Fisher Investment Fees Understanding the Cost of Management

Fisher Investment Fees: Understanding the Cost of Management, are a crucial aspect to consider when evaluating their services. Fisher Investments, a prominent investment management firm, offers a range of investment accounts and services, each with its own fee structure. Understanding these fees is essential for investors to make informed decisions about whether Fisher Investments aligns with their financial goals and risk tolerance.

This guide delves into the complexities of Fisher Investments’ fee structure, comparing them to competitors and analyzing their potential impact on investment returns. We explore the transparency of their fee disclosure and provide insights on key factors investors should consider when evaluating fees. Ultimately, this information aims to empower investors with the knowledge they need to navigate the world of investment management fees and make informed choices about their financial future.

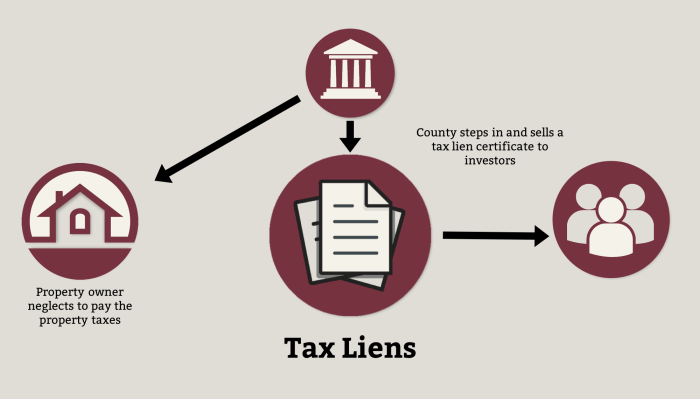

Fisher Investments Fee Structure

Fisher Investments, a well-known investment management firm, charges fees for its services. Understanding their fee structure is crucial for potential clients to evaluate if their services align with their financial goals and risk tolerance.

Fees Charged by Fisher Investments

Fisher Investments charges fees based on the assets under management (AUM) for their investment advisory services. This means that the more money you invest with them, the higher your fees will be. These fees cover their services, such as portfolio management, research, and client support.

Fee Structure for Different Investment Accounts and Services

Fisher Investments offers a range of investment accounts and services, each with its own fee structure.

Fee Structure for Individual Investment Accounts

For individual investment accounts, Fisher Investments charges an annual fee based on the AUM. This fee is typically a percentage of the assets managed, ranging from 1% to 1.5%.

For example, if you invest $1 million with Fisher Investments, your annual fee could be between $10,000 and $15,000.

Fee Structure for Retirement Accounts

Fisher Investments also offers services for retirement accounts, such as 401(k)s and IRAs. The fee structure for these accounts is similar to individual investment accounts, with an annual fee based on AUM.

Fee Structure for Other Services

Fisher Investments offers additional services, such as financial planning and estate planning. These services may have separate fees, which are typically charged on an hourly basis.

Breakdown of Annual Fee Percentage

The annual fee percentage charged by Fisher Investments is calculated based on the AUM.

For example, if your AUM is $500,000 and the annual fee is 1.25%, your annual fee would be $6,250.

Examples of Specific Fees for Managing Different Asset Classes

Fisher Investments manages a variety of asset classes, including stocks, bonds, and real estate. The fees for managing these asset classes can vary depending on the complexity of the investment strategy.

For example, managing a portfolio of large-cap stocks may have a lower fee than managing a portfolio of emerging market bonds.

