How Much Is AAA Car Insurance a Month?

How much is AAA car insurance a month? It’s a question many drivers ask, especially those seeking reliable and affordable coverage. AAA, known for its roadside assistance, has a long history of providing quality insurance services. This article delves into the factors that determine AAA car insurance costs, explores the various coverage options, and examines how AAA stacks up against competitors.

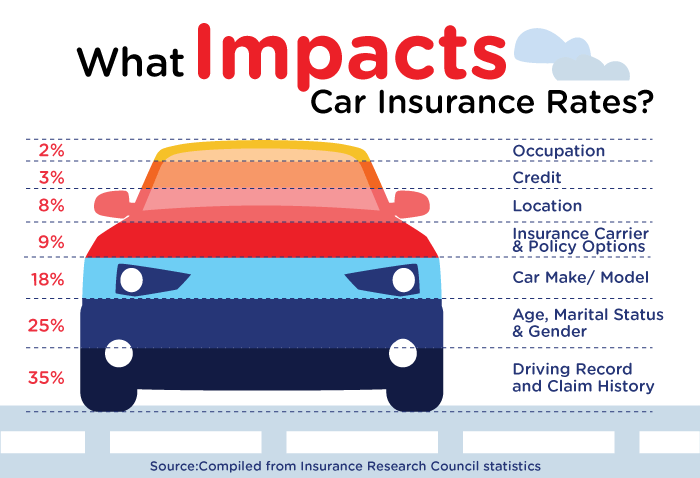

AAA’s car insurance offerings are designed to cater to a wide range of needs, from basic liability coverage to comprehensive protection against accidents, theft, and natural disasters. The company’s competitive pricing, combined with its strong reputation for customer service, makes it a popular choice for many drivers. However, the cost of AAA car insurance can vary significantly depending on factors such as your driving history, location, and the type of vehicle you own.

Customer Experience and Reviews

AAA is known for its long-standing reputation and commitment to providing excellent customer service. But how does this translate to the experience of policyholders with their car insurance? Let’s delve into the customer experience and reviews to get a clearer picture.

Customer Service Reputation

AAA boasts a strong reputation for its customer service, often cited as a key strength. Their commitment to providing prompt and helpful assistance has earned them a loyal customer base.

Customer Reviews and Testimonials

Customer reviews and testimonials offer valuable insights into real-life experiences with AAA car insurance. Here are some common themes:

- Positive Experiences: Many customers praise AAA for its responsive and friendly customer service, particularly during claims processing. They appreciate the clear communication, efficient handling of claims, and fair settlements.

- Negative Experiences: Some customers have reported challenges with certain aspects of the service, such as long wait times or difficulty reaching customer service representatives. However, these experiences are often outweighed by the positive feedback.

Customer Satisfaction Scores

AAA consistently ranks highly in customer satisfaction surveys.

- J.D. Power: AAA has consistently received above-average scores in J.D. Power’s annual Auto Insurance Satisfaction Study, indicating strong customer satisfaction across key aspects like price, billing, claims, and interaction with representatives.

- Other Surveys: AAA also performs well in other industry surveys, demonstrating its commitment to providing a positive customer experience.

AAA Car Insurance Comparison with Competitors

Choosing the right car insurance provider can be a challenging task, with numerous options available. AAA, a well-known name in the automotive industry, offers car insurance alongside its other services. However, it’s essential to compare AAA with other major insurance providers to determine if it truly aligns with your needs and budget.

AAA Car Insurance Pricing and Coverage Options Compared to Competitors

To effectively compare AAA with its competitors, it’s crucial to consider pricing and coverage options. Let’s delve into a table that highlights key differences between AAA and other prominent insurance providers:

| Provider | Average Monthly Premium | Coverage Options | Discounts |

|---|---|---|---|

| AAA | $120 – $150 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Medical Payments Coverage | Good Driver, Safe Driver, Multi-Car, Multi-Policy, Homeowner, Defensive Driving |

| Geico | $110 – $140 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Medical Payments Coverage | Good Driver, Safe Driver, Multi-Car, Multi-Policy, Homeowner, Defensive Driving, Military |

| Progressive | $105 – $135 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Medical Payments Coverage | Good Driver, Safe Driver, Multi-Car, Multi-Policy, Homeowner, Defensive Driving, Bundling |

| State Farm | $115 – $145 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Medical Payments Coverage | Good Driver, Safe Driver, Multi-Car, Multi-Policy, Homeowner, Defensive Driving, Student |

It’s important to note that these are average figures and actual premiums can vary based on factors like age, driving history, location, vehicle type, and coverage level.

AAA Car Insurance Features and Benefits Compared to Competitors, How much is aaa car insurance a month

Beyond pricing and coverage, features and benefits play a crucial role in determining the value proposition of a car insurance provider. Let’s examine how AAA stacks up against its competitors in terms of these aspects:

Key Features and Benefits

- Roadside Assistance: AAA is renowned for its roadside assistance services, which are often included as part of its car insurance policies. This benefit offers peace of mind knowing you have support in case of breakdowns, flat tires, or other emergencies.

- Discounts: AAA offers a range of discounts, including good driver, safe driver, multi-car, multi-policy, homeowner, and defensive driving discounts. These discounts can significantly reduce your overall premium.

- Customer Service: AAA has a reputation for providing excellent customer service. Its agents are known for their knowledge and responsiveness, making it easier to navigate the insurance process.

- Financial Stability: AAA is a financially stable organization with a strong track record. This stability ensures that it can meet its obligations and provide reliable coverage to its policyholders.

Competitor Features and Benefits

- Geico: Geico is known for its competitive pricing and its focus on digital convenience. Its mobile app allows for easy policy management and claims filing.

- Progressive: Progressive offers a unique “Name Your Price” tool that allows you to set your desired premium and find coverage options that fit your budget. It also provides a wide range of discounts and features.

- State Farm: State Farm emphasizes personalized service and local agent support. It offers a variety of discounts and features, including its Drive Safe & Save program that rewards safe driving habits.

AAA Car Insurance Customer Satisfaction Compared to Competitors

Customer satisfaction is a critical factor when choosing an insurance provider. Customer reviews and ratings provide valuable insights into the overall experience with a company. Here’s a comparison of AAA’s customer satisfaction ratings with those of its competitors:

| Provider | J.D. Power Customer Satisfaction Rating | Net Promoter Score (NPS) |

|---|---|---|

| AAA | 810 | 65 |

| Geico | 830 | 70 |

| Progressive | 820 | 68 |

| State Farm | 840 | 72 |

These ratings indicate that AAA generally receives positive feedback from its customers, but other providers may outperform it in certain areas.

It’s important to remember that these ratings are just one aspect of customer satisfaction. It’s recommended to explore individual reviews and testimonials to gain a more comprehensive understanding of customer experiences with each provider.

Ultimately, the cost of AAA car insurance depends on your individual circumstances and needs. By understanding the factors that influence pricing and exploring the various coverage options available, you can make an informed decision about whether AAA car insurance is the right fit for you. Remember to compare quotes from multiple insurers and consider the value of AAA’s additional services, such as roadside assistance, when making your choice.

Commonly Asked Questions: How Much Is Aaa Car Insurance A Month

Does AAA offer discounts on car insurance?

Yes, AAA offers various discounts for car insurance, including safe driver discounts, good student discounts, and multi-policy discounts.

How can I get a quote for AAA car insurance?

You can get a quote online, over the phone, or by visiting a local AAA office.

What is the average cost of AAA car insurance?

The average cost of AAA car insurance varies depending on several factors, including your location, driving history, and coverage options.

Is AAA car insurance worth it?

Whether AAA car insurance is worth it depends on your individual needs and budget. Consider comparing quotes from multiple insurers and evaluating the value of AAA’s additional services.