Arizona Property Management Investments

In the heart of the American Southwest lies Arizona, a state emblematic of growth and opportunity, rising from its desert landscapes to become one of the most attractive real estate markets in the United States. Whether it’s the breathtaking sunsets over the Grand Canyon or the thriving economy in cities like Phoenix and Tucson, there’s an undeniable allure to investing in Arizona’s property landscape. As more investors turn their attention to the Grand Canyon State, especially in the realm of property management investments, it becomes vital to understand the dynamics that are shaping this burgeoning market. Welcome to the world of Arizona Property Management Investments.

For years, Arizona has been a magnet for both seasoned investors and newcomers alike, offering a unique blend of economic vitality, population growth, and a business-friendly environment. This burgeoning interest is not without reason. From its competitive housing prices compared to other states on the West Coast, to its robust rental market driven by a steady influx of new residents, Arizona presents a fertile ground for property management investments. But what exactly makes Arizona such a hotbed for this kind of opportunity, and how can investors effectively leverage the existing market conditions to maximize their returns?

Understanding Arizona’s Unique Appeal

Arizona’s real estate market is characterized by its diversity and resilience. Unlike other states, where market trends might be dictated by a single industry, Arizona boasts an economy supported by sectors as varied as technology, manufacturing, healthcare, and tourism. This economic diversity lends stability to the housing market, making it less susceptible to the kinds of fluctuations seen in more homogenous economies. Coupled with the state’s strategic location — acting as a bridge between the U.S., Mexico, and the Pacific — it becomes clear why Arizona is often touted as a prime investment destination.

The Surge in Rental Demand

The flow of new residents into Arizona has catalyzed a burgeoning demand for rental properties, particularly in urban centers such as Phoenix, the fifth-most populous city in the United States. This influx is driven by factors including a relatively lower cost of living, a thriving job market, and a quality of life that entices individuals from more expensive regions like California. Property management companies have taken notice, gearing up their operations to manage an ever-expanding pool of rental properties, while offering attractive opportunities for investors looking to capitalize on this surge.

Challenges and Opportunities in Arizona Property Management

Of course, like any investment, property management in Arizona isn’t without its challenges. From understanding local zoning laws and licensing requirements to leveraging the right marketing strategies for tenant acquisition, navigating the Arizona property market requires due diligence and strategic planning. However, for those willing to invest the time and resources, the potential rewards are substantial. Effective property management can significantly enhance property value and rental income, providing robust returns on investment. As we delve deeper into Arizona’s property management landscape, we’ll explore how investors can overcome challenges and seize opportunities to optimize their portfolios.

Innovations in Property Management Technology

The role of technology in transforming property management cannot be overstated. With advancements in digital solutions, from property management software to virtual tours and AI-driven analytics, the landscape is ever-evolving. For Arizona’s property managers and investors, these tools provide a competitive edge, enhancing operational efficiency and tenant engagement. Our discussion will cover the latest technological trends that are shaping property management and how savvy investors can leverage these tools to stay ahead of the curve.

Whether you are a seasoned investor seeking to diversify your portfolio or a newcomer intrigued by the possibilities of property management in Arizona, this exploration will shed light on the essential aspects of making informed, strategic investments. From understanding market trends and strategic location advantages to navigating regulatory landscapes and technological innovations, we’ll unravel the complexities of Arizona property management investments to equip you with the insights needed to succeed.

In this journey through the Arizona real estate market, we’ll uncover how property management can be a powerful vehicle for investment, offering substantial returns while contributing to the state’s continued growth and vibrancy. Discover how you can be part of this dynamic market, making informed decisions that align with both your investment objectives and Arizona’s promising future.

Understanding the Arizona Real Estate Market

Arizona’s real estate market is as diverse as its landscape, offering a variety of opportunities for property management investors. Understanding local market trends is crucial for maximizing returns on investment. Arizona’s economy is bolstered by a steady influx of new residents, attracted by its pleasant climate, low property taxes, and a growing job market. This suggests a healthy demand for both rental properties and real estate purchases.

Investors must stay informed about current market conditions, such as property price fluctuations, vacancy rates, and neighborhood growth trends. By doing so, they can make informed decisions about when to buy, sell, or hold properties, significantly impacting their long-term profitability.

Diversification of Property Investment Portfolio

Diversification is a fundamental strategy for minimizing risk and maximizing returns. By investing in a mix of property types (residential, commercial, short-term, and long-term rentals), investors can hedge against downturns in specific sectors. Arizona offers unique opportunities in each of these categories.

Residential vs. Commercial Properties

Residential properties, including single-family homes and multifamily units, are often considered safer investments due to consistent demand driven by Arizona’s growing population. On the other hand, commercial properties can offer higher returns, although they might carry increased risk and longer vacancy periods. Savvy investors look for commercial spaces in thriving business districts or emerging neighborhoods to maximize potential ROI.

Short-Term vs. Long-Term Rentals

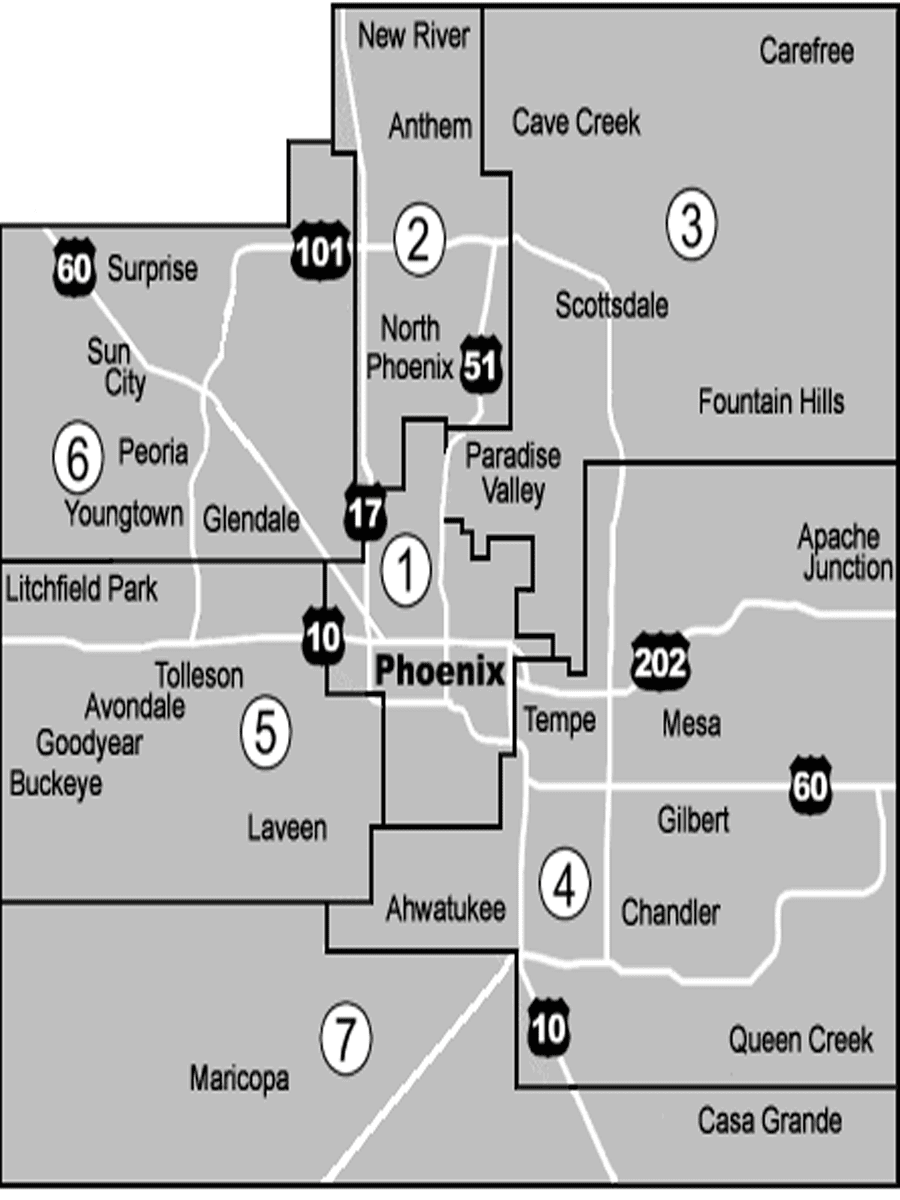

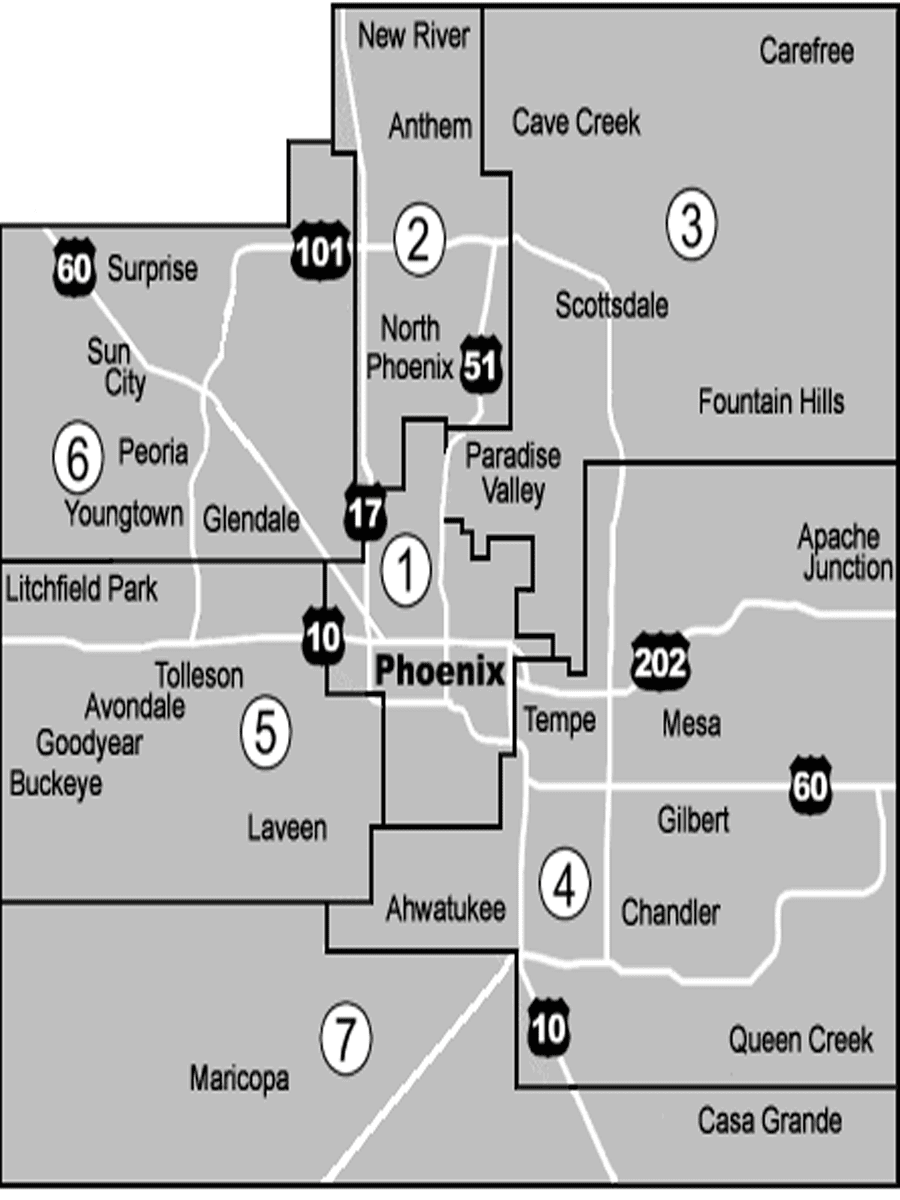

Short-term rentals, particularly in tourist-heavy areas like Scottsdale, provide high nightly rates and can be highly profitable, especially during peak tourism seasons. However, they require active management and can be impacted by regulatory changes. Long-term rentals offer stability and reduced turnover, appealing in areas with steady employment growth, such as Phoenix and Tempe.

Enhancing Property Value Through Strategic Upgrades

Increasing a property’s value can boost rental income and appreciation, leading to higher returns. Targeted upgrades based on common tenant preferences and current market demands often yield the best results. These enhancements can range from aesthetic improvements to energy-efficient installations.

Energy Efficiency Improvements

- Solar Panels: Arizona’s sunny climate makes solar energy a viable and attractive option for reducing utility costs and appealing to environmentally conscious tenants.

- Smart Home Technologies: Investing in smart thermostats, energy-efficient lighting, and appliances can not only cut utility costs but also attract tech-savvy renters willing to pay a premium for modern amenities.

Aesthetic and Functional Upgrades

- Updated Kitchens and Bathrooms: These are high-impact areas that can significantly raise a property’s rental value. Opt for modern finishes like granite or quartz countertops and stainless-steel appliances.

- Improved Landscaping: Curb appeal matters. Enhancing outdoor spaces with drought-resistant plants and contemporary hardscaping can improve first impressions and overall property desirability.

Effective Tenant Management

Tenant satisfaction is integral to maintaining high occupancy rates and steady cash flow. By implementing effective tenant management strategies, Arizona property managers can reduce turnover and maintain a positive reputation.

Thorough Tenant Screening

A detailed tenant screening process helps ensure you select reliable renters who will respect your property and pay rent on time. This includes background checks, credit assessments, and reference verification.

Consistent Communication and Prompt Maintenance

Regular communication with tenants builds trust and loyalty, making them less likely to leave. Additionally, maintaining properties and addressing repairs promptly can prevent small issues from escalating into costly problems, while also keeping tenants satisfied.

Leveraging Technology in Property Management

The technological landscape is rapidly transforming property management practices. Utilizing advanced technology can streamline operations, improve tenant experiences, and provide valuable insights into property performance.

Property Management Software

Investing in robust property management software allows for efficient handling of rent collection, maintenance requests, and lease agreements. It can also facilitate effective communication with tenants and offer real-time data analytics for informed decision-making.

Virtual Tours and Online Listings

Virtual tours and comprehensive online listings attract potential tenants more efficiently by providing convenient and immersive property views. This technology not only broadens your tenant reach but also reduces the time properties spend vacant.

Networking and Professional Development

Building a network within the Arizona property management community can provide valuable insights, support, and opportunities for collaboration. Engaging in professional development helps investors and managers stay ahead of industry trends and legal changes.

Joining Local Associations

Becoming a member of local real estate associations offers access to market data, training resources, and professional networking opportunities. These groups often host events that allow members to share strategies, tackle challenges, and celebrate successes.

Pursuing Continuing Education

Attending workshops, webinars, and courses about the latest property management practices and technologies can enhance your skills and knowledge, contributing to better operational decisions and increased returns.

Crafting a Strategy for Optimal Returns

As we’ve explored throughout this blog post, investing in property management in Arizona offers a compelling opportunity for both seasoned investors and newcomers to the real estate market. With Arizona’s booming economy, favorable climate, and consistent population growth, the state’s real estate sector is ripe with potential. Our journey through various facets of property management investment has illuminated several key elements that, when leveraged effectively, can lead to optimal returns.

First and foremost, we discussed the importance of understanding the local market dynamics. Arizona, particularly cities like Phoenix, Tucson, and Scottsdale, offers diverse opportunities but also presents unique challenges. Investors must stay informed about market trends, property values, and demographic shifts to make informed decisions. Whether it’s the influx of technology companies or the steady flow of retirees seeking warmer climates, knowing these dynamics is crucial for any successful investment strategy.

Another critical point we covered was the role of tenant management in securing sustained profitability. Building strong relationships with tenants, implementing efficient lease agreements, and maintaining high property standards are essential components that can minimize vacancies and enhance tenant satisfaction. Utilizing advanced property management tools and software can streamline operations, reduce overhead costs, and ultimately maximize returns.

We also delved into legal considerations, reminding investors of the importance of adhering to both state and local regulations. Arizona has specific laws regarding landlord-tenant relationships, property maintenance, and tax obligations. Comprehending these legal parameters not only safeguards your investment but also maintains your reputation as a responsible and ethical property owner.

In addition to these foundational elements, we explored strategies for portfolio diversification. Arizona’s property market includes a variety of investment types, from single-family homes to multi-unit complexes and commercial properties. Diversification helps mitigate risks and capitalizes on different market segments, ensuring more stable and predictable returns over time.

Technology also plays a significant role in modern property management investments. From digital marketing techniques to sophisticated data analytics and property management software, leveraging technology can provide sharp competitive advantages. We highlighted how tools like virtual tours and online tenant portals have become standard practices, catering to the needs of tech-savvy tenants and improving operational efficiency.

Furthermore, we emphasized the significance of having a responsive and agile strategy. The real estate market is inevitably influenced by economic cycles, interest rate fluctuations, and unforeseen global events. An adaptable investment strategy allows you to pivot your approach, whether that means re-evaluating your property portfolio, re-negotiating terms with tenants, or exploring new markets.

The blog post also touched upon the profound impact of Arizona’s sustainability initiatives. As environmental consciousness continues to rise, green investments, including energy-efficient properties and sustainable development projects, are gaining traction. These investments not only appeal to environmentally-minded tenants but can also yield tax incentives and long-term savings on utility costs.

Finally, the significance of professional networks cannot be overstated. Building connections with local real estate agents, contractors, financial advisors, and fellow investors enriches your wealth of knowledge and provides valuable insights and opportunities. Joining industry associations and attending property management seminars can further expand your expertise and help you stay abreast of market innovations.

A Call to Engage Further

In summary, crafting a strategy for optimal returns in Arizona property management investments involves a multi-faceted approach. By understanding local market dynamics, efficiently managing tenants, adhering to legal requirements, diversifying your investment portfolio, leveraging technology, adapting to market changes, focusing on sustainability, and building robust networks, you can greatly enhance your chances of achieving lucrative and sustainable returns.

We invite you to take the next step in your investment journey. Whether you are scaling your current portfolio or initiating your first investment, consider deepening your understanding through further research, workshops, or consultative sessions with property management experts. Our resource library provides white papers, case studies, and video content to expand your knowledge and inspire your next move.

Subscribe to our newsletter for the latest updates on Arizona’s property management trends and insights. Join our community of investors and stay connected with professionals who can offer guidance, share experiences, and provide support as you navigate the complexities of property management investments.

Get started today: Download our comprehensive guide on “Maximizing Rental Property ROI in Arizona.” Unlock actionable strategies tailored to the Arizona market and position yourself for enduring success in property management investments.