Best Cities for Property Investment Where to Invest Now

Best cities for property investment: The allure of owning property in thriving urban centers is undeniable. From bustling metropolises to emerging hubs, these cities offer investors a chance to capitalize on growth, rental income, and long-term appreciation. But with so many options, discerning investors need to carefully consider the factors that drive property value and make informed decisions.

This guide explores the key factors influencing property investment, highlighting the top cities worldwide with the highest potential for returns. We’ll delve into the investment landscape of each city, analyzing its unique strengths and potential risks. We’ll also discuss various investment strategies and considerations, providing practical tips for success.

Factors Influencing Property Investment

Property investment is a complex endeavor influenced by a multitude of factors. Understanding these factors is crucial for investors seeking to make informed decisions and maximize their returns.

Economic Indicators

Economic indicators provide valuable insights into a city’s economic health and its potential for property appreciation. Strong economic indicators signal a robust and growing economy, which can lead to increased demand for housing and higher property values.

- Gross Domestic Product (GDP) Growth: A consistently growing GDP indicates a thriving economy with strong employment and consumer spending, which positively impacts property demand.

- Unemployment Rate: A low unemployment rate reflects a strong job market and a higher likelihood of people being able to afford housing, leading to increased demand.

- Inflation Rate: While a moderate inflation rate is generally considered healthy, high inflation can erode purchasing power and make property investments less attractive.

- Interest Rates: Low interest rates make borrowing money more affordable, which can stimulate demand for property and drive up prices.

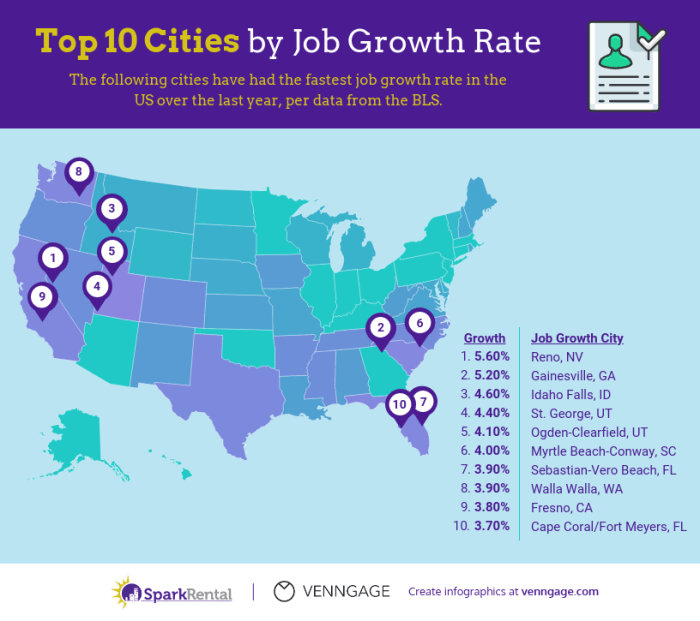

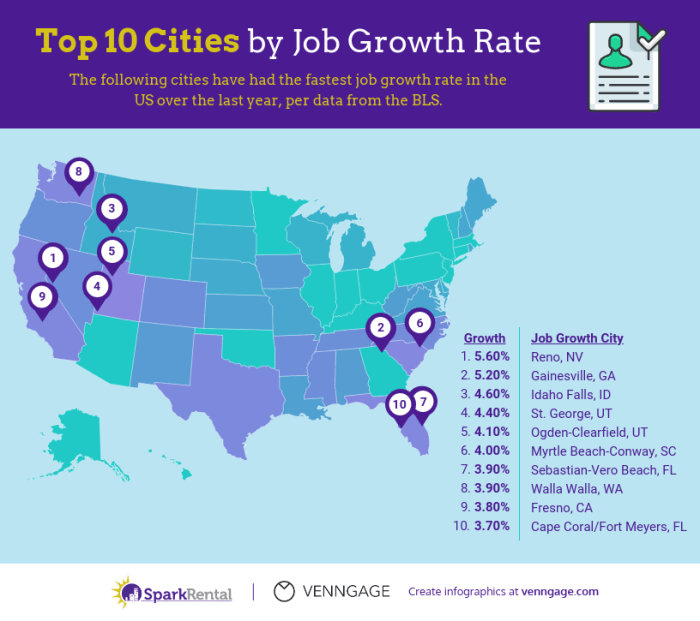

Population Growth and Employment Opportunities

Population growth and employment opportunities are inextricably linked to property values. As a city’s population expands, the demand for housing increases, driving up prices.

- Population Growth: A growing population indicates a strong demand for housing, which can lead to higher property values.

- Employment Opportunities: A city with a diverse and growing job market attracts more residents, increasing demand for housing and boosting property prices.

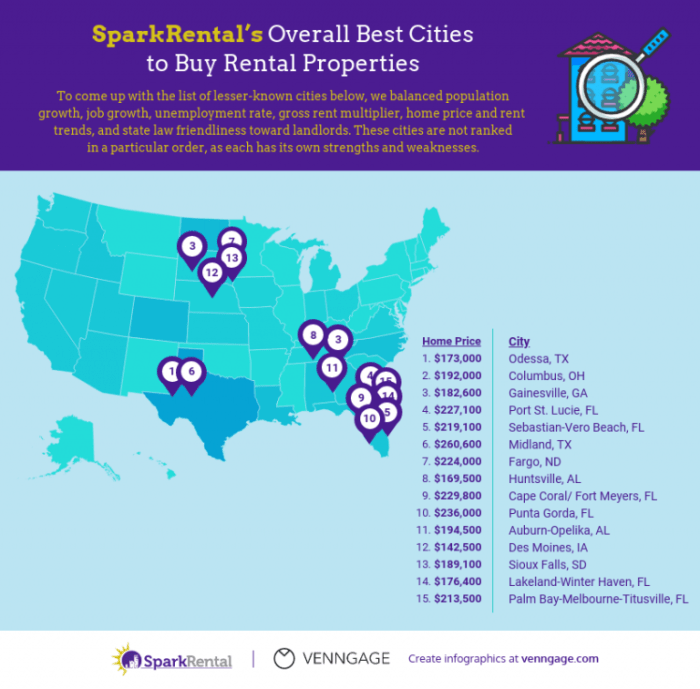

Top Cities for Property Investment: Best Cities For Property Investment

Investing in real estate can be a lucrative endeavor, offering potential for capital appreciation and steady rental income. However, choosing the right city is crucial to maximizing your returns. This section explores the top 10 cities worldwide known for their robust property markets and strong investment potential.

Top Cities for Property Investment

Here is a list of the top 10 cities worldwide with the highest property investment potential, based on factors such as average price growth, rental yields, and vacancy rates.

Choosing the best cities for property investment involves a lot of research, but you can also consider the job market and its growth potential. For example, cities with a strong healthcare sector often see good returns on property. If you’re looking to get into the healthcare field, consider enrolling in online CNA courses to gain valuable skills. This can open up opportunities in cities with high demand for healthcare professionals, further strengthening the case for property investment in those areas.

| Rank | City | Country | Average Price Growth (Annual) | Rental Yield | Vacancy Rate |

|---|---|---|---|---|---|

| 1 | Dubai | UAE | 8.5% | 5.5% | 1.5% |

| 2 | Hong Kong | China | 6.2% | 3.8% | 2.0% |

| 3 | London | UK | 4.8% | 4.2% | 2.5% |

| 4 | New York City | USA | 4.5% | 3.5% | 3.0% |

| 5 | Toronto | Canada | 4.0% | 4.0% | 2.0% |

| 6 | Sydney | Australia | 3.8% | 3.5% | 2.5% |

| 7 | Singapore | Singapore | 3.5% | 3.0% | 1.5% |

| 8 | Tokyo | Japan | 3.2% | 2.8% | 1.8% |

| 9 | Paris | France | 3.0% | 3.2% | 2.2% |

| 10 | Berlin | Germany | 2.8% | 3.5% | 2.0% |

It’s important to note that these rankings are based on current market conditions and can change over time.

