Interest Rates Key to Investment Property Success

Interest rates for investment properties are a critical factor influencing both the profitability and risk associated with these ventures. Understanding how interest rates impact property values, rental income, and appreciation is essential for investors seeking to make informed decisions.

This guide explores the intricacies of interest rates in the context of investment properties, providing insights into various mortgage types, key economic indicators, and strategies for managing interest rate risk. We’ll delve into the relationship between interest rates and investment property returns, empowering you to navigate the dynamic real estate market with confidence.

Understanding Interest Rates for Investment Properties

Interest rates are a crucial factor influencing investment property values, rental income, and overall returns. Understanding how interest rates impact these factors is essential for investors to make informed decisions.

The Relationship Between Interest Rates and Investment Property Values

Interest rates play a significant role in determining the affordability and desirability of investment properties. When interest rates rise, borrowing costs increase, making it more expensive to finance a property. This can lead to a decrease in demand for investment properties, as potential buyers may be priced out of the market. Conversely, when interest rates fall, borrowing costs decrease, making it more affordable to purchase an investment property. This can lead to increased demand and potentially higher property values.

Impact of Rising Interest Rates on Rental Income and Property Appreciation

Rising interest rates can have a mixed impact on rental income and property appreciation. While higher interest rates may discourage new investors from entering the market, leading to lower demand and potentially slower appreciation, it can also incentivize existing landlords to increase rental rates to offset their higher borrowing costs. This can benefit landlords in the short term but may also lead to a decrease in tenant demand, ultimately impacting rental income. Furthermore, rising interest rates can impact the overall economy, leading to slower economic growth and potentially lower property values.

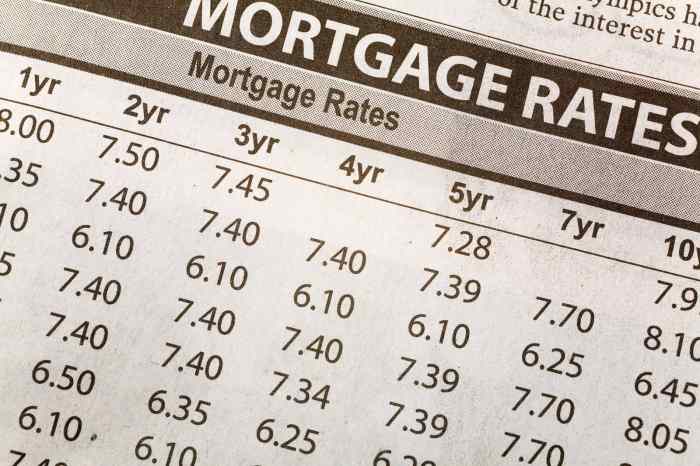

Comparing the Current Interest Rate Environment to Historical Trends

Current interest rates are significantly higher than they were in recent years. The Federal Reserve has been aggressively raising interest rates to combat inflation. While this has led to increased borrowing costs for investors, it is important to consider historical trends. Interest rates have fluctuated significantly over time, and the current environment is not unprecedented. Historically, periods of high interest rates have been followed by periods of lower rates, and vice versa. It is crucial to consider long-term trends and the overall economic outlook when making investment decisions.

Types of Interest Rates for Investment Properties

Understanding the different types of interest rates available for investment properties is crucial for making informed financial decisions. Choosing the right interest rate can significantly impact your monthly payments, overall costs, and long-term profitability. Let’s explore the most common types of interest rates and their characteristics.

Fixed-Rate Mortgages

Fixed-rate mortgages offer predictable and stable monthly payments for the duration of the loan term. This means your interest rate remains the same, regardless of market fluctuations.

- Predictable Payments: Fixed-rate mortgages provide certainty in your monthly expenses, making budgeting and financial planning easier.

- Protection Against Rising Rates: You’re shielded from rising interest rates, ensuring your payments stay consistent throughout the loan term.

- Long-Term Stability: Fixed-rate mortgages are ideal for long-term investments, as they offer financial security and predictable cash flow.

Adjustable-Rate Mortgages (ARMs)

ARMs offer initial lower interest rates that can adjust periodically based on market conditions. This can lead to lower initial payments but potentially higher payments later in the loan term.

- Lower Initial Payments: ARMs often have introductory rates that are significantly lower than fixed-rate mortgages, making them attractive for those seeking immediate affordability.

- Potential for Savings: If interest rates decline, your payments may decrease, leading to potential cost savings.

- Risk of Rate Increases: The primary risk with ARMs is that interest rates can rise, resulting in higher monthly payments. This uncertainty can impact your cash flow and financial planning.

- Interest Rate Caps: Most ARMs have interest rate caps that limit how much the interest rate can increase in a given period or over the life of the loan. This provides some protection against excessive rate hikes.

Interest-Only Mortgages

Interest-only mortgages allow you to pay only the interest on your loan each month, deferring principal repayment until the end of the loan term. This can lead to lower monthly payments but may result in a significant balloon payment at the end.

- Lower Monthly Payments: Interest-only mortgages provide a lower monthly payment, freeing up cash flow for other investments or expenses.

