David Ramsey Investment Calculator A Guide to Building Wealth

The David Ramsey Investment Calculator is a powerful tool that helps you understand and plan your financial future, aligning with his renowned philosophy of debt-free living and systematic wealth building. Ramsey’s approach emphasizes the importance of eliminating debt, creating a solid financial foundation, and investing strategically for long-term growth. The calculator provides a framework for visualizing your investment goals and potential outcomes, empowering you to make informed decisions about your financial journey.

The calculator works by taking into account your investment amount, time horizon, and expected return. It then projects your portfolio growth over time, showing you how your investments could potentially compound and generate income. This information can be invaluable for making informed decisions about your investment strategy, whether you’re saving for retirement, a down payment on a house, or simply building a nest egg.

David Ramsey’s Investment Philosophy

David Ramsey, a well-known personal finance expert, advocates a specific investment philosophy focused on debt-free living and building wealth through disciplined saving. His approach emphasizes financial independence and long-term financial stability, aiming to empower individuals to take control of their finances and achieve their financial goals.

Core Principles of David Ramsey’s Investment Approach

David Ramsey’s investment philosophy is built on a foundation of financial discipline and a systematic approach to wealth accumulation. He emphasizes a debt-free lifestyle as the cornerstone of financial success, believing that eliminating debt frees up resources for saving and investing. Ramsey advocates for a step-by-step approach to financial freedom, starting with building an emergency fund and then systematically eliminating debt before embarking on investing.

Ramsey’s Recommended Investment Strategies

Ramsey recommends a variety of investment strategies, tailored to different risk tolerances and financial goals. He emphasizes the importance of diversification and long-term investing, advocating for a balanced portfolio that includes a mix of stocks, bonds, and real estate.

Stocks

Ramsey suggests investing in stocks, particularly through index funds or mutual funds, for long-term growth. He believes that stocks, while volatile in the short term, offer the potential for significant returns over time.

Bonds

Bonds provide a more conservative investment option compared to stocks, offering lower returns but also lower risk. Ramsey recommends including bonds in a portfolio to balance out the risk of stocks and provide a steady stream of income.

Real Estate

Ramsey advocates for investing in real estate, either through rental properties or purchasing a primary residence. He believes that real estate can be a valuable asset, providing both income and appreciation potential.

“Investing in real estate is the best way to build wealth.” – David Ramsey

Understanding the David Ramsey Investment Calculator

The David Ramsey Investment Calculator is a tool designed to help individuals visualize their potential investment growth over time. It provides a simple yet effective way to understand the power of compounding and the impact of consistent saving and investing.

