Does US Car Insurance Cover Pre-Existing Conditions?

Does US Car Insurance Cover Pre-Existing Conditions?

Car insurance is a necessity for anyone who owns or operates a vehicle in the United States. While most drivers are familiar with the basic elements of car insurance—liability coverage, collision coverage, and comprehensive coverage, to name a few—there’s a particular area that remains shrouded in mystery: how does car insurance handle pre-existing conditions? In this blog, we’ll delve deep into this often-overlooked aspect of auto insurance, shedding much-needed light on the nuances of coverage as they relate to pre-existing conditions.

Pre-existing conditions, a term more commonly associated with health insurance, refer to known issues or damages that existed before a new insurance policy takes effect. When it comes to car insurance, this could mean any previous accidents, damages, or mechanical problems your car may have had before the current policy began. This idea prompts a slew of questions for car owners: How do insurers evaluate pre-existing conditions when issuing policies? Are such conditions ever covered by car insurance, and if so, under what circumstances?

In the journey to unravel these questions, it’s vital to understand the role of pre-existing conditions in the claims process. One of the primary concerns for insurers is ensuring that they are not paying for damages or issues that existed before the coverage period. This factor not only influences the type of policy you might qualify for but also significantly impacts the premiums you will pay. For instance, previous claims and the overall condition of your vehicle may weigh heavily in risk assessments made by insurance companies.

Within this complex landscape, understanding the legal and industry standards related to pre-existing conditions is key. Insurance companies have specific guidelines on how pre-existing damages are assessed and handled. Often, a vehicle inspection or a report of the car’s history is taken into account when setting up a policy. This ensures that insurers are well-aware of the car’s condition at the outset, helping to determine the level of risk they are taking on.

Moreover, drivers must navigate the fine line between transparency and privacy, balancing the need to disclose certain information about their vehicle’s past while also protecting their own interests. The blog post will guide you through this process, revealing what information needs to be shared and what may remain confidential.

While we’ve touched on some of the foundational questions surrounding pre-existing conditions in car insurance, our subsequent discussion will dive deeper into how you can better position yourself with car insurers. We’ll explore effective strategies for managing your car’s documentation, the importance of vehicle maintenance records, and how these contribute to a more favorable outcome when discussing insurance policies with providers.

By the end of this post, you will not only have a clearer picture of whether US car insurance covers pre-existing conditions, but you’ll also gain insights into the negotiation and claims processes that could potentially save you money. With our expert advice, navigating the complex world of car insurance will become a much more manageable task.

Get ready to embark on a comprehensive exploration of car insurance dynamics as we answer the looming question: Does US Car Insurance Cover Pre-Existing Conditions? Our detailed exposition will arm you with the knowledge to make informed decisions, ensuring your wheels are properly protected without unexpected insurance snags.

Understanding Pre-Existing Conditions in Car Insurance

In the realm of car insurance, understanding what constitutes a “pre-existing condition” and how it affects coverage can often be confusing for policyholders. Different from health insurance, the term doesn’t directly apply as one might expect. Let’s dive deeper into what pre-existing conditions mean in the context of car insurance and how they influence your coverage options.

What Are Pre-Existing Conditions in Car Insurance?

Unlike health insurance, where pre-existing conditions often refer to prior medical issues, car insurance operates differently. In this domain, the concept is more related to pre-existing damages or issues with the vehicle that occurred before purchasing the insurance policy. Insurers are primarily concerned with the car’s condition at the time the coverage begins.

When you apply for car insurance, the insurer expects that the vehicle will be in good or reasonable condition unless stated otherwise. Any known damage or wear and tear existing before the policy is taken out is generally not covered.

Types of Pre-Existing Conditions in Vehicles

- Physical Damage: This includes any dents, scratches, or structural damage resulting from previous accidents or incidents. Insurance policies typically exclude coverage for any claims related to these existing issues.

- Mechanical Issues: Pre-existing mechanical problems, such as transmission faults, engine issues, or electrical failures, which existed before the new policy was issued, are also not covered.

- Wear and Tear: General wear and tear consist of issues like aging tires or brakes. Insurance does not serve as a means to cover such inevitable deterioration.

How Insurers Identify Pre-Existing Conditions

Insurers employ various methods to assess the condition of your car before providing coverage. Here are some steps typically involved:

Vehicle Inspection

Some insurers require an inspection of your vehicle before issuing a policy. This inspection helps them document the car’s current state, including any visible damages or issues.

Vehicle History Report

Companies might also review a vehicle history report. Services like CARFAX provide detailed records regarding a car’s past accidents, repairs, and ownership changes.

Photographic Evidence

Policyholders might be asked to provide photographs of their vehicle from different angles. It’s a way to showcase the car’s current condition clearly and can be part of the application process.

Implications of Pre-Existing Conditions on Coverage

Comprehending how pre-existing conditions affect your policy is crucial. Here are some of the most significant implications:

- Denial of Claims: Claims related to pre-existing damage or issues can be denied. For example, if you file a claim for bodywork damage that existed before your policy, it likely won’t be covered.

- Policy Invalidation: Failure to disclose known issues can result in more severe consequences, such as the cancellation of the policy. Insurers require honest disclosure to properly assess risk.

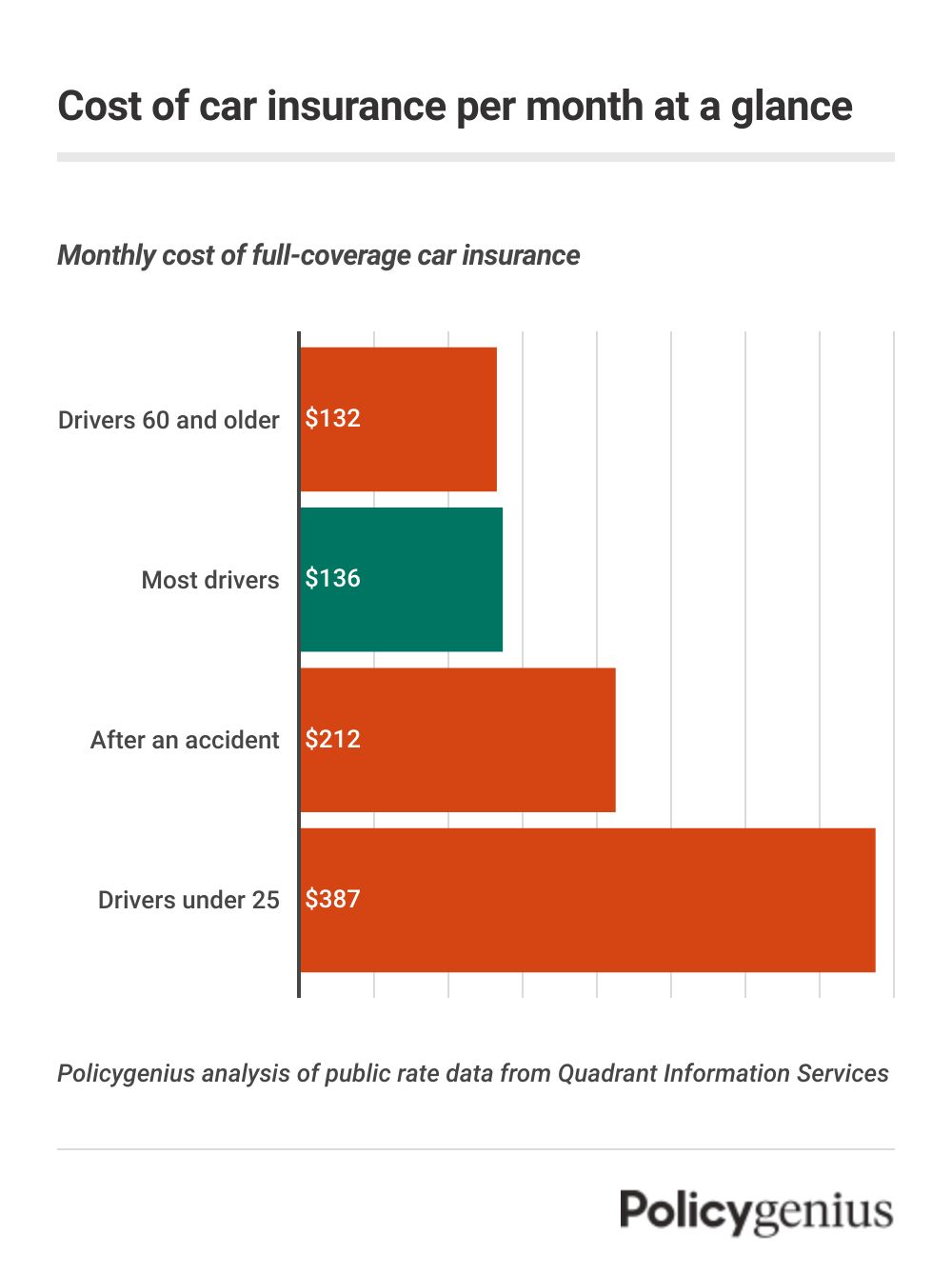

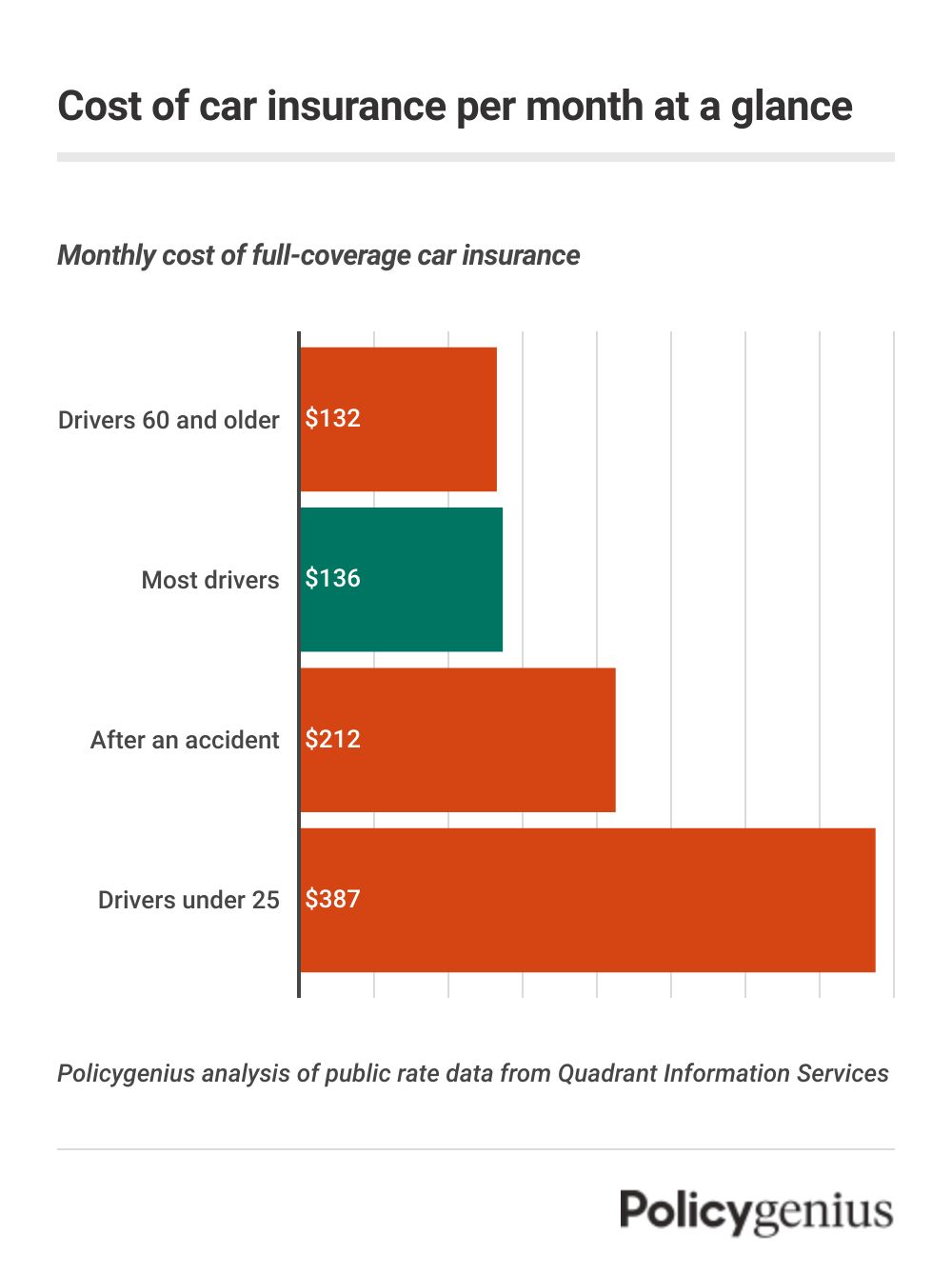

- Higher Premiums: A history of frequent claims or accidents noted on a vehicle history report might result in higher premiums. Although this doesn’t directly relate to coverage, it affects your ongoing costs.

Tips for Handling Pre-Existing Conditions

To manage pre-existing conditions effectively and ensure smooth proceedings with your insurer, consider these tips:

- Full Disclosure: Always inform your insurer of any pre-existing issues. Transparency is key to maintaining a favorable relationship with the insurance company.

- Maintain Records: Keep detailed records of all repairs and services performed on your vehicle. This documentation can serve as evidence of necessary repairs or upgrades made to the car.

- Regular Maintenance: Routine maintenance can prevent minor pre-existing conditions from escalating into more significant problems. Regular servicing of your car can help maintain its condition and minimize unexpected issues.

Common Misunderstandings About Pre-Existing Conditions

Here are some misconceptions that might arise when discussing pre-existing conditions in car insurance:

Belief in Blanket Coverage: Some policyholders mistakenly believe insurance covers any pre-existing issues automatically once a policy is in place. However, specific exclusions will apply to pre-existing damages, emphasizing the importance of understanding policy terms thoroughly.

Assuming Full Value Replacement: While insurance will cover repairs or reimburse for accidents occurring after the policy start, this doesn’t mean a replacement for vehicles with substantial pre-existing issues. Coverage adjustments and depreciation considerations are in play.

How to Effectively Shop for Car Insurance Considering Pre-Existing Conditions

When dealing with pre-existing conditions, a strategic approach to shopping for car insurance can influence your outcomes:

Compare Multiple Insurers

Each insurance company has its approach to handling pre-existing conditions. Comparing different insurers allows you to identify more favorable terms or exceptions that may benefit you.

Read Policy Details

Before committing to a policy, carefully read through the terms regarding pre-existing conditions. Understanding the nuances of what is and isn’t covered can prevent future disputes.

Consider Specialized Coverage

There may be options for specialized coverage that specifically addresses certain pre-existing conditions, particularly regarding mechanical problems. A consultation with an insurance broker might illuminate these opportunities.

By engaging with these steps, you can better navigate the insurance landscape, taking into account any pre-existing conditions and ensuring adequate protection without unwanted surprises.

As we wrap up our exploration of whether U.S. car insurance policies cover pre-existing conditions, it’s essential to revisit the key points we’ve discussed. This topic requires careful consideration because it directly influences both your financial security and peace of mind as a car owner. Understanding the nuances of car insurance policies and how they relate to pre-existing damage or conditions on your vehicle can help you make better-informed decisions and potentially save you from unexpected expenses.

First and foremost, we emphasized the definition and scope of pre-existing conditions in the context of car insurance. Generally, pre-existing conditions refer to damages or issues with your vehicle that existed prior to the initiation of a new insurance policy. This includes anything from minor dents and scratches to more severe mechanical problems. The primary concern for insurers is usually the risk they are taking on; thus, many pre-existing issues might be excluded from coverage.

We then moved on to the transparency of the car insurance industry. Most U.S. car insurance policies clearly state that pre-existing damages are excluded from coverage. The rationale is straightforward: insurance is designed to protect you against unforeseen incidents and risks rather than pre-existing conditions that were present beforehand. It’s crucial for policyholders to be open and honest during the application process, disclosing any existing damage. Misrepresentation can lead to claim denials or policy cancellation, highlighting the importance of integrity when obtaining car insurance.

Further, we dissect the implications of comprehensive and collision coverage. While these policies offer protection against a wide range of unforeseen events—such as accidents, theft, and natural disasters—they do not typically cover repairs for damages that were present before you acquired the policy. It’s important to examine your policy details or contact your insurance provider to understand fully what your policy entails and the specifics of your coverage options.

We also navigated through strategies for addressing pre-existing conditions and ensuring adequate insurance coverage. Many car owners choose to address pre-existing damages out of pocket before purchasing a new insurance policy, which can sometimes lead to favorable premium rates. Alternatively, securing a mechanical breakdown insurance (MBI) could be an option for some vehicle owners, although it typically focuses on mechanical failures rather than visible damage. Moreover, we underscored the importance of keeping comprehensive records of your vehicle’s condition, which could be invaluable during the claims process.

The technology-savvy readers might have appreciated our brief look into the role of technology and vehicle tracking systems. Telematics and other digital systems can provide insurance companies with accurate data regarding vehicle conditions and driving habits, which might influence the coverage and premiums. These tools may also offer discounts for safe driving while simultaneously solidifying your position if a dispute about pre-existing conditions arises.

Ultimately, successfully navigating the intricacies of car insurance and pre-existing conditions relies heavily on understanding your rights and responsibilities as a policyholder. We highlighted the consumer’s power when reviewing policy documents, comparing different providers, and seeking legal advice when necessary. Being proactive in these practices not only helps prevent potential disputes but also secures better coverage tailored to your specific needs.

Call to Action

As you assess your current car insurance situation or contemplate switching providers, having a clear plan of action is crucial. Here are several steps you can take to dive deeper into this topic:

- Review Your Current Policy: Go through your existing car insurance policy with a fine-tooth comb. Take note of any clauses regarding pre-existing conditions or damage, and reach out to your insurance provider for clarification if necessary.

- Get Multiple Quotes: If you’re considering a change, don’t hesitate to shop around. Different insurers have varying policies and premium rates. Utilize comparative tools online to find options that suit your requirements.

- Communicate with an Insurance Agent or Broker: An experienced agent can provide additional insights tailored to your situation. They can outline the potential consequences of identified pre-existing damages on your coverage and claims.

- Maintain Thorough Vehicle Documentation: Regular vehicle inspections and keeping a detailed log can prove invaluable. Ensure you have photographic evidence and service records stored securely.

- Stay Informed: Stay abreast of any updates in the insurance industry regarding policy changes or technological advancements that could affect your coverage for pre-existing conditions.

Remember, knowledge is power. The more informed you are, the better decisions you can make regarding your car insurance coverage and potential risks. Take control of your own situation by leveraging this understanding to secure a policy that meets your needs and guards against undue surprises.

At the end of the day, the relationship you have with car insurance is a two-way street. By arming yourself with the right information and asking the hard questions, you can ensure that this partnership serves your best interests. Drive confidently, knowing you’re protected not just against unforeseen accidents, but also by the informed actions you have taken. Share your experiences or any questions with our community below, and together, let’s continue driving towards a more transparent and understanding car insurance landscape.

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology