Interest Rates and Investment Property A Guide

Interest rates for investment property play a pivotal role in shaping the real estate market, influencing everything from property prices to rental yields. Understanding how interest rates work and how they impact investment decisions is crucial for any investor seeking to navigate this dynamic landscape.

This guide delves into the intricate relationship between interest rates and investment properties, exploring the various types of interest rates available, the factors that influence their fluctuations, and strategies for managing interest rate risk. We’ll also examine the historical correlation between interest rates and investment property performance, providing insights into the current market trends and their implications for investors.

Understanding Interest Rates for Investment Property

Interest rates play a crucial role in the real estate market, particularly for investment properties. They directly impact the cost of borrowing money to purchase property, influencing affordability, investment returns, and overall market trends. This section will delve into the relationship between interest rates and investment property prices, exploring historical trends and their impact on the market. We will also examine how interest rates affect the affordability of investment properties.

The Relationship Between Interest Rates and Investment Property Prices

Interest rates and investment property prices have an inverse relationship. When interest rates rise, the cost of borrowing money increases, making it more expensive to finance an investment property. This can lead to a decrease in demand for investment properties, as potential buyers find it less attractive to invest due to higher financing costs. Consequently, investment property prices may decline as sellers adjust their asking prices to reflect the reduced demand. Conversely, when interest rates fall, borrowing becomes cheaper, making investment properties more attractive. This can stimulate demand, leading to higher prices.

Historical Overview of Interest Rate Fluctuations and Their Impact on the Real Estate Market

Historically, interest rate fluctuations have significantly impacted the real estate market. For example, during the 1970s and 1980s, high interest rates caused a slowdown in the housing market. However, in the 1990s and early 2000s, low interest rates fueled a boom in real estate, with prices rising significantly. The 2008 financial crisis, triggered by a decline in housing prices and a subsequent rise in interest rates, led to a severe recession. In recent years, low interest rates have again stimulated the real estate market, but concerns remain about potential bubbles and a correction in prices.

Interest Rates and Affordability of Investment Properties

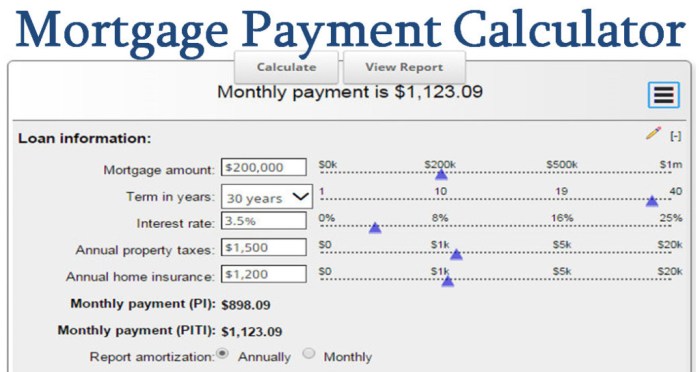

Interest rates directly influence the affordability of investment properties. When interest rates rise, the monthly mortgage payments increase, making it more expensive to own a property. This can discourage potential investors, particularly those with limited financial resources. On the other hand, when interest rates fall, mortgage payments become more manageable, increasing affordability and encouraging investment.

The affordability of investment properties is influenced by a combination of factors, including interest rates, property prices, and income levels.

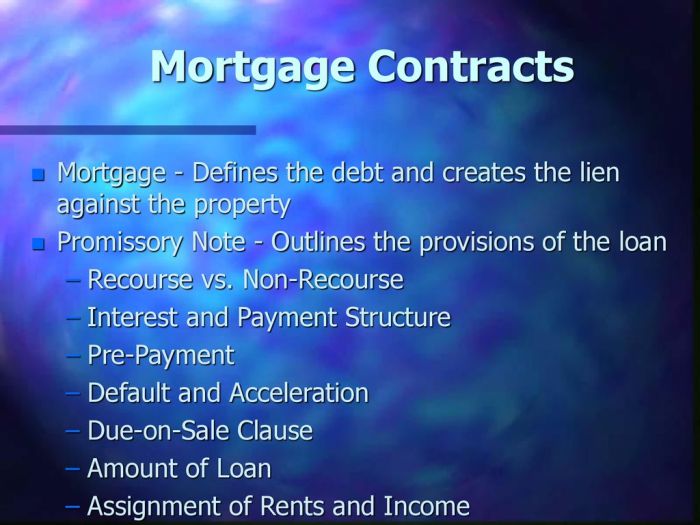

Types of Interest Rates for Investment Property

Understanding the different types of interest rates available for investment property loans is crucial for making informed financial decisions. These rates can significantly impact your monthly payments, overall borrowing costs, and the profitability of your investment.

