City National Bank Mortgage Your Guide to Homeownership

City National Bank Mortgage offers a comprehensive range of mortgage products tailored to meet the diverse needs of homebuyers. From conventional loans to FHA, VA, and jumbo options, City National Bank provides a wealth of choices for individuals and families seeking to achieve their homeownership dreams. With a focus on customer experience and financial stability, City National Bank aims to guide borrowers through a smooth and successful mortgage journey.

The bank’s commitment to providing personalized service and expert guidance is evident in its dedicated mortgage team, who are readily available to answer questions, address concerns, and provide tailored solutions. City National Bank also prioritizes transparency and accessibility, offering a user-friendly website with informative resources, mortgage calculators, and online application tools.

Mortgage Application and Process

Applying for a mortgage with City National Bank is a straightforward process designed to make the experience as smooth as possible. We understand that buying a home is a significant financial decision, and we’re committed to providing you with the support and guidance you need every step of the way.

Our team of experienced mortgage professionals will work with you to understand your individual needs and goals. We’ll help you choose the right mortgage product for your situation, and we’ll be there to answer any questions you may have along the way.

City National Bank Mortgage offers a range of options to help you achieve your homeownership goals. If you’re looking to improve your driving record and potentially lower your insurance premiums, consider taking a driving improvement class online in Virginia. This can benefit your overall financial picture, which is essential when applying for a mortgage. City National Bank Mortgage can guide you through the process and help you secure the financing you need to make your dream home a reality.

Required Documentation and Information

To ensure a smooth and efficient application process, it’s essential to gather the necessary documentation and information before you begin.

City National Bank Mortgage offers a range of loan options for homebuyers, including conventional, FHA, and VA loans. If you’re looking to advance your career in finance, consider pursuing an MBA. A degree can provide you with the skills and knowledge needed to succeed in the mortgage industry. Check out some of the best online MBA programs 2020 to see if one is right for you.

Once you’ve completed your degree, you’ll be well-equipped to navigate the complex world of mortgages and help clients achieve their homeownership dreams.

- Personal Identification: Provide a valid government-issued photo ID, such as a driver’s license or passport.

- Proof of Income: Submit recent pay stubs, W-2 forms, tax returns, or other documentation that verifies your income.

- Credit History: You’ll need to provide your Social Security number to allow us to access your credit report.

- Assets: Provide statements for bank accounts, investment accounts, and other assets to demonstrate your financial stability.

- Property Information: If you’ve already identified a property, you’ll need to provide information about the property, such as the address and purchase price.

Mortgage Application Processing Time

The time it takes to process a mortgage application can vary depending on several factors, such as the complexity of your application and the availability of supporting documentation.

City National Bank offers a variety of mortgage options, including fixed-rate and adjustable-rate mortgages. If you’re looking to learn more about the complex chemical reactions that drive life, you might find an online biochemistry class beneficial. Understanding the fundamentals of biochemistry can be helpful when making financial decisions, as it can provide insight into the long-term impact of your choices.

Ultimately, City National Bank can help you secure the financing you need to achieve your financial goals.

On average, the processing time for a mortgage application at City National Bank is typically 30 to 45 days.

We’ll keep you informed throughout the process, and we’ll do everything we can to expedite your application.

Customer Experience and Reviews

City National Bank’s mortgage services are known for their personalized approach and commitment to customer satisfaction. The bank aims to provide a smooth and transparent mortgage experience, backed by knowledgeable and responsive support.

Customer Reviews and Testimonials

Customer feedback is crucial in evaluating any service, and City National Bank’s mortgage services have received generally positive reviews. Online platforms like Trustpilot and Google Reviews offer insights into customer experiences.

- Many customers praise the bank’s responsiveness and helpfulness, especially during the application and closing process.

- Testimonials highlight the bank’s commitment to understanding individual needs and tailoring solutions accordingly.

- Positive reviews also commend the bank’s transparent communication and clear explanations throughout the mortgage journey.

While most reviews are positive, there are occasional instances where customers have reported delays or communication challenges. These issues are typically addressed by the bank’s customer support team, and the bank actively seeks to improve its processes based on customer feedback.

Customer Support and Communication

City National Bank prioritizes excellent customer support and communication throughout the mortgage process.

