation in value also contributed to the overall return on investment.

A Multi-Family Property in Orlando

This case study explores a multi-family property acquired in Orlando, Florida, in 2020 for $500,000. The investor purchased a four-unit apartment building in a central location with strong demand for rental units. The property required minimal renovation, but the investor focused on enhancing its amenities and common areas to attract tenants.

- Strategies: The investor’s strategy revolved around creating a desirable living environment for tenants. They invested in upgrading the property’s common areas, such as the laundry facilities and outdoor spaces. They also implemented a tenant-friendly lease agreement and provided responsive property management services.

- Challenges: The investor faced challenges related to managing multiple tenants, ensuring timely rent collection, and maintaining the property’s condition. They also had to adapt to changes in the local rental market and tenant preferences.

- Outcomes: The investment yielded significant rental income, allowing the investor to cover their mortgage payments, operating expenses, and property taxes. The property’s strong occupancy rate and consistent rental income stream generated a healthy cash flow. The investor also benefited from the property’s appreciation in value over time.

A Vacation Rental in Miami Beach

This case study showcases a vacation rental property in Miami Beach, Florida, purchased in 2021 for $750,000. The investor recognized the high demand for short-term rentals in this popular tourist destination. They acquired a beachfront condo and equipped it with luxurious amenities and modern furnishings to cater to vacationers.

- Strategies: The investor employed a strategic marketing approach, utilizing online booking platforms and social media to reach a global audience of potential guests. They focused on creating a unique and memorable experience for their renters, offering concierge services, access to amenities, and personalized recommendations.

- Challenges: The investor faced challenges related to seasonal fluctuations in demand, managing guest expectations, and complying with local regulations for short-term rentals. They also had to navigate the complexities of managing a property remotely.

- Outcomes: The investment generated substantial rental income, particularly during peak tourist seasons. The investor’s focus on high-quality amenities and personalized service resulted in positive guest reviews and repeat bookings. The property’s location and unique features also contributed to its popularity and profitability.

Investing in Florida real estate can be a rewarding endeavor, but it requires careful planning, thorough research, and a keen understanding of the market dynamics. By leveraging the insights shared in this guide, you can navigate the complexities of the Florida real estate landscape, identify lucrative investment opportunities, and position yourself for success in this dynamic and ever-evolving market. Remember, the key to success lies in a well-informed approach, a strategic mindset, and a commitment to building a profitable and sustainable investment portfolio.

Question & Answer Hub

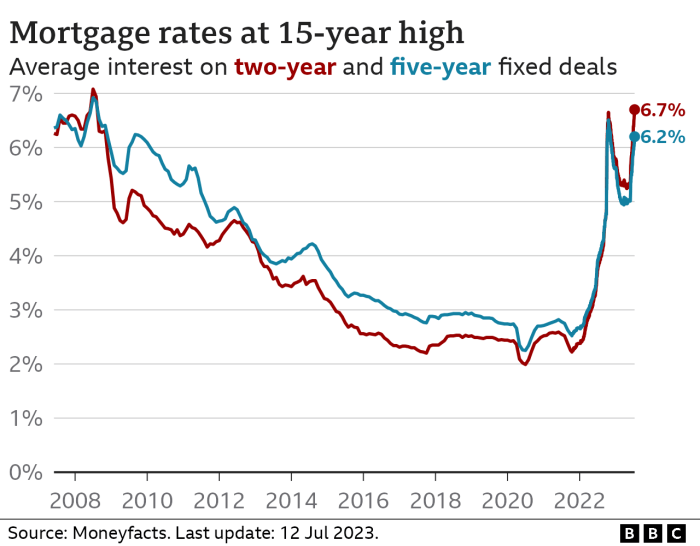

What are the current interest rates for investment property mortgages in Florida?

Interest rates for investment property mortgages in Florida fluctuate based on market conditions. It’s recommended to consult with a mortgage lender for the most up-to-date information.

What are the typical property taxes in Florida?

Property taxes in Florida vary depending on the location and assessed value of the property. You can use online calculators or consult with a tax professional for an estimate.

What are the best resources for finding reputable property managers in Florida?

You can find reputable property managers through online directories, professional associations, and recommendations from other investors.

How can I learn more about the specific regulations for investment properties in my chosen location in Florida?

You can access information about local regulations by contacting the city or county government, visiting their websites, or consulting with a real estate attorney.

Investing in Florida real estate can be a lucrative venture, especially with its strong tourism and growing population. But if you’re looking for a more hands-off approach, considering a career path in real estate investment trusts (REITs) might be worth exploring. Is real estate investment trusts a good career path ? This article provides insightful information about the industry and its potential.

While REITs offer diversification and potential for growth, understanding the risks and complexities involved is crucial before making any investment decisions. Ultimately, your decision to invest in Florida real estate, whether directly or through REITs, should align with your individual financial goals and risk tolerance.

Investing in Florida real estate can be a smart move, especially when considering the state’s strong tourism and economic growth. If you’re looking for professional guidance in navigating the complexities of investment property, consider partnering with a reputable firm like CBRE Investment Management. They offer a wide range of services, from market analysis to property acquisition and management, making them a valuable resource for anyone seeking to capitalize on the Florida real estate market.

Investing in Florida real estate can be a smart move, offering potential for both appreciation and rental income. For those seeking expert guidance in navigating this market, Lasalle Investment Management offers a wealth of knowledge and experience. Their team can help you identify the best investment opportunities, assess market trends, and create a tailored strategy for success in the Florida real estate landscape.