Investment Properties Houston A Comprehensive Guide

Investment properties Houston offer a compelling opportunity for those seeking to diversify their portfolios and capitalize on a thriving real estate market. With a strong economy, a diverse population, and a growing demand for housing, Houston presents a favorable landscape for investors. From single-family homes to multi-family units, commercial properties, and even land, the city boasts a wide range of investment options, each with its unique advantages and considerations.

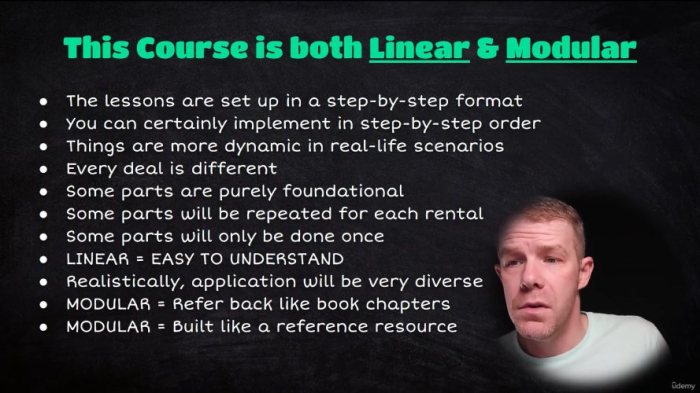

Understanding the nuances of the Houston real estate market is crucial for making informed investment decisions. This guide delves into key aspects such as market trends, property types, financing options, and tax implications, providing insights that can help investors navigate the path to success.

Houston Real Estate Market Overview

Houston’s real estate market is a dynamic landscape, known for its resilience and growth potential. The city’s robust economy, driven by energy, healthcare, and technology sectors, has historically supported a strong housing market. However, like any market, it experiences fluctuations influenced by various factors.

Current Market Trends

The Houston real estate market is currently characterized by:

* Stable Home Prices: While national markets have seen significant price increases, Houston has experienced a more moderate rise in home values. This stability is attributed to a diverse economy, a large inventory of homes, and a healthy supply of affordable housing options.

* Strong Rental Demand: Houston’s population growth and its affordability compared to other major cities continue to drive strong demand for rental properties. This translates to steady rental income for investors.

* Rising Interest Rates: The Federal Reserve’s recent interest rate hikes have impacted mortgage rates, making it more expensive for buyers to finance homes. This has slowed down the pace of home sales but has not significantly affected the overall market.

Historical Performance of Investment Properties, Investment properties houston

Houston has a track record of consistent appreciation in investment property values.

* Appreciation Rates: Over the past decade, Houston’s real estate market has seen an average annual appreciation rate of around 4-5%, with some areas experiencing higher growth.

* Rental Yields: Rental yields in Houston are generally considered competitive, with average gross rental yields ranging from 5% to 8% depending on the location and type of property.

Economic Outlook for Houston

Houston’s economic outlook remains positive, with its diverse industries mitigating the impact of economic downturns.

* Energy Sector: The city is a major hub for the energy industry, which is expected to continue its recovery and growth in the coming years.

* Healthcare and Technology: Houston’s healthcare and technology sectors are also experiencing robust growth, further diversifying the economy and driving job creation.

* Population Growth: Houston continues to attract new residents, contributing to a steady demand for housing and rental properties.

Investment Strategies for Houston Properties

Investing in Houston real estate can be a lucrative venture, offering a variety of strategies for investors with different goals and risk tolerances. The city’s robust economy, growing population, and diverse housing market present numerous opportunities for both experienced and novice investors.

Buy-and-Hold

The buy-and-hold strategy involves purchasing a property with the intention of holding it for an extended period, typically several years or even decades. This strategy aims to generate passive income through rental revenue and benefit from long-term appreciation in property value.

Advantages of Buy-and-Hold

- Passive Income: Rental income provides a steady stream of cash flow, which can offset mortgage payments and other expenses.

- Long-Term Appreciation: Houston’s real estate market has historically shown consistent growth, providing the potential for significant capital gains over time.

- Tax Advantages: Rental property owners can deduct various expenses, such as mortgage interest, property taxes, and insurance, from their taxable income.

- Inflation Hedge: Real estate is generally considered an inflation hedge, as property values tend to rise with inflation, preserving purchasing power.

Disadvantages of Buy-and-Hold

- High Initial Investment: Purchasing a property requires a substantial upfront investment, including down payment, closing costs, and potential renovation expenses.

- Property Management Responsibilities: Landlords are responsible for managing tenants, handling repairs, and maintaining the property, which can be time-consuming and demanding.

- Market Volatility: While Houston’s real estate market has been stable, unexpected economic downturns or local market fluctuations can impact property values and rental income.

- Tenant Issues: Dealing with difficult or unreliable tenants can be a significant challenge for landlords.

Legal and Regulatory Requirements

- Landlord-Tenant Laws: Investors must familiarize themselves with Texas landlord-tenant laws, which govern tenant rights, lease agreements, eviction procedures, and other legal aspects of property management.

- Property Taxes: Houston property owners are subject to annual property taxes, which are based on the assessed value of the property.

- Building Codes and Permits: Investors must ensure their properties comply with local building codes and obtain necessary permits for renovations or repairs.

Flipping

Property flipping involves purchasing a property, renovating it, and then reselling it for a profit within a relatively short timeframe, typically a few months to a year. This strategy focuses on maximizing returns through rapid appreciation driven by improvements and market timing.

Advantages of Flipping

- Potential for High Returns: Flipping can generate significant profits if the property is purchased at a good price and renovated effectively.

- Short-Term Investment: Flipping requires a shorter time commitment compared to buy-and-hold, making it appealing to investors seeking quick returns.

- Control over Renovation: Flippers have direct control over the renovation process, allowing them to customize the property to maximize its appeal to potential buyers.

Disadvantages of Flipping

- High Risk: Flipping involves a higher level of risk due to the shorter time frame and the potential for unforeseen costs or market fluctuations.

- Extensive Time Commitment: Flipping requires significant time and effort, including property sourcing, renovation planning, and marketing.

- Market Knowledge: Successful flipping requires a deep understanding of local real estate markets, including pricing trends, renovation costs, and buyer preferences.

- Financing Challenges: Securing financing for flipping projects can be challenging, as lenders often require a specific track record or a higher down payment.

Legal and Regulatory Requirements

- Building Codes and Permits: Flippers must obtain necessary permits and ensure their renovations comply with local building codes.

- Disclosure Laws: Investors are required to disclose any known defects or issues with the property to potential buyers.

- Real Estate Licensing: Individuals who are actively involved in flipping properties may need to obtain a real estate license, depending on the scope of their activities.

Short-Term Rentals

Short-term rentals involve renting out a property for short periods, typically less than 30 days, often through platforms like Airbnb or VRBO. This strategy can generate higher rental income than long-term rentals, but it also comes with increased responsibilities and potential regulatory challenges.

Advantages of Short-Term Rentals

- Higher Rental Income: Short-term rentals can command higher rates than long-term rentals, particularly in popular tourist destinations or during peak seasons.

- Flexibility: Short-term rentals offer more flexibility for both landlords and tenants, as rental periods can be customized to suit individual needs.

- Marketing Advantages: Online platforms like Airbnb provide convenient marketing and booking tools for short-term rentals.

Disadvantages of Short-Term Rentals

- Higher Turnover: Short-term rentals experience higher turnover rates, which can increase maintenance and cleaning costs.

- Regulatory Challenges: Short-term rentals are subject to increasing regulations in many cities, including licensing requirements, occupancy limits, and noise restrictions.

- Guest Management: Landlords are responsible for managing guest interactions, handling complaints, and ensuring the property is clean and well-maintained between bookings.

- Seasonality: Rental income from short-term rentals can fluctuate significantly based on seasonality and demand.

Legal and Regulatory Requirements

- Short-Term Rental Licensing: Many cities require short-term rental operators to obtain a license or permit, which may involve inspections and fees.

- Occupancy Limits: Short-term rental properties often have occupancy limits, which can vary based on the size of the property and local regulations.

- Noise Ordinances: Landlords must ensure that their guests comply with local noise ordinances to avoid complaints from neighbors.

- Tax Compliance: Short-term rental income is subject to taxation, and landlords may be required to collect and remit sales taxes on behalf of the city.

Tax Implications of Investment Properties

Owning and operating investment properties in Houston, like any other real estate investment, comes with a set of tax implications. Understanding these tax implications is crucial for maximizing your returns and minimizing your tax liability.

Depreciation Deductions

Depreciation deductions are one of the most significant tax benefits for real estate investors. Depreciation allows you to deduct a portion of the cost of your property over its useful life. This deduction reduces your taxable income and, consequently, your tax liability.

- Depreciable Assets: For investment properties, the depreciable assets are the building and any improvements made to the property. Land is not depreciable.

- Depreciation Methods: The most common depreciation method for residential rental properties is the straight-line method, which spreads the depreciation evenly over the property’s useful life, which is generally 27.5 years for residential properties.

