Capital One Rental Car Insurance

Capital One Rental Car Insurance: Everything You Need to Know

Whether you’re planning a cross-country road trip, a weekend getaway, or a business trip, renting a car can provide the freedom and flexibility to get around at your own pace. However, this convenience often comes with its own set of challenges—what if something unexpected happens on the road? This is where rental car insurance becomes an essential consideration. Fortunately, if you’re a Capital One cardholder, you may already have a safety net in place.

Capital One rental car insurance is a lesser-known perk that can save you significant time, hassle, and money during your travels. But with so much fine print involved in both your credit card agreements and rental car contracts, it can be tough to understand exactly what coverage you have and how it can work to your advantage. This blog post aims to demystify the ins and outs of Capital One’s rental car insurance offerings and equip you with the knowledge you need to make smart and confident choices when you’re on the road.

First, we’ll delve into the basics of rental car insurance, helping you understand various terms like collision damage waiver (CDW) and loss damage waiver (LDW) that are frequently tossed around in rental agreements. Familiarizing yourself with these terms is crucial for anyone who wants to make informed decisions during the car-renting process.

Following this, we’ll specifically focus on the benefits Capital One provides with respect to rental car insurance. Not all credit cards offer the same level of protection, and Capital One cards vary by type and what they cover. We’ll go over which types of damages are covered, any secondary services offered, and even special conditions you should be aware of.

While Capital One rental car insurance can be a lifesaver, it’s equally important to know its limitations. Credit card insurance might not cover everything—there are exclusions, limits, and potential loopholes you should be aware of. We’ll explore these so you won’t encounter any surprises if you ever need to file a claim.

On a more practical note, we’ll offer you a step-by-step guide on how to use this insurance from Capital One. This will include everything from reserving your rental car to the paperwork needed if a claim becomes necessary. This guide will ensure you make the best use of this valuable credit card perk right from the point of reservation, reducing the stress associated with potential damage incidents.

Additionally, we’ll compare Capital One’s rental car insurance with offerings from other credit card issuers. This comparison will provide useful insights, especially if you hold multiple credit cards and are trying to decide which one offers the best protection for your next trip.

Finally, we’ll wrap up with some tips and tricks for maximizing the value of your Capital One rental car insurance. Being strategic about how and when you utilize this benefit can greatly enhance your travel experience, protecting both your peace of mind and your wallet.

By the end of this article, you’ll have a comprehensive understanding of not just what Capital One rental car insurance offers but also how it integrates into your overall travel and financial planning. You’ll be equipped with all the necessary information to make your travels less worrisome, leaving you free to focus on the more enjoyable aspects of your journey, whether you are heading to a meeting in a bustling city or exploring quiet country roads.

Ready to dive into the details? Let’s begin by exploring the basic terms and concepts you’ll encounter with rental car insurance.

Capital One Rental Car Insurance: What’s Covered?

Capital One rental car insurance is an appealing benefit for many cardholders who travel frequently and rely on rental cars during their trips. However, understanding the full extent of its coverage is essential to make the most of this benefit. Capital One offers this through their credit cards, often saving you from purchasing additional insurance through rental companies. Let’s delve into the details of what is typically covered.

Primary or Secondary Coverage

One key aspect to recognize is whether the rental car insurance provided by your Capital One card is primary or secondary. Typically, this coverage is secondary, meaning it kicks in only after your personal auto insurance has been utilized. However, some premium cards might offer primary coverage, which circumvents the need to contact your personal insurance provider, potentially preventing rate increases after a claim.

What is Typically Covered

- Damage to the Rental Car: The coverage generally includes repair costs for damage caused by collision or theft. This can provide substantial savings if you face accidents or theft during your rental period.

- Theft of Vehicle: If the rented vehicle is stolen during the coverage period, this insurance helps cover the replacement costs, reducing your financial risk.

- Towing Costs: Some Capital One cards may cover towing expenses if your rented vehicle is disabled following an accident, adding an extra layer of convenience.

- Loss of Use: Some policies include coverage for loss-of-use charges that rental companies might impose for the time the damaged vehicle is unavailable for rental.

Exclusions to Be Aware Of

Understanding what’s not covered by your Capital One rental car insurance is as crucial as knowing what is covered. The following are standard exclusions you should be aware of:

- Luxury and Exotic Cars: Often, luxury vehicles, exotic cars, and antiques are excluded from coverage due to their high repair and replacement costs.

- Trucks and Vans: Rentals of trucks, vans, and motorcycles are usually not covered under standard policies.

- Non-Collision Damage: Damage not resulting from a collision, unless otherwise specified, may not be covered, leading to potential out-of-pocket expenses.

- Liability Coverage: Most rental car insurance offered is limited to damage to the rental car itself and does not include liability insurance for injuries or damages to others unless specified.

How to Activate Your Capital One Rental Car Insurance

Utilizing your Capital One rental car insurance is straightforward if you follow these simple steps:

- Use the Card for Payment: To activate the insurance, the rental car must be fully paid using your Capital One card.

