Best Investment for $100,000 A Comprehensive Guide

Best investment for 100k – Investing $100,000 can be both exciting and daunting. This guide will explore a range of investment options, from traditional stocks and bonds to alternative assets like real estate and mutual funds. We’ll examine the factors to consider when making investment decisions, including your financial goals, risk tolerance, and time horizon. Whether you’re aiming for long-term wealth accumulation or short-term financial goals, understanding the best investment strategies for your unique circumstances is crucial.

We’ll also delve into the importance of diversification and how to build a well-balanced investment portfolio. By carefully considering your options and seeking professional advice when necessary, you can confidently navigate the world of investing and maximize your chances of achieving your financial goals.

Understanding Your Investment Goals

Before diving into specific investment strategies, it’s crucial to understand your personal investment goals. This involves defining what you want to achieve with your investments and how much risk you’re willing to take to reach those goals.

Defining Investment Goals

Your investment goals determine the direction of your investment strategy. They provide a clear vision of what you aim to achieve with your investments, shaping your choices and guiding your actions. Investment goals can range from short-term savings for a vacation to long-term retirement planning.

- Retirement Planning: This goal typically involves investing for the long term, aiming to accumulate enough funds to support your lifestyle after you stop working. The time horizon for retirement planning is usually long, allowing for greater potential for growth and recovery from market fluctuations.

- Short-Term Savings: These goals are often for specific purchases or events in the near future, such as a down payment on a house, a new car, or a wedding. Short-term savings typically involve lower-risk investments with a shorter time horizon, aiming for preservation of capital and steady returns.

- Real Estate Investment: This goal involves investing in properties for rental income, appreciation, or both. Real estate investments can offer potential for both growth and passive income, but they also come with higher risk and require significant capital.

- Education Savings: This goal focuses on funding your child’s education, whether it’s college, graduate school, or vocational training. Education savings plans often involve long-term investments, aiming for growth to cover the rising costs of education.

Risk Tolerance and Investment Choices, Best investment for 100k

Risk tolerance refers to your ability and willingness to accept potential losses in exchange for the possibility of higher returns. It’s a crucial factor in determining your investment strategy.

- High Risk Tolerance: Investors with a high risk tolerance are comfortable with the possibility of significant losses in exchange for the potential for high returns. They may choose investments like stocks, growth-oriented mutual funds, or venture capital, which have the potential for substantial gains but also carry greater volatility.

- Moderate Risk Tolerance: Investors with a moderate risk tolerance are willing to accept some risk but prefer investments with a balance of growth potential and stability. They may choose a mix of stocks, bonds, and real estate, aiming for a diversified portfolio that balances risk and reward.

- Low Risk Tolerance: Investors with a low risk tolerance prioritize capital preservation and are averse to significant losses. They may choose investments like bonds, certificates of deposit (CDs), or money market accounts, which offer lower returns but are generally considered safer.

Examples of Investment Goals and Risk Profiles

| Investment Goal | Risk Profile | Example Investment Strategy |

|---|---|---|

| Retirement Planning (30 years) | High | 70% stocks, 30% bonds |

| Down Payment on a House (5 years) | Low | 100% bonds or CDs |

| Education Savings (18 years) | Moderate | 60% stocks, 40% bonds |

Exploring Investment Options

Now that you’ve established your investment goals, let’s delve into the various investment avenues available to you with $100,000. Understanding the characteristics of each option is crucial to making informed decisions aligned with your risk tolerance and desired returns.

Stocks

Stocks represent ownership in publicly traded companies. Investing in stocks can potentially yield high returns, but it also carries significant risk.

- Pros:

- Potential for high returns: Stocks have historically outperformed other asset classes over the long term.

- Liquidity: Stocks are readily traded on stock exchanges, allowing for easy buying and selling.

- Growth potential: Stocks offer the potential for capital appreciation as companies grow and prosper.

- Cons:

- Volatility: Stock prices can fluctuate significantly, leading to potential losses.

- Market risk: The overall stock market can be influenced by economic factors, impacting individual stock prices.

- Company-specific risk: Individual companies can face challenges that affect their stock performance.

Bonds

Bonds represent loans you make to a company or government entity. They generally offer lower returns than stocks but are considered less risky.

- Pros:

- Regular income: Bonds typically pay interest payments at fixed intervals.

- Lower risk than stocks: Bonds are generally considered less volatile than stocks.

- Diversification: Bonds can help diversify your portfolio and reduce overall risk.