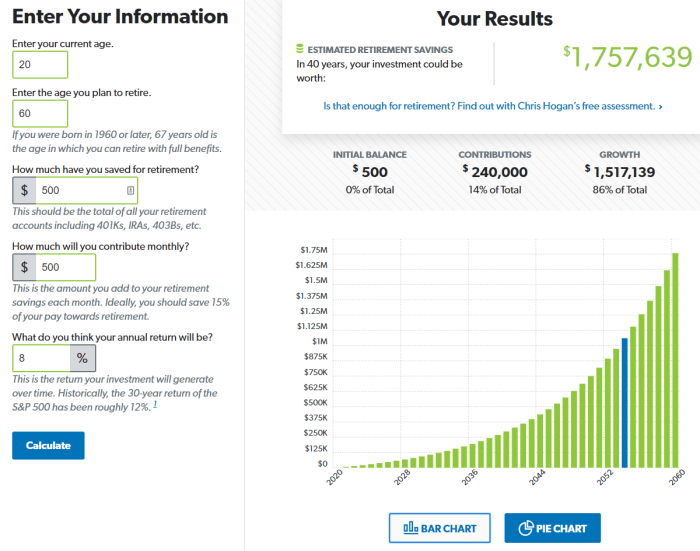

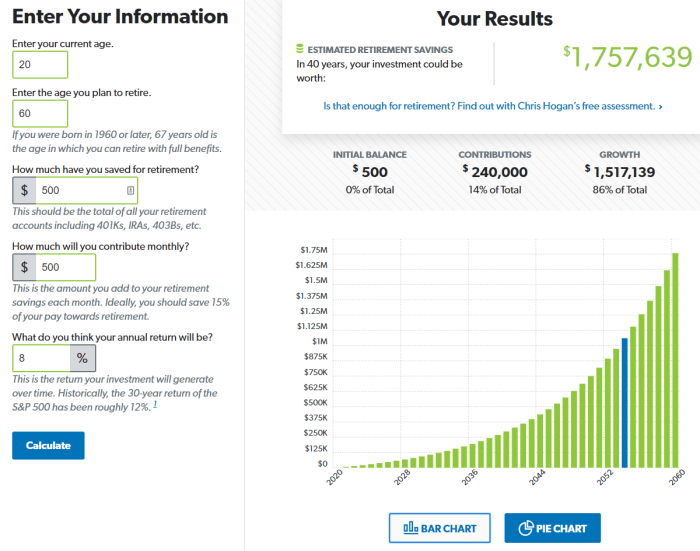

Key Inputs

The calculator requires several key inputs to generate projections. These inputs are essential for providing accurate and personalized results.

- Investment Amount: This represents the initial amount of money you plan to invest. It can be a lump sum or a recurring monthly contribution.

- Time Horizon: This indicates the duration of your investment, typically expressed in years. It reflects your long-term financial goals and the time you have to achieve them.

- Expected Return: This refers to the average annual return you anticipate on your investments. It’s essential to consider historical market performance and your risk tolerance when estimating this value.

Outputs Generated

The calculator generates various outputs to help you understand the potential growth of your investments.

- Projected Portfolio Growth: This shows the estimated value of your investment portfolio at the end of your chosen time horizon. It demonstrates the power of compounding, where your initial investment grows over time, generating returns that themselves earn returns.

- Potential Income: The calculator can also estimate the potential income you might generate from your investments, such as dividends from stocks or interest from bonds. This helps you visualize how your investments can contribute to your financial goals.

Using the Calculator for Investment Planning

The David Ramsey Investment Calculator is a valuable tool for visualizing your investment journey. It helps you understand the potential growth of your investments over time, considering factors like initial investment amount, expected return, and time horizon. By inputting different scenarios, you can gain insights into how these variables impact your future financial goals.

Understanding the Input Variables

The calculator requires you to input specific information to generate projections. These variables play a crucial role in determining your investment outcomes.

- Investment Amount: This is the initial amount you plan to invest. The higher the initial investment, the greater the potential for growth.

- Expected Return: This represents the average annual return you anticipate on your investments. It’s important to set realistic expectations based on historical market performance and your chosen investment strategy.

- Time Horizon: This refers to the length of time you plan to keep your investments. Longer time horizons generally allow for greater compounding and potentially higher returns.

Scenario Analysis: Exploring Different Investment Options, David ramsey investment calculator

To illustrate the calculator’s utility, let’s explore a few scenarios with varying investment amounts, time horizons, and expected returns.

- Scenario 1: You invest $5,000 with an expected annual return of 7% for 10 years. The calculator might show a projected balance of around $9,835. This scenario demonstrates the power of compounding over time.

- Scenario 2: You invest $10,000 with an expected annual return of 5% for 20 years. The calculator might project a balance of around $26,533. This scenario highlights the impact of a longer time horizon on investment growth.

- Scenario 3: You invest $2,000 with an expected annual return of 10% for 5 years. The calculator might project a balance of around $3,221. This scenario illustrates the potential for higher returns with a higher expected return, although it’s important to remember that higher returns often come with greater risk.

Analyzing the Results

The calculator’s results are presented in a clear and concise format, typically showcasing the projected balance at the end of the chosen time horizon. By comparing different scenarios, you can gain valuable insights into the impact of various factors on your investment outcomes.

- Impact of Investment Amount: Increasing the initial investment amount leads to a higher projected balance, assuming all other factors remain constant. This underscores the importance of saving and investing early and often.

- Impact of Expected Return: A higher expected return generally results in a larger projected balance, but it’s crucial to remember that higher returns often come with greater risk. It’s essential to choose investments that align with your risk tolerance.

- Impact of Time Horizon: Longer time horizons allow for greater compounding, which can significantly enhance investment growth. This highlights the importance of long-term investing and patience in achieving your financial goals.