Choosing the best cities for property investment requires careful consideration of factors like job market growth and affordability. A thriving healthcare industry often indicates a strong local economy, making cities with high demand for medical professionals attractive for real estate investment. If you’re interested in a career in healthcare, consider exploring online courses for medical assistants to gain the skills needed to contribute to this growing field.

The demand for qualified medical assistants is high, which can translate to a stable job market and potential for career advancement, ultimately impacting the real estate market in those areas.

Detailed City Descriptions

Here is a detailed description of each city’s unique investment landscape, highlighting its strengths and potential risks.

Deciding on the best cities for property investment often involves considering factors like job market growth and overall economic health. These factors can be influenced by the availability of skilled professionals in key industries. For example, the healthcare sector is booming in many cities, making it a good idea to consider pursuing a career as a Licensed Practical Nurse (LPN) through online LPN courses.

This could lead to job opportunities and a boost in the local economy, which in turn, could positively impact property values.

- Dubai: Dubai is a global hub for tourism, trade, and finance. Its strong economy, favorable tax regime, and high-quality infrastructure attract investors from around the world. The city’s booming real estate market has seen significant price appreciation in recent years. However, potential risks include dependence on oil prices and government regulations.

- Hong Kong: Hong Kong is a leading financial center with a highly developed property market. Its strong rental yields and limited land supply have made it a popular destination for investors. However, high property prices and political uncertainties pose potential risks.

- London: London is a global financial and cultural center with a long history of real estate investment. Its strong economy, diverse population, and world-class amenities attract investors from around the world. However, high property prices and potential for Brexit-related uncertainty pose challenges.

- New York City: New York City is a global metropolis with a thriving economy and a strong real estate market. Its high rental yields and strong demand from tenants make it attractive for investors. However, high property prices and potential for market fluctuations pose risks.

- Toronto: Toronto is Canada’s largest city and a major financial center. Its strong economy, growing population, and limited land supply have driven up property prices in recent years. However, high property prices and potential for government regulations pose risks.

- Sydney: Sydney is Australia’s largest city and a popular destination for investors. Its strong economy, limited land supply, and high rental yields make it an attractive investment opportunity. However, high property prices and potential for government regulations pose risks.

- Singapore: Singapore is a global financial center with a highly developed property market. Its strong economy, low vacancy rates, and government-supported infrastructure make it a popular destination for investors. However, high property prices and potential for government regulations pose risks.

- Tokyo: Tokyo is Japan’s capital and a global financial center. Its strong economy, low vacancy rates, and high-quality infrastructure attract investors from around the world. However, high property prices and potential for economic fluctuations pose risks.

- Paris: Paris is a global tourist destination with a strong economy and a highly developed property market. Its strong rental yields and limited land supply make it attractive for investors. However, high property prices and potential for government regulations pose risks.

- Berlin: Berlin is Germany’s capital and a growing economic hub. Its affordable property prices, strong rental yields, and growing population make it an attractive investment opportunity. However, potential risks include economic uncertainty and government regulations.

Comparison of Property Markets

The property markets of these cities vary significantly in terms of investment strategies and potential returns.

Choosing the best cities for property investment can be a complex process, considering factors like economic growth, job markets, and infrastructure. If you’re looking to diversify your portfolio, you might want to consider the potential of learning in-demand skills like coding and billing through online courses, such as those offered at coding and billing courses online. This could open doors to lucrative career opportunities in growing industries, ultimately impacting your property investment choices by influencing your earning potential and lifestyle preferences.

- High-Growth Markets: Cities like Dubai, Hong Kong, and London are known for their high property price growth, offering the potential for significant capital appreciation. However, these markets also tend to have higher entry costs and may be more susceptible to market fluctuations.