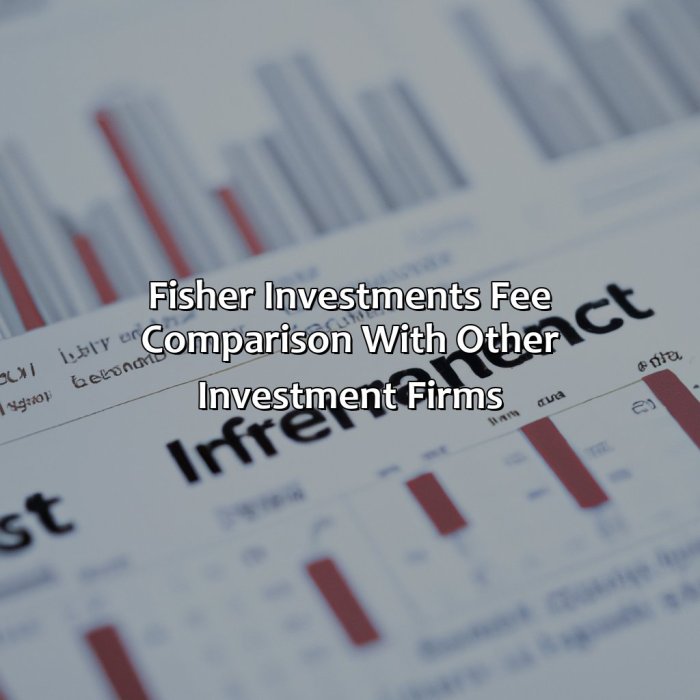

Fee Comparison with Competitors

Fisher Investments charges fees for its investment management services, and these fees are a significant consideration for potential clients. To understand the value proposition of Fisher Investments, it’s essential to compare its fees with those of other prominent investment management firms.

Comparison of Fees

The fees charged by investment management firms can vary significantly based on factors such as the firm’s size, investment strategy, and minimum investment requirements.

Here’s a table comparing Fisher Investments fees with those of its competitors:

| Firm Name | Fee Structure | Annual Fee Percentage | Minimum Investment Requirement |

|—|—|—|—|

| Fisher Investments | AUM-based fee | 1.00% – 1.50% | $50,000 |

| Vanguard | AUM-based fee | 0.15% – 0.35% | $3,000 |

| Fidelity | AUM-based fee | 0.35% – 0.75% | $10,000 |

| Schwab | AUM-based fee | 0.25% – 0.50% | $5,000 |

| BlackRock | AUM-based fee | 0.50% – 1.00% | $25,000 |

Pros and Cons of Fisher Investments Fees

It’s crucial to analyze the pros and cons of Fisher Investments fees compared to its competitors.

Pros

* Experienced and well-established firm: Fisher Investments has a long history of providing investment management services, which can instill confidence in potential clients.

* Active management approach: Fisher Investments employs an active management approach, which aims to outperform the market by making strategic investment decisions.

* Personalized investment strategies: Fisher Investments offers personalized investment strategies tailored to individual client needs and risk tolerance.

Cons

* Higher fees compared to some competitors: Fisher Investments fees are generally higher than those charged by some of its competitors, such as Vanguard and Schwab.

* Lack of transparency: Fisher Investments does not disclose specific investment strategies or portfolio holdings, which can raise concerns about transparency.

* No index-based options: Fisher Investments does not offer index-based investment options, which can be more cost-effective for investors seeking passive management strategies.

Value Proposition

Fisher Investments’ value proposition lies in its active management approach, personalized investment strategies, and experienced team. The firm’s high fees are justified by its commitment to providing a hands-on approach to investment management, aiming to generate higher returns for clients.

However, the value proposition is subjective and depends on individual investor preferences and financial goals. Investors seeking a more passive and cost-effective approach might find alternative investment management firms with lower fees more appealing.

Impact of Fees on Investment Returns: Fisher Investment Fees

Investment fees are a crucial factor to consider when evaluating any investment strategy, as they can significantly impact your overall returns. Understanding how fees affect your investment growth is essential for making informed decisions.

The Effect of Fees on Portfolio Performance Over Time

Fees can eat away at your investment returns over time, acting like a hidden tax on your gains. This is because fees are typically calculated as a percentage of your assets under management (AUM), meaning that the larger your portfolio grows, the more you pay in fees. This can significantly impact your long-term investment growth.

For example, let’s say you invest $100,000 with an annual fee of 1%. After one year, assuming a 7% return, your portfolio would grow to $107,000. However, after deducting the 1% fee, your net return would be only 6%. Over time, this difference can compound, leading to a substantial reduction in your overall returns.

Examples of How Fees Can Influence Investment Growth

Here are some examples of how fees can impact investment growth:

- Lowering Returns: Fees directly reduce your investment returns. A higher fee can lead to a significant difference in your portfolio’s growth over the long term.

- Reducing Investment Growth: Fees can slow down the compounding effect of your investments. Compounding is the process of earning interest on your interest, which can accelerate investment growth. Fees can significantly reduce the power of compounding, leading to lower overall returns.

- Increasing the Time to Reach Financial Goals: Fees can increase the time it takes to reach your financial goals, such as retirement or a down payment on a house. This is because fees reduce your returns, making it harder to accumulate the necessary funds.

Hypothetical Scenario: The Difference in Returns With and Without Fees

Imagine two investors, both starting with $100,000 and aiming for a 7% annual return. Investor A pays a 1% annual fee, while Investor B has no fees.

| Year | Investor A (with 1% fee) | Investor B (no fees) |

|---|---|---|

| 1 | $106,000 | $107,000 |

| 5 | $140,255 | $140,710 |

| 10 | $196,715 | $200,120 |

| 20 | $386,968 | $406,569 |

As you can see, even a small fee of 1% can make a significant difference in returns over time. After 20 years, Investor A’s portfolio is about $20,000 smaller than Investor B’s, demonstrating the impact of fees on long-term investment growth.

Transparency and Disclosure of Fees

Fisher Investments’ transparency in disclosing its fee structure is a crucial aspect for potential clients to understand. This transparency allows investors to make informed decisions regarding their investment choices.

Clarity and Comprehensiveness of Fee Disclosure Documents

Fisher Investments provides fee disclosure documents to its clients, outlining the different fees associated with their investment services. These documents, which are available on their website and can be provided upon request, offer detailed information about the fees charged.

- Advisory Fees: These fees are typically based on a percentage of the assets under management (AUM) and are disclosed in the advisory agreement. This fee structure is transparent and allows investors to easily understand the cost associated with their investments.

- Trading Commissions: Fisher Investments may charge trading commissions for specific transactions, such as buying or selling securities. These commissions are typically disclosed in the account statements and are often a fixed amount per trade.

- Other Fees: In addition to advisory fees and trading commissions, Fisher Investments may charge other fees, such as account maintenance fees or custodian fees. These fees are typically disclosed in the account statements or the advisory agreement.

Potential Areas for Improvement in Fee Transparency

While Fisher Investments provides detailed information about its fees, there are areas where further transparency could be beneficial for clients.

- Fee Schedules: Providing a comprehensive fee schedule that Artikels all potential fees, including any applicable discounts or waivers, would be helpful for clients to understand the full range of fees they may incur.

- Fee Comparisons: Including a comparison of Fisher Investments’ fees with industry benchmarks or competitors would offer clients a clearer perspective on the competitiveness of their fees.

- Fee Impact Analysis: Presenting an analysis of how fees impact investment returns, such as through illustrative examples or scenarios, would provide clients with a better understanding of the real-world implications of their fees.

Examples of How Fisher Investments Communicates Its Fees to Clients

Fisher Investments uses several methods to communicate its fees to clients:

- Website: The Fisher Investments website provides information about its fees and fee structure. This information is readily available to potential clients and can be accessed at any time.

- Brochures and Marketing Materials: Fisher Investments uses brochures and other marketing materials to communicate its fees to potential clients. These materials often include summaries of its fee structure and highlight the value it provides for its clients.

- Client Meetings: Fisher Investments’ financial advisors discuss fees with clients during initial consultations and ongoing meetings. This allows clients to ask questions and receive personalized explanations about the fees associated with their investments.

Factors to Consider When Evaluating Fees

Investment management fees are a crucial aspect of any investment strategy. Understanding and evaluating these fees is essential to ensure that your investment goals are aligned with the costs associated with managing your portfolio.

Fee Transparency and Disclosure, Fisher investment fees

It’s crucial to understand how fees are structured and what they cover. Ask for a clear and concise breakdown of all fees, including asset management fees, performance-based fees, and any other charges. Look for fee schedules and disclosures that are easy to understand and readily available. Transparency in fee disclosure is a key indicator of a reputable investment manager.

Fee Structure and Comparison

Different investment managers employ various fee structures. Common structures include:

- Asset-based fees: These fees are calculated as a percentage of the assets under management (AUM). The fee is typically charged annually and can vary based on the size of the portfolio.

- Performance-based fees: These fees are tied to the performance of the investment portfolio. They are often structured as a percentage of profits generated above a certain benchmark.

- Flat fees: These fees are a fixed amount charged regardless of the portfolio’s size or performance.

Compare fee structures across different investment managers to determine the most cost-effective option for your investment goals.

Fee Impact on Investment Returns

Fees can significantly impact investment returns over time. A seemingly small fee can compound over the long term, reducing the overall growth of your portfolio. Consider the impact of fees on your investment returns and ensure they are aligned with your risk tolerance and expected returns.

Fee Alignment with Investment Goals and Risk Tolerance

Fees should be aligned with your investment goals and risk tolerance. If you’re investing for the long term with a high-risk tolerance, you might be willing to accept higher fees in exchange for the potential for higher returns. However, if you’re investing for the short term with a low-risk tolerance, you may prefer lower fees.

Questions to Ask Potential Investment Managers

When evaluating potential investment managers, ask the following questions about their fees:

- What are the specific fees associated with your services?

- How are the fees calculated?

- Are there any hidden fees or additional charges?

- What are the minimum investment requirements?

- How are fees reviewed and adjusted?

Navigating the world of investment management fees can be daunting, but understanding the costs involved is crucial for making informed investment decisions. By understanding the fee structure, comparing it to competitors, and considering its impact on potential returns, investors can gain valuable insights into whether Fisher Investments aligns with their financial goals. Remember, transparency and clarity are essential when it comes to fees, and investors should feel confident in their ability to understand and evaluate the costs associated with any investment management firm.

Frequently Asked Questions

What are the different types of fees charged by Fisher Investments?

Fisher Investments charges a variety of fees, including asset management fees, advisory fees, and transaction fees. The specific fees charged will depend on the type of account and services you utilize.

How do Fisher Investments’ fees compare to other investment management firms?

Fisher Investments’ fees are generally in line with other prominent investment management firms. However, it’s essential to compare fees across different firms based on their investment strategies, services, and minimum investment requirements.

What is the minimum investment requirement for Fisher Investments?

Fisher Investments typically has a minimum investment requirement, which varies depending on the specific account and service. It’s crucial to check the minimum investment requirements before making any investment decisions.

How do Fisher Investments communicate their fees to clients?

Fisher Investments provides detailed information about their fees in their client agreements, account statements, and other relevant documents. It’s essential to carefully review these documents to understand the fees you will be charged.

What questions should I ask potential investment managers about their fees?

When evaluating investment managers, it’s essential to ask questions about their fee structure, how fees are calculated, the minimum investment requirements, and their fee disclosure practices. You should also inquire about any performance-based fees or incentives.

Fisher Investments, like many investment firms, charges fees for their services. These fees can vary depending on the type of account and the amount of money invested. While considering your options, you might also want to explore real estate investments, such as Costa Rica investment properties , which can offer different avenues for growth and diversification. Ultimately, it’s important to carefully analyze the fees associated with any investment strategy and compare them to the potential returns.

Fisher Investments fees are a crucial factor to consider when deciding whether to invest with them. While their fees might seem high compared to some competitors, it’s important to remember that their investment strategy is focused on long-term growth. This strategy often involves investing in sectors like property development investment , which can offer substantial returns over time.

Ultimately, the decision of whether or not to invest with Fisher Investments depends on your individual financial goals and risk tolerance.

Fisher Investments offers a range of investment options, but their fees can be a significant factor to consider. If you’re looking for alternative investment opportunities, you might want to explore properties like those found in sunnyvale investment properties joplin mo. While real estate investments come with their own set of costs, understanding the potential returns and risks can help you make informed decisions about your investment strategy.