Down Payment Required for Investment Property A Guide

Down Payment Required for Investment Property: A Guide is an essential resource for anyone looking to enter the real estate investment market. Investing in rental properties can be a lucrative endeavor, but it requires careful planning and a thorough understanding of the financial aspects involved. One crucial element is the down payment, which significantly impacts the overall investment strategy. This guide will delve into the intricacies of down payment requirements for investment properties, exploring the factors that influence them, providing practical tips for saving, and outlining various financing options.

Navigating the world of investment property financing can be complex. Understanding the down payment requirements, including loan types, property characteristics, and lender policies, is paramount. This guide will break down these intricacies, offering insights into conventional loans, FHA loans, and VA loans, along with the impact of credit score and debt-to-income ratio on the required down payment.

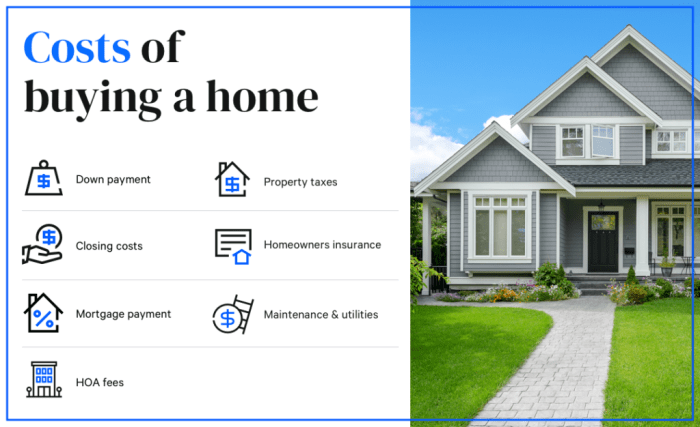

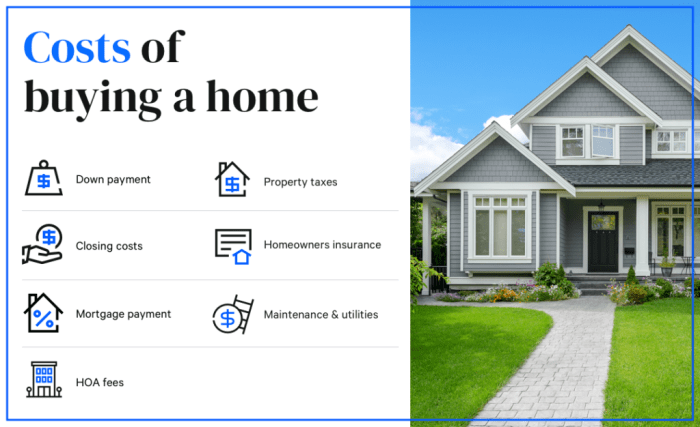

Understanding Down Payment Requirements

Securing financing for an investment property involves understanding the down payment requirements. Several factors influence the down payment amount, making it essential to research and plan accordingly.

Down Payment Requirements for Investment Properties

The down payment required for an investment property depends on various factors, including the loan type, property type, and lender policies.

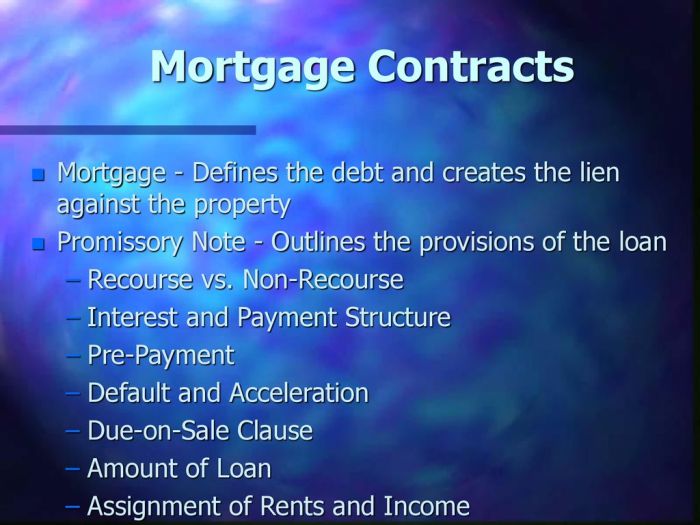

Loan Type

- Conventional Loans: Conventional loans typically require a down payment of 20% for investment properties. However, some lenders may offer lower down payment options, such as 15% or even 10%, depending on the borrower’s creditworthiness and the property’s characteristics.

- FHA Loans: FHA loans are government-insured loans that often have more lenient down payment requirements than conventional loans. For investment properties, FHA loans typically require a down payment of 15% to 25%.

- VA Loans: VA loans are available to eligible veterans and active-duty military personnel. While VA loans typically require no down payment for primary residences, they often require a 25% down payment for investment properties.

Property Type

The type of investment property can also influence down payment requirements. For example, multi-family properties, such as duplexes or triplexes, may have different down payment requirements than single-family homes.

Lender Policies

Each lender has its own specific policies regarding down payment requirements for investment properties. Some lenders may offer lower down payment options for borrowers with strong credit scores and low debt-to-income ratios.

Impact of Credit Score and Debt-to-Income Ratio, Down payment required for investment property

A borrower’s credit score and debt-to-income ratio (DTI) can significantly impact down payment requirements.

Credit Score

A higher credit score generally translates to more favorable loan terms, including lower down payment requirements. Lenders typically view borrowers with higher credit scores as less risky, making them more likely to approve loans with lower down payments.

Debt-to-Income Ratio

The debt-to-income ratio is a measure of a borrower’s monthly debt payments compared to their gross monthly income. Lenders use DTI to assess a borrower’s ability to repay a loan. A lower DTI typically leads to more favorable loan terms, including lower down payments.

Debt-to-Income Ratio (DTI) = Total Monthly Debt Payments / Gross Monthly Income

For example, a borrower with a DTI of 30% may be able to secure a loan with a lower down payment than a borrower with a DTI of 45%.

Calculating Down Payment Amounts

Calculating the down payment for an investment property involves several factors, including the purchase price, loan type, and closing costs. Understanding these components is crucial for accurately determining your financial commitment.

Calculating Down Payment Amounts

The down payment amount is a percentage of the total purchase price. The percentage varies based on the loan type and your financial situation. For example, conventional loans typically require a 20% down payment, while FHA loans may require as little as 3.5%.

- Determine the purchase price: This is the agreed-upon price for the investment property.

- Identify the loan type: The loan type dictates the minimum down payment percentage.

- Calculate the down payment amount: Multiply the purchase price by the down payment percentage.

- Estimate closing costs: These are additional expenses incurred during the closing process, typically around 2-5% of the purchase price.

Down Payment Scenarios

Let’s illustrate the calculation process with different scenarios:

Scenario 1: Conventional Loan

Property price: $250,000

Loan type: Conventional (20% down payment)

Down payment amount: $250,000 x 0.20 = $50,000

Scenario 2: FHA Loan

Property price: $200,000

Loan type: FHA (3.5% down payment)

Down payment amount: $200,000 x 0.035 = $7,000

Down Payment Table

The following table summarizes down payment amounts for different loan types and property values:

| Loan Type | Property Value | Down Payment Percentage | Down Payment Amount |

|---|---|---|---|

| Conventional | $200,000 | 20% | $40,000 |

| Conventional | $300,000 | 20% | $60,000 |

| FHA | $200,000 | 3.5% | $7,000 |

| FHA | $300,000 | 3.5% | $10,500 |

Financing Options and Strategies

Securing financing for an investment property can be challenging, especially if you’re working with a limited down payment. Fortunately, there are alternative financing options beyond traditional mortgages that can cater to your specific needs and circumstances.

Hard Money Loans

Hard money loans are short-term loans typically provided by private investors or lending institutions. They are often used for investment properties, fix-and-flip projects, or situations where traditional lenders might be hesitant to lend.

- Pros:

- Faster approval process compared to traditional mortgages.

- Less stringent credit requirements, making them accessible to borrowers with lower credit scores.

- Flexible loan terms, including shorter repayment periods, which can be advantageous for short-term projects.

- Cons:

- Higher interest rates than traditional mortgages.

- Shorter loan terms, typically 1-5 years, which can result in larger monthly payments.

- Origination fees and closing costs can be significant.

Private Lenders

Private lenders are individuals or companies that provide loans outside of traditional banking institutions. They often have more flexibility in their lending criteria and can offer tailored financing solutions for investment properties.

- Pros:

- More flexible loan terms and underwriting criteria compared to traditional lenders.

- Potentially lower interest rates than hard money loans.

- Greater willingness to consider borrowers with less-than-perfect credit histories.

- Cons:

- Loan amounts may be smaller than those offered by traditional lenders.

- Loan terms may be shorter than traditional mortgages.

- Higher interest rates than traditional mortgages.

Seller Financing

Seller financing occurs when the seller of a property agrees to provide a loan to the buyer instead of requiring a traditional mortgage. This can be a beneficial option for buyers who have limited down payment funds.

- Pros:

- Lower down payment requirements, potentially as low as 10% or less.

- Can be a good option for buyers with limited credit history.

- Potential for lower interest rates than traditional mortgages.

- Cons:

- Loan terms may be shorter than traditional mortgages.

- Interest rates may be higher than traditional mortgages.

- Seller financing agreements can be complex and require careful legal review.

Minimizing Down Payment Requirements

There are strategies that can help minimize the down payment needed for an investment property.

- 1031 Exchange: This tax-deferred exchange allows investors to sell one investment property and reinvest the proceeds into another without paying capital gains taxes. This can help free up capital for a down payment on a new property.

- Partnering with Other Investors: Pooling resources with other investors can allow you to acquire a larger property or reduce the individual down payment burden. You can collaborate on the investment, sharing profits and responsibilities.

Impact of Down Payment on Investment Returns

The size of your down payment for an investment property plays a crucial role in determining your overall return on investment. A larger down payment generally translates to lower monthly mortgage payments, leading to increased cash flow and potentially higher returns. Let’s explore the relationship between down payment size and investment returns.

Relationship Between Down Payment and Investment Returns

A larger down payment directly impacts your monthly mortgage payments. A lower mortgage balance translates to lower interest payments, leading to increased cash flow. This increased cash flow can be used to cover expenses, build equity faster, or even be reinvested in other opportunities.

For example, consider two scenarios:

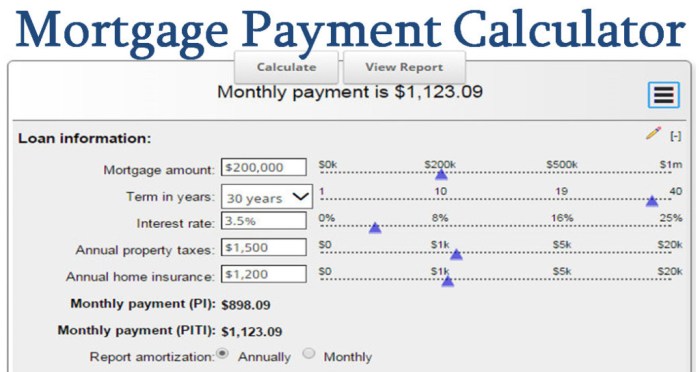

– Scenario 1: You purchase a property for $200,000 with a 20% down payment ($40,000). Your monthly mortgage payment will be lower compared to someone with a 10% down payment.

– Scenario 2: You purchase the same property for $200,000 with a 10% down payment ($20,000). Your monthly mortgage payment will be higher due to a larger loan amount.

The difference in monthly mortgage payments between these two scenarios can significantly impact your cash flow and overall return on investment.

Impact of Down Payment on Monthly Expenses and Net Operating Income

The following table illustrates the impact of different down payment percentages on monthly expenses and net operating income for a hypothetical investment property:

| Down Payment Percentage | Loan Amount | Monthly Mortgage Payment | Monthly Expenses | Net Operating Income |

|—|—|—|—|—|

| 10% | $180,000 | $1,200 | $1,500 | $1,000 |

| 20% | $160,000 | $1,000 | $1,500 | $1,200 |

| 30% | $140,000 | $800 | $1,500 | $1,400 |

As the down payment percentage increases, the monthly mortgage payment decreases, leading to higher net operating income. This increased cash flow can be used to pay down the mortgage faster, generate higher returns, or cover unexpected expenses.

Net Operating Income (NOI): NOI is the profit generated by a rental property after deducting operating expenses. It is calculated as follows:

NOI = Rental Income – Operating Expenses

Where operating expenses include property taxes, insurance, maintenance, and other expenses.

Tips for Saving for a Down Payment

Saving for a down payment on an investment property can seem daunting, but with a strategic approach and consistent effort, it’s achievable. The key is to develop a solid plan, track your progress, and make adjustments along the way.

Budgeting and Reducing Expenses

A well-defined budget is crucial for maximizing your savings. Start by tracking your income and expenses for a few months to understand your spending patterns. Identify areas where you can cut back and allocate those savings towards your down payment goal.

- Reduce unnecessary expenses: This could include dining out less, canceling subscriptions you don’t use, or finding cheaper alternatives for entertainment and leisure activities.

- Negotiate bills: Contact your service providers, such as your internet, phone, and cable companies, to see if you can negotiate lower rates. Many providers offer discounts for bundling services or for long-term contracts.

- Shop around for better deals: Compare prices for groceries, insurance, and other essential goods and services to find the best value. Consider using online tools and price comparison websites to make this process easier.

- Consider downsizing: If you own a home, consider downsizing to a smaller property to free up cash flow. You could also explore renting out a spare room or basement to generate additional income.

Maximizing Income

Increasing your income can significantly accelerate your savings journey. Explore various avenues to boost your earnings, both through your current employment and by pursuing side hustles or additional income streams.

- Ask for a raise or promotion: If you’re performing well in your current role, consider asking for a raise or promotion. This can provide a substantial increase in your income.

- Take on a side hustle: Consider freelancing, tutoring, driving for a ride-sharing service, or starting an online business to generate extra income. Many platforms offer flexible work arrangements that can fit into your existing schedule.

- Invest in your skills: Invest in your education or training to acquire new skills that can make you more valuable in the job market. This can lead to higher earning potential and career advancement.

- Rent out a property: If you own a property, consider renting out a spare room or basement to generate rental income. This can provide a consistent stream of revenue that can be used towards your down payment.

Setting Realistic Goals and Establishing a Consistent Savings Plan

Setting realistic financial goals and establishing a consistent savings plan are essential for success. It’s important to understand the time it takes to accumulate the required down payment and to create a plan that aligns with your financial situation.

“Set SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound.”

- Determine your down payment target: Research the typical down payment requirements for investment properties in your desired location. Consider factors such as the type of property, loan type, and your credit score.

- Estimate your savings timeframe: Based on your income and expenses, estimate how long it will take you to save the required down payment. Be realistic about your savings potential and factor in any unexpected expenses that may arise.

- Automate your savings: Set up automatic transfers from your checking account to your savings account on a regular basis. This can help you stay consistent with your savings goals and prevent you from spending money you’ve allocated for your down payment.

- Review your progress regularly: Monitor your savings progress regularly to ensure you’re on track to meet your goals. Adjust your savings plan as needed to account for any changes in your income, expenses, or investment returns.

Accelerating Savings

Exploring strategies for accelerating your savings can significantly shorten the time it takes to reach your down payment goal. Consider utilizing high-yield savings accounts, investing in the stock market, or exploring other investment options.

- High-yield savings accounts: These accounts offer higher interest rates than traditional savings accounts, allowing your savings to grow faster. Research different banks and credit unions to find the best rates and terms.

- Investing in the stock market: Investing in the stock market can provide the potential for higher returns over the long term. However, it’s important to understand the risks involved and to invest only what you can afford to lose.

- Other investment options: Consider exploring other investment options, such as real estate investment trusts (REITs) or bonds, to diversify your portfolio and potentially earn higher returns. Consult with a financial advisor to determine the best investment strategy for your individual circumstances.

Investing in real estate requires careful consideration of various factors, and the down payment is a critical piece of the puzzle. Understanding the intricacies of down payment requirements, exploring financing options, and implementing smart savings strategies can set the stage for a successful investment journey. This guide has provided a comprehensive overview of the key aspects of down payment requirements, empowering you with the knowledge to make informed decisions and achieve your real estate investment goals.

FAQ Overview: Down Payment Required For Investment Property

What are the common loan types for investment properties?

The most common loan types for investment properties include conventional loans, FHA loans, and VA loans, each with its own down payment requirements and eligibility criteria.

Can I use a personal loan for an investment property down payment?

While you can technically use a personal loan for a down payment, it’s generally not recommended. Personal loans typically have higher interest rates than mortgages, making it a less cost-effective option.

What are the tax implications of investing in rental properties?

Investing in rental properties comes with various tax implications, including deductions for mortgage interest, property taxes, and depreciation. It’s essential to consult with a tax professional to understand the specific tax benefits and liabilities associated with your investment.

Securing an investment property often involves a substantial down payment, a crucial factor to consider when planning your investment strategy. If you’re looking for investment opportunities in the Davis area, davis investment properties might be a good place to start your research. Remember, the required down payment can vary depending on factors like loan type, property value, and your credit history, so be sure to do your due diligence and consult with a financial advisor.

The down payment required for an investment property can vary depending on the type of financing you secure and the lender’s requirements. If you’re considering investing in Arizona, you’ll want to familiarize yourself with the state’s unique real estate market and consider the services offered by experienced professionals in arizona property management & investments. They can provide valuable insights on securing financing and managing your investment, helping you navigate the complexities of down payments and other financial aspects of owning rental properties.

Securing financing for an investment property often requires a significant down payment, which can be a major hurdle for many investors. While single-family homes are popular, exploring multifamily investment properties could be a strategic move. These properties often offer the potential for greater cash flow and appreciation, which can help offset the initial down payment burden.