Fixed Interest Rates

A fixed interest rate remains constant throughout the loan term, regardless of fluctuations in market interest rates. This provides predictable monthly payments and protects you from rising interest rates.

- Pros: Predictable monthly payments, protection from rising interest rates, budget stability.

- Cons: May not benefit from falling interest rates, potentially higher initial interest rate compared to variable rates.

Variable Interest Rates

Variable interest rates fluctuate based on changes in market interest rates. This means your monthly payments can go up or down depending on the prevailing economic conditions.

- Pros: Potential for lower initial interest rates compared to fixed rates, opportunity to benefit from falling interest rates.

- Cons: Unpredictable monthly payments, risk of higher payments if interest rates rise, potential for budget instability.

Adjustable Rate Mortgages (ARMs)

ARMs have an initial fixed interest rate for a set period (e.g., 5 or 7 years), after which the rate becomes variable and adjusts periodically based on a specific index.

- Pros: Lower initial interest rates compared to fixed-rate mortgages, potential for lower long-term costs if interest rates remain low.

- Cons: Unpredictable payments after the fixed period, risk of higher payments if interest rates rise, potential for budget instability.

Factors Determining Interest Rates

Several factors influence the interest rate offered on an investment property loan.

- Credit Score: A higher credit score generally leads to lower interest rates as lenders perceive you as a lower risk borrower.

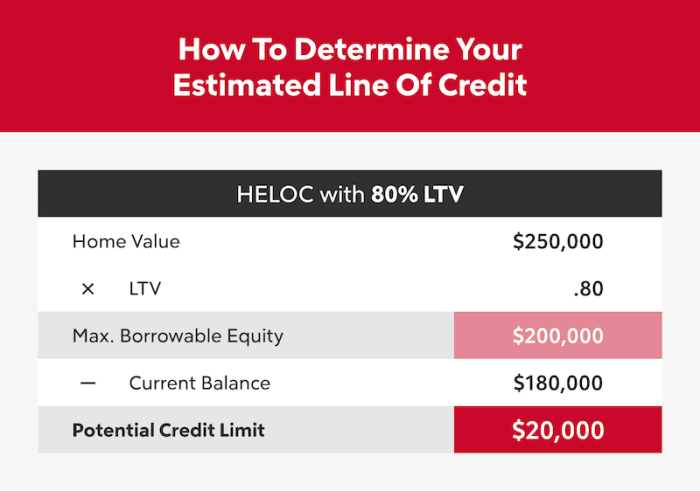

- Loan-to-Value (LTV) Ratio: A lower LTV ratio (the amount borrowed compared to the property value) often results in lower interest rates.

- Property Type: The type of property (e.g., residential, commercial) and its location can influence interest rates.

- Market Conditions: Interest rates are influenced by prevailing economic conditions, including inflation, unemployment, and the Federal Reserve’s monetary policy.

- Lender’s Policies: Each lender has its own lending criteria and pricing strategies, which can impact interest rates.

Factors Influencing Interest Rates

Interest rates for investment properties are not static; they fluctuate based on various economic and market factors. Understanding these influences is crucial for investors to make informed decisions and potentially capitalize on favorable market conditions.

Economic Indicators

Economic indicators provide valuable insights into the overall health of the economy and can significantly influence interest rates.

- Inflation: Inflation is a key driver of interest rates. When inflation rises, central banks typically raise interest rates to curb excessive spending and control price increases. Conversely, when inflation is low or declining, interest rates tend to decrease. For instance, during periods of high inflation, lenders demand higher interest rates to compensate for the diminishing value of their money over time.

- Economic Growth: A strong economy generally leads to higher interest rates. When economic growth is robust, businesses and consumers are more likely to borrow money, increasing demand for credit and pushing interest rates upward. Conversely, during economic downturns, interest rates may fall as lenders become more cautious about lending and demand for credit decreases.