- Bear the Cardholder Name: The cardholder’s name and the primary renter’s name should match to ensure compliance with policy requirements.

- Decline the Rental Company’s Insurance: When renting the vehicle, you must decline the Collision Damage Waiver (CDW) or similar coverage offered by the rental company.

Claims Process

Filing a claim involves timely notification and documentation. Here are the steps you’ll need to take:

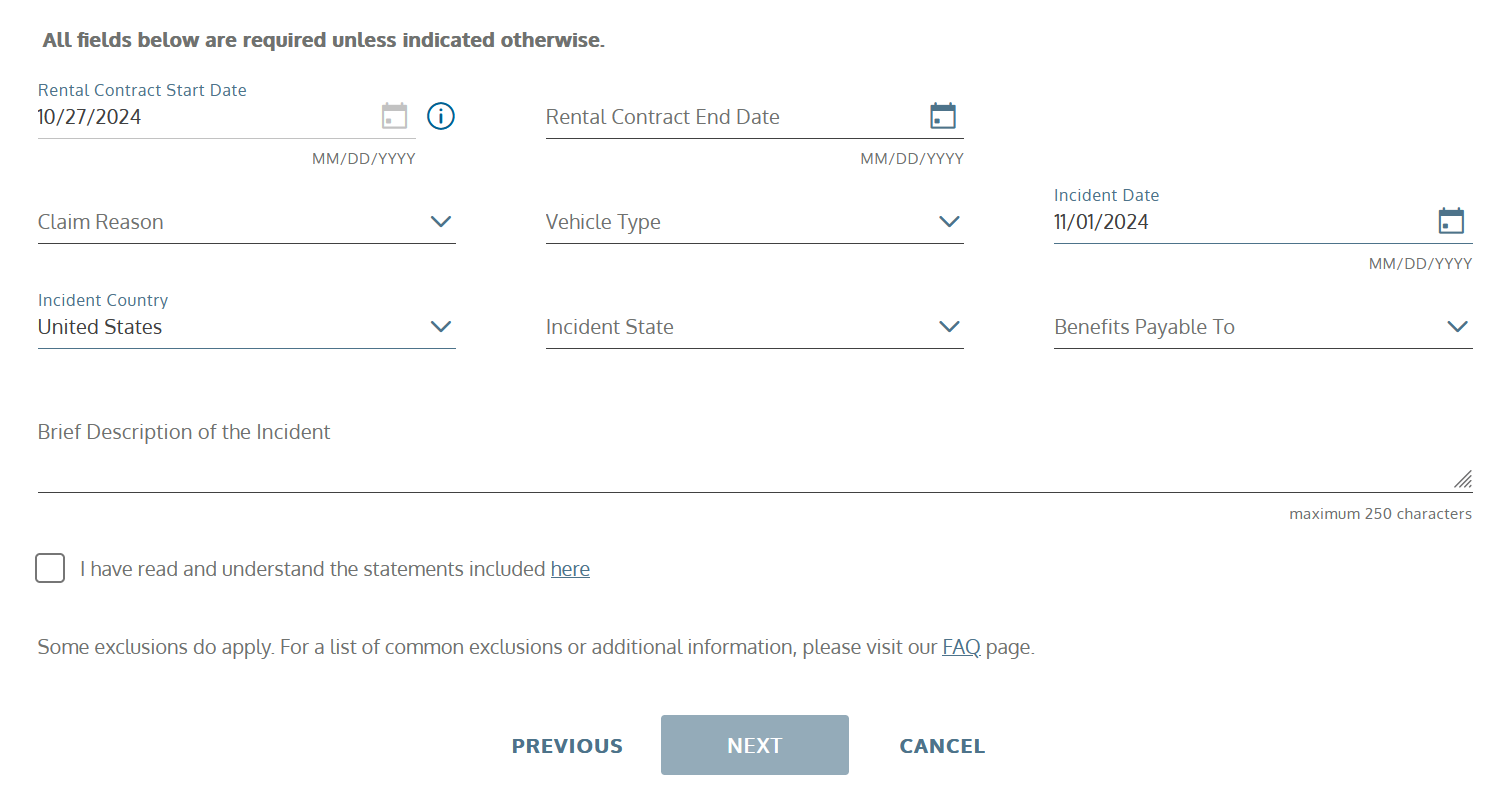

- Report the incident to the benefits administrator as soon as possible.

- Gather necessary documentation, including the rental agreement, accident report, and copies of all correspondence with the rental company.

- Submit the claim form along with all required documents by the deadline specified in the terms and conditions.

Advantages of Capital One Rental Car Insurance

The main advantage of this credit card benefit is the potential savings. Paying for rental car insurance directly through the agency can run anywhere from $10 to $30 per day, which can add up significantly on longer rentals. Capital One cardholders enjoy the peace of mind that they are covered against damage and theft without the additional daily charge.

Additionally, some travelers find the loss-of-use coverage beneficial, as it’s not always covered by non-credit card primary insurers. This affordability and added coverage can positively influence your travel budget.

When Should You Buy Supplemental Insurance?

