Are Annuities a Good Investment?

Are annuities a good investment? This question is at the forefront of many investors’ minds, particularly as they approach retirement. Annuities, financial products designed to provide guaranteed income streams, can seem complex and their suitability varies depending on individual circumstances. This article delves into the world of annuities, exploring their advantages and disadvantages, and ultimately helping you determine if they align with your financial goals.

Annuities come in various forms, each with its own set of features and risks. Fixed annuities offer guaranteed interest rates, while variable annuities provide potential for growth but also carry market risk. Indexed annuities tie returns to a specific index, aiming to provide growth while offering some protection from losses. Understanding these nuances is crucial when evaluating whether annuities are a good fit for you.

Understanding Annuities

Annuities are financial products that provide a stream of payments over a period of time. They are often used for retirement planning, but they can also be used for other purposes, such as supplementing income, providing long-term care, or leaving a legacy to loved ones. Annuities can be complex financial instruments, and it’s important to understand how they work before making an investment decision.

Types of Annuities

Annuities can be classified into different types, depending on the features and how the payouts are structured.

- Fixed Annuities: These annuities offer a guaranteed rate of return, which means you know exactly how much income you will receive each year. The downside is that the rate of return is typically lower than what you might get with other investments.

- Variable Annuities: These annuities invest your money in the stock market, so your payments can fluctuate depending on the performance of the market. The potential upside is that you could earn a higher return than with a fixed annuity. However, there is also the risk of losing money if the market goes down.

- Indexed Annuities: These annuities offer a return that is linked to the performance of a specific index, such as the S&P 500. This type of annuity provides some protection from market losses, but the returns may be lower than a variable annuity.

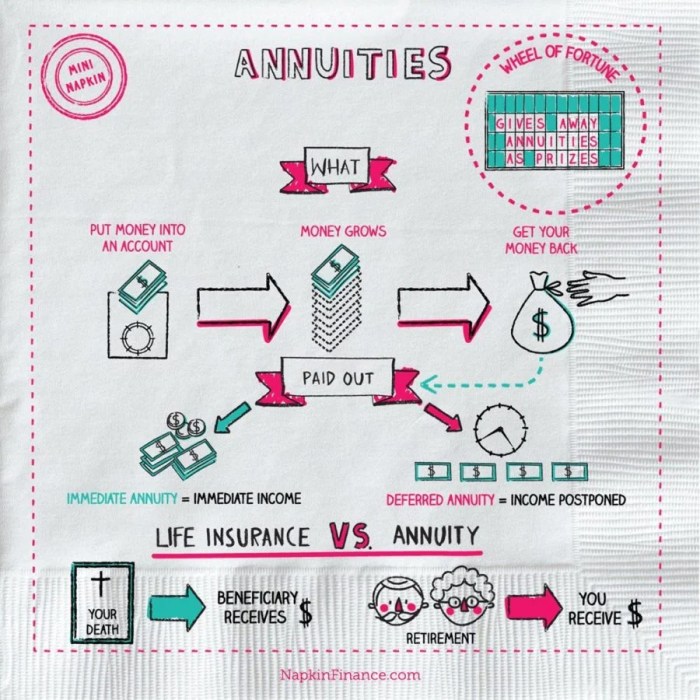

How Annuities Work

Annuities work by accumulating a pool of money that is then used to generate a stream of payments. The amount of income you receive each year depends on several factors, including:

- The amount of money you invest: The more you invest, the more income you will receive.

- The type of annuity: As mentioned earlier, different types of annuities offer different payout structures and potential returns.

- The length of the payout period: If you choose to receive payments for a longer period, the amount of each payment will be smaller.

Annuities offer guaranteed income streams, which means that you can be sure of receiving a certain amount of money each year for a specified period. This can be particularly valuable for retirees who want to ensure a steady stream of income for the rest of their lives.

Situations Where Annuities Can Be Suitable

Annuities can be a useful financial tool in several situations, including:

- Retirement planning: Annuities can provide a guaranteed income stream for retirees, helping them to cover their living expenses.

- Income supplementation: Annuities can supplement your income during retirement or other life stages, providing a financial cushion.

- Long-term care: Annuities can provide a source of income for long-term care expenses, which can be significant.

- Leaving a legacy: Annuities can be used to provide income for loved ones after your death.

Advantages of Annuities

Annuities offer several advantages, particularly for individuals approaching or in retirement. They can provide a steady stream of income, potentially helping to alleviate concerns about outliving your savings and ensure a comfortable retirement.

Guaranteed Income Streams

Annuities provide a guaranteed income stream, which can be a significant benefit, especially during retirement. This guaranteed income stream helps to provide financial security and peace of mind, knowing that you will receive regular payments regardless of market fluctuations or your own health.

A fixed annuity, for example, guarantees a specific payment amount for a set period.

This predictable income stream can help you budget effectively and plan for future expenses, knowing exactly how much money you will have available each month.

Longevity Risk Protection

Annuities can help protect against longevity risk, the risk of outliving your savings. As life expectancies continue to increase, the potential for outliving your retirement funds becomes a growing concern. Annuities can help mitigate this risk by providing a stream of income that can last for your entire lifetime.

Variable annuities, for instance, offer the potential for growth while also providing a guaranteed minimum income stream.

This can help ensure that you have enough money to cover your expenses even if you live longer than expected.

Tax Advantages

Certain types of annuities can offer tax advantages. For example, contributions to a traditional IRA or 401(k) may be tax-deductible, and withdrawals in retirement may be taxed as ordinary income. However, some annuities, such as deferred annuities, allow for tax-deferred growth, meaning that you won’t pay taxes on the earnings until you withdraw the money.

For instance, a deferred annuity allows for tax-deferred growth, meaning that you won’t pay taxes on the earnings until you withdraw the money.

This can result in significant tax savings over time, particularly for those in higher tax brackets.

Disadvantages of Annuities

Annuities, while offering potential benefits, also come with certain disadvantages that investors should carefully consider before making a decision. Understanding these drawbacks can help you make an informed choice about whether an annuity is the right investment for your specific financial goals.

Surrender Charges and Limited Liquidity

Annuities often have surrender charges, which are penalties imposed if you withdraw your money before a certain period. These charges can be substantial, especially in the early years of the annuity contract. For example, you might have to pay a 10% penalty if you withdraw funds within the first five years. Surrender charges can significantly reduce your returns, especially if you need to access your money unexpectedly.

Furthermore, annuities generally offer limited liquidity, meaning you can’t easily access your funds without incurring penalties. This can be problematic if you require immediate access to your money for unforeseen expenses or emergencies.

Risk Associated with Variable Annuities

Variable annuities invest in the stock market, meaning their value fluctuates with market performance. While this can offer the potential for higher returns, it also exposes you to significant risk. If the market declines, the value of your variable annuity can decrease, potentially leading to a loss of principal. It’s important to remember that variable annuities are not FDIC insured and are subject to market volatility.

Returns Compared to Other Investment Options

Annuities may not always offer the highest returns compared to other investment options, such as mutual funds or exchange-traded funds (ETFs). The guaranteed returns provided by fixed annuities are often lower than those offered by other investments, especially during periods of strong market growth. Variable annuities, while potentially offering higher returns, also carry the risk of market volatility.

Annuities and Retirement Planning

Annuities can be a valuable tool in retirement planning, offering a guaranteed stream of income for life. While not a one-size-fits-all solution, they can play a significant role in diversifying your retirement income sources and providing peace of mind.

Incorporating Annuities into a Retirement Plan

To effectively incorporate annuities into your retirement plan, consider the following steps:

- Assess your retirement goals: Identify your financial objectives, such as covering essential expenses, maintaining your lifestyle, or leaving an inheritance.

- Evaluate your risk tolerance: Annuities offer different levels of risk and return. Determine your comfort level with market fluctuations and the potential for losses.

- Calculate your income needs: Estimate your anticipated monthly expenses in retirement, factoring in inflation and potential healthcare costs.

- Explore annuity options: Research different annuity types and their features, such as fixed, variable, and indexed annuities.

- Consult a financial advisor: A qualified advisor can help you choose the annuity that best aligns with your individual circumstances and goals.

Suitability of Annuity Types for Retirement Goals

| Annuity Type | Retirement Goal | Suitability |

|—|—|—|

| Fixed Annuities | Guaranteed income for life, protecting against market volatility | Highly suitable |

| Variable Annuities | Potential for growth, but with investment risk | Suitable for those with higher risk tolerance |

| Indexed Annuities | Growth potential linked to a market index, with downside protection | Suitable for those seeking moderate growth with some risk mitigation |

Examples of Annuities Supplementing Retirement Income, Are annuities a good investment

- Income for essential expenses: A fixed annuity can provide a reliable stream of income to cover essential expenses such as housing, utilities, and healthcare.

- Supplementing Social Security: An annuity can bridge the gap between Social Security benefits and desired retirement income.

- Funding travel or hobbies: A variable annuity can offer the potential for growth to fund leisure activities or travel plans.

- Leaving an inheritance: A deferred annuity can provide a legacy for heirs, with potential growth over time.

Annuities and Estate Planning: Are Annuities A Good Investment

Annuities can play a significant role in estate planning, particularly for beneficiaries. They can provide a steady stream of income to loved ones after your passing, helping them manage financial needs and maintain their lifestyle.

Annuities as Legacy Tools

Annuities can be used to create a legacy for future generations by providing financial security and supporting their goals. Annuities offer several features that make them suitable for estate planning purposes:

- Guaranteed Income Streams: Annuities provide a predictable income stream for beneficiaries, offering financial stability and peace of mind. This is especially beneficial for those who may not have other sources of income or require regular payments for living expenses.

- Long-Term Income Security: Annuities can be structured to provide income for a specified period or for the lifetime of the beneficiary, ensuring financial support over the long term. This can be crucial for individuals who rely on regular income for their financial well-being.

- Tax Advantages: Depending on the type of annuity, beneficiaries may receive tax-advantaged income, potentially reducing their overall tax burden. This can be a significant advantage, especially for individuals with higher income levels.

Tax Implications of Annuities in Estate Planning

The tax implications of annuities in estate planning can vary depending on the type of annuity and the specific circumstances. It’s essential to understand these implications to make informed decisions:

- Death Benefit: The death benefit of an annuity, which is the remaining value of the annuity contract after the annuitant’s death, is generally included in the deceased’s estate and subject to estate taxes. However, certain types of annuities, such as variable annuities, may have tax-advantaged death benefit provisions.

- Income Tax: Beneficiaries receiving income from an annuity are generally taxed on the income as ordinary income. However, the specific tax treatment may depend on the type of annuity and the beneficiary’s tax status.

- Estate Tax: The value of the annuity contract at the time of death may be subject to estate tax, depending on the size of the estate and the applicable estate tax laws.

Annuities and Insurance

Annuities and life insurance policies are both financial products offered by insurance companies, but they serve distinct purposes and have different characteristics. While life insurance provides a death benefit to beneficiaries upon the policyholder’s death, annuities are designed to provide income streams for a specified period or for life.

Annuities and Life Insurance: Similarities and Differences

Annuities and life insurance policies share some similarities. Both are offered by insurance companies and involve the accumulation of funds over time. However, they differ in their primary objectives, payout structures, and tax implications.

- Objective: Life insurance aims to protect beneficiaries financially in the event of the policyholder’s death, while annuities focus on providing income streams for the policyholder during retirement or other life stages.

- Payout Structure: Life insurance pays a lump sum death benefit to beneficiaries, while annuities can provide a stream of regular payments for a specified period or for life.

- Tax Implications: Death benefits from life insurance are generally tax-free, while annuity payments are typically taxed as ordinary income.

The Role of Insurance Companies in Annuities

Insurance companies play a central role in the annuity market, offering a wide range of annuity products and managing the underlying investments.

- Product Development and Offering: Insurance companies design and offer various annuity products to cater to different needs and risk profiles. These products can range from fixed annuities with guaranteed interest rates to variable annuities that offer the potential for growth but also carry investment risk.

- Investment Management: Insurance companies manage the underlying investments for annuities, ensuring the safety and growth of the funds. They may invest in a variety of assets, including bonds, stocks, and real estate.

- Contractual Obligations: Insurance companies are obligated to fulfill the terms of the annuity contracts, providing guaranteed income streams or death benefits as promised.

Regulatory Framework for Annuities

The insurance industry is subject to stringent regulatory oversight, with specific regulations governing annuities. These regulations aim to protect consumers and ensure the financial stability of insurance companies.

- State Insurance Departments: Each state has its own insurance department responsible for regulating insurance companies operating within its borders. These departments enforce compliance with state insurance laws and regulations.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-governmental organization that develops model insurance laws and regulations for adoption by individual states. These models provide a framework for consistent regulation across different jurisdictions.

- Federal Regulations: The federal government also plays a role in regulating the insurance industry, with laws and regulations such as the Employee Retirement Income Security Act (ERISA) and the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Annuities and Financial Advisors

Annuities can be complex financial products, and seeking advice from a qualified financial advisor can be highly beneficial. A financial advisor can help you understand the different types of annuities, assess their suitability for your financial goals, and guide you through the selection process.

Questions to Ask a Financial Advisor

It’s crucial to be well-prepared when discussing annuities with a financial advisor. Asking the right questions can help you gain clarity and make an informed decision.

- What are your qualifications and experience in advising on annuities?

- What types of annuities do you recommend for my situation, and why?

- What are the fees associated with the annuity, and how do they compare to other investment options?

- What are the potential tax implications of the annuity, and how will it affect my overall financial plan?

- How does the annuity’s performance track against other investment options?

- What are the risks associated with the annuity, and how are they mitigated?

- How can I access my money if I need it before the annuity’s maturity date?

- What are the surrender charges if I withdraw money from the annuity before a certain period?

- What happens to the annuity if I pass away?

Importance of Professional Advice

A financial advisor can provide valuable insights and guidance that you may not be able to obtain on your own. They can:

- Analyze your financial situation and goals.

- Help you understand the complexities of annuities.

- Compare different annuity options and their suitability for your needs.

- Identify potential risks and benefits associated with each option.

- Develop a personalized financial plan that incorporates the annuity.

Finding a Reputable Financial Advisor

Choosing a qualified and reputable financial advisor is essential. Here are some tips:

- Seek referrals from trusted sources, such as friends, family, or colleagues.

- Check the advisor’s credentials and experience with annuities.

- Verify their licenses and registrations with relevant regulatory bodies.

- Review their fees and compensation structure.

- Look for advisors who have a fiduciary duty, meaning they are legally obligated to act in your best interests.

- Consider working with an advisor who specializes in annuities.

Annuities can be a valuable tool for retirement planning and income generation, but they are not a one-size-fits-all solution. Ultimately, the decision of whether annuities are a good investment for you depends on your individual financial situation, risk tolerance, and retirement goals. Careful consideration, research, and potentially, consultation with a financial advisor can help you make an informed decision.

Detailed FAQs

How do annuities work?

Annuities work by allowing you to invest a lump sum or make regular payments over time. The money grows tax-deferred, and when you reach retirement age, you can choose to receive payments for a set period, for life, or as a lump sum.

Are annuities safe?

The safety of an annuity depends on the type. Fixed annuities are backed by the insurance company issuing them, providing a level of security. Variable annuities, however, are subject to market fluctuations, and their value can go up or down.

What are the tax implications of annuities?

The tax implications of annuities vary depending on the type and how they are structured. Generally, the growth of annuity investments is tax-deferred, meaning you won’t pay taxes on the earnings until you start withdrawing money. However, withdrawals are typically taxed as ordinary income.

Annuities can be a good investment for some, offering guaranteed income streams, but they often come with hefty fees and limited flexibility. If you’re looking for a different kind of investment with potentially higher returns, you might consider exploring the world of luxury properties investment. While it’s a higher-risk venture, the potential for appreciation and rental income can be attractive.

Ultimately, the best investment for you depends on your individual financial goals and risk tolerance.

Annuities can be a good investment, especially for those looking for guaranteed income in retirement. However, they can also be complex and involve high fees. If you’re seeking a more hands-on approach to building wealth, consider investing in real estate. You can learn about creative financing strategies like how to buy an investment property with no money down , which can help you get started without a large down payment.

Ultimately, the best investment strategy for you will depend on your individual circumstances and goals.

Annuities can be a good investment for those seeking guaranteed income in retirement, but they may not be the best choice for everyone. If you’re looking for a more hands-on investment strategy, consider exploring real estate. You can learn how to buy investment property with little money down by reading this helpful article: how to buy investment property with little money down.

While real estate can be more volatile than annuities, it also has the potential for higher returns. Ultimately, the best investment for you depends on your individual circumstances and risk tolerance.

Whether annuities are a good investment depends on your individual financial goals and risk tolerance. If you’re looking for a guaranteed stream of income, an annuity might be a good option. However, if you’re looking for potential for higher returns, you might consider investing in real estate, like investment properties in Houston. Ultimately, the best investment strategy is the one that aligns with your personal circumstances and financial objectives.

Annuities can be a good investment, but they’re not for everyone. It depends on your financial goals and risk tolerance. If you’re looking to invest in real estate, you might consider an FHA loan for an investment property, as outlined in this helpful guide on fha loan for investment property. Ultimately, the best investment strategy is the one that aligns with your individual circumstances and goals.