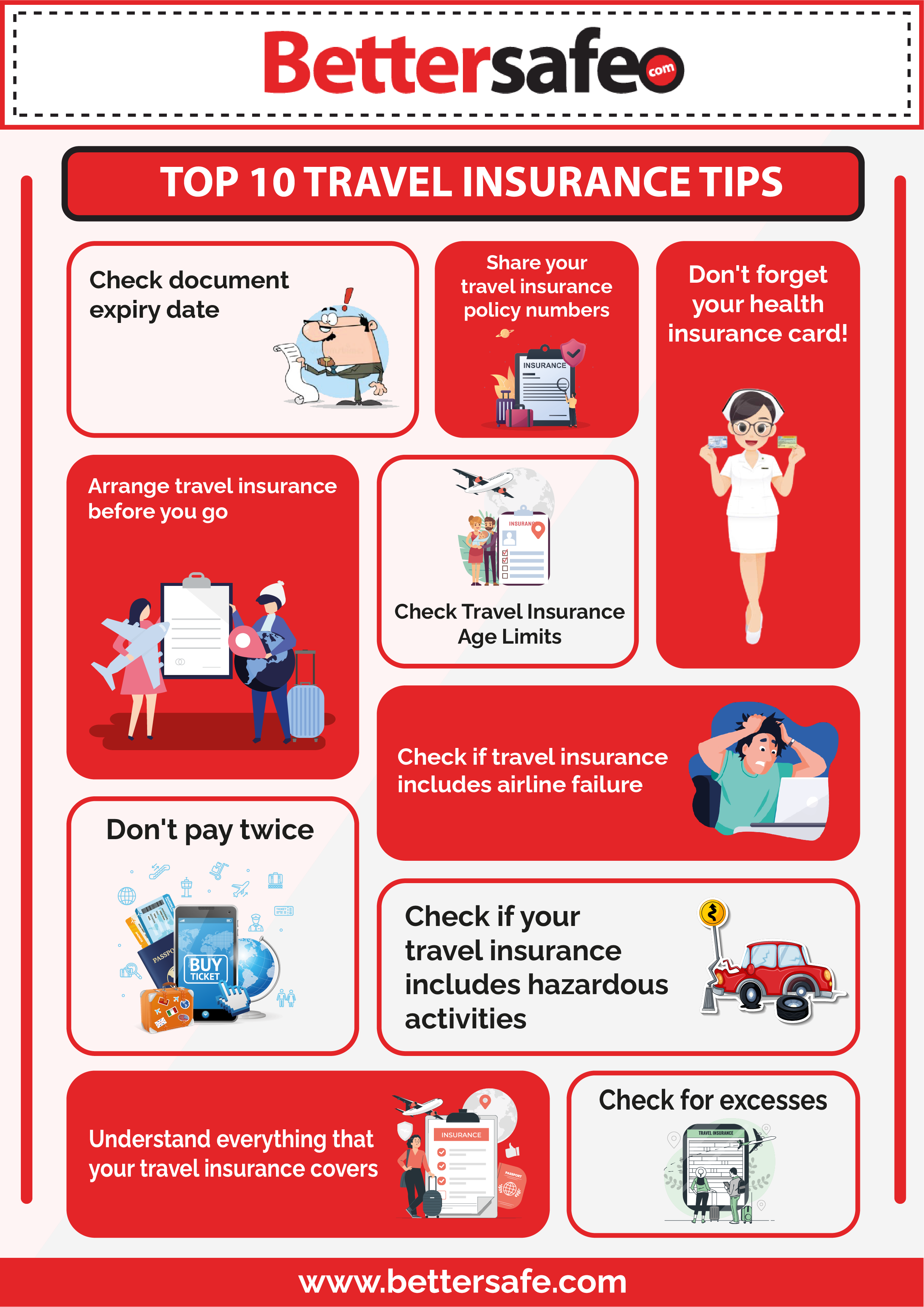

Insurance Tips

Insurance Tips: Navigating the World of Coverage with Confidence

In a world where the unexpected can happen at any moment, having insurance is a safety net that provides much-needed peace of mind. Whether it’s protecting your home, car, health, or even your future, insurance stands as a barrier between you and potential financial ruin. However, the world of insurance can often seem like an intricate maze, with a plethora of options, terminology, and fine print that can easily overwhelm even the most savvy individuals. This is where a comprehensive understanding of insurance tips becomes invaluable.

As you step into the realm of insurance, you’re likely bombarded with questions: Do I have enough coverage? Am I overpaying for my policy? What are the exclusions I should be wary of? These are just a few of the inquiries that might come to mind as you navigate different insurance plans. The good news is, you’re not alone. Many find themselves in similar dilemmas, and that’s why this blog post exists—to demystify the complexities and equip you with practical insights to make informed decisions.

Insurance serves multiple purposes: it acts as a protective shield, a financial safeguard, and sometimes even as a sound investment. Yet, choosing the right plan or understanding how to leverage your policy effectively can be daunting tasks. There’s a myriad of considerations, from deductibles and premiums to riders and endorsements, each playing a crucial role in how your insurance functions. Furthermore, the landscape of insurance is always evolving, with new products and reforms reshaping the market constantly.

In this blog post, we will embark on a journey through the essential tips you need to navigate this complex field. We’ll begin by exploring the fundamentals of insurance, including types of coverage you can’t afford to overlook. From there, we’ll delve into strategic advice for optimizing your policies. Whether it’s bundling insurance to score discounts or understanding the fine print to avoid common pitfalls, these insights are designed to empower you in your insurance dealings.

Your financial wellbeing is paramount, and safeguarding it requires knowledge and action. Learning how to choose the right coverage based on your personal lifestyle, the significance of regular policy reviews, and the smartest ways to file claims are all tools that will be discussed. We aim to provide you with not just information, but actionable advice that you can implement right away.

Moreover, we understand that everyone’s insurance needs are different, which is why we’ll also touch upon personalized strategies. For instance, navigating healthcare insurance in the United States varies significantly from planning for property insurance when living in hurricane-prone regions. This post is designed to cater to diverse needs, ensuring that you can tailor the information to your unique requirements.

To enrich this discussion, we’ll highlight the importance of understanding emerging trends such as telematics in auto insurance and the role of artificial intelligence in policy underwriting. These advancements are changing the landscape of insurance, offering both challenges and opportunities for consumers.

Prepare to engage with insights that not only educate but also inspire. After all, knowledge is power—and when it comes to insurance, having the right knowledge could safeguard your future in more ways than one. Stay tuned as we break down these insurance tips and transform how you perceive and utilize insurance in your life.

By the end of this blog post, you’ll walk away with a richer understanding of how to effectively manage your insurance portfolio, confidently choose policies, and adapt to the ever-evolving world of coverage. Your journey to mastering insurance starts here.

Understand Your Insurance Needs

Before diving into policy hunting, it’s crucial to assess your insurance needs comprehensively. Everyone’s financial situation, assets, and risk exposure differ significantly, thus requiring tailored coverage solutions.

Evaluate Your Assets

Begin with a thorough evaluation of your assets. This includes tangible assets like your home, car, and valuable possessions, as well as intangible assets such as bonds, stocks, and retirement savings. Understanding the value and potential risk exposure of these assets will help in determining how much and what kind of coverage you need.

Consider Your Family Needs

Think about your dependents and their specific needs. If you have children, liabilities like education, healthcare, and future financial opportunities should factor into your decision. This perspective is crucial, especially for life insurance and health insurance considerations.

Research Different Types of Insurance

The insurance landscape is diverse, with numerous types of coverages available. Knowing what options are out there can significantly aid in finding optimal solutions.

Common Types of Coverage

- Home Insurance: Offers protection against damage or loss caused by perils like fire, theft, or natural disasters.

- Auto Insurance: Covers liabilities and damages from vehicle-related incidents.

- Health Insurance: Assists in managing medical expenses. It’s crucial to understand different plans, coverage limits, and out-of-pocket costs.

- Life Insurance: Provides financial security for your beneficiaries after your death. Term and whole life insurance are the main categories here.

Comparing Insurance Providers

Once you’ve identified the types of insurance you need, the next step is choosing a provider. This step is more than just finding the cheapest option; it’s about finding a reliable partner you can depend on in times of need.

Check Financial Strength and Reputation

Assess an insurer’s financial stability and reputation. Financial strength ratings from agencies like A.M. Best or Moody’s can give insight into their reliability. Also, customer reviews and Better Business Bureau ratings can illuminate their customer service approach.

Compare Quotes

Never settle for the first quote you receive. Use online tools or hire an insurance broker to compare policies and premiums across different insurers. Remember, the cheapest policy isn’t always the best; consider the coverage limits, exclusions, and customer service reviews.

Optimize Coverage to Maximize Savings

Many people pay more than necessary for their insurance policies. Optimizing your coverage means tailoring it to fit your specific needs while keeping costs manageable.

Bundle Policies

Many insurers offer discounts if you purchase more than one type of insurance from them. For instance, combining home and auto insurance can often lead to significant savings.

Increase Deductibles

Choosing a higher deductible reduces your premium. This approach makes sense if you’re prepared to cover the deductible in case of a claim and can be a simple way to lower costs.

Review Your Coverage Regularly

Insurance needs can change over time due to new life events, financial changes, or legislative updates. Conduct an annual review of your policies to ensure your coverage is still optimal. This review can reveal areas where you might downgrade coverage or need to increase your limits.

Take Advantage of Discounts

Ask about available discounts. Insurance companies frequently offer discounts for things like safe driving (auto), smoking cessation (life), or installing home security systems (home). Making the insurer aware of these qualifying features can lead to noticeable savings.

Central Strategies for Dealing with Claims

Knowing how to effectively handle insurance claims can save time, reduce frustration, and ensure you get the payout you deserve.

Document Everything

Maintaining thorough records can significantly influence claim settlements. Keep a file of all communications with your insurer, receipts, photographs, and any pertinent documents to support your claim.