While Capital One provides a robust insurance package, it may not meet every need or scenario. Consider buying supplemental insurance in the following cases:

- If renting a luxury or exotic car.

- If traveling in a foreign country where local laws might necessitate liability insurance.

- If your trip involves a lot of risky driving conditions or off-road terrain that might not be covered under the credit card policy.

Consulting Your Personal Auto Insurance

Always review your personal auto insurance policy to determine overlap or gaps in coverage. Consulting with your insurance agent could uncover unexpected coverage or exclusions that might impact your decision on whether to rely solely on Capital One’s offering or to purchase additional insurance.

Final Considerations

Capital One rental car insurance offers a valuable benefit for cardholders who frequently use rental cars for travel or business purposes. It’s crucial to read the fine print of your particular card’s benefits guide to understand the specific details and limitations. Doing so will ensure you’re prepared in case of any unexpected incidents, making your rental car experience seamless and worry-free.

Navigating Capital One Rental Car Insurance

As we wrap up our exploration of Capital One Rental Car Insurance, it’s crucial to circle back to the primary questions and concerns driving our need for understanding this financial option. In today’s fast-paced world, where flexibility and convenience often reign supreme, rental cars remain a popular choice for millions. However, ensuring you’re equipped with the best protection when you’re on the road is paramount. Capital One offers credit card holders the added advantage of rental car insurance, a unique feature we’ve dissected to enhance both your travel experience and financial security.

Throughout this blog post, we’ve unravelled several key aspects of Capital One’s rental car insurance that demand your attention:

-

The Basics of Capital One Rental Car Insurance:

We began by introducing the primary elements of Capital One rental car insurance. This coverage is one of the many benefits that come with being a Capital One cardholder, offering peace of mind when renting a car as part of your travel plans. This insurance can help cover potential damage or theft of rental vehicles, allowing you to bypass additional costs the rental company might impose. -

Who is Eligible?

It’s crucial to understand that not all Capital One cards offer this insurance. We dove into the specific card types that include rental car insurance as a benefit. Typically, cards such as the Capital One Venture and Capital One Savor are likely candidates. For assurance, however, a quick call to Capital One or a read-through of your card’s benefit guide can confirm eligibility. -

Coverage Details: What Does It Include?

A significant portion of the content was dedicated to breaking down what the insurance includes. Common coverage often involves collision damage and theft, ensuring that your financial liability is significantly reduced. However, aspects like liability insurance, personal injuries, or coverage for luxury and exotic vehicles weren’t typically included, underscoring the necessity to read your policy documents closely. -

Understanding Coverage Limitations:

No insurance policy is devoid of limitations. We highlighted key exclusions you need to be aware of—ranging from the types of vehicles covered to geographical constraints. This awareness allows you to make informed decisions and can prevent unexpected hiccups during your travels. -

Steps to Activate and Claim Rental Car Insurance:

The procedure for using this insurance was detailed to avoid any operational confusion. From booking and paying for the rental with your eligible Capital One card to understanding precise timelines and documentations for claims, knowing the protocol is quintessential for seamless coverage activation.

Having retraced these important elements, it’s evident that Capital One rental car insurance is a beneficial tool, yet one that requires diligent exploration to fully leverage its advantages. A primary takeaway is the necessity of planning—engaging with the details of your card benefits well ahead of your rental needs is likely your best strategy to avoid any last-minute stresses.

For anyone preparing to book a rental car, understanding the accompanying insurance options can significantly impact both your travel ease and financial investment. Should you find gaps in the coverage provided by your Capital One insurance, supplementary options are available. Aligning this with any personal vehicle insurance or additional products offered directly through rental agencies can create a robust safety net.

Ultimately, the realm of rental car insurance—from understanding coverage to successfully applying it—requires a proactive approach. Taking the time to investigate your options, clarify any misunderstandings with a Capital One representative, and confidently act on your findings can transform the insurance from a simple card benefit into a critical piece of your travel safety puzzle.

A Call to Action

Now that you are more informed about Capital One rental car insurance, it’s time to put this knowledge into practice. First, review your current credit card benefits to see if you’re already covered or if it’s time to consider a new card with these features. If you’ve decided this coverage aligns with your travel needs and goals, share this information with others who might stand to benefit, perhaps through social media or simply by word of mouth.

I invite you to join the conversation further. Have you ever utilized Capital One’s rental car insurance? Were there any challenges you faced that others might learn from? Comment below and share your stories or questions—your experiences are not only valued but could provide critical insights to fellow travelers.

Furthermore, consider engaging with broader travel and financial forums online, actively seeking recent updates and changes to such insurance policies. Policies can shift, and staying informed is key to maintaining the advantage in an ever-evolving landscape.

Finally, don’t hesitate to explore additional resources on travel insurance best practices. Whether through blog posts, webinars, or connecting with insurance professionals, expanding your horizons ensures that you travel safer and smarter.

Thank you for journeying with us through the nuances of Capital One rental car insurance. As always, knowledge is power—and in this case, it could save you both time and money on your next adventure.

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology