Find the Best City for Investment Property

The best city for investment property is a question that sparks the interest of savvy investors seeking lucrative returns. This quest involves navigating a complex landscape of factors, including property prices, rental yields, economic growth, and quality of life. A deep understanding of these variables is crucial for making informed decisions and maximizing potential profits.

This guide will explore the key factors that influence investment property value, analyze potential investment cities, and provide strategies for mitigating risks and capitalizing on opportunities. By delving into the intricacies of the real estate market, investors can gain valuable insights and position themselves for success.

Factors Influencing Investment Property Value

Investing in real estate can be a lucrative endeavor, but it’s crucial to understand the factors that influence property value to make informed decisions. Several key elements contribute to the appreciation or depreciation of investment properties. These factors encompass a wide range of variables, including location, market conditions, property type, and amenities.

Location

Location is arguably the most significant factor influencing investment property value. A property’s location determines its accessibility to amenities, employment opportunities, schools, and transportation infrastructure. Desirable locations typically command higher prices due to increased demand and limited supply.

- Proximity to employment centers: Properties located near major employment hubs tend to be more attractive to renters and buyers, driving up demand and value. For example, a property near a thriving tech hub like Silicon Valley in California is likely to experience significant appreciation due to the high concentration of tech jobs and professionals seeking housing in the area.

- Accessibility to amenities: Proximity to essential amenities like shopping centers, restaurants, entertainment venues, and healthcare facilities enhances a property’s desirability. Properties in areas with a wide array of amenities are often more appealing to renters and buyers, contributing to higher rental yields and resale values.

- Quality of schools: Families with children often prioritize properties located near highly-rated schools. The presence of excellent schools in a neighborhood can significantly boost property values, as families are willing to pay a premium for access to quality education.

- Transportation infrastructure: Convenient access to public transportation, highways, and airports is essential for commuters and residents alike. Properties located near well-developed transportation networks are generally more desirable, leading to higher property values.

Market Conditions

The real estate market is dynamic and influenced by various economic factors that impact property values. Understanding current market trends and future projections is crucial for investors seeking to maximize their returns.

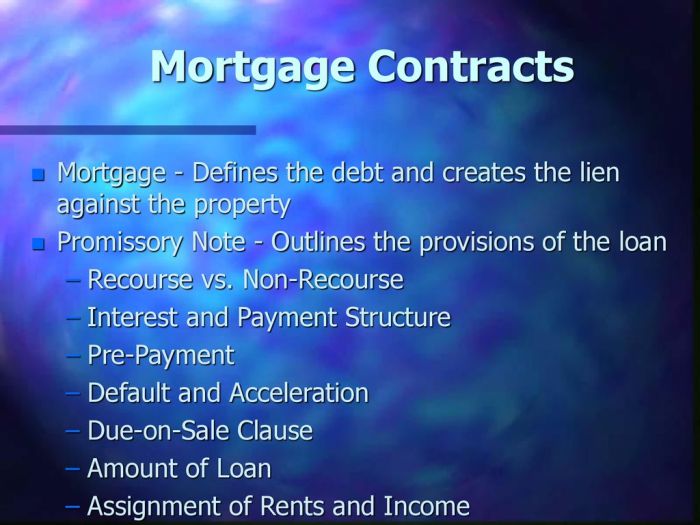

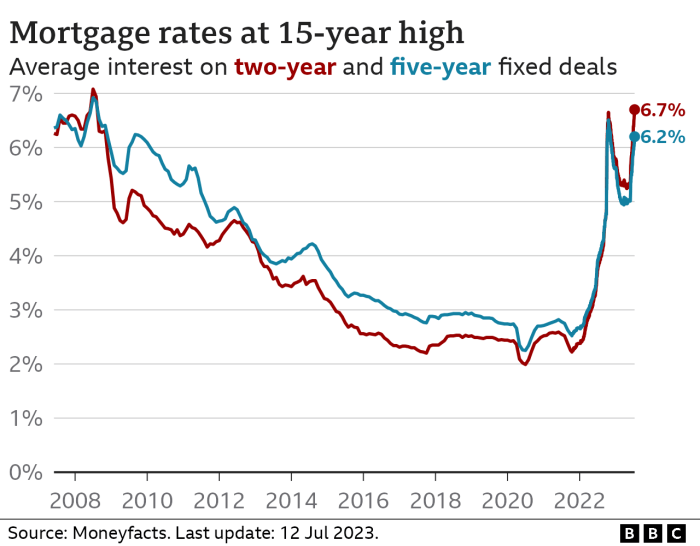

- Interest rates: Interest rates play a significant role in determining mortgage affordability. Lower interest rates make it easier for buyers to qualify for loans, increasing demand and driving up prices. Conversely, higher interest rates can dampen demand, potentially leading to price declines.

- Economic growth: A strong economy with low unemployment and rising wages typically translates to increased demand for housing, boosting property values. Conversely, economic downturns can lead to job losses and reduced purchasing power, impacting property prices negatively.

- Inflation: Inflation can erode the purchasing power of money, potentially leading to higher property values. As inflation rises, the cost of building materials and labor increases, driving up construction costs and influencing property prices.

- Supply and demand: The balance between supply and demand significantly impacts property values. In areas with limited housing supply and high demand, prices tend to rise. Conversely, areas with an oversupply of properties and low demand may experience price declines.

Property Type

Different property types cater to distinct market segments and offer varying investment opportunities. Understanding the characteristics and appeal of different property types is essential for making informed investment decisions.

- Single-family homes: Single-family homes are popular investment properties, offering potential for appreciation and rental income. They often appeal to families and individuals seeking space and privacy. The value of single-family homes is influenced by factors like lot size, number of bedrooms and bathrooms, and overall condition.

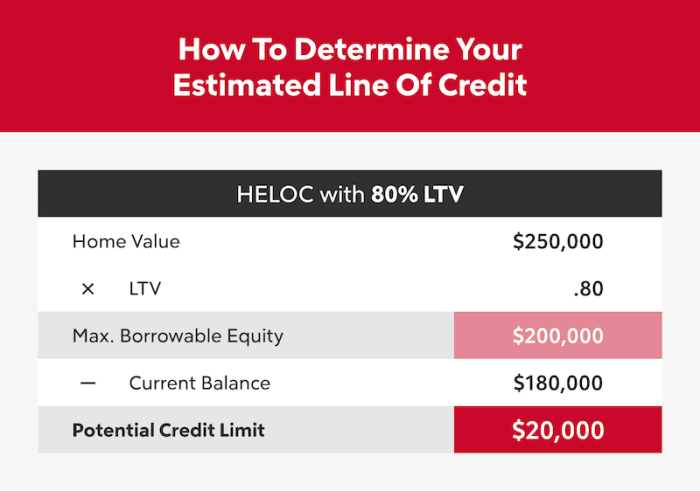

- Multi-family properties: Multi-family properties, such as duplexes, triplexes, and apartment buildings, provide rental income and potential for appreciation. They are attractive to investors seeking to diversify their portfolios and benefit from economies of scale. The value of multi-family properties is influenced by factors like occupancy rates, rental income, and property management expenses.

- Commercial properties: Commercial properties, such as office buildings, retail spaces, and industrial facilities, offer investment opportunities for both rental income and potential appreciation. The value of commercial properties is influenced by factors like location, tenant mix, lease terms, and market demand.

Amenities

Amenities play a crucial role in enhancing the desirability and value of investment properties. They can provide a competitive advantage and attract tenants or buyers willing to pay a premium for added convenience and lifestyle benefits.

- Community amenities: Neighborhoods with desirable amenities, such as parks, recreational facilities, and community centers, often command higher property values. These amenities enhance the quality of life for residents and attract families and individuals seeking a vibrant and active community.

- Property amenities: Properties with desirable amenities, such as swimming pools, fitness centers, and laundry facilities, can attract tenants and buyers willing to pay a premium for added convenience and lifestyle benefits. These amenities enhance the overall appeal and value of the property.

Analyzing Potential Investment Cities

Once you’ve grasped the factors influencing investment property value, it’s time to delve into specific cities that might align with your investment goals. Analyzing potential investment cities involves comparing various locations based on key metrics to identify the most promising opportunities.

Comparing Cities Based on Key Investment Factors

To make informed investment decisions, it’s crucial to compare cities based on factors like property prices, rental yields, economic growth, and quality of life. This comparative analysis helps identify strengths and weaknesses, allowing you to prioritize cities that best suit your investment strategy.

| City | Property Prices | Rental Yields | Economic Growth | Quality of Life |

|---|---|---|---|---|

| City A | High property prices, but steady appreciation | Moderate rental yields, but strong demand | Robust economic growth, diverse industries | Excellent infrastructure, high living standards |

| City B | Lower property prices, but slower appreciation | Higher rental yields, but lower demand | Stable economic growth, focused industries | Good infrastructure, affordable living |

| City C | Moderate property prices, potential for growth | Average rental yields, growing demand | Emerging economy, rapid development | Developing infrastructure, improving living standards |

Example: Let’s consider City A with high property prices but steady appreciation. While initial investment costs might be higher, the potential for capital appreciation and strong rental demand could offset the initial expense. Conversely, City B offers lower property prices and higher rental yields, making it attractive for investors seeking immediate cash flow. However, slower appreciation and lower demand might impact long-term returns.

By comparing cities based on these factors, you can identify those that offer the best balance of risk and reward for your investment goals.

Evaluating Investment Risks and Opportunities

Investing in real estate can be a lucrative endeavor, but it’s crucial to acknowledge the inherent risks and opportunities associated with this investment strategy. Understanding these aspects is vital for making informed decisions and mitigating potential losses.

Potential Risks Associated with Real Estate Investments, Best city for investment property

Understanding the potential risks involved in real estate investment is crucial for making informed decisions and mitigating potential losses. Several factors can influence the value of your investment, some of which are beyond your control.

- Market Volatility: Real estate markets are susceptible to fluctuations influenced by economic conditions, interest rates, and local market dynamics. A downturn in the market can lead to a decline in property values, affecting your investment returns.

- Economic Downturns: Recessions or economic slowdowns can significantly impact real estate markets. During such periods, demand for housing may decrease, leading to lower rental income and potential difficulties in selling properties.

- Property Management Challenges: Owning rental properties involves ongoing responsibilities, including tenant screening, maintenance, and rent collection. Inefficient property management can lead to financial losses, legal issues, and stress.

- Natural Disasters: Unexpected events like earthquakes, hurricanes, or floods can cause significant damage to properties, resulting in financial losses and potential disruptions to rental income.

- Unforeseen Expenses: Real estate investments often involve unexpected expenses, such as repairs, renovations, or legal fees. These costs can eat into your profits and impact your overall returns.

Strategies for Mitigating Investment Risks

While risks are inherent in real estate investments, several strategies can help mitigate potential losses and enhance the likelihood of positive returns.

- Diversification: Investing in multiple properties across different locations or asset classes can help reduce risk. If one market experiences a downturn, other investments might perform better, providing a buffer against losses.

- Thorough Due Diligence: Before investing in any property, it’s crucial to conduct thorough research and due diligence. This includes analyzing market trends, property condition, rental income potential, and potential risks. It’s essential to rely on reliable data sources and consult with experienced professionals.

- Professional Advice: Seeking advice from real estate agents, property managers, and financial advisors can provide valuable insights and guidance. They can help identify potential risks, evaluate investment opportunities, and develop strategies for mitigating losses.

- Contingency Planning: It’s essential to have a contingency plan in place to address potential unforeseen events. This could include setting aside funds for repairs, legal fees, or unexpected vacancies. Having a plan can help minimize financial stress and protect your investment.

Emerging Investment Opportunities

Despite the risks, real estate investment offers exciting opportunities for growth and profitability. Emerging trends and market dynamics present new avenues for investors to capitalize on.

- Urban Regeneration: Cities undergoing revitalization projects often offer attractive investment opportunities. As neighborhoods improve, property values tend to rise, leading to potential capital appreciation and rental income growth. For example, cities like Detroit and Cleveland are experiencing urban renewal, attracting new residents and businesses, which can boost property values.

- Sustainable Real Estate: Growing awareness of environmental sustainability is driving demand for energy-efficient and eco-friendly properties. Investing in green buildings or implementing sustainable features can attract tenants and potentially command higher rents. Cities like Seattle and Portland are known for their commitment to sustainability, making them attractive for investors seeking eco-conscious properties.

- Short-Term Rentals: The rise of platforms like Airbnb and Vrbo has created a new market for short-term rentals. Investing in properties suitable for short-term rentals can generate significant income, especially in popular tourist destinations. Cities like New Orleans and Austin are popular tourist destinations, attracting visitors who seek short-term rental accommodations.

- Co-Living Spaces: As urban populations grow, co-living spaces are gaining popularity, offering affordable and communal living options. Investing in co-living properties can provide a steady stream of rental income, catering to a growing segment of the market. Cities like San Francisco and New York City are experiencing high demand for co-living spaces due to their dense populations and high housing costs.

Investment Strategies and Considerations: Best City For Investment Property

Investing in real estate can be a rewarding venture, but it’s crucial to have a well-defined strategy to maximize returns and manage risks. This section explores common investment strategies, their advantages and disadvantages, and provides examples of successful implementation in different cities.

Buy-and-Hold

This strategy involves purchasing a property with the intention of holding it for an extended period, typically years or even decades. It aims to benefit from long-term appreciation in property value and rental income.

Advantages

- Passive Income: Rental income provides a steady stream of cash flow, helping cover expenses and generating positive returns.

- Tax Advantages: Mortgage interest and property taxes are often deductible, reducing tax liability.

- Long-Term Appreciation: Real estate historically appreciates over time, potentially leading to significant capital gains.

- Potential for Equity Growth: As mortgage payments are made, equity in the property increases, providing a financial safety net.

Disadvantages

- High Initial Investment: Purchasing a property requires substantial upfront capital for the down payment, closing costs, and potential renovations.

- Market Fluctuations: Real estate values can fluctuate, potentially leading to temporary losses or slower appreciation.

- Property Management Responsibilities: Landlords are responsible for maintenance, repairs, tenant issues, and legal compliance, which can be time-consuming and demanding.

- Interest Rate Risk: Rising interest rates can increase mortgage payments, impacting cash flow and profitability.

Examples

- San Francisco: Investors have traditionally employed the buy-and-hold strategy in San Francisco, benefiting from long-term appreciation and strong rental demand despite high property prices.

- New York City: The buy-and-hold strategy remains popular in New York City, where rental income can offset expenses and property values tend to appreciate over time.

Flipping

This strategy involves purchasing a property, renovating or improving it, and then quickly reselling it for a profit. It focuses on short-term appreciation and capital gains.

Advantages

- Potential for High Returns: Successful flipping projects can generate substantial profits within a relatively short timeframe.

- Flexibility: Flipping allows investors to target specific markets and properties based on their expertise and resources.

Disadvantages

- High Risk: Flipping involves significant financial risk, as renovation costs, market fluctuations, and unforeseen issues can impact profitability.

- Time Commitment: Flipping requires significant time and effort for sourcing, renovating, and marketing properties.

- Limited Appreciation Potential: Flipping focuses on short-term gains, limiting potential for long-term appreciation.

Examples

Short-Term Rentals

This strategy involves renting out a property for short periods, typically less than 30 days, to tourists or business travelers. It aims to generate higher rental income than long-term leases.

Advantages

- Higher Rental Income: Short-term rentals can command significantly higher rates than long-term leases, generating greater revenue.

- Flexibility: Investors can adjust rental rates and availability based on seasonal demand and market conditions.

- Potential for Passive Income: Short-term rentals can be managed remotely through online platforms, reducing the need for direct property management.

Disadvantages

- Regulatory Restrictions: Short-term rentals are often subject to local regulations and permits, which can vary widely and be challenging to navigate.

- High Turnover: Frequent guest turnover can lead to increased cleaning and maintenance costs.

- Potential for Damage: Short-term rentals are more susceptible to damage or theft, requiring additional insurance coverage and potentially higher security measures.

Examples

Investing in real estate can be a rewarding endeavor, but it requires careful planning, research, and a keen eye for opportunity. By understanding the nuances of the market, considering investment strategies, and mitigating risks, investors can increase their chances of achieving their financial goals. Whether you’re a seasoned professional or a first-time buyer, this guide provides a comprehensive framework for navigating the world of investment properties.

Popular Questions

What are the most important factors to consider when choosing an investment property?

Location, property type, rental yield, and potential for appreciation are key factors to consider. Researching the local market, analyzing economic trends, and understanding the demographics of the area are essential for making informed decisions.

How can I mitigate risks associated with real estate investments?

Diversifying investments, conducting thorough due diligence, seeking professional advice, and maintaining a healthy cash flow are effective strategies for mitigating risks. It’s also important to stay informed about market conditions and be prepared to adjust your strategy as needed.

What are some emerging investment opportunities in the real estate market?

Emerging trends in the real estate market include growth in urban areas, increasing demand for rental properties, and the rise of alternative investment strategies like short-term rentals. Researching these trends and identifying cities with strong potential for growth can lead to profitable opportunities.

Choosing the best city for investment property involves careful consideration of factors like economic growth, rental demand, and property values. A strong educational system can be a significant driver of these factors, and Chapel Hill, North Carolina, is known for its excellent academic institutions, including the University of North Carolina at Chapel Hill. If you’re looking to invest in a thriving community, a chapel hill online mba program might be a good indicator of a city’s intellectual capital and potential for future growth, making it an attractive investment destination.

Choosing the best city for investment property can be tricky, especially when you consider factors like economic growth, population trends, and future development. A helpful resource to consider is the asynchronous online class on real estate investing, which can provide valuable insights and strategies. Once you have a solid understanding of the fundamentals, you can then focus on identifying cities with strong potential for rental income and property appreciation.

Choosing the best city for investment property requires careful consideration of factors like economic growth, rental demand, and property values. A strong understanding of financial management is crucial for navigating the complexities of real estate investment, and an online MBA in accounting can provide the necessary expertise. With a solid financial foundation, you’ll be well-equipped to identify and capitalize on profitable investment opportunities in the best cities for real estate.