ECU Mortgage Rates A Guide for Borrowers

ECU mortgage rates, the interest rates applied to home loans in Ecuador, are a crucial factor for potential homebuyers. Understanding these rates, how they compare to national averages, and the factors that influence them is essential for making informed decisions. This guide delves into the intricacies of ECU mortgage rates, providing insights into the different types of mortgages available, eligibility requirements, current trends, and tips for securing the best rates.

Navigating the world of ECU mortgages can be daunting, but this comprehensive overview aims to simplify the process and equip you with the knowledge necessary to make confident choices. From understanding the various mortgage types and their associated pros and cons to navigating the application process and securing competitive rates, this guide serves as your roadmap to homeownership in Ecuador.

Understanding ECU Mortgage Rates

ECU mortgage rates are the interest rates that East Carolina University Federal Credit Union (ECU FCU) offers to its members for home loans. These rates fluctuate based on various market factors and are usually expressed as an annual percentage rate (APR).

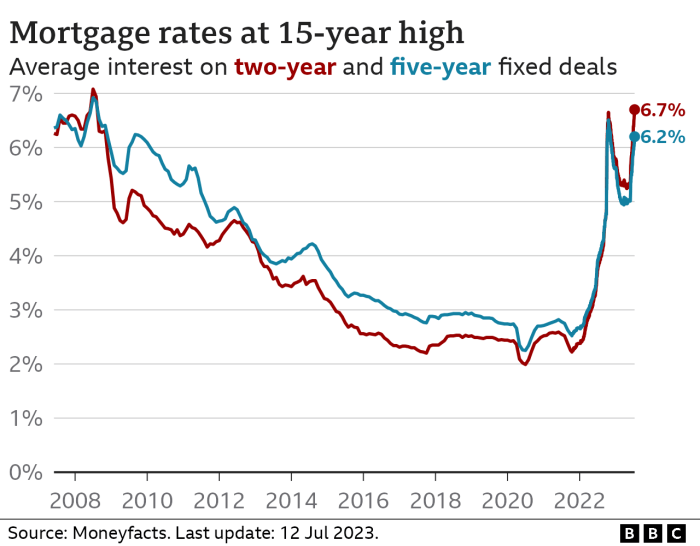

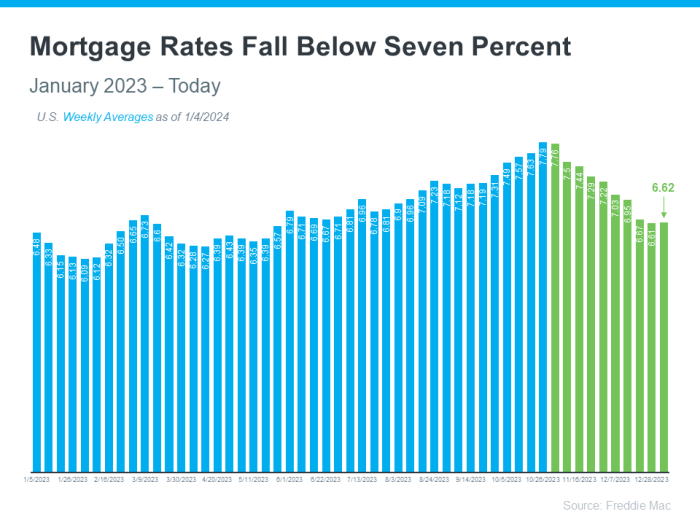

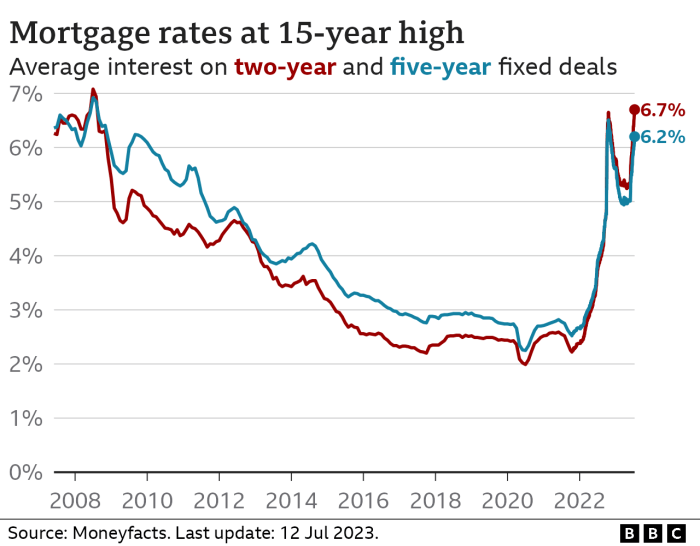

ECU Mortgage Rates Compared to National Averages

ECU mortgage rates can be compared to the national average mortgage rates to determine if they offer competitive rates. It’s essential to note that national average rates are simply averages and may not reflect the actual rates available to individuals. Factors like credit score, loan amount, and loan type can influence the actual rates offered.

Factors Influencing ECU Mortgage Rates

- Current Market Conditions: Interest rates are influenced by factors like inflation, economic growth, and Federal Reserve policies. When the Federal Reserve raises interest rates, mortgage rates tend to rise as well, and vice versa.

- Credit Score: Borrowers with higher credit scores typically qualify for lower interest rates. This is because lenders perceive them as less risky.

- Loan Amount: Larger loan amounts may come with slightly higher interest rates. Lenders often adjust rates based on the perceived risk associated with larger loans.

- Loan Type: Different loan types, such as fixed-rate mortgages or adjustable-rate mortgages, have varying interest rates. Fixed-rate mortgages typically have higher interest rates than adjustable-rate mortgages, but they offer more predictable monthly payments.

- ECU FCU Policies: ECU FCU may offer special rates or discounts to certain members, such as employees of ECU or members with specific financial products. These policies can impact the interest rates offered.

Eligibility and Requirements: Ecu Mortgage Rates

Securing a mortgage in ECU involves meeting specific eligibility criteria and providing necessary documentation. Understanding these requirements is crucial for a smooth and successful application process.

Eligibility Criteria

To be eligible for a mortgage in ECU, you generally need to meet the following criteria:

- Be a resident of ECU: This typically involves having a valid residency permit or citizenship.

- Have a stable income: Lenders often require proof of regular income, such as salary slips or bank statements.

- Have a good credit history: A strong credit score demonstrates your ability to manage finances responsibly.

- Have a sufficient down payment: Lenders usually require a down payment, which is a percentage of the property’s purchase price.

- Be of legal age: You must be at least 18 years old to apply for a mortgage.

Required Documents, Ecu mortgage rates

When applying for a mortgage in ECU, you’ll typically need to provide the following documents:

- Proof of identity: This could include a passport, driver’s license, or national identity card.

- Proof of residency: Utility bills, rental agreements, or bank statements can be used as proof of residency.

- Income documentation: This could include salary slips, tax returns, or bank statements.

- Credit report: You’ll need to provide a credit report that shows your credit history.

- Down payment proof: This could include bank statements or a letter of confirmation from your financial institution.

- Property details: This could include the property’s title deed, valuation report, or other relevant documents.

Mortgage Application Process

Here’s a checklist of steps involved in the mortgage application process in ECU:

- Pre-approval: Getting pre-approved for a mortgage can help you determine your borrowing capacity and make a more informed decision about your home purchase.

- Property search: Once you have pre-approval, you can start searching for a property that meets your needs and budget.

- Mortgage application: You’ll need to complete a mortgage application form and provide all the required documents.

- Mortgage approval: The lender will review your application and assess your eligibility. If approved, you’ll receive a mortgage offer.

- Closing: This involves finalizing the mortgage agreement, signing the necessary documents, and transferring the property ownership.

Tips for Finding the Best ECU Mortgage Rates

Securing the best mortgage rate in ECU requires proactive steps and careful consideration. By following these tips, you can increase your chances of obtaining a competitive rate that aligns with your financial goals.

Comparing Offers from Multiple Lenders

It is crucial to compare offers from multiple lenders before making a decision. This allows you to assess different interest rates, fees, and loan terms.

- Shop around: Contact several lenders, including banks, credit unions, and mortgage brokers. Obtain personalized quotes based on your financial profile.

- Use online mortgage calculators: These tools can help you estimate monthly payments and compare different loan scenarios. However, remember that these are just estimates, and actual rates may vary.

- Consider different loan types: Explore various mortgage options, such as fixed-rate, adjustable-rate, and FHA loans, to find the best fit for your needs and financial situation.

Negotiating Mortgage Terms and Conditions

While interest rates are a significant factor, it’s equally important to negotiate other loan terms and conditions.

- Loan points: Discuss the possibility of paying points to lower your interest rate. Points are upfront fees that can reduce your monthly payments. However, it’s essential to calculate the return on investment and determine if it’s financially beneficial.

- Closing costs: Negotiate with the lender to minimize closing costs, which include appraisal fees, title insurance, and other expenses. Some lenders may offer to cover certain closing costs, especially for borrowers with excellent credit scores.

- Loan origination fees: This fee is charged by lenders for processing your mortgage application. You can try to negotiate a lower origination fee or explore lenders who offer lower or no origination fees.

Improving Your Credit Score

A higher credit score generally leads to lower interest rates.

- Check your credit report: Review your credit report for any errors and dispute any inaccuracies. A clean credit report can positively impact your score.

- Pay your bills on time: Consistent on-time payments are crucial for maintaining a good credit history.

- Reduce credit utilization: Keep your credit utilization ratio low by avoiding maxing out your credit cards. Aim for a utilization rate below 30%.

Maintaining a Stable Financial Profile

Lenders assess your financial stability before offering a mortgage.

- Steady income: Demonstrating consistent income is essential. If you have a recent job change, provide documentation to verify your employment status.

- Low debt-to-income ratio: Lenders prefer borrowers with a low debt-to-income ratio (DTI). Your DTI is the percentage of your gross monthly income that goes towards debt payments. Aim for a DTI below 43%.

- Adequate savings: Having a sufficient down payment and emergency savings demonstrates financial responsibility and improves your chances of securing a favorable mortgage rate.

Seeking Professional Advice

Consider consulting with a mortgage broker or financial advisor for personalized guidance.

- Mortgage brokers: They have access to multiple lenders and can help you compare rates and terms.

- Financial advisors: They can provide comprehensive financial planning advice, including mortgage strategies.

By understanding the nuances of ECU mortgage rates, borrowers can make informed decisions about their home financing options. From analyzing current trends and comparing offers from multiple lenders to utilizing mortgage calculators and seeking professional advice, this guide provides a solid foundation for navigating the mortgage landscape in Ecuador. Remember, careful planning, thorough research, and a clear understanding of your financial situation are key to securing the best mortgage rates and achieving your homeownership goals.

Clarifying Questions

What are the current average mortgage rates in ECU?

Current average mortgage rates in ECU vary depending on the lender, loan type, and borrower’s creditworthiness. It’s best to contact different lenders directly to get personalized rate quotes.

How can I improve my chances of getting a mortgage in ECU?

To improve your chances of getting a mortgage in ECU, maintain a good credit score, have a stable income, and provide the required documentation, such as proof of income and employment history.

What are the typical closing costs associated with a mortgage in ECU?

Closing costs in ECU can include appraisal fees, title insurance, legal fees, and other expenses. These costs can vary depending on the lender and the specific mortgage terms.

Is it possible to refinance my existing mortgage in ECU?

Yes, refinancing your existing mortgage in ECU is possible. You can refinance to secure a lower interest rate, change your loan term, or access funds for other purposes. However, refinancing may involve additional fees and costs.

ECU mortgage rates can fluctuate, making it important to shop around for the best deal. If you’re considering a career change, an online MBA could be a great option, and you may not even need a GMAT score! There are programs available that don’t require the exam, like those found at online mba with no gmat.

Once you’ve secured your financing and education, you’ll be well-positioned to make a smart decision about your future.

ECU mortgage rates can vary depending on factors like your credit score and the type of loan you’re seeking. If you’re considering a career change that requires an advanced degree, you might want to research the online MBA price to see how it fits into your financial plan. Once you’ve determined your budget for education and housing, you can then compare ECU mortgage rates with other lenders to find the best deal for your needs.

ECU mortgage rates are constantly changing, so it’s essential to stay updated. While you’re busy crunching numbers, consider taking an online biochemistry class to expand your knowledge. You might be surprised at how the principles of chemistry can be applied to everyday life, even when it comes to understanding financial concepts like mortgage rates.

ECU mortgage rates can fluctuate, so it’s crucial to stay informed about current trends. To make sound financial decisions, understanding the factors that influence rates is essential. This knowledge can be enhanced by pursuing an marketing MBA online , which equips you with the analytical skills needed to navigate the complexities of the financial market. By combining your financial expertise with a strong understanding of marketing principles, you can confidently make informed decisions regarding your mortgage options.