- Stable Markets: Cities like Toronto, Sydney, and Singapore offer more stable property markets with moderate price growth and strong rental yields. These markets may be less volatile but may also offer lower returns compared to high-growth markets.

- Emerging Markets: Cities like Berlin and Paris are considered emerging markets with potential for significant growth in the coming years. These markets offer lower entry costs and may provide higher returns over the long term, but also carry higher risks.

Investment Strategies and Considerations

Choosing the right investment strategy is crucial for success in property investment. Understanding the different approaches, their potential risks and rewards, and the practical considerations involved can help you make informed decisions.

Buy-to-Let, Best cities for property investment

Buy-to-let involves purchasing a property with the intention of renting it out to tenants for a steady income stream. This strategy is popular among investors seeking long-term passive income.

Pros of Buy-to-Let

- Passive income: Rent payments provide a consistent source of income, even if you’re not actively involved in the property’s day-to-day management.

- Capital appreciation: Property values tend to appreciate over time, potentially generating capital gains when you sell the property.

- Tax benefits: In some jurisdictions, buy-to-let investors can benefit from tax deductions on mortgage interest payments, property maintenance costs, and other expenses.

Cons of Buy-to-Let

- Rental market volatility: Fluctuations in rental demand and vacancy rates can impact your income and profitability.

- Property management responsibilities: Managing tenants, handling repairs, and dealing with potential issues can be time-consuming and stressful.

- Financial risks: Unexpected expenses, tenant defaults, and market downturns can negatively affect your returns.

Property Flipping

Property flipping involves buying a property, renovating it, and then reselling it for a profit. This strategy is often used for short-term gains, capitalizing on market trends and undervalued properties.

Pros of Property Flipping

- Quick returns: Flipping can generate significant profits within a shorter timeframe compared to buy-to-let.

- Active involvement: This strategy allows for hands-on involvement in the project, potentially leading to greater satisfaction.

- Potential for high profits: By identifying undervalued properties and implementing strategic renovations, investors can achieve substantial returns.

Cons of Property Flipping

- High upfront costs: Flipping requires significant initial investment for purchase, renovation, and holding costs.

- Market volatility: Changes in market conditions can affect the value of your property and potentially lead to losses.

- Renovation risks: Unexpected delays, cost overruns, and unforeseen issues during renovations can impact profitability.

Development Projects

Development projects involve acquiring land or existing properties to construct new buildings or renovate them for a higher purpose. This strategy typically involves larger investments and higher risk but offers the potential for substantial returns.

Pros of Development Projects

- High potential returns: Development projects can generate significant profits, particularly in areas with strong demand and limited supply.

- Control over the project: Developers have more control over the design, construction, and marketing of the project.

- Long-term investment: Development projects can create valuable assets that provide long-term income streams or appreciation potential.

Cons of Development Projects

- High initial investment: Development projects require significant capital for land acquisition, construction, and other expenses.

- Complex regulatory processes: Obtaining permits, approvals, and financing for development projects can be challenging and time-consuming.

- Market risks: Economic downturns, changes in regulations, and unforeseen circumstances can impact project feasibility and profitability.

Investing in real estate can be a rewarding endeavor, offering the potential for both financial gains and a sense of ownership. By understanding the factors that drive property values, analyzing market trends, and employing sound investment strategies, you can position yourself for success in the dynamic world of property investment. Whether you’re seeking a buy-to-let opportunity, property flipping, or development projects, this guide provides valuable insights to help you make informed decisions and maximize your investment potential.

FAQ Guide

What are the most important factors to consider when choosing a city for property investment?

The most important factors include economic growth, population growth, employment opportunities, infrastructure development, government policies, rental yields, vacancy rates, and quality of life.

What are some common risks associated with property investment?

Risks include market volatility, interest rate fluctuations, economic downturns, and unexpected property maintenance expenses.

How can I mitigate the risks of property investment?

You can mitigate risks by conducting thorough due diligence, diversifying your portfolio, understanding local regulations, and managing rental properties effectively.