- Potential for Higher Returns: By minimizing principal payments, you can allocate more funds towards property appreciation or other investments, potentially leading to higher returns.

- Significant Balloon Payment: At the end of the loan term, you’ll need to pay off the entire remaining principal balance, which can be a substantial sum. This requires careful financial planning and preparation.

- Risk of Default: If you’re unable to make the balloon payment at the end of the loan term, you may face foreclosure or other financial consequences.

Factors Influencing Interest Rates for Investment Properties

Interest rates on investment properties are not fixed; they fluctuate based on various economic factors. Understanding these factors is crucial for investors to make informed decisions about their real estate investments.

Economic Indicators

Economic indicators play a significant role in influencing interest rates. These indicators provide insights into the overall health of the economy, which directly impacts lending decisions.

- Inflation: Inflation is a key factor influencing interest rates. When inflation rises, lenders demand higher interest rates to compensate for the decreased purchasing power of their money. The Federal Reserve, the central bank of the United States, monitors inflation closely and adjusts interest rates accordingly. For example, if inflation is at 3%, lenders might demand a higher interest rate on investment properties to offset the erosion of their returns.

- Unemployment Rate: A high unemployment rate indicates a weak economy, which can lead to lower interest rates. Lenders may lower rates to stimulate borrowing and economic growth. Conversely, a low unemployment rate signals a strong economy, which can lead to higher interest rates as lenders become more confident in borrowers’ ability to repay their loans.

- Gross Domestic Product (GDP): GDP growth reflects the overall health of the economy. A strong GDP growth rate can lead to higher interest rates as lenders become more confident in borrowers’ ability to repay their loans. Conversely, a weak GDP growth rate can lead to lower interest rates as lenders become more cautious about lending.

Federal Reserve’s Monetary Policy

The Federal Reserve plays a crucial role in setting interest rates through its monetary policy. The Fed uses various tools to manage the money supply and influence interest rates.

- Federal Funds Rate: The federal funds rate is the target interest rate that banks charge each other for overnight loans. The Fed sets this rate as a benchmark for other interest rates in the economy. When the Fed raises the federal funds rate, it becomes more expensive for banks to borrow money, which can lead to higher interest rates for borrowers, including those seeking loans for investment properties.

- Quantitative Easing (QE): QE is a monetary policy tool used by the Fed to inject liquidity into the financial system by purchasing assets, such as government bonds. This can lead to lower interest rates by increasing the supply of money available for lending.

Supply and Demand Dynamics in the Real Estate Market, Interest rates for investment properties

The supply and demand dynamics in the real estate market also play a significant role in influencing interest rates.

- High Demand and Low Supply: When demand for investment properties is high and supply is low, competition among borrowers increases, leading to higher interest rates. Lenders can afford to charge higher rates because borrowers are willing to pay more to secure a loan.

- Low Demand and High Supply: Conversely, when demand for investment properties is low and supply is high, competition among lenders increases, leading to lower interest rates. Lenders may lower rates to attract borrowers in a less competitive market.

Strategies for Managing Interest Rate Risk: Interest Rates For Investment Properties

Interest rate fluctuations are an inherent aspect of real estate investing, and understanding how to manage the risk associated with these changes is crucial for long-term success. This section will explore effective strategies for mitigating the potential impact of rising interest rates on your investment properties.

Hedging Against Interest Rate Increases

Hedging against interest rate increases involves implementing strategies to minimize the negative impact of higher borrowing costs. Here are some key approaches:

- Fixed-Rate Mortgages: Securing a fixed-rate mortgage locks in your interest rate for the duration of the loan, providing predictability and shielding you from future rate increases. While fixed-rate mortgages may have higher initial interest rates compared to adjustable-rate mortgages, they offer stability and peace of mind in the long run.

- Interest Rate Caps: With adjustable-rate mortgages (ARMs), you can negotiate interest rate caps that limit how much your rate can increase over a specific period. This helps you control your monthly payments and avoid sudden spikes in interest costs.

- Interest Rate Swaps: Interest rate swaps are financial instruments that allow you to exchange interest rate payments with another party. This can be a complex strategy, but it can potentially lock in a lower interest rate or mitigate the risk of future rate increases.

- Short-Term Mortgages: Choosing a shorter mortgage term, such as a 15-year mortgage instead of a 30-year mortgage, can reduce the overall interest paid and potentially expose you to less risk from rising rates. However, this will require larger monthly payments.

Refinancing Options and Implications

Refinancing your investment property mortgage can be a viable strategy to lower your interest rate and monthly payments, but it’s important to weigh the costs and benefits carefully. Here are key considerations:

- Lower Interest Rates: If interest rates have declined since you took out your initial mortgage, refinancing can potentially save you money on your monthly payments and reduce your overall interest costs.

- Refinancing Costs: Refinancing involves closing costs, such as appraisal fees, origination fees, and title insurance, which can offset any potential savings.

- Loan Term: Refinancing can allow you to extend or shorten your loan term, impacting your monthly payments and overall interest paid.

- Break-Even Point: It’s essential to calculate the break-even point, which is the amount of time it takes for the savings from refinancing to cover the costs.

Securing Favorable Interest Rates

Obtaining competitive interest rates on investment property loans requires a strategic approach:

- Improve Your Credit Score: A higher credit score typically translates to lower interest rates. Focus on paying your bills on time, managing your debt levels, and avoiding unnecessary credit inquiries.

- Shop Around: Compare rates and terms from multiple lenders to find the most favorable offer.

- Negotiate: Don’t be afraid to negotiate with lenders to secure the best possible interest rate. Highlight your strong financial profile and commitment to repayment.

- Consider Lender Fees: While lower interest rates are attractive, it’s important to consider the lender’s fees, such as origination fees, closing costs, and prepayment penalties.

The Impact of Interest Rates on Investment Property Returns

Interest rates play a pivotal role in shaping the profitability of investment properties. Understanding how interest rate changes affect cash flow and profitability is crucial for investors to make informed decisions. This section explores the multifaceted impact of interest rates on investment property returns, examining their influence on cash flow, profitability, and property appreciation potential.

Impact on Cash Flow and Profitability

Interest rate fluctuations directly impact an investment property’s cash flow and profitability. When interest rates rise, borrowing costs increase, leading to higher mortgage payments. This reduces the amount of cash flow available to the investor. Conversely, falling interest rates result in lower mortgage payments, boosting cash flow.

Here’s how interest rates affect cash flow and profitability:

* Higher Interest Rates: Increased mortgage payments reduce the cash flow available to the investor. This can negatively impact profitability, especially if the property’s rental income remains stagnant.

* Lower Interest Rates: Reduced mortgage payments increase the cash flow available to the investor. This can enhance profitability, potentially allowing for greater returns on investment.

For instance, consider an investor who purchased a property for $500,000 with a 20% down payment. If the interest rate rises from 4% to 6%, their monthly mortgage payment would increase significantly, reducing their cash flow.

Comparing Investment Property Performance in Different Interest Rate Environments

The performance of investment properties can vary significantly depending on the prevailing interest rate environment.

* Rising Interest Rate Environment: In a rising interest rate environment, investors may find it more challenging to secure financing, and the cost of borrowing increases. This can lead to reduced demand for investment properties, potentially impacting property values and rental income.

* Falling Interest Rate Environment: A falling interest rate environment often encourages investment in real estate. Lower borrowing costs make it more affordable to purchase properties, potentially leading to increased demand and higher property values.

During the 2008 financial crisis, for example, interest rates fell significantly, leading to a surge in investment property purchases. However, the subsequent rise in interest rates resulted in a slowdown in the market.

Relationship Between Interest Rates and Property Appreciation Potential

Interest rates can also influence property appreciation potential.

* Higher Interest Rates: Higher interest rates can dampen property appreciation potential. This is because increased borrowing costs may deter potential buyers, reducing demand and putting downward pressure on property values.

* Lower Interest Rates: Lower interest rates can stimulate property appreciation. Increased affordability and demand can lead to higher property values, potentially resulting in greater returns for investors.

It’s important to note that other factors, such as economic growth, supply and demand, and local market conditions, also play a role in property appreciation.

By understanding the interplay of interest rates, economic factors, and investment property dynamics, investors can make strategic decisions to optimize their returns and navigate the complexities of the real estate market. Whether you’re a seasoned investor or just starting your journey, a comprehensive understanding of interest rates is crucial for success in the world of investment properties.

Clarifying Questions

What are the current interest rates for investment properties?

Current interest rates for investment properties fluctuate based on various factors, including economic conditions and market demand. To obtain the most up-to-date information, it’s best to consult with a mortgage lender or financial advisor.

How do interest rates affect my monthly mortgage payments?

Higher interest rates generally lead to higher monthly mortgage payments. Conversely, lower interest rates result in lower monthly payments. This is because the interest rate determines the cost of borrowing money.

Should I consider an adjustable-rate mortgage (ARM) for an investment property?

ARMs can offer lower initial interest rates, but they come with the risk of fluctuating rates over time. Carefully consider your financial situation, risk tolerance, and long-term investment goals before deciding on an ARM.

What are some strategies for securing a favorable interest rate?

Improving your credit score, making a larger down payment, and shopping around for different lenders can help you secure a favorable interest rate on your investment property loan.

Interest rates play a crucial role in making investment property decisions. If you’re looking for a lucrative opportunity, consider investment properties in the Dominican Republic. With a thriving tourism industry and a growing economy, the Dominican Republic offers strong potential for rental income and appreciation. However, it’s essential to research current interest rates and financing options to ensure a profitable investment.

Interest rates for investment properties can fluctuate, impacting your potential return on investment. If you’re considering a Houston, TX property, investment property houston tx could be a good option, but remember to factor in current interest rates when evaluating your financing options.

Interest rates for investment properties can fluctuate significantly, influencing the overall return on investment. When considering potential markets, Atlanta, GA, stands out as a promising location. Investment properties in Atlanta, GA , benefit from a strong rental market and consistent appreciation, making it a compelling option for investors seeking to capitalize on favorable interest rates.