- Depreciation Calculation: To calculate depreciation, you’ll subtract the estimated salvage value (the value of the property at the end of its useful life) from the adjusted basis (the cost of the property plus any improvements, minus any deductions for depreciation). The resulting amount is then divided by the useful life of the property.

For example, if you purchase a rental property for $200,000, and the land is worth $50,000, the depreciable basis is $150,000. Using the straight-line method over 27.5 years, your annual depreciation deduction would be $5,455 ($150,000 / 27.5).

Depreciation is a non-cash expense, meaning you don’t actually pay it out of pocket. However, it reduces your taxable income, which can lead to significant tax savings over time.

Capital Gains Taxes

When you sell an investment property, you may have to pay capital gains taxes on any profit you make. Capital gains are the difference between the selling price and your adjusted basis in the property.

- Short-Term Capital Gains: If you hold the property for less than one year, the capital gains are taxed at your ordinary income tax rate.

- Long-Term Capital Gains: If you hold the property for more than one year, the capital gains are taxed at a preferential rate, which is typically lower than your ordinary income tax rate.

The current long-term capital gains tax rates are 0%, 15%, and 20%, depending on your income level.

Understanding the holding period and the applicable tax rates is essential for planning your investment strategy and maximizing your returns.

Property Taxes

Property taxes are an annual expense that all property owners in Houston must pay. The amount of property taxes you pay depends on the assessed value of your property and the tax rate set by the city and county. While property taxes are not deductible at the federal level, they may be deductible at the state level.

- Assessed Value: The assessed value of your property is determined by the local tax assessor’s office. It is generally based on the market value of the property.

- Tax Rate: The tax rate is set by the city and county and can vary depending on the location and type of property. The tax rate is expressed as a percentage of the assessed value.

For example, if your property has an assessed value of $200,000 and the tax rate is 2%, your annual property tax bill would be $4,000 ($200,000 x 0.02).

Other Tax Considerations

- Mortgage Interest Deduction: If you finance your investment property, you may be able to deduct the interest you pay on your mortgage. However, the deductibility of mortgage interest is subject to certain limitations.

- Property Insurance: Property insurance premiums are generally not deductible for tax purposes, but they can be included in your rental expenses.

- Rental Expenses: You can deduct various expenses related to operating your rental property, such as repairs, maintenance, utilities, advertising, and property management fees.

- Tax Credits: There are various tax credits available for real estate investors, such as the rehabilitation tax credit and the energy-efficient home improvement credit.

Case Studies of Successful Investment Properties in Houston: Investment Properties Houston

Successful investment properties in Houston demonstrate the potential for substantial returns, showcasing the diverse opportunities and strategies available in this dynamic market. By examining these case studies, aspiring investors can gain valuable insights into the factors that drive success, including property selection, market analysis, and financial management.

Single-Family Home Flipping in the Heights

This case study explores the successful flipping of a single-family home in the Heights neighborhood of Houston. The investor purchased a property in need of renovation for $300,000. They invested $50,000 in renovations, including modernizing the kitchen and bathrooms, updating the landscaping, and painting the exterior. The property was listed for $400,000 and sold within three months. The investor realized a profit of $50,000, excluding closing costs and holding expenses.

- Property Description: A 3-bedroom, 2-bathroom single-family home built in 1950, located in a desirable neighborhood with proximity to parks, schools, and restaurants.

- Financial Statements:

- Purchase Price: $300,000

- Renovation Costs: $50,000

- Selling Price: $400,000

- Profit: $50,000

- Market Data: The Heights neighborhood experienced a median home price appreciation of 7% in the past year, making it an attractive area for investment.

- Strategies Employed:

- Identifying undervalued properties in a desirable neighborhood.

- Performing strategic renovations to enhance property value.

- Utilizing a competitive pricing strategy to attract buyers.

- Challenges Faced:

- Managing renovation costs within budget.

- Securing financing for the purchase and renovation.

- Finding qualified contractors and managing the renovation process.

- Outcomes Achieved:

- Successful sale of the property at a profit.

- Demonstration of the potential for high returns in the Houston real estate market.

Multi-Family Property in Midtown

This case study examines the successful acquisition and management of a multi-family property in the Midtown area of Houston. The investor purchased a 10-unit apartment building for $1 million. They implemented a comprehensive property management strategy, including rent collection, tenant screening, and maintenance. The property generated a consistent annual cash flow of $100,000, providing a 10% return on investment.

- Property Description: A 10-unit apartment building located in a high-demand area with easy access to transportation, entertainment, and employment opportunities.

- Financial Statements:

- Purchase Price: $1 million

- Annual Rental Income: $120,000

- Annual Operating Expenses: $20,000

- Annual Cash Flow: $100,000

- Market Data: Midtown is a rapidly growing area with a high demand for rental properties, particularly from young professionals and students.

- Strategies Employed:

- Acquiring a multi-family property in a high-demand location.

- Implementing a comprehensive property management strategy to maximize cash flow.

- Utilizing a long-term investment approach to generate passive income.

- Challenges Faced:

- Managing tenant relations and resolving conflicts.

- Maintaining the property and responding to maintenance requests.

- Navigating the complexities of multi-family property ownership.

- Outcomes Achieved:

- Generation of consistent annual cash flow.

- Appreciation in property value over time.

- Creation of a passive income stream for the investor.

Commercial Property in the Galleria Area

This case study explores the successful investment in a commercial property in the Galleria area of Houston. The investor purchased a retail space for $2 million and leased it to a national retailer for a 10-year term. The lease generated an annual rental income of $250,000, providing a 12.5% return on investment.

- Property Description: A 5,000 square foot retail space located in a high-traffic area with ample parking and visibility.

- Financial Statements:

- Purchase Price: $2 million

- Annual Rental Income: $250,000

- Annual Operating Expenses: $50,000

- Annual Cash Flow: $200,000

- Market Data: The Galleria area is a major retail and commercial hub in Houston, attracting a large volume of foot traffic and business activity.

- Strategies Employed:

- Investing in a commercial property in a high-demand location.

- Securing a long-term lease with a reputable tenant.

- Negotiating favorable lease terms to maximize rental income.

- Challenges Faced:

- Finding a reliable tenant and negotiating a favorable lease agreement.

- Managing the property and addressing any maintenance issues.

- Navigating the complexities of commercial property ownership.

- Outcomes Achieved:

- Generation of stable and predictable rental income.

- Appreciation in property value over time.

- Creation of a passive income stream for the investor.

Investing in Houston real estate can be a rewarding endeavor, offering the potential for long-term growth and passive income. By carefully considering factors such as location, property condition, rental potential, and financing options, investors can position themselves for success in this dynamic market. Remember to conduct thorough due diligence, seek professional guidance, and stay informed about market trends to maximize your investment returns.

FAQs

What are the current interest rates for investment property mortgages in Houston?

Interest rates for investment property mortgages in Houston fluctuate based on market conditions. It’s recommended to consult with a mortgage lender for current rates and eligibility requirements.

What are the typical property taxes in Houston?

Property taxes in Houston vary depending on the assessed value of the property. It’s advisable to research the tax rates for specific neighborhoods and properties before making an investment decision.

How competitive is the rental market in Houston?

Houston’s rental market is generally competitive, especially in popular neighborhoods. Researching rental demand, vacancy rates, and average rental prices can help determine the potential for rental income.

What are the best neighborhoods in Houston for investment properties?

The best neighborhoods for investment properties in Houston depend on your investment goals and risk tolerance. Factors such as appreciation potential, rental demand, and crime rates should be considered when selecting a neighborhood.

Investing in properties in Houston can be a lucrative venture, especially given the city’s booming economy. Understanding the financial implications of such investments requires a strong grasp of accounting principles, which can be acquired through cpa online courses. These courses provide a comprehensive understanding of tax laws and regulations, crucial for navigating the intricacies of property investment in Houston.

Investing in properties in Houston can be a lucrative venture, especially considering the city’s booming economy and diverse population. However, before diving into the real estate market, it’s wise to consider alternative career paths that could offer financial stability. For instance, a career in medical billing and coding is in high demand, and online courses can provide the necessary skills to enter this field.

To learn more about the cost of medical billing and coding online courses, check out this resource: medical billing and coding online courses cost. Ultimately, your investment strategy should align with your personal goals and financial situation, whether it’s acquiring properties in Houston or pursuing a career in medical billing and coding.

Investing in properties in Houston can be a lucrative venture, but it requires meticulous record keeping and data management. If you’re looking to enhance your skills in this area, consider taking data entry courses online. These courses can equip you with the necessary tools and techniques to efficiently manage your property investments, from tracking rental income to maintaining tenant records.

Investing in properties in Houston can be a smart move, especially with the city’s strong economy and growing population. If you’re looking for a career change that offers stability and high demand, consider enrolling in online LPN courses. The healthcare industry is booming, and becoming a licensed practical nurse can open doors to a variety of rewarding opportunities.

And who knows, maybe you’ll even be able to use your new skills to provide healthcare services to residents of your Houston investment properties.