Car Insurance Iowa Navigating Your Options

Car insurance Iowa is a vital aspect of responsible driving in the Hawkeye State. Navigating the complex world of car insurance can be overwhelming, especially with the unique regulations and factors that influence premiums in Iowa. Understanding your options, coverage requirements, and potential cost-saving strategies is crucial for ensuring you have the right protection at an affordable price.

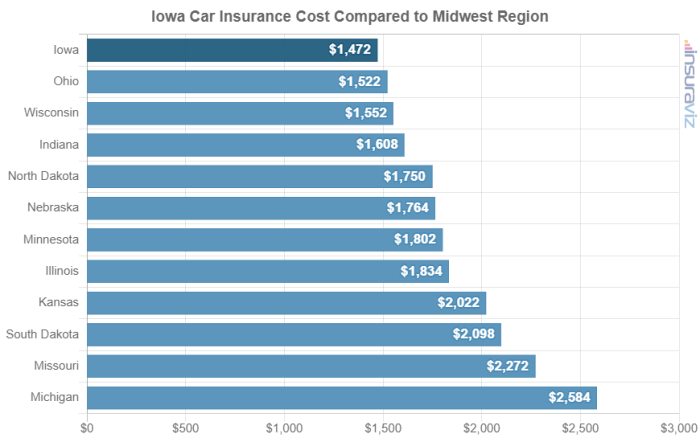

Iowa’s car insurance market is shaped by its own set of regulations, including mandatory coverage types and specific requirements for insurance providers. The state also has its own average insurance costs, which can vary depending on factors like your driving history, the type of vehicle you own, and your location. Understanding these nuances is essential for making informed decisions about your car insurance in Iowa.

Understanding Iowa’s Car Insurance Landscape

Navigating the world of car insurance in Iowa can feel like driving through a cornfield maze, but understanding the state’s unique landscape can help you find the right coverage at the right price. This section delves into the specifics of Iowa’s car insurance market, highlighting key regulations, average costs, and common insurance types.

Iowa’s Car Insurance Requirements

Iowa has a mandatory minimum car insurance requirement, ensuring that all drivers have basic financial protection in case of an accident. These minimum requirements include:

- Liability Coverage: This protects you financially if you cause an accident that injures someone or damages their property. In Iowa, the minimum liability coverage requirements are:

- Bodily Injury Liability: $25,000 per person/$50,000 per accident

- Property Damage Liability: $20,000 per accident

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This protects you if you are involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. In Iowa, the minimum UM/UIM coverage requirements are the same as the liability coverage requirements.

Comparison with Neighboring States

Iowa’s car insurance requirements are similar to those of neighboring states like Nebraska and Missouri. However, there are some key differences:

- Nebraska: Nebraska has a higher minimum liability coverage requirement for bodily injury ($25,000 per person/$50,000 per accident) than Iowa. However, Nebraska’s minimum property damage liability requirement is lower ($15,000 per accident) than Iowa’s.

- Missouri: Missouri has a lower minimum liability coverage requirement for bodily injury ($25,000 per person/$50,000 per accident) than Iowa. However, Missouri’s minimum property damage liability requirement is higher ($30,000 per accident) than Iowa’s.

Factors Influencing Car Insurance Premiums in Iowa

Several factors influence car insurance premiums in Iowa. These include:

- Driving History: Your driving record plays a significant role in determining your insurance premiums. A clean driving record with no accidents or violations will generally result in lower premiums. However, if you have a history of accidents, speeding tickets, or DUI convictions, your premiums will likely be higher.

- Vehicle Type: The type of vehicle you drive also affects your insurance premiums. Higher-performance vehicles or those with expensive repair costs generally have higher premiums than more basic vehicles. Additionally, newer vehicles often have higher premiums due to their greater value and repair costs.

- Location: Your location can also influence your car insurance premiums. Areas with higher rates of car accidents or theft tend to have higher premiums. For example, urban areas with heavy traffic and congested roads may have higher premiums compared to rural areas with fewer vehicles on the road.

- Age and Gender: Age and gender can also play a role in determining your insurance premiums. Younger drivers and males tend to have higher premiums due to their higher risk of accidents.

Essential Car Insurance Coverage in Iowa

In Iowa, like in many other states, having the right car insurance coverage is crucial for protecting yourself financially in case of an accident. Iowa law mandates specific types of car insurance coverage, ensuring that drivers are prepared to handle the financial consequences of an accident. This section will delve into the essential car insurance coverage required in Iowa, explaining their benefits and limitations.