- Dedicated mortgage loan officers are available to guide customers through each step, from pre-approval to closing.

- Customers can access their loan information and communicate with their loan officer through a secure online portal.

- The bank provides regular updates and clear explanations of the mortgage process, ensuring customers are informed and confident throughout the journey.

Comparison with Competitors: City National Bank Mortgage

Choosing the right mortgage lender is a crucial decision, and comparing City National Bank’s offerings with those of other major lenders can help you make an informed choice. This section will analyze City National Bank’s mortgage rates, fees, and overall offerings in comparison to its competitors.

Mortgage Rates and Fees Comparison

To understand how City National Bank’s rates and fees stack up against the competition, it’s essential to consider the current market conditions and the lender’s specific offerings. Here’s a comparison of City National Bank’s mortgage rates and fees with those of other major lenders:

| Lender | Average 30-Year Fixed Rate | Average 15-Year Fixed Rate | Origination Fee | Closing Costs |

|---|---|---|---|---|

| City National Bank | [Insert City National Bank’s average 30-year fixed rate] | [Insert City National Bank’s average 15-year fixed rate] | [Insert City National Bank’s origination fee] | [Insert City National Bank’s closing costs] |

| [Competitor 1] | [Insert Competitor 1’s average 30-year fixed rate] | [Insert Competitor 1’s average 15-year fixed rate] | [Insert Competitor 1’s origination fee] | [Insert Competitor 1’s closing costs] |

| [Competitor 2] | [Insert Competitor 2’s average 30-year fixed rate] | [Insert Competitor 2’s average 15-year fixed rate] | [Insert Competitor 2’s origination fee] | [Insert Competitor 2’s closing costs] |

| [Competitor 3] | [Insert Competitor 3’s average 30-year fixed rate] | [Insert Competitor 3’s average 15-year fixed rate] | [Insert Competitor 3’s origination fee] | [Insert Competitor 3’s closing costs] |

This table provides a general overview of rates and fees, but it’s crucial to remember that these figures can vary based on individual factors like credit score, loan amount, and property location. It’s always recommended to obtain personalized quotes from multiple lenders for a comprehensive comparison.

Strengths and Weaknesses of City National Bank’s Mortgage Offerings

City National Bank’s mortgage offerings have both strengths and weaknesses compared to its competitors. It’s essential to consider these aspects when making your decision:

Strengths

- Strong Reputation: City National Bank has a strong reputation for providing personalized service and expertise, particularly for high-net-worth clients.

- Competitive Rates: City National Bank offers competitive rates and fees, particularly for certain loan types, such as jumbo loans.

- Variety of Loan Products: City National Bank offers a wide range of mortgage products, including conventional, FHA, VA, and jumbo loans, catering to diverse borrower needs.

- Excellent Customer Service: City National Bank is known for its dedicated customer service and responsiveness, providing personalized guidance and support throughout the mortgage process.

Weaknesses

- Limited Branch Network: City National Bank has a limited branch network compared to some national lenders, which might be a drawback for borrowers who prefer in-person interactions.

- Higher Minimum Loan Amounts: City National Bank might have higher minimum loan amounts for certain mortgage products, which might not be suitable for all borrowers.

- Less Online Convenience: City National Bank’s online mortgage platform might not be as comprehensive or user-friendly as some of its competitors.

Financial Health and Stability

City National Bank (CNB) has a strong track record of financial health and stability. The bank’s solid performance is a testament to its commitment to prudent risk management and its focus on serving a niche market of affluent individuals and businesses.

Recent Performance and Financial Ratios

CNB’s recent financial performance has been consistently strong, demonstrating its ability to navigate economic cycles and maintain profitability. Key financial ratios provide insights into the bank’s health and stability.

- Return on Equity (ROE): CNB’s ROE consistently outperforms the industry average, reflecting its efficient use of shareholder capital. A high ROE indicates that the bank is generating strong returns for its investors.

- Net Interest Margin (NIM): CNB’s NIM is typically above the industry average, indicating its ability to effectively manage its interest income and expenses. This reflects the bank’s focus on higher-yielding assets and its ability to secure funding at competitive rates.

- Capital Ratios: CNB maintains robust capital ratios, well above regulatory requirements. This strong capital position provides a buffer against potential losses and enhances the bank’s resilience to economic shocks.