- Cons:

- Lower returns than stocks: Bonds typically offer lower returns than stocks.

- Interest rate risk: Rising interest rates can decrease the value of existing bonds.

- Credit risk: There’s a risk that the issuer of a bond may default on its payments.

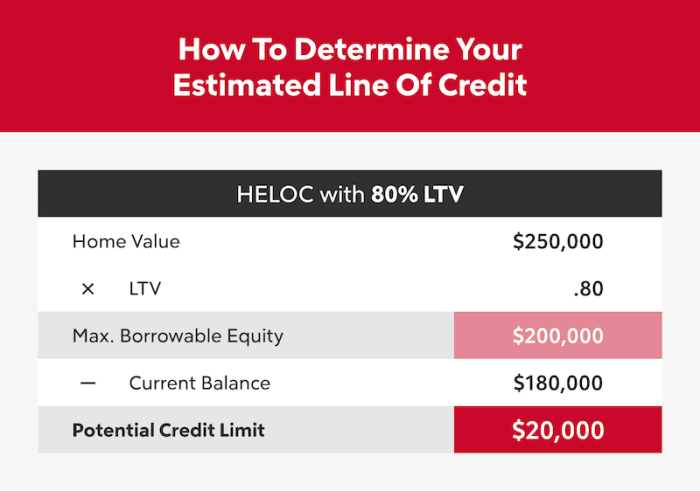

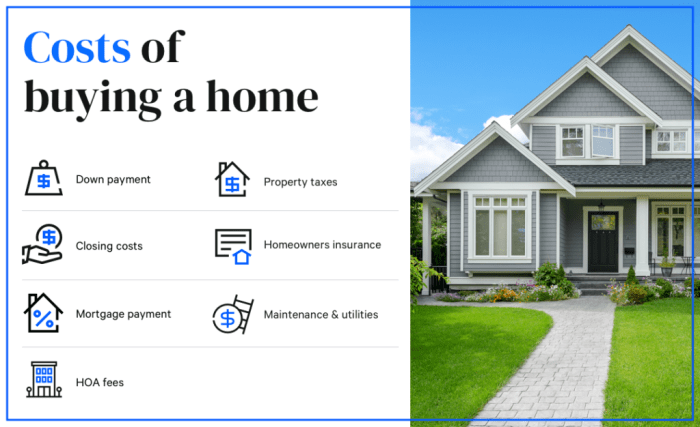

Real Estate

Real estate encompasses land and any structures built on it. It can provide rental income and potential appreciation.

- Pros:

- Rental income: Owning rental properties can generate passive income.

- Potential for appreciation: Real estate values can appreciate over time.

- Tangible asset: Real estate is a tangible asset that you can physically see and use.

- Cons:

- Illiquidity: Real estate can be difficult to sell quickly.

- High initial investment: Purchasing real estate often requires a significant upfront investment.

- Maintenance costs: Owning real estate comes with ongoing maintenance and repair expenses.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

- Pros:

- Diversification: Mutual funds provide instant diversification across multiple assets.

- Professional management: Funds are managed by experienced professionals who make investment decisions.

- Accessibility: Mutual funds are readily available through brokerage accounts.

- Cons:

- Fees: Mutual funds charge management fees, which can impact returns.

- Performance risk: The performance of a mutual fund depends on the underlying investments.

- Limited control: Investors have limited control over individual investments within a fund.

Investment Options Comparison

| Investment Option | Liquidity | Risk | Potential Return |

|---|---|---|---|

| Stocks | High | High | High |

| Bonds | Medium | Medium | Medium |

| Real Estate | Low | Medium to High | Medium to High |

| Mutual Funds | High | Medium | Medium |

Diversification Strategies: Best Investment For 100k

Diversification is a fundamental principle in investing that involves spreading your investment capital across various assets to reduce risk and enhance potential returns. It is a cornerstone of sound investment management, allowing you to mitigate losses and potentially achieve greater returns over the long term.

Benefits of Diversification

Diversification helps manage risk by reducing the impact of poor performance in any single investment. When your investments are spread across different asset classes, industries, and geographical regions, a downturn in one area is less likely to significantly affect your overall portfolio. This principle is based on the idea that different asset classes tend to move in different directions, and when one asset class performs poorly, another may perform well, offsetting losses.