Key Considerations

While the calculator provides valuable projections, it’s essential to remember that these are estimates based on assumptions. Actual investment outcomes can vary depending on market conditions, investment performance, and other unforeseen factors. It’s crucial to use the calculator as a tool for planning and understanding potential outcomes, but not as a guarantee of future results.

“Investing is a long-term game. Don’t expect to get rich quick. Be patient and stay disciplined. The calculator can help you visualize your journey, but it’s up to you to make informed decisions and stick to your plan.” – David Ramsey

Benefits and Limitations of the David Ramsey Investment Calculator

The David Ramsey Investment Calculator is a valuable tool for those following the Baby Steps approach to financial planning. It provides a clear and straightforward way to visualize how your investments will grow over time and helps you track your progress toward your financial goals. However, it’s important to understand both the advantages and limitations of the calculator before relying on it as your sole source of investment guidance.

Advantages of Using the Calculator

The David Ramsey Investment Calculator offers several benefits that make it a useful tool for many investors.

- Simplicity: The calculator is designed to be user-friendly, with a simple interface and straightforward inputs. It doesn’t require extensive financial knowledge to use, making it accessible to individuals at all levels of investment experience.

- Visualization: The calculator allows you to visualize the growth of your investments over time, helping you to understand the power of compound interest and the potential impact of your investment decisions.

- Goal Setting: The calculator helps you to set specific financial goals and track your progress toward achieving them. This can be a powerful motivator and provide a sense of direction for your investment journey.

- Customization: The calculator allows you to adjust various parameters, such as the amount you invest, the rate of return, and the length of time you plan to invest. This flexibility helps you tailor the calculations to your specific circumstances and goals.

Limitations of the Calculator

While the David Ramsey Investment Calculator has its benefits, it’s crucial to acknowledge its limitations:

- Simplified Assumptions: The calculator uses simplified assumptions about investment returns, inflation, and other economic factors. These assumptions may not always accurately reflect real-world conditions, which can lead to inaccurate projections.

- Lack of Specific Investment Recommendations: The calculator doesn’t provide specific investment recommendations, such as which stocks or mutual funds to invest in. It focuses on overall investment planning rather than providing detailed asset allocation advice.

- Limited Risk Assessment: The calculator doesn’t incorporate a comprehensive assessment of your risk tolerance or investment time horizon. This can lead to unrealistic expectations or inappropriate investment strategies for your individual circumstances.

Comparison to Other Investment Planning Tools

The David Ramsey Investment Calculator is one of many tools available for investment planning. It aligns with the Baby Steps approach, which emphasizes debt reduction and emergency fund building before investing.

- Traditional Financial Planning: Traditional financial planning often involves a more comprehensive assessment of your financial situation, risk tolerance, and investment goals. It may include personalized asset allocation recommendations and a broader range of investment strategies.

- Robo-Advisors: Robo-advisors use algorithms to create automated investment portfolios based on your financial goals and risk tolerance. They often offer a wider range of investment options and may incorporate more sophisticated financial modeling than the David Ramsey Investment Calculator.

Alternative Investment Strategies and Resources

David Ramsey’s investment philosophy emphasizes debt elimination, building an emergency fund, and investing in a diversified portfolio of low-cost index funds. While this approach is sound, there are alternative investment strategies that align with his core principles, offering potential diversification and growth opportunities.

Here are some alternative investment strategies that align with David Ramsey’s philosophy:

Real Estate Investing

Real estate investing can be a good way to diversify your portfolio and generate passive income. It aligns with Ramsey’s principles of building wealth through tangible assets and avoiding debt. While buying rental properties can be expensive, you can explore other options like investing in real estate investment trusts (REITs), which are publicly traded companies that own and operate income-producing real estate. REITs provide diversification, liquidity, and potential for growth.

Precious Metals

Precious metals like gold and silver are considered safe haven assets that can help preserve wealth during economic uncertainty. They are not correlated with stocks and bonds, offering a hedge against inflation and market volatility. While Ramsey advocates for a balanced portfolio, he also recognizes the value of having some assets that are less volatile than stocks. However, it’s crucial to invest in precious metals responsibly and diversify your portfolio to mitigate risks.

Private Equity

Private equity investments involve owning a stake in privately held companies. While typically reserved for accredited investors, some platforms offer access to private equity opportunities for smaller investors. This can provide exposure to companies with high growth potential, but it’s important to understand the risks associated with illiquidity and limited transparency.

Alternative Resources

To learn more about these and other alternative investment strategies, you can consult these reputable financial resources:

- The Motley Fool: A popular website and publication that provides investment advice and analysis.

- Morningstar: A leading provider of investment research, data, and analysis.

- Investopedia: A comprehensive resource for financial education, covering a wide range of topics, including alternative investments.

- Vanguard: A renowned investment company offering low-cost index funds and other investment products.

- Fidelity: Another leading investment firm offering a range of investment options, including mutual funds, ETFs, and retirement accounts.

Investment Tool Comparison

Here’s a table comparing the features and benefits of different investment tools and platforms:

| Tool/Platform | Features | Benefits |

|---|---|---|

| Vanguard | Low-cost index funds, ETFs, mutual funds, retirement accounts | Diversification, low fees, ease of use |

| Fidelity | Mutual funds, ETFs, retirement accounts, brokerage accounts | Wide range of investment options, research tools, customer support |

| Schwab | Brokerage accounts, mutual funds, ETFs, retirement accounts | Low fees, research tools, fractional shares |

| Robinhood | Brokerage accounts, fractional shares, commission-free trading | Easy to use, mobile-friendly, commission-free trading |

| Acorns | Micro-investing, automated investing, round-up feature | Convenient, affordable, automated investing |

By using the David Ramsey Investment Calculator, you gain a clear understanding of the potential impact of your investment choices. You can experiment with different scenarios, adjusting factors like investment amount, time horizon, and expected return to see how they affect your projected outcomes. This process can help you identify the best strategies for reaching your financial goals, whether it’s building wealth over time, achieving financial independence, or securing your future. Remember, while the calculator provides valuable insights, it’s important to consult with a financial advisor for personalized guidance and to develop a comprehensive investment plan tailored to your specific needs and circumstances.

FAQ Guide: David Ramsey Investment Calculator

What are some of the investment strategies recommended by David Ramsey?

David Ramsey advocates for a diversified investment approach, focusing on low-cost index funds and real estate. He emphasizes the importance of long-term investing and avoiding speculative or high-risk investments.

How accurate are the projections generated by the David Ramsey Investment Calculator?

The calculator provides estimates based on historical market data and assumptions about future returns. While these projections can be helpful for planning purposes, they are not guarantees of future performance. Market conditions can fluctuate, and actual returns may vary significantly.

Is the David Ramsey Investment Calculator suitable for everyone?

The calculator can be a useful tool for many individuals, particularly those who are new to investing or looking for a simplified approach. However, it’s important to consider your individual circumstances and consult with a financial advisor for personalized guidance.

What are some alternative investment planning tools and resources?

There are numerous investment planning tools and resources available, including online calculators, investment platforms, and financial advisors. Some popular alternatives include Vanguard’s Investment Planning Tools, Fidelity’s Investment Planning Services, and Betterment’s Robo-Advisor.

The David Ramsey investment calculator is a great tool for visualizing your financial goals. However, if you’re considering a more hands-on approach, you might want to explore Portugal property investment. With a strong economy and growing tourism industry, Portugal offers a promising real estate market. Ultimately, the best investment strategy for you will depend on your individual risk tolerance and financial situation, which the David Ramsey calculator can help you assess.

David Ramsey’s investment calculator is a great tool for planning your financial future, but it doesn’t always account for the unexpected costs of renovating an investment property. If you’re considering a fixer-upper, be sure to explore options like a renovation loan for investment property to help cover those expenses. By factoring in these additional costs, you can get a more realistic picture of your overall investment potential and ensure your financial goals are on track.

David Ramsey’s investment calculator is a helpful tool for budgeting and planning your financial future, especially if you’re considering real estate. If you’re looking to diversify your portfolio, consider investing in Atlanta investment properties , a market known for its strong rental demand and potential for appreciation. The calculator can help you determine how much you can afford to invest, allowing you to make informed decisions about your real estate investments.