HELOC Investment Property Strategies and Considerations

HELOC investment property presents a compelling opportunity for savvy investors to leverage existing equity for real estate ventures. This strategy involves utilizing a home equity line of credit (HELOC) to finance the purchase or renovation of an investment property, potentially unlocking significant returns. While this approach offers advantages like flexible financing and potential tax benefits, it’s crucial to carefully assess the risks and financial implications before embarking on this journey.

This guide delves into the intricacies of HELOC investment properties, exploring the mechanics of HELOCs, financial considerations, investment strategies, legal and tax implications, and real-world examples. We’ll examine the potential rewards and pitfalls associated with this approach, providing valuable insights to help you make informed decisions.

Understanding HELOCs and Investment Properties

A Home Equity Line of Credit (HELOC) and an investment property can be powerful tools for building wealth, but understanding their mechanics and potential benefits is crucial before diving in. This section will break down the intricacies of HELOCs, explore the characteristics of investment properties, and highlight the advantages and disadvantages of using a HELOC to finance an investment property.

HELOC Mechanics

A HELOC is a type of revolving credit line secured by your home’s equity. You can borrow money against your home’s value, up to a certain percentage, and access funds as needed.

- Interest Rates: HELOC interest rates are typically variable, meaning they fluctuate based on market conditions. This can be a risk, as your monthly payments could increase if interest rates rise. However, variable rates can also be beneficial if interest rates fall, leading to lower payments.

- Draw Periods: This is the period during which you can access funds from your HELOC. It typically lasts for 10 years.

- Repayment Terms: Once the draw period ends, you enter the repayment period. This is when you must begin repaying the principal and interest borrowed. Repayment terms typically range from 10 to 20 years.

Investment Property Characteristics

Investment properties are real estate assets purchased for the purpose of generating income and/or appreciating in value. They come with a unique set of characteristics:

- Rental Income Potential: Investment properties can generate consistent income through rental payments, which can offset mortgage payments and contribute to your overall return.

- Appreciation Potential: Real estate values tend to appreciate over time, especially in desirable locations. This appreciation can lead to significant gains when you eventually sell the property.

- Tax Benefits: Investment properties can offer tax benefits, such as deductions for mortgage interest, property taxes, and depreciation.

HELOC Advantages for Investment Properties

Using a HELOC to finance an investment property can offer several advantages:

- Lower Interest Rates: HELOCs often have lower interest rates than personal loans or credit cards, making them a more affordable way to finance an investment property.

- Flexibility: A HELOC allows you to access funds as needed, providing flexibility in managing your investment property.

- Tax Deductibility: Interest paid on a HELOC used to finance an investment property may be tax deductible, potentially reducing your overall tax burden.

HELOC Disadvantages for Investment Properties

While HELOCs can be beneficial, they also come with potential drawbacks:

- Variable Interest Rates: As mentioned earlier, variable interest rates can lead to higher monthly payments if rates rise. This can impact your cash flow and potentially reduce your overall return on investment.

- Risk to Primary Residence: Since a HELOC is secured by your primary residence, defaulting on the loan could lead to foreclosure on your home. This is a significant risk to consider.

- Limited Draw Period: The limited draw period of a HELOC can restrict your ability to access funds for future renovations or improvements to your investment property.

Financial Considerations

Using a HELOC for an investment property involves several financial considerations that you need to carefully evaluate before making a decision. It’s essential to understand the potential benefits and risks associated with this type of financing to ensure it aligns with your financial goals and risk tolerance.

Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is a crucial factor lenders consider when evaluating your loan application. DTI represents the percentage of your gross monthly income that goes towards debt payments. Lenders typically prefer a DTI below 43%, but this can vary depending on your credit score and other factors. A higher DTI indicates a higher risk for the lender, as it suggests you may have difficulty making your loan payments.

DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100

When using a HELOC for an investment property, your DTI will increase because you’ll have additional debt payments. Therefore, it’s essential to ensure that your DTI remains within an acceptable range to qualify for the loan and maintain a healthy financial situation.

Credit Score

Your credit score plays a significant role in determining your eligibility for a HELOC and the interest rate you’ll receive. A higher credit score generally translates to lower interest rates and better loan terms. Lenders typically require a minimum credit score of 620 or higher for HELOCs.

It’s essential to maintain a good credit score by paying your bills on time, keeping your credit utilization low, and avoiding excessive credit applications. A higher credit score can significantly reduce your borrowing costs and make your loan application more competitive.

Property Value

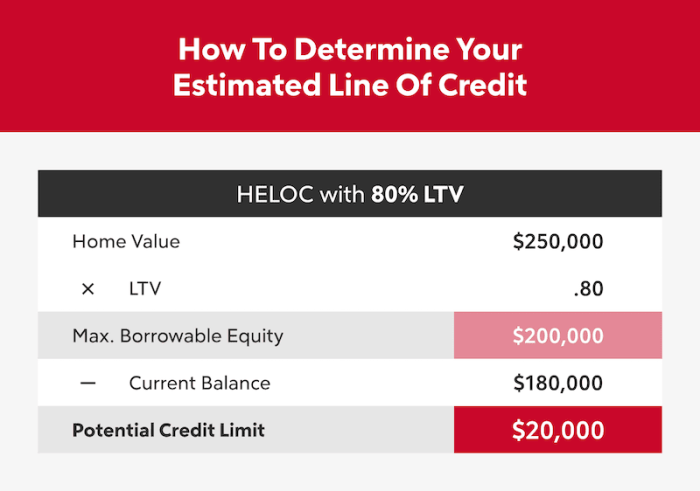

The value of your investment property is crucial for determining the amount of equity you can tap into using a HELOC. Lenders typically limit the loan-to-value (LTV) ratio, which represents the percentage of the property’s value that can be borrowed.

LTV = (Loan Amount / Property Value) x 100

A higher LTV indicates a higher risk for the lender, as it means you’re borrowing a larger proportion of the property’s value. Lenders may require an appraisal to determine the current market value of your investment property.

Potential Risks, Heloc investment property

While a HELOC can be a valuable financing tool, it’s essential to be aware of the potential risks associated with using it for an investment property.

Interest Rate Fluctuations

HELOCs typically have variable interest rates, which can fluctuate based on market conditions. If interest rates rise, your monthly payments could increase, making it challenging to manage your finances.

Negative Cash Flow

Investment properties may not always generate positive cash flow, especially in a volatile market. If your rental income is lower than your mortgage payments and other expenses, you’ll experience negative cash flow. This can significantly impact your financial stability and make it difficult to meet your debt obligations.

Potential Foreclosure

If you fail to make your HELOC payments, you could face foreclosure on your investment property. This can result in significant financial losses and damage your credit score.

Investment Strategies

A HELOC can unlock a variety of investment strategies for your property. By leveraging your existing equity, you can pursue opportunities that might otherwise be out of reach. Let’s explore some popular strategies and their potential benefits and drawbacks.

Buy-and-Hold

The buy-and-hold strategy is a classic approach to real estate investing. You purchase a property with the intention of holding it for an extended period, typically several years or even decades. The primary goal is to generate passive income through rental payments and benefit from long-term property appreciation.

Pros and Cons of Buy-and-Hold

- Pros:

- Passive Income: Rental income provides a steady stream of cash flow.

- Property Appreciation: Real estate historically appreciates in value over time, potentially generating significant returns.

- Tax Advantages: Certain deductions, such as mortgage interest and property taxes, can reduce your tax burden.

- Long-Term Stability: Buy-and-hold offers a more predictable and stable investment compared to short-term strategies.

- Cons:

- High Initial Investment: Purchasing a property requires a substantial upfront investment.

- Maintenance Costs: Unexpected repairs and ongoing maintenance can eat into your profits.

- Tenant Issues: Finding reliable tenants and managing potential issues can be time-consuming and stressful.

- Market Volatility: Economic downturns can impact rental demand and property values.

Calculating Potential Return on Investment

To estimate your potential return on investment (ROI) for a buy-and-hold strategy, you can use the following formula:

ROI = (Annual Rental Income – Annual Expenses) / Total Investment

For example, let’s say you purchase a property for $200,000 with a $50,000 down payment and a HELOC for the remaining balance. You estimate annual rental income of $24,000 and annual expenses (including mortgage payments, property taxes, insurance, and maintenance) of $18,000.

ROI = ($24,000 – $18,000) / $200,000 = 0.03 or 3%

This indicates a potential annual return of 3% on your investment. Remember that this is a simplified calculation, and actual returns may vary based on various factors.

Legal and Tax Implications

Using a HELOC for an investment property involves specific legal and tax considerations. Understanding these aspects is crucial for maximizing your returns and minimizing potential liabilities.

Tax Implications

Tax implications associated with owning an investment property are significant and can influence your financial decisions. It’s essential to understand how your investment property impacts your tax obligations.

- Property Taxes: As an investment property owner, you’ll be responsible for paying property taxes annually. These taxes are based on the assessed value of your property and are typically collected by your local government.

- Insurance: You’ll also need to pay for insurance, such as homeowners’ insurance and liability insurance. These policies protect you from financial losses due to unforeseen events like fire, theft, or lawsuits.

- Capital Gains Taxes: When you sell your investment property, you may be subject to capital gains taxes on any profits you make. These taxes are calculated based on the difference between your selling price and your purchase price, minus any expenses incurred during ownership.

Legal Considerations

Navigating the legal landscape of investment property ownership is essential for avoiding potential legal issues.

- Zoning Regulations: Before purchasing an investment property, you must understand local zoning regulations. These regulations determine what types of activities are permitted on a property and can affect your investment strategy.

- Landlord-Tenant Laws: Understanding landlord-tenant laws is critical for protecting your rights and responsibilities as a property owner. These laws cover topics such as lease agreements, tenant rights, eviction procedures, and security deposits.

- Property Management Responsibilities: Managing an investment property requires adherence to various legal responsibilities. These include maintaining the property’s condition, handling tenant complaints, and complying with safety regulations.

Minimizing Tax Liabilities

Understanding tax deductions can help you minimize your tax liability as an investment property owner.

- Mortgage Interest Deduction: You can deduct the interest paid on your HELOC for your investment property on your federal income taxes. This deduction can significantly reduce your tax bill.

- Property Tax Deduction: You can also deduct the property taxes you pay on your investment property.

- Depreciation Deduction: You can depreciate the value of your investment property over time, which allows you to deduct a portion of the property’s value each year on your taxes.

Case Studies and Real-World Examples

Real-world examples can offer valuable insights into how HELOCs have been utilized to finance investment property purchases. These examples showcase the potential benefits and challenges associated with this strategy, providing a practical understanding of its application in different scenarios.

Successful Investment Property Purchase Using a HELOC

This case study illustrates how a HELOC can be a powerful tool for acquiring investment properties, particularly for individuals seeking to diversify their portfolio and generate passive income.

Let’s consider Sarah, a homeowner with a substantial amount of equity in her primary residence. She has been contemplating expanding her investment portfolio by purchasing a rental property. Sarah’s financial advisor suggests utilizing a HELOC to finance the acquisition, leveraging her existing home equity to secure favorable loan terms.

Sarah’s financial strategy involves:

- Securing a HELOC with a competitive interest rate and flexible repayment terms. This allows her to access a significant portion of her home equity at a relatively low cost.

- Utilizing the HELOC proceeds to purchase a multi-family rental property in a desirable location with strong rental demand. The property’s rental income is expected to cover the mortgage payments, property taxes, and other expenses, generating positive cash flow for Sarah.

- Gradually paying down the HELOC debt while simultaneously benefiting from the rental income. This approach allows Sarah to build equity in the investment property while reducing her overall debt burden.

Sarah’s strategy carries certain risks, including:

- Potential fluctuations in rental income, which could impact her ability to meet the HELOC payments.

- Unexpected property maintenance expenses, which can strain her budget.

- Interest rate increases on the HELOC, potentially leading to higher monthly payments.

However, the potential rewards of Sarah’s investment are substantial:

- Generating passive income from rental revenue.

- Building equity in the investment property over time.

- Diversifying her investment portfolio and creating a long-term source of income.

Real-World Examples of HELOC Leverage

Several real-world examples demonstrate the successful use of HELOCs for investment property acquisition.

* John, a seasoned real estate investor, utilizes a HELOC to purchase a distressed property in a revitalizing neighborhood. John’s expertise in property rehabilitation allows him to acquire the property at a discount, renovate it, and resell it at a significant profit. The HELOC provides him with the necessary capital for the acquisition and renovation, while the profits from the sale cover the HELOC debt and generate substantial returns.

* A small business owner leverages a HELOC to purchase a commercial property for expansion. The HELOC provides the necessary capital to purchase the property, allowing the business to expand its operations and increase its revenue. The increased revenue stream enables the business to comfortably cover the HELOC payments and generate a positive return on investment.

* A family uses a HELOC to purchase a vacation rental property in a popular tourist destination. The HELOC provides the financing needed for the acquisition, and the rental income generated by the property covers the mortgage payments and associated expenses. The family enjoys the benefits of owning a vacation property while generating passive income through rentals.

Challenges and Lessons Learned

Real-world examples highlight both the potential benefits and challenges associated with using HELOCs for investment property purchases.

* Careful planning and due diligence are essential. Thoroughly assess the investment property’s potential rental income, expenses, and market conditions before committing to the purchase.

* Maintain a strong financial foundation. Ensure that your existing debt obligations and financial commitments do not hinder your ability to meet the HELOC payments.

* Manage risk effectively. Consider potential risks such as fluctuations in rental income, unexpected maintenance costs, and interest rate increases.

* Seek professional guidance. Consult with a financial advisor, real estate agent, and tax professional to navigate the complexities of investment property ownership and HELOC utilization.

In conclusion, utilizing a HELOC for investment property can be a powerful tool for experienced investors seeking to expand their real estate portfolio. By carefully evaluating financial considerations, exploring various investment strategies, and understanding the legal and tax implications, you can navigate the complexities of this approach and potentially achieve substantial returns. However, it’s imperative to remember that risk is inherent in any investment, and thorough due diligence is crucial to ensure success.

Essential FAQs: Heloc Investment Property

What are the typical interest rates on HELOCs?

HELOC interest rates are typically variable and fluctuate with market conditions. They are usually based on a prime rate plus a margin, which can range from 1.5% to 3%.

How does a HELOC affect my credit score?

Opening a HELOC can slightly impact your credit score, as it increases your overall debt-to-credit ratio. However, responsible repayment can help maintain a healthy credit score.

What are the potential tax benefits of owning an investment property?

Investment property owners can deduct expenses such as mortgage interest, property taxes, and depreciation, which can potentially reduce their tax liability.

What are some common risks associated with HELOC investment properties?

Risks include interest rate fluctuations, negative cash flow, potential foreclosure, and the possibility of property value depreciation.

A HELOC can be a powerful tool for funding an investment property, especially when considering a market like Las Vegas. With its strong rental demand and potential for appreciation, investment property Las Vegas offers a compelling opportunity. A HELOC allows you to leverage your existing equity to finance your investment, potentially leading to higher returns and a faster path to financial freedom.

A HELOC can be a useful tool for financing an investment property, but it’s important to consider your overall financial picture. If you’re considering buying an investment property before your first home, you might want to read this article on buying an investment property before first home. While the article is focused on buying before a first home, the concepts can be applied to any situation where you’re considering using a HELOC for an investment property.

Remember, a HELOC is a loan secured by your primary residence, so make sure you can comfortably handle the additional debt.