Filing a Claim Promptly

File your claims as soon as possible. Promptness can speed up the processing time, and some policies have time limits on reporting claims.

Understand the Claims Process

Familiarize yourself with the claims process before you need it. Know what information will be required and how the timeline typically unfolds. This understanding can eliminate surprises and empower you during negotiations.

Leverage Professional Advice

For complex insurance needs or when you’re unsure, seeking professional advice can be invaluable. Insurance brokers and financial advisors have the expertise to guide you toward the most suitable options for your specific circumstances.

Working with an Insurance Broker

Brokers represent multiple insurance providers and can offer expert advice and multiple policy options tailored to your needs. They can also assist with claims, acting on your behalf to ensure the process runs smoothly if problems arise.

Consulting a Financial Advisor

Financial advisors can analyze your overall financial health and goals, helping to integrate your insurance needs into a broader financial strategy. They can assess whether your coverage is aligned with your short-term and long-term objectives and suggest adjustments when necessary.

Stay Informed and Adaptive

The insurance industry and relevant government regulations are continually evolving. Keeping informed about these changes ensures that your decisions remain well-grounded and beneficial.

Engage with Educational Resources

Take advantage of online resources, webinars, and seminars focusing on insurance trends and policies. These resources can help demystify complex insurance terminology and concepts, empowering you to make well-informed decisions.

Monitor Regulatory Changes

Legislative changes can affect coverage mandates, premium prices, or available insurance products. Periodically checking in with your insurance company or advisor can help you preemptively adjust your policies to comply with new laws or to harness new opportunities.

Navigating the Complex World of Insurance with Confidence

As we draw our discussion on Insurance Tips to a close, it’s essential to reflect on the critical insights that have been presented. This comprehensive look at the insurance landscape aimed not only to equip you with valuable knowledge but also to encourage an informed approach to your insurance needs.

At the outset, the purpose was clear: demystify the often opaque world of insurance to empower you, the consumer, to make better decisions. From understanding the fundamentals to evaluating policy details and leveraging available resources, we’ve traversed various critical aspects to enhance your journey through the insurance maze.

Key Takeaways

Let’s review the significant takeaways that can aid you in making sound insurance choices:

Understanding Your Needs: One of the first steps discussed was evaluating the specific protection you require. Whether it’s health, vehicle, life, or property insurance, understanding your unique situation and needs sets the foundation for selecting the right policy.

Comparative Shopping: Another highlight was the importance of shopping around. Comparing different providers, understanding the subtle differences in policy offerings, and reviewing customer feedback can result in substantial financial savings and enhanced coverage.

Deciphering Policy Language: We explored the often confusing language used in insurance documents. Learning to decipher policy terms and conditions is crucial. Policies vary significantly, and being aware of what is and isn’t covered can prevent unwelcome surprises.

Maximizing Discounts and Incentives: Throughout our journey, we touched on various ways to maximize savings on premiums. Whether it’s bundling insurance policies or taking advantage of incentives for safety measures, exploring all available discounts helps in cost management.

Regular Policy Review: Regularly reviewing your policies as your circumstances evolve ensures continued relevance and adequacy of coverage. This vigilance can lead to adjustments that better align with your current lifestyle.

Utilizing Digital Tools: Finally, leveraging technology through apps and online platforms can simplify your insurance management process, offering convenience and real-time updates at your fingertips.

The Path Forward

As you reflect on everything covered, the path forward should be less daunting and more of an opportunity for proactive engagement with your insurance requirements. Insurance is not a static entity; it evolves with emerging risks, technological advancements, and changes in your own life. Staying informed and adapting is key.

Remember that the value of insurance lies in its ability to provide peace of mind, financial protection, and risk management throughout life’s journey. By applying the tips and strategies discussed, you can ensure that your insurance policies are tailored to your needs, lifestyle, and budget.

Call to Action

We encourage you to take control of your insurance journey with confidence and curiosity. Start by reviewing your current insurance policies: ask questions, seek clarity, and don’t hesitate to make changes if needed. Engage with your insurance agent or provider to fully understand your protection and uncover potential improvements.

Commit to staying informed: The insurance world is complex and ever-changing. Sign up for newsletters, attend webinars, or join discussion forums centered around insurance topics you wish to delve deeper into.

Finally, we invite you to share your own experiences and tips. Leave a comment below with insights or questions that could help others in their insurance endeavors. Stay proactive and keep the dialogue going, as collective knowledge empowers us all.

By making insurance a priority and leveraging resources wisely, you’re not just preparing for the unforeseen; you’re embracing a more secure, financially savvy future. Remember, being an informed policyholder doesn’t end with your signature on the dotted line; it’s an ongoing journey of learning and adaptation.

Thank you for joining us. Keep exploring, and here’s to making informed insurance decisions that align with your unique journey. Together, let’s aim for a future where insurance isn’t just a necessity but a well-understood and strategically managed part of life.

Stay safe, stay insured, and stay informed!

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology