Graduated Payment Mortgages A Guide to Increasing Payments

Graduated payment mortgages, often referred to as GPMs, offer a unique approach to homeownership, allowing borrowers to start with lower monthly payments that gradually increase over time. This structure can be particularly appealing to young professionals or those with limited upfront income, providing them with an opportunity to buy a home sooner than they might otherwise be able to. However, it’s crucial to understand the intricacies of GPMs before making a decision, as they come with both advantages and disadvantages.

The concept behind GPMs is simple: your initial monthly payment is lower than it would be with a traditional fixed-rate mortgage. As time passes, your payments gradually increase, typically in a predetermined pattern. This allows you to manage your finances more easily in the early years while your income is potentially lower, but it also means that your payments will become more substantial as your earning potential grows.

Payment Structure and Calculation: Graduated Payment Mortgage

A graduated payment mortgage (GPM) is a type of mortgage where the monthly payments start low and increase gradually over a set period. This structure is designed to help borrowers who expect their income to rise over time. The initial lower payments make it easier to qualify for the mortgage, but the payments will eventually become higher than a traditional fixed-rate mortgage.

Payment Schedule Calculation

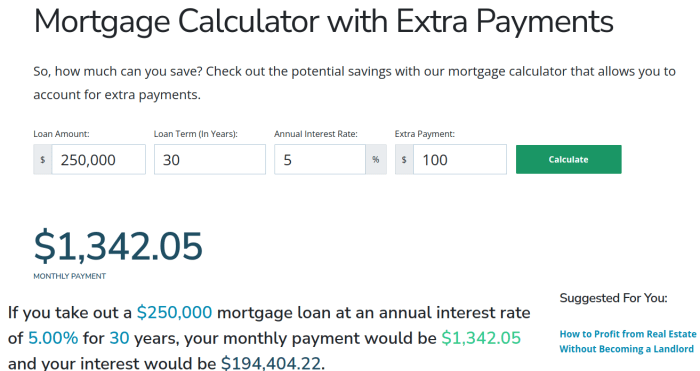

The calculation of a graduated payment mortgage payment involves a few key steps:

- Determine the initial payment amount: The initial payment is typically set at a lower amount than a traditional fixed-rate mortgage, based on a predetermined percentage of the loan amount. This percentage is usually set between 75% and 90% of the traditional fixed-rate payment.

- Calculate the annual payment increase: The payment amount increases annually by a predetermined percentage, which is typically between 2% and 7%. This percentage is negotiated with the lender at the time of the loan origination.

- Calculate the total number of payments: The total number of payments is determined by the loan term, which is typically 15 or 30 years.

- Calculate the total interest paid: The total interest paid over the life of the loan is determined by the loan amount, the interest rate, and the payment schedule.

Payment Schedule Example, Graduated payment mortgage

Here is an example of a graduated payment mortgage payment schedule for a $200,000 loan with a 30-year term, a 5% interest rate, and an initial payment amount of 75% of the traditional fixed-rate payment:

| Year | Payment Amount | Interest Paid | Principal Paid | Loan Balance |

|---|---|---|---|---|

| 1 | $1,073.64 | $8,333.33 | $240.31 | $199,759.69 |

| 2 | $1,126.22 | $8,240.18 | $286.04 | $199,473.65 |

| 3 | $1,181.08 | $8,143.78 | $337.30 | $199,136.35 |

| … | … | … | … | … |

| 30 | $2,021.85 | $2,595.45 | $1,426.40 | $0 |

Negative Amortization

Negative amortization occurs when the monthly payment is not enough to cover the accrued interest on the loan. In a graduated payment mortgage, negative amortization can occur in the early years of the loan, when the payments are lower than the interest accrued. This means that the loan balance actually increases over time.

Negative amortization is a feature of graduated payment mortgages and can occur when the payment amount is less than the interest accrued. This can lead to a situation where the loan balance increases over time.

Graduated Payment Mortgage vs. Traditional Mortgages

A graduated payment mortgage (GPM) and a traditional fixed-rate mortgage are both common loan options for homebuyers, but they differ significantly in their payment structures and overall cost. Understanding the key differences between these mortgage types is crucial for making an informed decision about which one is right for your individual financial situation.

Comparison of Features

A GPM and a traditional fixed-rate mortgage share some common features, but their payment structures set them apart. A traditional fixed-rate mortgage has a fixed interest rate and a fixed monthly payment for the entire loan term. In contrast, a GPM features a lower initial monthly payment that gradually increases over a set period. This gradual increase in payments is designed to help borrowers who anticipate their income growing over time.

- Fixed-rate mortgage: The interest rate and monthly payment remain the same throughout the loan term.

- Graduated payment mortgage: The initial monthly payment is lower than a fixed-rate mortgage, but it increases gradually over a predetermined period.

Pros and Cons for Different Borrower Profiles

The suitability of a GPM or a traditional fixed-rate mortgage depends on the borrower’s financial situation and future income expectations.

Graduated Payment Mortgage

- Pros:

- Lower initial monthly payments can be more affordable for young professionals or those with increasing income.

- The gradual payment increases can help borrowers adjust to higher monthly costs over time.

- Cons:

- The increasing payments can become burdensome if income growth does not keep pace.

- Higher overall interest costs due to the delayed repayment of principal.

- Potential for negative amortization, where the loan balance increases over time.

Traditional Fixed-Rate Mortgage

- Pros:

- Predictable monthly payments provide budgeting stability.

- Lower overall interest costs compared to GPMs.

- No risk of negative amortization.

- Cons:

- Higher initial monthly payments may be challenging for borrowers with limited income.

- Less flexibility for borrowers who anticipate significant income growth.

Key Differences Between GPMs and Traditional Mortgages

| Feature | Graduated Payment Mortgage | Traditional Fixed-Rate Mortgage |

|---|---|---|

| Interest Rate | Fixed | Fixed |

| Monthly Payment | Gradually increases over a set period | Fixed throughout the loan term |

| Initial Payment | Lower than a fixed-rate mortgage | Higher than a GPM |

| Overall Interest Cost | Higher | Lower |

| Risk of Negative Amortization | Yes | No |

Situations Where a GPM Might Be a Better Choice

A GPM may be a better option for borrowers who:

- Expect significant income growth in the near future.

- Are comfortable with the potential for increasing monthly payments.

- Prioritize affordability in the early years of the mortgage.

In conclusion, graduated payment mortgages can be a viable option for borrowers who anticipate a rise in their income over time. However, it’s crucial to carefully consider the potential risks associated with negative amortization and rising interest rates. By understanding the intricacies of GPMs and weighing the advantages against the disadvantages, you can make an informed decision that aligns with your individual financial goals and circumstances.

FAQ Overview

What is the typical payment increase schedule for a graduated payment mortgage?

Payment increases are usually predetermined and can vary depending on the lender. Common schedules include annual increases, bi-annual increases, or increases every few years.

How long does it typically take for the graduated payment to reach the full amount?

The time it takes for payments to reach their full amount varies depending on the specific GPM structure. It can range from 5 to 15 years, after which the payments remain fixed for the rest of the loan term.

Are graduated payment mortgages available for all types of properties?

GPMs are generally available for both single-family homes and multi-family properties. However, availability may vary depending on the lender and the specific property.

A graduated payment mortgage (GPM) can be a good option for young professionals, especially those who anticipate their income increasing over time. As you progress in your career, you might consider pursuing an affordable online MBA to enhance your earning potential. This advanced degree can make it easier to manage your GPM payments as your salary grows, ensuring you remain on track with your mortgage obligations.

A graduated payment mortgage, or GPM, is a loan where your monthly payments increase over time. This can be a good option for those who expect their income to rise in the future. If you’re looking for a career that can help you achieve that financial stability, consider taking a pharmacy technician class online. With a GPM, you can start with lower payments and gradually increase them as your income grows, allowing you to invest in your future.

A graduated payment mortgage (GPM) can be a good option for young professionals, as the lower initial payments allow them to build their financial footing. Understanding the intricacies of GPMs, along with other mortgage options, is a valuable skill for financial professionals. An online MBA in finance can provide the necessary knowledge and expertise to navigate the complex world of mortgages and other financial instruments.

A graduated payment mortgage (GPM) can be a good option for young professionals who anticipate their income increasing over time. This type of mortgage allows for lower payments in the early years, gradually increasing as your income grows. For those seeking to enhance their earning potential and potentially qualify for a GPM, an MBA can be a valuable investment.

The Penn State Online MBA program offers a flexible and rigorous curriculum that can help you advance your career and achieve your financial goals. With a GPM, you can manage your monthly expenses while investing in your future through a program like Penn State’s online MBA.