Designing a Diversified Portfolio

A diversified investment portfolio typically includes a mix of asset classes, each with distinct characteristics and risk-return profiles. Common asset classes include:

- Stocks: Represent ownership in companies and offer the potential for high growth but also carry higher risk.

- Bonds: Debt securities issued by companies or governments that provide a fixed or variable income stream. They generally carry lower risk than stocks but offer lower returns.

- Real Estate: Tangible assets that can provide rental income and potential appreciation. It can be a good hedge against inflation but can also be illiquid and require significant capital.

- Commodities: Raw materials like gold, oil, and agricultural products. They can offer inflation protection and diversification but are often volatile.

- Cash and Cash Equivalents: Low-risk assets like savings accounts and money market funds that provide liquidity and stability.

The specific allocation of your portfolio across these asset classes will depend on your investment goals, risk tolerance, and time horizon.

Asset Allocation Strategies

Here are some examples of asset allocation strategies based on different risk profiles:

Conservative

A conservative investor typically prioritizes capital preservation and income generation over high growth. They may allocate a larger portion of their portfolio to bonds and cash equivalents, with a smaller allocation to stocks. For example, a conservative investor might allocate 60% to bonds, 30% to stocks, and 10% to cash.

Moderate

A moderate investor seeks a balance between growth and risk management. They may allocate a larger portion of their portfolio to stocks than conservative investors but still maintain a significant portion in bonds. For example, a moderate investor might allocate 40% to bonds, 50% to stocks, and 10% to other assets like real estate or commodities.

Aggressive

An aggressive investor prioritizes high growth potential and is willing to accept higher risk. They may allocate a larger portion of their portfolio to stocks and other higher-risk assets, with a smaller allocation to bonds. For example, an aggressive investor might allocate 20% to bonds, 70% to stocks, and 10% to alternative investments like private equity or venture capital.

Remember: Diversification is not a guarantee against losses, but it can help reduce the impact of negative market fluctuations and increase the potential for long-term returns.

The Role of Time Horizon

The time horizon refers to the period you plan to keep your investments. It’s a crucial factor in investment decisions because it influences your risk tolerance, investment choices, and overall strategy. Understanding your time horizon helps you make informed decisions that align with your financial goals.

The Impact of Time Horizon on Investment Decisions

Your time horizon plays a significant role in determining how much risk you’re willing to take with your investments. Generally, investors with longer time horizons can tolerate higher levels of risk. This is because they have more time to recover from potential market downturns. Conversely, investors with shorter time horizons often prefer lower-risk investments, as they need to access their funds sooner.

Investment Strategies for Different Time Horizons

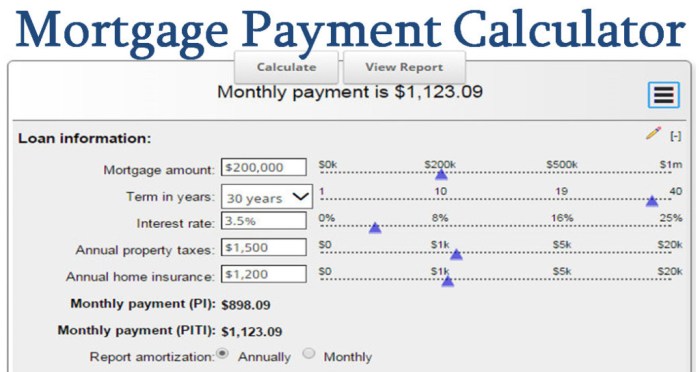

- Short-Term Goals (Less than 5 years): Short-term goals, such as saving for a down payment on a house or a vacation, require a more conservative approach. Investments with lower risk and potential for capital preservation, like high-yield savings accounts, certificates of deposit (CDs), or short-term bonds, are typically preferred. These options offer stability and predictable returns, minimizing the risk of losing money before your target date.

- Long-Term Goals (5 years or more): Long-term goals, such as retirement planning or college savings, allow for a more aggressive investment strategy. This is because you have time to ride out market fluctuations and potentially earn higher returns. Investments like stocks, mutual funds, and exchange-traded funds (ETFs) offer the potential for growth over the long term, but they also carry a higher risk of short-term volatility.

Examples of How Time Horizon Affects Risk Tolerance and Investment Choices

- Retirement Planning: A 30-year-old individual with a long time horizon before retirement might invest a larger portion of their portfolio in stocks, aiming for long-term growth. They can afford to ride out market fluctuations and benefit from potential capital appreciation over the years.

- Down Payment for a House: A couple saving for a down payment on a house in two years would likely prefer a more conservative approach. They might choose investments like CDs or high-yield savings accounts, prioritizing capital preservation and minimizing the risk of losing money before their target date.

Seeking Professional Advice

While you can certainly research and invest on your own, consulting with a financial advisor can offer significant advantages. A financial advisor can provide personalized guidance, help you navigate complex investment strategies, and ensure your portfolio aligns with your financial goals.

Benefits of Consulting a Financial Advisor

- Personalized Guidance: Financial advisors take the time to understand your individual circumstances, risk tolerance, and financial goals. They can then tailor investment strategies that are specifically designed to meet your needs.

- Expertise and Knowledge: Financial advisors possess extensive knowledge of the financial markets, investment products, and tax implications. They can provide insights and guidance that may be difficult to obtain on your own.

- Objectivity and Perspective: When making investment decisions, emotions can often cloud judgment. A financial advisor can offer an objective perspective and help you avoid impulsive decisions that could harm your portfolio.

- Time Savings: Managing your investments can be time-consuming. A financial advisor can handle the day-to-day tasks of monitoring your portfolio, researching investment opportunities, and making adjustments as needed.

- Accountability and Support: Having a financial advisor provides accountability. They can help you stay on track with your investment goals and offer ongoing support and guidance throughout your financial journey.

Factors to Consider When Choosing a Financial Advisor

- Experience and Qualifications: Look for a financial advisor with a proven track record and relevant credentials, such as a Certified Financial Planner (CFP) or a Chartered Financial Analyst (CFA).

- Fees and Compensation: Understand how the advisor is compensated. Fees can be based on assets under management, hourly rates, or a combination of both.

- Investment Philosophy: Make sure the advisor’s investment philosophy aligns with your own risk tolerance and investment goals.

- Communication Style: Choose an advisor who communicates clearly and effectively. You should feel comfortable asking questions and discussing your financial situation openly.

- References and Reviews: Ask for references from past clients and research the advisor’s reputation online.

Finding a Reputable Financial Advisor

- Professional Organizations: Organizations like the Financial Planning Association (FPA) and the Certified Financial Planner Board of Standards (CFP Board) offer resources for finding qualified financial advisors.

- Networking: Ask friends, family, and colleagues for recommendations.

- Online Platforms: Websites like Advisorpedia and SmartAsset provide tools for finding and comparing financial advisors.

- Financial Institutions: Many banks and investment firms offer financial advisory services. However, it’s important to note that advisors employed by these institutions may have conflicts of interest.

Investing $100,000 is a significant decision that requires careful consideration and a strategic approach. By understanding your investment goals, exploring different options, and seeking professional advice when needed, you can make informed choices that align with your risk tolerance and time horizon. Remember, investing is a journey, and consistent planning and monitoring are essential to achieving long-term success.

FAQ Guide

What are some common investment mistakes to avoid?

Common investment mistakes include:

- Investing based on emotion or hype.

- Not diversifying your portfolio.

- Failing to rebalance your portfolio regularly.

- Chasing high returns without considering risk.

- Not seeking professional advice when needed.

How can I find a reputable financial advisor?

When choosing a financial advisor, look for someone with:

- Relevant experience and qualifications.

- A fiduciary responsibility to act in your best interests.

- A good track record and positive client testimonials.

- A clear understanding of your financial goals and risk tolerance.

What are some low-risk investment options?

Low-risk investment options include:

- High-yield savings accounts.

- Certificates of deposit (CDs).

- Treasury bonds.

- Investment-grade corporate bonds.

Investing $100,000 can open doors to a range of opportunities, and real estate often tops the list. If you’re considering a tangible asset with potential for appreciation, exploring investment properties in Colorado could be a smart move. The state’s vibrant economy and desirable lifestyle make it an attractive market for both long-term growth and rental income, making it a solid contender for your $100,000 investment.

When considering the best investment for $100,000, diversification is key. While traditional options like stocks and bonds offer potential for growth, exploring alternative avenues can be beneficial. Investing in luxury property, invest in luxury property , can provide both capital appreciation and potential rental income, adding another dimension to your portfolio.

When it comes to investing $100,000, real estate often stands out as a solid option. If you’re looking to diversify your portfolio, buying a first investment property can be a smart move. For guidance on navigating this process, check out this comprehensive guide on buying first investment property. Remember, researching the local market and understanding rental income potential is crucial for making informed decisions with your investment.