Best Cities to Invest in Rental Properties A Guide to Success

Best cities to invest in rental properties – the phrase itself evokes dreams of passive income, appreciating assets, and a secure financial future. But navigating the complex world of real estate investment requires more than just a hunch. This guide delves into the factors that make certain cities prime locations for rental property investments, providing insights into market trends, evaluation strategies, and essential financial considerations.

From understanding the dynamics of population growth and job markets to analyzing rental rates and vacancy rates, this guide empowers you to make informed decisions and maximize your chances of success in the rental property market.

Factors Influencing Rental Property Investment

Investing in rental properties can be a lucrative endeavor, but it requires careful consideration of various factors to maximize returns and minimize risks. Choosing the right city is crucial, as it significantly impacts the success of your investment.

Key Factors Investors Consider

Investors carefully evaluate several factors when selecting cities for rental property investments. These factors influence the potential for rental income, property appreciation, and overall investment performance.

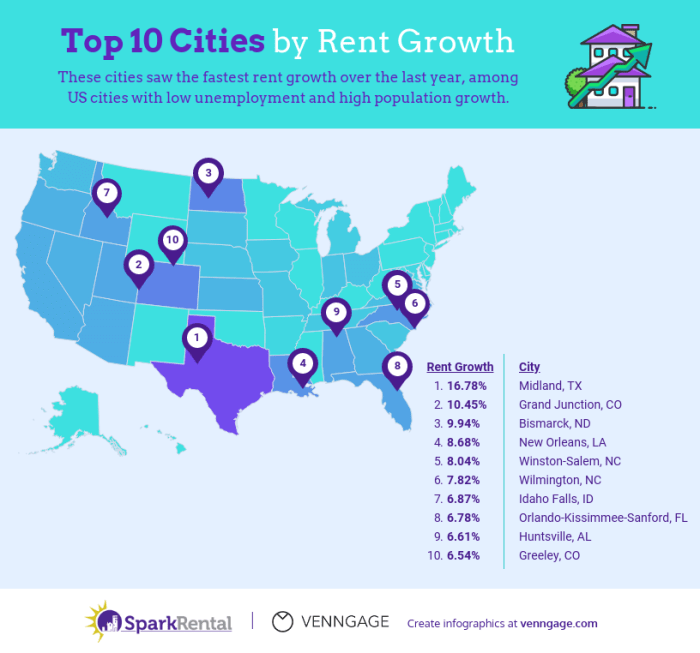

- Population Growth: A growing population signifies an expanding demand for housing, potentially leading to higher rental rates and property values. Cities with strong population growth are generally attractive for rental property investments. For example, Austin, Texas, has experienced significant population growth in recent years, driven by its thriving tech industry and favorable cost of living, contributing to a robust rental market.

- Job Market: A robust job market indicates a strong local economy, attracting residents and supporting rental demand. Cities with diverse industries and low unemployment rates tend to offer stable rental markets. For instance, San Francisco, California, boasts a thriving tech industry, creating a strong job market and driving demand for rental housing.

- Housing Affordability: The affordability of housing plays a crucial role in attracting renters and determining rental rates. Cities with relatively lower housing costs compared to income levels tend to attract a wider range of renters, fostering a more stable rental market. For example, cities like Detroit, Michigan, and Cleveland, Ohio, offer relatively affordable housing options, attracting renters seeking lower living expenses.

- Rental Yields: Rental yields measure the annual rental income generated by a property as a percentage of its purchase price. Higher rental yields indicate a stronger return on investment. Cities with high rental yields attract investors seeking passive income streams. For instance, cities like Atlanta, Georgia, and Charlotte, North Carolina, have historically offered attractive rental yields, drawing investors seeking to capitalize on strong rental markets.

- Property Appreciation: Property appreciation refers to the increase in value over time. Cities with robust economies and growing populations tend to experience higher property appreciation rates. For example, cities like Denver, Colorado, and Seattle, Washington, have seen significant property value appreciation in recent years, driven by strong job markets and population growth.

The Importance of Factors in Different Cities

The relative importance of these factors can vary significantly across different cities. For example, in a city with a booming tech industry and high demand for housing, factors like population growth and job market might be more critical than housing affordability. Conversely, in a city with a mature economy and limited population growth, factors like rental yields and property appreciation might be more important.

Managing Rental Properties

Successfully managing rental properties involves a multifaceted approach that encompasses tenant screening, rent collection, property maintenance, and risk mitigation strategies. By implementing effective management practices, landlords can maximize returns on their investments while ensuring a smooth and positive experience for both themselves and their tenants.

Tenant Screening

Thorough tenant screening is essential to minimize the risk of financial losses and property damage.

- Credit History: Review credit reports to assess the tenant’s financial responsibility and ability to pay rent on time.

- Background Checks: Conduct criminal background checks to ensure the safety of the property and other tenants.

- Employment Verification: Verify employment status and income to confirm the tenant’s ability to afford the rent.

- Rental History: Contact previous landlords to inquire about the tenant’s rental history, including their payment history and any issues encountered.

- References: Request personal references to gain insights into the tenant’s character and reliability.

Rent Collection, Best cities to invest in rental properties

Efficient rent collection is crucial for maintaining cash flow and ensuring financial stability.

- Establish Clear Payment Terms: Clearly define the rent amount, due date, and acceptable payment methods in the lease agreement.

- Automated Payment Systems: Implement online payment portals or automated payment systems to simplify rent collection and reduce the risk of late payments.

- Late Fee Policies: Establish clear late fee policies and enforce them consistently to discourage late payments.

- Communication: Maintain open communication with tenants regarding rent payments, especially if there are any issues or delays.

- Legal Action: If a tenant consistently fails to pay rent, be prepared to take legal action to recover unpaid rent and potentially evict the tenant.

Property Maintenance

Regular property maintenance is essential for preserving the value of the investment and ensuring tenant satisfaction.

- Routine Inspections: Conduct regular inspections to identify and address any maintenance issues promptly.

- Preventative Maintenance: Implement a preventative maintenance schedule to address potential issues before they become major problems.

- Emergency Repairs: Establish a system for handling emergency repairs quickly and efficiently, such as a 24/7 maintenance hotline.

- Tenant Responsibilities: Clearly define the tenant’s responsibilities for maintaining the property, such as keeping the unit clean and reporting any maintenance issues.

- Professional Contractors: Use qualified and licensed contractors for major repairs and renovations to ensure quality work and compliance with building codes.

Landlord and Tenant Responsibilities

The following table Artikels the typical responsibilities of landlords and tenants in a rental agreement:

| Responsibility | Landlord | Tenant |

|---|---|---|

| Providing habitable housing | Yes | No |

| Maintaining the property | Yes (major repairs) | Yes (minor repairs) |

| Paying rent on time | No | Yes |

| Following lease terms | Yes | Yes |

| Respecting the rights of others | Yes | Yes |

Minimizing Risks and Maximizing Returns

Effective risk management and return optimization are crucial for successful rental property investments.

- Diversification: Invest in a portfolio of rental properties in different locations and price ranges to reduce risk.

- Market Research: Conduct thorough market research to identify areas with strong rental demand and potential for appreciation.

- Property Management: Consider hiring a professional property manager to handle day-to-day operations and reduce the workload.

- Insurance: Obtain comprehensive insurance coverage to protect against unexpected events, such as fire, theft, or liability claims.

- Financial Planning: Develop a financial plan that includes budgeting for expenses, setting rental rates, and managing cash flow.

Emerging Trends in Rental Property Investment

The rental property market is constantly evolving, driven by shifting demographics, technological advancements, and changing consumer preferences. Understanding these trends is crucial for investors seeking to capitalize on emerging opportunities and navigate the evolving landscape.

The Rise of Short-Term Rentals

The popularity of platforms like Airbnb and Vrbo has significantly impacted the rental market, offering property owners a new avenue for generating income. Short-term rentals have become increasingly attractive for both investors and travelers, providing flexibility and a unique experience.

- Increased Revenue Potential: Short-term rentals can generate higher revenue compared to traditional long-term leases, particularly in popular tourist destinations.

- Flexibility and Control: Owners have greater control over their properties, setting their own rates and availability, and managing guest interactions.

- Growing Demand: The demand for short-term rentals continues to rise, fueled by the growing popularity of travel and the desire for unique accommodations.

However, it’s essential to consider the regulatory landscape and potential challenges associated with short-term rentals, such as local restrictions, insurance requirements, and potential for neighborhood disruption.

The Growing Demand for Sustainable Housing

Sustainability is no longer a niche concern but a mainstream priority for both renters and investors. The demand for environmentally friendly and energy-efficient rental properties is increasing, driven by rising awareness of climate change and the desire for a healthier living environment.

- Energy Efficiency: Renters are increasingly seeking properties with features like solar panels, energy-efficient appliances, and insulation, leading to lower utility bills and a reduced carbon footprint.

- Green Building Practices: Sustainable building materials, water conservation measures, and green landscaping are becoming standard features in new rental developments.

- Increased Property Value: Sustainable properties tend to command higher rents and attract a wider pool of tenants, boosting their long-term value.

Investing in sustainable rental properties can not only contribute to a greener future but also offer a competitive advantage in the market.

Examples of Cities Leading Sustainable Rental Property Development

Several cities are at the forefront of sustainable rental property development, demonstrating innovative approaches to meet the growing demand for eco-friendly housing.

- Amsterdam, Netherlands: Amsterdam has implemented strict energy efficiency regulations for rental properties, requiring landlords to meet specific standards for insulation, heating, and ventilation. This has resulted in a significant reduction in energy consumption and carbon emissions.

- Portland, Oregon, USA: Portland has a robust green building program, encouraging developers to incorporate sustainable features into new rental projects. The city also offers incentives for energy-efficient retrofits of existing buildings.

- Vancouver, British Columbia, Canada: Vancouver has a comprehensive sustainability strategy that includes targets for reducing greenhouse gas emissions and promoting green building practices. The city offers financial incentives for landlords who make their properties more sustainable.

These cities demonstrate that sustainable rental property development is not only possible but also profitable, attracting investors and tenants who prioritize environmental responsibility.

Investing in rental properties can be a rewarding endeavor, but it’s crucial to approach it strategically. By carefully considering the factors Artikeld in this guide, you can identify promising cities, evaluate investment opportunities, and build a successful rental property portfolio. Remember, thorough research, meticulous planning, and ongoing management are essential for achieving long-term success in this dynamic market.

Popular Questions: Best Cities To Invest In Rental Properties

What are the most important factors to consider when choosing a city for rental property investment?

Factors like population growth, job market strength, housing affordability, rental demand, and potential for appreciation are crucial considerations. A city with a growing population, a thriving job market, and a healthy demand for rental properties is likely to offer attractive investment opportunities.

How can I determine if a rental property is a good investment?

Evaluate factors such as property condition, location, potential for appreciation, rental income potential, and potential expenses. Conduct thorough due diligence, including property inspections and market research, before making a purchase decision.

What are the risks associated with rental property investment?

Risks include tenant issues, property damage, market fluctuations, and economic downturns. Proper tenant screening, comprehensive insurance, and a well-structured rental agreement can help mitigate these risks.

What are some tips for managing rental properties effectively?

Establish clear communication with tenants, enforce lease terms, respond promptly to maintenance requests, and maintain accurate financial records. Consider hiring a professional property manager if you’re not comfortable handling all aspects of property management yourself.

When deciding on the best cities to invest in rental properties, it’s crucial to consider factors like population growth, job market strength, and affordability. A growing healthcare sector, for example, often indicates a strong demand for certified nursing assistants (CNAs), making it a wise investment. If you’re interested in pursuing a CNA career, consider enrolling in one of the many online CNA certification courses available, which can provide you with the skills and knowledge needed to succeed in this field.

This, in turn, could lead to a greater demand for rental properties in cities with thriving healthcare industries, making them even more attractive investment opportunities.

When choosing the best cities to invest in rental properties, consider factors like population growth, job market, and affordability. A strong job market often translates to a higher demand for housing, making it a good investment. If you’re interested in a career in healthcare, you might want to look into online courses for medical assistant which can open up opportunities in various cities.

Ultimately, the best cities to invest in rental properties depend on your individual goals and financial situation.

Determining the best cities to invest in rental properties requires careful consideration of factors like population growth, job markets, and housing demand. If you’re looking to enter the healthcare field, you might consider becoming a Certified Nursing Assistant (CNA) by taking online CNA courses. This career path offers excellent job security and a high demand for skilled professionals, particularly in cities with a strong healthcare infrastructure, making these cities even more attractive for real estate investment.

Choosing the right city to invest in rental properties is crucial for success. Factors like population growth, job market, and affordability all play a role. If you’re looking for a career change that can complement your real estate investments, consider taking phlebotomy courses online. This in-demand healthcare field offers flexible work schedules and a steady income stream, which can be a valuable asset when managing rental properties.

Choosing the best cities to invest in rental properties requires careful research and consideration of factors like population growth, job market, and local regulations. A strong understanding of electrical systems is crucial for property management, and taking online electrical courses can equip you with the knowledge to maintain your rental properties effectively. This investment in your skills can ultimately lead to greater profitability and success in the rental market.