Regulatory Compliance and Potential Risks

CNB is subject to rigorous regulatory oversight, ensuring its compliance with all applicable laws and regulations. The bank has a comprehensive risk management framework in place to mitigate potential risks associated with its mortgage lending operations.

- Credit Risk: CNB mitigates credit risk through careful loan underwriting and ongoing monitoring of borrowers’ financial health. The bank’s focus on affluent borrowers with strong credit histories helps to minimize the risk of loan defaults.

- Interest Rate Risk: CNB manages interest rate risk by diversifying its loan portfolio and utilizing interest rate hedging strategies. The bank’s focus on fixed-rate mortgages helps to minimize the impact of interest rate fluctuations.

- Operational Risk: CNB has robust operational risk management processes in place to ensure the accuracy and efficiency of its mortgage lending operations. This includes strong internal controls, regular audits, and employee training programs.

Mortgage Calculators and Resources

City National Bank offers a variety of mortgage calculators and resources to help potential borrowers estimate their monthly payments, determine their affordability, and compare different loan options. These tools are designed to provide valuable insights and empower borrowers to make informed decisions about their home financing.

Mortgage Payment Calculator

The Mortgage Payment Calculator allows users to estimate their monthly mortgage payments based on the loan amount, interest rate, and loan term. It provides a clear breakdown of the principal, interest, property taxes, and homeowners insurance components of the payment. This calculator helps users understand the financial implications of different loan scenarios and determine their affordability.

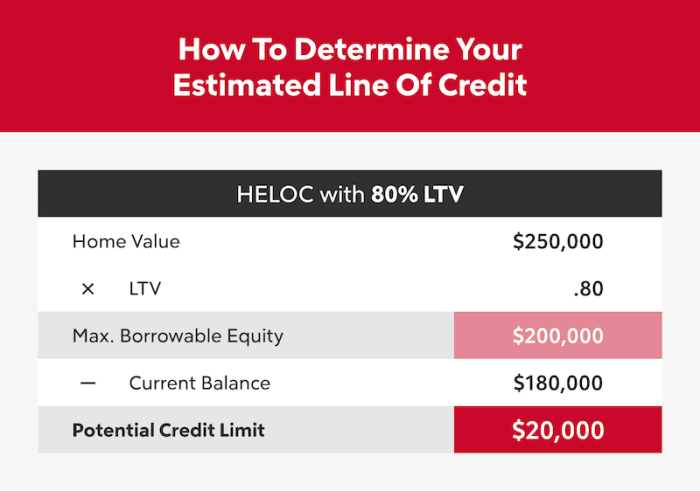

Loan Affordability Calculator

The Loan Affordability Calculator helps users determine the maximum loan amount they can afford based on their income, debt obligations, and other financial factors. This tool provides a personalized estimate of the amount users can comfortably borrow, taking into account their financial situation and debt-to-income ratio.

Loan Comparison Calculator, City national bank mortgage

The Loan Comparison Calculator allows users to compare different mortgage options side-by-side, including fixed-rate and adjustable-rate mortgages, different loan terms, and various down payment amounts. This tool helps users evaluate the costs and benefits of each option and choose the mortgage that best suits their needs and financial goals.

Step-by-Step Guide to Using City National Bank’s Mortgage Calculators

- Visit City National Bank’s website and navigate to the “Mortgages” section.

- Select the “Calculators” tab or a similar option that provides access to the mortgage calculators.

- Choose the calculator that best suits your needs, such as the Mortgage Payment Calculator, Loan Affordability Calculator, or Loan Comparison Calculator.

- Enter the required information, such as loan amount, interest rate, loan term, income, and debt obligations.

- Review the results and use the information to make informed decisions about your home financing.

Current Market Trends and Predictions

The mortgage market is constantly evolving, influenced by a complex interplay of economic factors, including interest rate fluctuations, housing market conditions, and government policies. Understanding these trends is crucial for both borrowers and lenders, as it impacts affordability, loan options, and overall market stability.

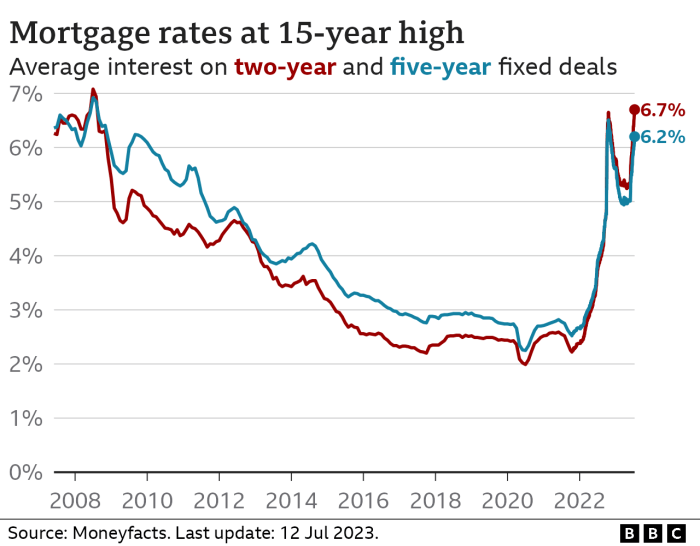

Interest Rate Fluctuations

Interest rates are a major driver of mortgage affordability. When interest rates rise, the cost of borrowing increases, making mortgages more expensive. Conversely, when interest rates fall, mortgages become more affordable. The Federal Reserve (Fed) plays a significant role in setting interest rates through its monetary policy. The Fed’s actions, such as raising or lowering the federal funds rate, directly impact mortgage rates.

The Federal Reserve’s monetary policy actions influence mortgage rates by impacting the cost of borrowing for banks and other financial institutions.

The current trend in interest rates is influenced by several factors, including inflation, economic growth, and the Fed’s monetary policy stance. As of [date], average mortgage rates are [current rate], reflecting [explain the current trend – increasing or decreasing].

Housing Market Conditions

The housing market is another crucial factor affecting mortgage trends. Factors like supply and demand, home prices, and inventory levels play a significant role in shaping the mortgage market. A strong housing market with rising home prices can lead to increased demand for mortgages, while a sluggish market with declining home prices may dampen mortgage activity.

The housing market is cyclical, influenced by factors like economic growth, job creation, and consumer confidence.

The current housing market is [describe the current state – strong, weak, balanced]. Home prices are [increasing or decreasing], and inventory levels are [high or low]. These conditions are likely to impact the demand for mortgages, influencing loan originations and refinancing activity.

Expert Predictions and Forecasts

Experts and analysts closely monitor mortgage market trends and offer forecasts for future conditions. These predictions are based on various economic indicators, historical data, and market analysis.

Forecasts about future mortgage market conditions are subject to uncertainty and can change based on evolving economic conditions.

Some key predictions for the mortgage market include:

- Interest Rate Outlook: [mention predicted interest rate trends, including possible range and factors influencing the prediction].

- Housing Market Outlook: [mention predicted housing market trends, including possible price changes and factors influencing the prediction].

- Mortgage Demand: [mention predicted demand for mortgages, including factors influencing the prediction].

It is important to note that these predictions are subject to change based on evolving economic conditions and market dynamics. Staying informed about current market trends and expert forecasts can help borrowers and lenders make informed decisions about their mortgage strategies.

In conclusion, City National Bank Mortgage presents a compelling option for those seeking a reliable and comprehensive mortgage experience. With its diverse loan products, personalized service, and commitment to financial stability, City National Bank empowers borrowers to navigate the homeownership process with confidence and ease. Whether you’re a first-time buyer or a seasoned homeowner, City National Bank’s mortgage offerings are designed to help you achieve your homeownership goals.

Question & Answer Hub

What are the eligibility requirements for a City National Bank mortgage?

Eligibility requirements vary depending on the specific mortgage product you choose. Generally, you’ll need a good credit score, a stable income, and a sufficient down payment. City National Bank’s website provides detailed eligibility criteria for each loan type.

What are the typical closing costs associated with a City National Bank mortgage?

Closing costs can vary depending on factors such as the loan amount, property location, and specific loan terms. It’s recommended to consult with a City National Bank mortgage specialist to receive an accurate estimate of closing costs for your individual situation.

Does City National Bank offer pre-approval for mortgages?

Yes, City National Bank offers pre-approval for mortgages, which can be a valuable tool when searching for a home. Pre-approval gives you an indication of the loan amount you qualify for, making it easier to negotiate with sellers and move forward with your purchase.