How To Choose Between Emergency Medical Coverage And Pip In The Us

How To Choose Between Emergency Medical Coverage And PIP In The US

Navigating the labyrinthine corridors of healthcare insurance in the United States can feel like learning a foreign language. There’s an acronym for everything, and understanding what each one means could potentially save—or cost—you thousands of dollars. Among these acronyms are two particularly critical to ensuring you’re adequately covered in the event of a car accident: Emergency Medical Coverage (EMC) and Personal Injury Protection (PIP). While they might seem similar at first glance, each offers a distinct type of coverage that could influence how you’re taken care of financially and medically in the wake of an unforeseen incident.

In a country where healthcare expenses can quickly escalate, knowing which option fits your needs is crucial. Both EMC and PIP aim to secure your peace of mind, yet they come with conditions, exceptions, and benefits tailored to various situations. How do you know which is right for you? The answer requires a thorough exploration of each type of coverage and a keen understanding of your personal circumstances, state laws, and specific needs.

Before we dive deeper, consider these scenarios: You’re in a minor fender bender on a commute home, and suddenly you’re facing unexpected medical bills. That’s where knowing the difference between EMC and PIP becomes vital. Emergency Medical Coverage generally steps in to cover your medical expenses irrespective of who is at fault in the accident. It’s typically an add-on to your existing auto insurance policy, focused primarily on immediate and acute medical care arising from an accident.

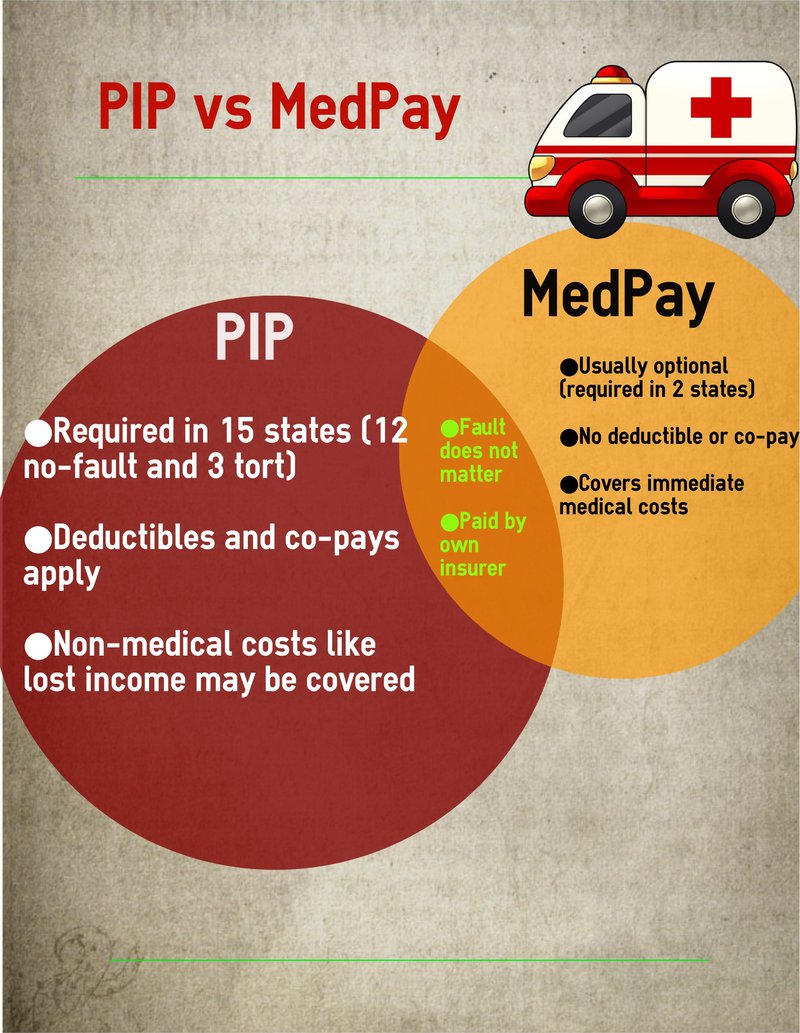

On the other hand, Personal Injury Protection, mandated in some states and optional in others, extends its coverage to broader circumstances. PIP not only covers medical expenses but also takes into account lost wages and even services that you might not be able to perform due to your injuries. The broader scope of PIP can be invaluable if your injuries affect your daily life and financial stability. Understanding these nuances is where many find themselves perplexed, including considering factors like the state requirements—Florida’s no-fault insurance laws, for example, make PIP mandatory.

Perhaps one of the most critical considerations when choosing between EMC and PIP is the analysis of cost versus benefit. EMC can often seem more affordable as an added feature on your auto insurance, but if you require extensive medical treatment, PIP might ultimately be the more financially sound investment. This decision can also affect the process of filing claims—an area we will explore further—and your ability to seek legal compensation in the event that someone else’s negligence caused the accident.

By choosing wisely, you could not only protect your physical and financial health but also streamline any potential claims process, making it less arduous and more straightforward. The key, then, is understanding your needs, the legal landscape of your state, and where each form of coverage fits within that matrix.

As we delve further into this topic, we will shed light on what each type of coverage really means, the pros and cons of both, and offer you valuable tips on how to align a choice with your specific situation. Our goal is to empower you with the knowledge needed to make a confident and informed decision, ultimately ensuring that, should the unexpected occur, you’re ready and resilient, armed with the right protection.

So, buckle up as we explore the intricacies and nuances that come into play when choosing between Emergency Medical Coverage and Personal Injury Protection. Whether you’re a seasoned insurance holder trying to reassess your needs or a new policy owner navigating these choices for the first time, this guide is crafted to illuminate your path forward.

Understanding Emergency Medical Coverage (EMC)

Emergency Medical Coverage (EMC) is a type of insurance that provides coverage for medical emergencies. It is designed to pay for immediate medical costs that arise from unexpected emergencies, whether they’re due to accidents or sudden illnesses. EMC typically covers the expenses for hospital stays, surgeries, ambulance services, and sometimes even follow-up care related to the initial emergency.

Key Features of EMC

- Immediate Response: EMC is intended for use during unexpected emergencies, offering swift payouts to manage urgent medical expenses.

- Scope of Coverage: Policies can vary, but EMC usually covers a broad range of emergency medical services and treatments.

- Out-of-Network Flexibility: One important advantage of EMC is that it often covers out-of-network medical providers, which can be crucial in an emergency situation.

When to Consider EMC

EMC is ideal if you want assurance for sudden medical needs that arise from accidents or unexpected health episodes. If you frequently travel out of state or even abroad, EMC can offer peace of mind knowing you’d be covered for emergencies regardless of your location or choice of medical provider.

Understanding Personal Injury Protection (PIP)

Personal Injury Protection (PIP) is often a component of auto insurance policies in the United States, designed to cover medical expenses and other related costs after an automobile accident, regardless of fault. In states that mandate or offer PIP, it aims to reduce the need to prove fault in insurance claims, thereby expediting the provision of funds for medical care and other losses resulting from an accident.

Key Features of PIP

- No-Fault Coverage: PIP provides coverage without the need to determine who was at fault in an auto accident, allowing for quicker access to funds.

- Comprehensive Benefits: In addition to medical bills, PIP also covers lost wages, rehabilitation costs, funeral expenses, and sometimes even services like child care if you’re incapacitated.

- State Variations: The requirements and benefits for PIP vary significantly by state. In some states, PIP is mandatory, while in others it is not available at all.

When to Consider PIP

If you live in a no-fault state or drive frequently, PIP can be highly advantageous. It ensures swift coverage for injuries resulting from auto accidents and extends its benefits beyond just medical costs. This can be crucial in ensuring financial stability while recovering from an accident.

Comparing EMC with PIP

Choosing between Emergency Medical Coverage and Personal Injury Protection depends on a variety of factors, including your lifestyle, state of residence, and specific needs. Let’s compare the two across different dimensions:

Coverage Scope

While both EMC and PIP provide substantial medical coverage, EMC is broader in terms of the situations it covers as it includes medical emergencies unrelated to car accidents. On the other hand, PIP is specific to auto accidents but offers a wider array of benefits related to those situations, such as lost wages and other economic losses.

Speed of Access to Benefits

PIP often provides quicker access to funding because it bypasses the fault system typical in traditional auto insurance claims. EMC also offers fast access to funds but primarily focuses on immediate medical needs rather than economic losses.

Geographic Considerations

Geographical presence and traveling habits should also influence your decision. EMC may be preferable if you travel regularly as it covers emergencies irrespective of location. Conversely, PIP’s benefits are more confined to auto-related incidents and are more beneficial if you’re frequently driving within your state or particular regions where it’s available.

Cost Considerations

The cost for both EMC and PIP can vary widely based on the level of coverage, state laws, and personal circumstances. EMC might be more expensive if it includes international coverage but can offset those costs by providing global protection. PIP’s costs hinge on factors like the state’s requirements and the insurance company’s policies.

Interplay with Other Insurance Policies

Consider how EMC or PIP will coordinate with your existing insurance coverages. EMC usually supplements health insurance, especially useful for high-deductible plans or plans with limited emergency coverage. PIP’s benefits typically integrate with other components of auto insurance, potentially offering a more cohesive protection package for drivers.

Deciding What Suits Your Needs

To decide between EMC and PIP, assessing personal circumstances and preferences is key. Here’s a checklist to help guide your decision-making process:

- Evaluate your current health and auto insurance coverages.

- Consider your driving habits and risk exposure to auto accidents.

- Analyze your travel patterns and exposure to healthcare systems outside your home state/country.

- Review your financial situation: would lost wages after an auto accident significantly impact you?

- Check state laws regarding mandatory insurance coverage, including EMC and PIP requirements.

By thoroughly evaluating these factors, you can make an informed choice tailored to your unique situation.

Choosing the Right Coverage for Your Needs

As we wrap up our discussion on choosing between Emergency Medical Coverage and Personal Injury Protection (PIP) in the US, it’s vital to consolidate the understanding gained throughout this guide. Both these types of coverage play critical roles in safeguarding you from financial burdens following an accident, but their distinct differences and unique offerings necessitate a strategic decision based on personal circumstances and state requirements.

Recap of Key Points

At the outset, we laid the groundwork by defining Emergency Medical Coverage and Personal Injury Protection (PIP). This foundational understanding is imperative, as it elucidates the scope and limitations each policy entails. Emergency Medical Coverage is typically associated with health insurance plans, offering coverage for immediate medical expenses post-accident. It focuses strictly on the medical costs and is often limited to use within a certain timeframe post-accident.

On the contrary, Personal Injury Protection is a more comprehensive form of auto insurance. It not only covers immediate medical expenses like Emergency Medical Coverage but also extends to lost wages, rehabilitation costs, and sometimes even funeral expenses resulting from a vehicular accident. Crucially, PIP can provide compensation regardless of who is at fault in the accident.

Given these definitions, the decision to choose between the two depends largely on individual needs and state mandates. We explored how state regulations dictate the necessity of PIP, with some states mandating it as part of their no-fault insurance laws. This translates to at least minimum PIP coverage being a legal requirement for drivers in these states, whereas in other regions, it’s offered as an optional add-on.

Evaluating Personal Needs

In making an informed decision, evaluating your personal needs becomes crucial. Several factors should influence your choice:

- State Regulations: As discussed, understanding whether you reside in a no-fault state mandates PIP insurance can direct your choice. If not mandated, compare the benefits vs. cost of adding PIP to your existing policy.

- Existing Health Coverage: Consider what your current health insurance covers, particularly if it already provides comprehensive emergency medical coverage. This might reduce the necessity of opting for additional PIP coverage.

- Financial Stability: If your finances can comfortably absorb unexpected expenses like lost wages or rehabilitation, the broader coverage scope of PIP might not be as necessary unless legally required.

- Risk Factors: If you frequently drive, particularly in areas with high accident rates, the benefits of PIP can outweigh the costs due to its broader protective umbrella against financial fallout.

These considerations help tailor your insurance approach, adapting the coverage to meet both legal obligations and personal peace of mind.

The Benefits of Each

Throughout the guide, we also highlighted specific benefits of each coverage option:

- Emergency Medical Coverage: Offers targeted and often more affordable protection solely for medical costs stemming from an accident.

- Personal Injury Protection (PIP): Provides a comprehensive safety net covering a wider array of accident-related expenses, potentially relieving significant financial stress. The no-fault nature of PIP also ensures faster claims processing, essential for immediate financial support.

Merging Coverages

In some scenarios, the best approach might be to combine coverages strategically. For instance, enhancing a health insurance plan with Emergency Medical Coverage and adding PIP to your auto insurance policy can create a robust protective barrier, ensuring that you’re well-covered irrespective of the nature of an accident or the expenses involved.

Call to Action

Understanding and choosing the right type of coverage is an investment in your financial safety and peace of mind. We encourage you to thoroughly evaluate your current coverage. Speak with an insurance advisor to update or enhance your policy according to legislative mandates and personal financial safety nets. Engaging with professionals can further illuminate nuanced benefits or provide clarity on complex state insurance laws. It’s also beneficial to perform a regular assessment of your coverage, especially following major life changes like moving states, career shifts, or significant financial shifts.

We invite you to share your thoughts in the comments below – what factors most influence your insurance decisions? Does your state’s legislation impact your choice heavily? Your experiences could provide invaluable insights to others navigating the insurance landscape. Finally, remember to subscribe to our newsletter for more in-depth guides and insurance tips that empower you with the knowledge to make informed, strategic decisions.

Together, let’s continue this journey towards a fully protected, worry-free future.

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology