Allocated Waiver Mortgages A Guide for Homebuyers

Allocated waiver mortgages offer a unique path to homeownership, providing a potential alternative to traditional mortgages. These mortgages, often characterized by lower interest rates and flexible repayment options, can be particularly appealing to borrowers with specific financial situations.

Allocated waiver mortgages work by allowing borrowers to waive certain closing costs or fees, often in exchange for a slightly higher interest rate or a longer repayment term. This can result in lower monthly payments, making homeownership more attainable for some individuals.

What is an Allocated Waiver Mortgage?

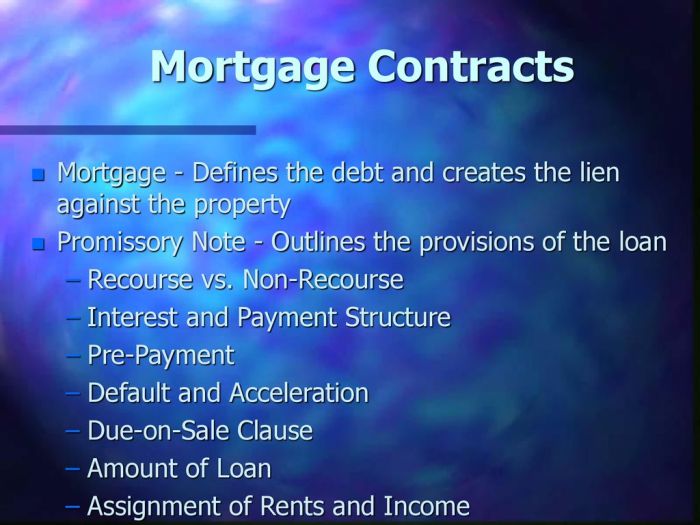

An allocated waiver mortgage is a type of mortgage where the borrower pays a lump sum amount upfront to reduce the overall interest rate on the loan. This upfront payment, known as a “waiver fee,” essentially buys down the interest rate for the entire mortgage term.

Unlike a traditional mortgage, where interest is calculated on the entire outstanding principal balance throughout the loan term, an allocated waiver mortgage separates the interest portion from the principal. The waiver fee is allocated to cover a portion of the interest payable over the loan term, effectively lowering the overall interest cost.

Benefits of an Allocated Waiver Mortgage

An allocated waiver mortgage can be beneficial in several situations:

* Lower Monthly Payments: The reduced interest rate due to the waiver fee results in lower monthly mortgage payments, making it more affordable for borrowers.

* Faster Debt Repayment: With lower monthly payments, a larger portion of each payment goes towards principal reduction, leading to faster debt repayment.

* Potential for Savings: By paying the waiver fee upfront, borrowers can potentially save on overall interest costs over the life of the mortgage.

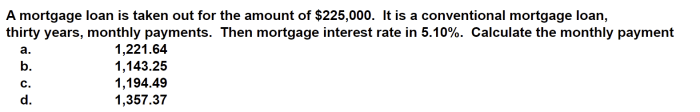

Example: Imagine a borrower taking out a $300,000 mortgage with a 5% interest rate over 30 years. If they opt for an allocated waiver mortgage and pay a $10,000 waiver fee, their interest rate could be reduced to 4.5%. This lower interest rate could significantly reduce their monthly payments and help them pay off the mortgage faster.

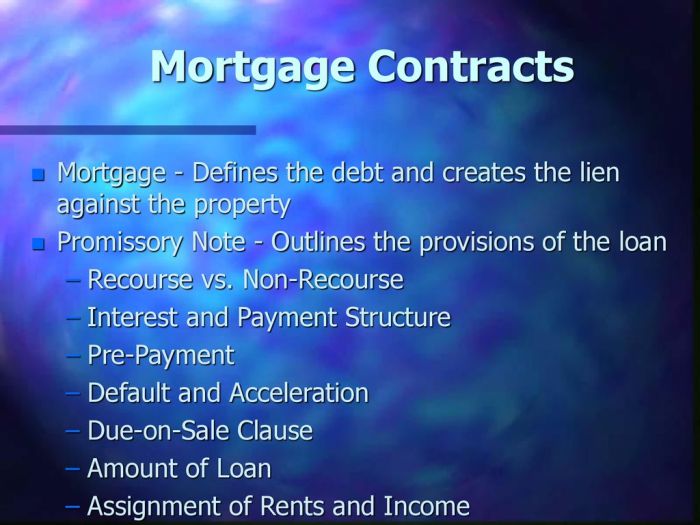

How Does an Allocated Waiver Mortgage Work?

An allocated waiver mortgage is a type of home loan that allows borrowers to waive certain upfront fees associated with the mortgage, such as loan origination fees or appraisal fees. These fees are typically rolled into the principal amount of the loan, which can result in a slightly higher interest rate. However, the borrower may find that the overall cost of the mortgage is lower over the long term, due to the savings on upfront fees.

Obtaining an Allocated Waiver Mortgage

To obtain an allocated waiver mortgage, borrowers typically need to meet certain eligibility criteria and provide specific documentation.

Eligibility Criteria

- Credit Score: Lenders generally require a minimum credit score for borrowers to qualify for an allocated waiver mortgage. The specific score requirement may vary depending on the lender and the type of mortgage.

- Debt-to-Income Ratio: Lenders also assess a borrower’s debt-to-income ratio (DTI), which is the percentage of their monthly income that goes towards debt payments. A lower DTI generally indicates a lower risk for the lender, making it more likely for the borrower to qualify for a loan.

- Down Payment: Borrowers may need to make a down payment on the property, typically ranging from 3% to 20% of the purchase price. The down payment amount may influence the interest rate and loan terms.

Required Documentation

- Proof of Income: Borrowers must provide documentation verifying their income, such as pay stubs, tax returns, or bank statements.

- Credit Report: Lenders will request a copy of the borrower’s credit report, which will include their credit history and score.

- Assets and Liabilities: Borrowers need to provide information about their assets, such as savings accounts or investments, and their liabilities, such as outstanding loans or credit card debt.

Key Features of an Allocated Waiver Mortgage

Allocated waiver mortgages typically share several key features, including:

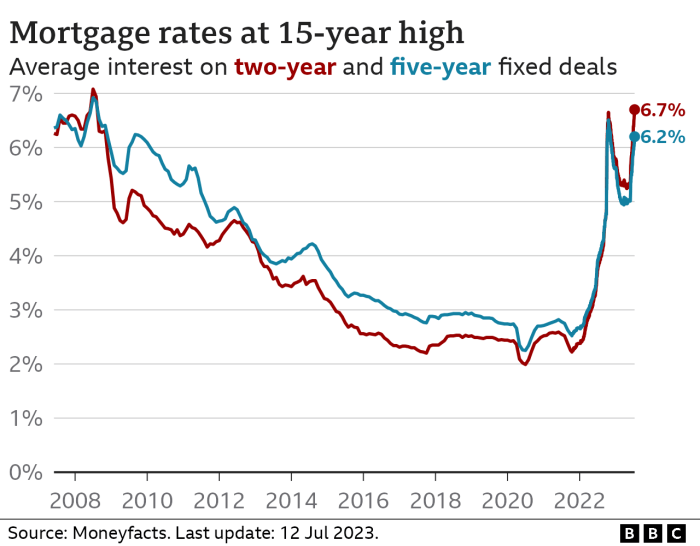

Interest Rates

- Interest rates on allocated waiver mortgages are often slightly higher than traditional mortgages due to the upfront fees being rolled into the principal.

- However, the overall cost of the mortgage may be lower over the long term, as the borrower saves on the upfront fees.

Repayment Terms

- Repayment terms for allocated waiver mortgages are similar to traditional mortgages, typically ranging from 15 to 30 years.

- Borrowers can choose a fixed-rate mortgage, where the interest rate remains the same for the entire loan term, or an adjustable-rate mortgage (ARM), where the interest rate can fluctuate based on market conditions.

Potential Fees

- While allocated waiver mortgages waive certain upfront fees, other fees may still apply, such as closing costs, title insurance, and property taxes.

- Borrowers should carefully review the loan documents to understand all applicable fees and costs.

Benefits and Drawbacks of Allocated Waiver Mortgages

- Benefits:

- Lower upfront costs: Borrowers save on upfront fees such as origination fees and appraisal fees.

- Potential for lower overall cost: The savings on upfront fees can offset the slightly higher interest rate, potentially resulting in lower overall costs over the long term.

- Drawbacks:

- Higher interest rates: Allocated waiver mortgages typically have slightly higher interest rates than traditional mortgages.

- Potential for higher monthly payments: Due to the higher interest rate, monthly payments may be slightly higher compared to a traditional mortgage.

Types of Allocated Waiver Mortgages

Allocated waiver mortgages are offered by various lenders and are tailored to specific property types and borrower needs. Each type comes with its own set of advantages and disadvantages.

Allocated Waiver Mortgages by Lender

Different lenders offer allocated waiver mortgages with varying terms and conditions. For example, some lenders might specialize in allocated waiver mortgages for specific property types, like residential or commercial properties.

- Bank of America offers allocated waiver mortgages for both residential and commercial properties. They have flexible terms and competitive interest rates. However, their loan requirements might be stricter compared to other lenders.

- Wells Fargo is another lender that provides allocated waiver mortgages, mainly for residential properties. Their loan process is typically faster and more straightforward. However, their interest rates might be slightly higher compared to Bank of America.

- Chase specializes in allocated waiver mortgages for commercial properties. They have extensive experience in commercial lending and offer tailored solutions for businesses. However, their loan requirements might be more complex and require a significant down payment.

Allocated Waiver Mortgages by Property Type

Allocated waiver mortgages are also tailored to specific property types. For instance, lenders might offer different terms and conditions for residential, commercial, or industrial properties.

- Residential Allocated Waiver Mortgages are typically offered for single-family homes, townhouses, and condominiums. These mortgages often have lower interest rates and flexible repayment terms compared to other types of allocated waiver mortgages. They are suitable for individuals or families looking to purchase a home.

- Commercial Allocated Waiver Mortgages are designed for commercial properties, such as office buildings, retail stores, and industrial facilities. These mortgages often have higher interest rates and stricter loan requirements due to the higher risk associated with commercial properties. They are suitable for businesses or investors seeking to acquire or develop commercial properties.

- Industrial Allocated Waiver Mortgages are specialized mortgages for industrial properties, including factories, warehouses, and distribution centers. These mortgages often have the highest interest rates and require a significant down payment. They are suitable for businesses involved in manufacturing, logistics, or other industrial activities.

Eligibility for an Allocated Waiver Mortgage

Securing an allocated waiver mortgage hinges on meeting specific eligibility criteria. Lenders assess various factors to determine your suitability for this type of loan. Understanding these requirements can help you navigate the process and increase your chances of approval.

Typical Eligibility Requirements

Lenders typically consider several key factors when evaluating your eligibility for an allocated waiver mortgage:

- Credit Score: A strong credit score is crucial for obtaining an allocated waiver mortgage. Lenders generally prefer borrowers with a credit score of at least 620, although the specific requirement may vary depending on the lender and loan program. A higher credit score indicates a lower risk to the lender, potentially leading to more favorable loan terms.

- Income: Lenders want to ensure you have a stable income sufficient to cover your monthly mortgage payments. They typically assess your income based on your income history, employment stability, and debt-to-income ratio (DTI). A higher income generally improves your chances of approval.

- Debt-to-Income Ratio (DTI): Your DTI measures the percentage of your gross monthly income that goes towards debt payments. Lenders typically prefer a DTI below 43%, although this can vary depending on the lender and loan program. A lower DTI indicates a lower risk of default.

Factors Affecting Eligibility

In addition to the typical requirements, other factors can influence your eligibility for an allocated waiver mortgage:

- Employment History: Lenders generally prefer borrowers with a stable employment history. A consistent employment record demonstrates your ability to make regular mortgage payments.

- Property Type: The type of property you intend to purchase can affect your eligibility. Some lenders may have specific requirements for certain property types, such as condominiums or multi-family units.

- Loan Amount: The amount you are seeking to borrow can also impact your eligibility. Lenders may have limits on the maximum loan amount they are willing to provide, depending on your income and creditworthiness.

Tips for Improving Eligibility

Here are some tips to improve your chances of qualifying for an allocated waiver mortgage:

- Build a Strong Credit Score: Regularly check your credit report and address any errors or negative items. Pay your bills on time, keep credit utilization low, and avoid opening too many new credit accounts.

- Increase Your Income: Explore ways to increase your income, such as getting a raise, taking on a side job, or starting a new career.

- Reduce Your Debt: Pay down high-interest debt, such as credit card balances, to lower your DTI.

- Save for a Down Payment: A larger down payment can reduce the loan amount and improve your chances of approval.

- Shop Around for Lenders: Compare loan terms and requirements from multiple lenders to find the best fit for your financial situation.

Benefits of an Allocated Waiver Mortgage

An allocated waiver mortgage offers several benefits that can make it an attractive option for borrowers, particularly those seeking a more flexible and potentially cost-effective way to finance their home purchase. This type of mortgage allows borrowers to waive certain upfront costs, such as mortgage insurance premiums, and have these costs allocated to their mortgage principal balance. This allocation can lead to several advantages, including lower interest rates, flexible repayment options, and potentially reduced closing costs.

Lower Interest Rates

Allocated waiver mortgages often come with lower interest rates compared to traditional mortgages. This is because the lender has already factored in the waived upfront costs, allowing them to offer a lower interest rate. Lower interest rates translate to lower monthly payments and significant savings over the life of the mortgage. For example, a borrower with a $300,000 mortgage at a 4% interest rate will pay approximately $1,350 per month. If they were to secure an allocated waiver mortgage with a 3.5% interest rate, their monthly payment would be reduced to around $1,270, resulting in a monthly savings of $80. Over the life of a 30-year mortgage, this savings can amount to thousands of dollars.

Flexible Repayment Options

Allocated waiver mortgages often offer flexible repayment options, allowing borrowers to adjust their payments to fit their financial situation. For instance, some lenders may allow borrowers to make bi-weekly payments, which can accelerate the amortization of the mortgage and lead to earlier payoff. Additionally, borrowers may have the option to make lump-sum payments to reduce their principal balance and further lower their interest costs. These flexible repayment options provide borrowers with greater control over their mortgage and can help them achieve their financial goals more effectively.

Reduced Closing Costs

Allocated waiver mortgages can potentially reduce closing costs, as some upfront fees are waived and allocated to the mortgage principal. Closing costs typically include items such as appraisal fees, title insurance, and loan origination fees. While these costs can vary depending on the lender and the specific mortgage, they can be substantial, often ranging from 2% to 5% of the loan amount. By allocating these costs to the mortgage principal, borrowers can reduce their out-of-pocket expenses at closing.

Comparing Allocated Waiver Mortgages to Other Options

An allocated waiver mortgage is just one of many mortgage options available to borrowers. To make the best decision for your financial situation, it’s crucial to understand how an allocated waiver mortgage compares to other common types of loans.

Comparison with Other Mortgage Options

To provide a comprehensive comparison, we’ll consider three popular mortgage options: conventional mortgages, FHA loans, and VA loans. Each type of mortgage has its unique characteristics, advantages, and disadvantages.

Key Features of Different Mortgage Options

| Feature | Allocated Waiver Mortgage | Conventional Mortgage | FHA Loan | VA Loan |

|---|---|---|---|---|

| Interest Rates | Generally higher than conventional mortgages | Typically the lowest among the options | Usually higher than conventional mortgages | Often competitive with conventional mortgages |

| Down Payment | Typically 0% down payment | Usually 3-20% down payment | Minimum 3.5% down payment | No down payment required |

| Eligibility | Specific eligibility criteria, often requiring a minimum credit score and income level | Wide range of eligibility, with various credit score and income requirements | For borrowers with lower credit scores and limited down payment | For active military personnel, veterans, and eligible surviving spouses |

| Closing Costs | Can be higher due to the waiver process | Vary depending on lender and loan terms | Can be higher than conventional mortgages | Generally lower than conventional mortgages |

| Loan Limits | May have loan limits based on the specific lender and program | Have loan limits based on the county or region | Have loan limits based on the county or region | Have loan limits based on the county or region |

Advantages and Disadvantages

- Allocated Waiver Mortgage

- Advantages: No down payment required, potential for lower monthly payments due to the waiver, may be suitable for borrowers with limited savings or a lower credit score.

- Disadvantages: Generally higher interest rates, potential for higher closing costs, limited eligibility criteria, may have a shorter loan term.

- Conventional Mortgage

- Advantages: Typically lower interest rates, wide range of loan options and terms, flexible down payment requirements, potentially lower closing costs.

- Disadvantages: Requires a down payment, stricter eligibility criteria, may not be suitable for borrowers with lower credit scores or limited savings.

- FHA Loan

- Advantages: Lower down payment requirement, more lenient eligibility criteria, suitable for borrowers with lower credit scores and limited savings.

- Disadvantages: Higher interest rates compared to conventional mortgages, mortgage insurance premiums required, may have stricter loan limits.

- VA Loan

- Advantages: No down payment required, often competitive interest rates, no mortgage insurance premiums, generous eligibility for military personnel, veterans, and surviving spouses.

- Disadvantages: Limited to eligible military personnel, veterans, and surviving spouses, funding fee may be required, loan limits may apply.

Case Studies and Examples

Allocated waiver mortgages are a relatively new type of mortgage product, so there are limited real-world examples of their application. However, we can examine some hypothetical scenarios to understand how they might work in practice.

Illustrative Case Studies

Here are two hypothetical scenarios illustrating how allocated waiver mortgages could be used:

- Scenario 1: The First-Time Homebuyer

- Scenario 2: The Homeowner with Equity

A young couple, Sarah and John, are looking to buy their first home. They have a good credit score but limited savings for a down payment. They find a property they love, but it requires a larger down payment than they can afford. An allocated waiver mortgage allows them to borrow a larger amount, covering the down payment and closing costs, while waiving the mortgage insurance premium. This allows them to purchase the home sooner and build equity faster.

Mark has been living in his home for 10 years and has built up significant equity. He wants to refinance his mortgage to a lower interest rate and take out some cash for home improvements. A traditional refinance would require him to pay mortgage insurance because his loan-to-value ratio is above 80%. However, an allocated waiver mortgage allows him to refinance without paying mortgage insurance, as the loan is secured by the equity he has built up. This helps him save money on monthly payments and get the renovations he needs.

Factors Contributing to Success

The success of an allocated waiver mortgage depends on several factors, including:

- Borrower’s Credit Score: A strong credit score is crucial for obtaining an allocated waiver mortgage, as it signals to lenders that the borrower is creditworthy.

- Loan-to-Value Ratio: The loan-to-value ratio, or LTV, is the amount of the mortgage compared to the value of the property. A lower LTV generally makes it easier to qualify for an allocated waiver mortgage, as it indicates less risk for the lender.

- Property Value: The value of the property is a key factor in determining the loan amount and whether the allocated waiver mortgage is feasible.

- Borrower’s Income and Debt: Lenders will consider the borrower’s income and debt-to-income ratio to assess their ability to repay the loan.

Potential Challenges

While allocated waiver mortgages offer advantages, it’s important to consider potential challenges:

- Availability: These mortgages are not yet widely available, so finding a lender offering this product might be challenging.

- Loan Terms: The terms of an allocated waiver mortgage, such as interest rates and loan periods, may vary depending on the lender and the borrower’s specific circumstances.

- Risk for Borrowers: If the borrower defaults on the loan, they may lose the property.

Conclusion: Allocated Waiver Mortgage

Allocated waiver mortgages can be a valuable tool for borrowers seeking to reduce their mortgage payments and potentially build equity faster. They offer flexibility and the potential for lower overall interest costs, making them an attractive option for certain borrowers. However, it’s crucial to carefully consider the terms and conditions of these mortgages before making a decision.

Key Takeaways

Allocated waiver mortgages offer several benefits, including:

- Lower monthly payments compared to traditional mortgages.

- Potential for faster equity growth due to accelerated principal repayment.

- Flexibility in choosing a repayment schedule that aligns with your financial goals.

However, it’s essential to be aware of the potential drawbacks, such as:

- Higher initial interest rates compared to some other mortgage types.

- Potential for increased interest costs over the long term if the allocated payments are not used effectively.

- Limited availability and eligibility criteria.

Understanding the nuances of allocated waiver mortgages is crucial for borrowers seeking to leverage their benefits. While these mortgages can offer advantages, it’s essential to weigh the potential risks and carefully consider your individual financial circumstances. Consulting with a mortgage professional can provide personalized guidance and help you determine if an allocated waiver mortgage is the right fit for your homeownership journey.

FAQs

What are the typical eligibility requirements for an allocated waiver mortgage?

Eligibility requirements can vary depending on the lender, but generally include a good credit score, sufficient income, and a manageable debt-to-income ratio.

Are there any specific types of allocated waiver mortgages available?

Yes, different lenders may offer variations of allocated waiver mortgages, such as those tailored for specific property types or with unique features like adjustable interest rates.

How do allocated waiver mortgages compare to other mortgage options?

Comparing allocated waiver mortgages to conventional mortgages, FHA loans, and VA loans involves considering factors like interest rates, down payment requirements, and eligibility criteria. Each option has its own advantages and disadvantages.

What are some strategies for mitigating the risks associated with allocated waiver mortgages?

Strategies include carefully evaluating the terms and conditions, ensuring a stable income, and maintaining a healthy credit score.

An allocated waiver mortgage can be a valuable tool for homeowners looking to reduce their monthly payments. However, before making any decisions, it’s essential to understand the full scope of your financial situation. Perhaps you could consider furthering your financial knowledge by pursuing an online MBA , which can equip you with the skills and knowledge to make informed financial decisions, including those related to mortgages.

Ultimately, the best approach for your allocated waiver mortgage will depend on your individual circumstances and goals.

An allocated waiver mortgage can be a great way to save money on your home loan, but it’s important to understand the terms and conditions before you commit. If you’re looking for a career change that could help you navigate the complex world of finance, consider an MBA in marketing online. This degree can provide you with the skills and knowledge needed to succeed in a variety of marketing roles, including those related to financial services.

Once you have a solid understanding of the financial landscape, you’ll be better equipped to make informed decisions about your own finances, including your mortgage.