Liability Coverage

Liability coverage is a fundamental part of car insurance in Iowa, and it’s required by law. This coverage protects you financially if you cause an accident that results in injury or damage to another person or their property. It’s crucial to have adequate liability coverage to cover potential costs, including:

- Medical expenses for injured parties

- Property damage repairs or replacement

- Lost wages for injured parties

- Legal fees and court costs

Iowa’s minimum liability coverage requirements are:

- Bodily Injury Liability: $25,000 per person, $50,000 per accident

- Property Damage Liability: $20,000 per accident

It’s important to note that these minimum limits may not be enough to cover all potential costs in a serious accident. For instance, if you cause an accident that results in a fatality, the minimum liability coverage might not be sufficient to cover the significant legal and medical expenses involved. Therefore, considering higher liability limits is recommended to protect yourself from substantial financial burdens.

Personal Injury Protection (PIP) Coverage

PIP coverage, also known as no-fault insurance, is another mandatory car insurance coverage in Iowa. This coverage pays for your medical expenses, lost wages, and other related costs, regardless of who caused the accident. This means you can access benefits even if you were at fault.

PIP coverage is designed to help you recover from injuries and minimize financial hardship after an accident.

The minimum PIP coverage requirement in Iowa is $5,000 per person.

Here’s how PIP coverage works:

- Medical Expenses: Covers medical bills, including doctor visits, hospital stays, surgeries, and rehabilitation

- Lost Wages: Compensates for income lost due to inability to work after an accident

- Other Expenses: May cover expenses like funeral costs, transportation, and other related expenses

However, PIP coverage has limitations. The coverage typically has a maximum benefit limit, and there might be a waiting period before benefits are available. For example, you might have to wait a certain number of days before your lost wages are covered. Additionally, PIP coverage may not cover all medical expenses, and there might be deductibles to consider.

Uninsured/Underinsured Motorist (UM/UIM) Coverage

UM/UIM coverage is crucial in protecting yourself financially when involved in an accident with an uninsured or underinsured driver. This coverage pays for your medical expenses, lost wages, and property damage if the other driver is at fault and doesn’t have enough insurance to cover your losses.

In Iowa, UM/UIM coverage is mandatory and must be equal to the liability limits you choose. This means if you have $25,000/$50,000 bodily injury liability, you must also have at least $25,000/$50,000 UM/UIM coverage.

- Uninsured Motorist Coverage: Covers your losses if you’re involved in an accident with a driver who has no insurance at all.

- Underinsured Motorist Coverage: Covers the difference between your losses and the other driver’s insurance coverage if they have inadequate insurance.

For example, if you are in an accident with an underinsured driver who only has $10,000 in liability coverage and your damages exceed that amount, your UM/UIM coverage would cover the remaining costs.

Choosing the Right Coverage Levels

Choosing the appropriate levels of car insurance coverage is a crucial decision that requires careful consideration. Factors like your driving history, financial situation, and personal risk tolerance play a role in determining the right coverage for you. Here’s a guide to help you choose the appropriate levels of coverage:

- Liability Coverage: Higher liability limits provide greater financial protection in case of an accident. Consider your financial situation, driving history, and the potential risks you face. It’s wise to choose liability limits that exceed the minimum requirements to protect yourself from significant financial burdens.

- PIP Coverage: While the minimum PIP coverage is $5,000, you can opt for higher limits for greater protection. Consider your health, income, and potential medical expenses if you were involved in an accident. Choosing higher PIP limits can provide peace of mind knowing that you have sufficient coverage to address medical and other related costs.

- UM/UIM Coverage: It’s recommended to have UM/UIM coverage equal to your liability limits, as this ensures you have adequate protection against uninsured or underinsured drivers. This is particularly important in areas with a higher prevalence of uninsured drivers.

Optional Car Insurance Coverage in Iowa: Car Insurance Iowa

While Iowa law mandates basic liability coverage, you can choose to add optional coverage to your policy for additional protection. These optional coverages can provide financial security in various situations, but it’s essential to weigh the costs and benefits before deciding.

Cost-Benefit Analysis of Optional Coverage, Car insurance iowa

Understanding the cost-benefit analysis of each optional coverage can help you make informed decisions about your car insurance policy. Here’s a breakdown of the potential savings, risk mitigation, and financial implications associated with each optional coverage type:

| Coverage Type | Potential Savings | Risk Mitigation | Financial Implications |

|---|---|---|---|

| Collision Coverage | May be less expensive for older vehicles with lower value | Covers repairs or replacement of your vehicle if you’re at fault in an accident | Higher premiums, but can protect you from significant out-of-pocket expenses in case of an accident |

| Comprehensive Coverage | May be less expensive for older vehicles with lower value | Covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters | Higher premiums, but can protect you from unexpected costs related to damage from non-collision events |

| Rental Reimbursement | May be bundled with other coverage options, potentially lowering the overall cost | Provides coverage for rental car expenses while your vehicle is being repaired after an accident | Higher premiums, but can help offset the cost of renting a car while your vehicle is unavailable |

Factors to Consider When Choosing Optional Coverage

When deciding which optional coverages are right for you, consider these factors:

- Vehicle Value: If your vehicle is relatively new or has a high value, collision and comprehensive coverage can be valuable. For older vehicles with lower values, these coverages might not be as cost-effective.

- Driving Habits: If you frequently drive in high-traffic areas or have a history of accidents, collision coverage might be more beneficial. For drivers with a clean driving record and minimal risk, comprehensive coverage might be sufficient.

- Personal Risk Tolerance: Some drivers are comfortable taking on more financial risk and may choose to forgo optional coverages, while others prefer the peace of mind that comes with comprehensive coverage.

Examples of Situations Where Optional Coverage Would Be Valuable

- Collision Coverage: If you are involved in an accident where you are at fault, collision coverage will pay for repairs or replacement of your vehicle, regardless of the other driver’s insurance.

- Comprehensive Coverage: If your vehicle is damaged by a tree falling on it during a storm, comprehensive coverage will pay for repairs or replacement.

- Rental Reimbursement: If your vehicle is totaled in an accident, rental reimbursement will cover the cost of renting a car while your vehicle is being repaired or replaced.

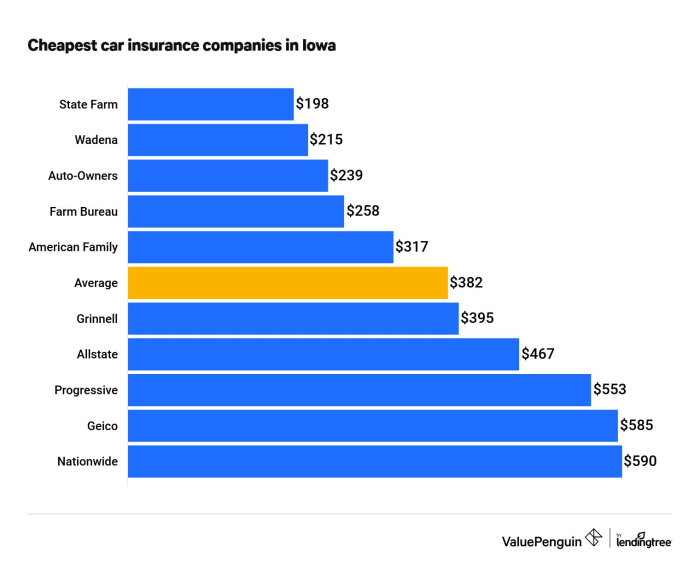

Finding the Right Car Insurance in Iowa

Finding the right car insurance in Iowa involves a strategic approach that balances cost, coverage, and insurer reputation. It’s not simply about picking the cheapest option, but about securing a policy that offers adequate protection at a price you can afford. This guide Artikels steps to help you navigate the car insurance buying process in Iowa, ensuring you make informed decisions.

Getting Quotes and Comparing Rates

Getting quotes from multiple insurers is crucial for comparing rates and finding the best deal.

- Online Quote Tools: Many insurance companies offer online quote tools that allow you to input your information and receive instant estimates. This provides a quick and convenient way to compare rates from various insurers.

- Insurance Brokers: Insurance brokers work with multiple insurers and can help you compare quotes from different companies. They can also provide expert advice on choosing the right coverage.

- Direct Contact: You can contact insurers directly by phone or email to request quotes. This allows you to ask specific questions and get personalized recommendations.

When comparing quotes, pay close attention to the coverage limits, deductibles, and any additional fees or charges. Make sure you are comparing apples to apples, as policies can vary significantly in terms of what they cover.

Understanding Policy Terms and Conditions

Understanding the terms and conditions of your car insurance policy is crucial to ensure you have adequate protection in case of an accident.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, but you will have to pay more in the event of a claim.

- Coverage Limits: Coverage limits refer to the maximum amount your insurance company will pay for a particular type of claim. For example, the liability coverage limit determines the maximum amount your insurer will pay for damages to another person’s property or injuries caused by an accident.

- Exclusions: Exclusions are specific events or situations that are not covered by your insurance policy. It’s important to carefully review the exclusions to understand what is and isn’t covered.

Negotiating Car Insurance Premiums

While car insurance rates are regulated in Iowa, there are still strategies you can use to negotiate lower premiums.

- Safe Driving Record: Maintaining a clean driving record is the most effective way to lower your premiums. This includes avoiding accidents, traffic violations, and driving under the influence.

- Bundling Policies: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in discounts.

- Loyalty Programs: Many insurance companies offer loyalty programs that reward long-term customers with discounts.

- Safety Features: Installing safety features in your vehicle, such as anti-theft devices or airbags, can also qualify you for discounts.

- Payment Options: Paying your premium in full or opting for a shorter payment plan can sometimes lead to lower rates.

Managing Your Car Insurance in Iowa

Navigating the world of car insurance in Iowa can be straightforward once you understand the essentials of managing your policy. This includes understanding the process of filing a claim, keeping your information updated, and navigating the renewal process.

Filing a Car Insurance Claim in Iowa

When you need to file a car insurance claim in Iowa, it’s crucial to act promptly and follow the right steps to ensure a smooth and efficient process.

- Contact Your Insurer Immediately: After an accident, the first step is to contact your insurance company as soon as possible. This is typically done by phone or through their online portal.

- Gather Necessary Documentation: You’ll need to provide your insurer with specific information, including details about the accident, your vehicle’s damage, and any injuries sustained. This may include:

- Police report (if applicable)

- Photos of the damage

- Contact information of other parties involved

- Details of your vehicle’s registration and insurance

- Follow the Claim Process: Your insurer will guide you through the claim process, which may involve:

- An initial assessment of the damage

- Negotiating a settlement amount

- Choosing a repair shop

- Receiving payment for your claim

- Understand Claim Timelines: The time it takes to process a claim varies depending on the complexity of the case. Your insurer should provide you with an estimated timeframe for processing your claim.

Maintaining Accurate Contact Information

Keeping your insurer informed about any changes to your contact information is essential for seamless communication and efficient claim processing.

- Update Your Contact Information: It’s crucial to inform your insurer about any changes to your address, phone number, or email address. This ensures you receive important updates and communications regarding your policy.

- Provide Timely Updates: If you change your vehicle or your driving circumstances, such as adding a new driver or changing your driving habits, notify your insurer promptly. These changes can impact your premiums and coverage.

Understanding Your Policy Renewal Process

The renewal process for your car insurance policy in Iowa is straightforward and usually involves a review of your coverage and premium.

- Premium Adjustments: Your insurance premium may change at renewal based on factors such as:

- Your driving record

- Your vehicle’s age and safety features

- Your location and driving habits

- Market fluctuations

- Coverage Changes: You may have the option to adjust your coverage during the renewal process, such as adding or removing optional coverages or increasing or decreasing your liability limits.

- Policy Modifications: You can also request changes to your policy, such as adding a new driver or updating your vehicle information.

By understanding the intricacies of car insurance in Iowa, you can navigate the buying process with confidence and secure the coverage that best suits your needs and budget. Remember to compare quotes, negotiate rates, and take advantage of available discounts to ensure you are getting the best possible value for your insurance policy. By being proactive and informed, you can protect yourself financially while driving safely on Iowa’s roads.

Commonly Asked Questions

What are the minimum car insurance requirements in Iowa?

Iowa requires drivers to have liability coverage, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. The specific amounts required for each coverage type are Artikeld in Iowa law.

How can I find the cheapest car insurance in Iowa?

To find the cheapest car insurance in Iowa, compare quotes from multiple insurers, consider bundling your policies, and explore discounts for safe driving, good student status, and other qualifying factors. You can also use online comparison tools to streamline the process.

What are some common car insurance discounts available in Iowa?

Iowa offers various discounts for car insurance, including safe driver discounts, good student discounts, multi-car discounts, and discounts for safety features in your vehicle. You can inquire about available discounts when requesting quotes from insurance companies.

What should I do if I need to file a car insurance claim in Iowa?

If you need to file a car insurance claim in Iowa, contact your insurer immediately, gather necessary documentation such as police reports and medical records, and follow the instructions provided by your insurance company.