- Monetary Policy: Central banks, such as the Federal Reserve in the United States, play a crucial role in setting interest rates through monetary policy. When central banks want to stimulate economic growth, they may lower interest rates to encourage borrowing and spending. Conversely, when they want to curb inflation, they may raise interest rates to make borrowing more expensive.

Government Policies and Regulations

Government policies and regulations can significantly impact interest rates for investment properties.

- Tax Policies: Tax incentives or deductions for investment property ownership can influence demand and, consequently, interest rates. For example, if tax benefits for real estate investments are reduced, demand may decrease, leading to lower interest rates. Conversely, if tax incentives are increased, demand may rise, potentially pushing interest rates upward.

- Housing Regulations: Regulations related to housing construction, zoning, and property taxes can influence the supply and demand for investment properties. For example, stricter regulations on housing development can lead to a decrease in supply, potentially driving up prices and interest rates. Conversely, relaxed regulations can increase supply, potentially lowering prices and interest rates.

- Mortgage Regulations: Government regulations governing mortgage lending, such as loan-to-value ratios and credit requirements, can influence the availability and cost of financing for investment properties. For example, stricter mortgage regulations may limit the availability of loans or increase borrowing costs, leading to higher interest rates. Conversely, relaxed regulations can make it easier and cheaper to obtain financing, potentially lowering interest rates.

Market Competition

Competition among lenders plays a significant role in shaping interest rates for investment properties.

- Number of Lenders: A larger number of lenders competing for borrowers can drive down interest rates as lenders try to attract customers with more favorable terms. Conversely, a smaller number of lenders can lead to higher interest rates due to less competition.

- Loan Products: The variety and competitiveness of loan products offered by lenders can also influence interest rates. For example, lenders offering innovative or flexible loan options may be able to attract borrowers with lower interest rates.

- Market Conditions: The overall economic and market conditions can influence the level of competition among lenders. For example, during periods of strong economic growth and high demand for credit, lenders may be more willing to offer lower interest rates to attract borrowers. Conversely, during economic downturns or periods of low demand for credit, competition may be less intense, potentially leading to higher interest rates.

Strategies for Managing Interest Rate Risk

Interest rate fluctuations can significantly impact the profitability of investment properties. As a property investor, it’s crucial to develop strategies to mitigate the risk of rising interest rates. This section will explore effective techniques for managing interest rate risk, allowing you to navigate market volatility and protect your investment returns.

Strategies for Mitigating Interest Rate Risk

Managing interest rate risk is essential for maintaining a stable and profitable investment portfolio. Here are some strategies you can implement to mitigate the impact of rising interest rates:

- Fixed-Rate Mortgages: Locking in a fixed interest rate for the duration of your mortgage provides certainty and protection against future rate increases. While fixed-rate mortgages might have a slightly higher initial interest rate compared to variable-rate mortgages, they offer stability and predictability in your monthly payments.

- Interest Rate Caps: An interest rate cap is a financial instrument that limits the maximum interest rate you’ll pay on your mortgage. It provides a safety net against sudden and drastic interest rate hikes, allowing you to control your borrowing costs.

- Short-Term Mortgages: Opting for a shorter-term mortgage allows you to pay off your loan faster, reducing your overall interest payments and minimizing exposure to future rate increases. However, this strategy might require higher monthly payments.

- Debt-to-Equity Ratio Management: A lower debt-to-equity ratio reduces your financial leverage and vulnerability to interest rate changes. By increasing your equity contribution, you minimize the impact of rising interest rates on your overall borrowing costs.

- Diversification: Diversifying your investment portfolio across different asset classes, such as stocks, bonds, and real estate, can help mitigate the impact of interest rate fluctuations. This approach allows you to spread your risk and reduce your exposure to any single asset class.

- Property Selection: Carefully selecting investment properties in areas with strong rental demand and limited supply can help mitigate the impact of interest rate changes. Properties in high-demand areas tend to maintain their value and rental income even in fluctuating markets.

Interest Rate Hedging Techniques

Interest rate hedging techniques involve using financial instruments to protect your investment against adverse interest rate movements.

| Technique | Description | Effectiveness |

|---|---|---|

| Interest Rate Swaps | An agreement to exchange interest rate payments with another party. | High |

| Interest Rate Futures | Contracts that allow you to lock in a future interest rate. | Moderate |

| Interest Rate Options | Give you the right, but not the obligation, to buy or sell an asset at a predetermined price. | Moderate to High |

Evaluating Interest Rate Changes on Cash Flow and Profitability

To understand the potential impact of interest rate changes on your investment property, it’s crucial to evaluate the following factors:

- Loan Payment Increases: Calculate the potential increase in your monthly mortgage payments if interest rates rise. Consider various interest rate scenarios and their impact on your cash flow.

- Rental Income Stability: Assess the stability of your rental income and its potential to offset higher mortgage payments. Analyze historical rental trends in your area and consider factors that could influence future rental demand.

- Property Value Fluctuations: Evaluate the potential impact of interest rate changes on the value of your investment property. Higher interest rates can lead to a decrease in property values, potentially affecting your equity and overall return on investment.

- Refinancing Options: Explore the possibility of refinancing your mortgage if interest rates fall. Refinancing can help you lower your monthly payments and improve your cash flow.

“By understanding the potential impact of interest rate changes on your investment property and implementing effective strategies to mitigate risk, you can navigate market volatility and protect your investment returns.”

Interest Rates and Investment Property Performance

Understanding the relationship between interest rates and investment property performance is crucial for investors. Interest rates play a significant role in shaping the overall attractiveness and profitability of real estate investments.

Historical Relationship, Interest rates for investment property

Historically, there has been an inverse relationship between interest rates and investment property returns. When interest rates rise, the cost of borrowing increases, making it more expensive to finance investment properties. This can lead to a decrease in demand for investment properties, resulting in lower rental yields and appreciation rates. Conversely, when interest rates fall, borrowing costs decrease, making investment properties more affordable. This can lead to increased demand, driving up rental yields and appreciation rates.

Correlation Between Interest Rate Fluctuations and Investment Property Performance

The following table illustrates the general correlation between interest rate fluctuations and key investment property performance indicators:

| Interest Rate Change | Rental Yield Impact | Appreciation Rate Impact | Overall Investment Performance Impact |

|—|—|—|—|

| Increase | ↓ (Lower) | ↓ (Lower) | ↓ (Lower) |

| Decrease | ↑ (Higher) | ↑ (Higher) | ↑ (Higher) |

Note: This table is a general representation and actual outcomes may vary depending on specific market conditions and property types.

Impact of Interest Rate Changes on Investment Property Demand

Interest rate changes can have a significant impact on the demand for investment properties in different market segments. For example, rising interest rates can make it more challenging for investors to finance luxury properties, leading to a decrease in demand in this segment. However, in the affordable housing market, the impact of rising interest rates may be less pronounced, as investors may still find it attractive to invest in properties that offer steady rental income.

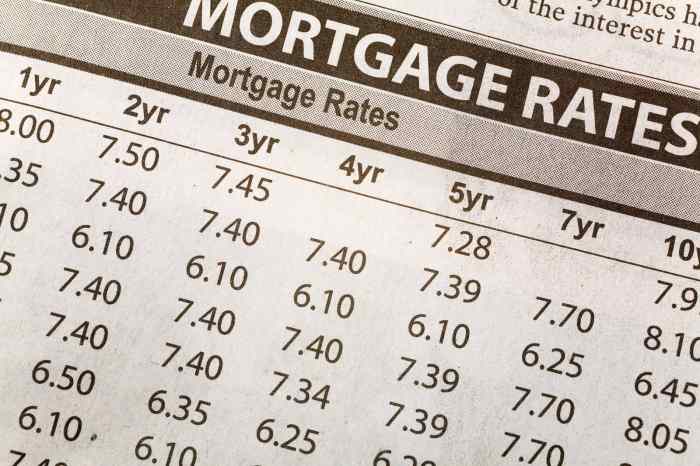

Current Interest Rate Trends and Outlook

Interest rates are a crucial factor influencing investment property performance. Understanding current trends and their potential trajectory is essential for investors to make informed decisions.

Current Interest Rate Trends

Interest rates have been on an upward trajectory in recent years, primarily driven by inflation and central bank policies. The Federal Reserve has raised interest rates several times in 2023 to combat inflation, and further increases are anticipated. This has led to higher borrowing costs for investors seeking to finance investment properties.

Factors Influencing Interest Rates

Several factors contribute to the direction of interest rates, including:

- Inflation: High inflation erodes the purchasing power of money, prompting central banks to raise interest rates to curb spending and cool the economy.

- Economic Growth: Strong economic growth can lead to higher inflation, potentially driving up interest rates. Conversely, weak economic growth may lead to lower interest rates.

- Central Bank Policies: Central banks play a significant role in setting interest rates through monetary policy tools. These tools include adjusting the federal funds rate, buying or selling government bonds, and setting reserve requirements for banks.

- Government Debt: High levels of government debt can put upward pressure on interest rates as the government competes with private borrowers for capital.

- Global Economic Conditions: Interest rates are influenced by global economic factors, such as global inflation, economic growth, and geopolitical events.

Implications for Investment Property Investors

Rising interest rates have a direct impact on investment property investors:

- Higher Borrowing Costs: As interest rates increase, the cost of financing an investment property rises, potentially reducing profitability.

- Reduced Affordability: Higher interest rates can make it more challenging for potential buyers to qualify for mortgages, leading to a decrease in demand for investment properties.

- Increased Competition: As interest rates rise, some investors may choose to sell their properties, increasing competition in the market.

- Potential for Capital Appreciation: While rising interest rates can negatively impact affordability, they can also lead to slower economic growth, potentially limiting inflation and reducing the need for further rate hikes. This could create a more stable environment for investment property appreciation.

Interest Rate Projections

Predicting future interest rate movements is complex and subject to various factors. However, several forecasts suggest that interest rates are likely to remain elevated in the near term. The Federal Reserve has indicated that it will continue to raise rates until inflation is under control.

“The Federal Reserve will continue to raise interest rates until inflation is under control.”

The future trajectory of interest rates will depend on the evolving economic landscape, including inflation, economic growth, and global economic conditions.

By understanding the intricacies of interest rates and their impact on investment properties, investors can make informed decisions, mitigate potential risks, and maximize their returns. From analyzing historical trends to navigating current market conditions, this guide equips investors with the knowledge and tools necessary to succeed in the dynamic world of real estate investment.

Question Bank: Interest Rates For Investment Property

What are the current interest rate trends for investment property loans?

Current interest rates for investment property loans are influenced by a number of factors, including inflation, economic growth, and monetary policy. It’s important to consult with a financial advisor or mortgage lender to get the most up-to-date information on current rates.

How do I determine the best interest rate for my investment property loan?

The best interest rate for your investment property loan depends on your individual circumstances, including your credit score, loan amount, and loan term. It’s advisable to compare offers from multiple lenders and negotiate for the best possible rate.

What are the potential risks associated with rising interest rates?

Rising interest rates can lead to higher monthly mortgage payments, potentially reducing cash flow and profitability. They can also impact the demand for investment properties, leading to slower appreciation or even depreciation in value.

What strategies can I use to mitigate interest rate risk?

Strategies for mitigating interest rate risk include obtaining a fixed-rate mortgage, exploring interest rate hedging techniques, and diversifying your investment portfolio. Consulting with a financial advisor can help you develop a tailored strategy for managing interest rate risk.

Interest rates for investment properties can fluctuate, impacting the overall profitability of your venture. To find the best deals on investment properties, consider exploring the current market in New Jersey, where you can discover a range of options like investment properties for sale in New Jersey. By carefully analyzing interest rates and exploring available properties, you can make informed decisions that align with your investment goals.

Interest rates for investment property can fluctuate, making it crucial to stay informed about current trends. If you’re considering investing in Austin, you’ll want to check out property investment austin to see what opportunities are available. Understanding interest rates and the local market can help you make informed decisions when it comes to securing financing for your investment property.

Interest rates for investment properties can fluctuate, making it crucial to stay informed about current trends. If you’re considering investing in real estate, New Jersey offers a range of opportunities. Check out this guide on investment properties in NJ to learn more about the market and potential investment options. Understanding the current interest rate environment is key to making informed decisions about your investment strategy.