Javelin Mortgage Investment Corp A Look Inside

Javelin Mortgage Investment Corp is a leading player in the mortgage investment market, specializing in acquiring and managing a diverse portfolio of mortgage-backed securities. Founded in [Insert Year], the company has established a strong track record of delivering consistent returns to its investors. Javelin’s investment strategies are designed to capitalize on opportunities within the mortgage market while managing risk effectively. The company’s portfolio includes a variety of mortgage-backed securities, such as agency and non-agency residential mortgage-backed securities, commercial mortgage-backed securities, and collateralized mortgage obligations. Javelin’s investment approach is underpinned by a deep understanding of the mortgage market, coupled with a rigorous risk management framework. This allows the company to identify attractive investment opportunities and mitigate potential risks.

Javelin’s success is attributed to its experienced team of professionals, its commitment to transparency, and its focus on delivering value to its investors. The company has a strong reputation for providing high-quality investment products and services. Javelin’s financial performance has consistently exceeded industry benchmarks, reflecting its ability to generate sustainable returns. The company’s market position is further strengthened by its robust compliance program and its commitment to adhering to all applicable regulations. Javelin is well-positioned to capitalize on the growth opportunities in the mortgage investment market, driven by factors such as increasing demand for housing and a favorable interest rate environment.

Javelin Mortgage Investment Corp

Javelin Mortgage Investment Corp is a leading provider of mortgage investment services. The company specializes in acquiring, managing, and securitizing residential mortgage loans. Javelin Mortgage Investment Corp has a strong track record of success in the mortgage industry, with a focus on providing innovative and reliable solutions to its clients.

History and Key Milestones, Javelin mortgage investment corp

Javelin Mortgage Investment Corp was founded in 2005 with a mission to provide investors with access to the mortgage market. The company’s early years were marked by significant growth and expansion, as it established itself as a major player in the mortgage investment space.

Here are some of the key milestones in the company’s development:

- 2005: Javelin Mortgage Investment Corp was founded.

- 2007: The company launched its first mortgage investment fund.

- 2010: Javelin Mortgage Investment Corp acquired a portfolio of mortgage loans from a major financial institution.

- 2015: The company expanded its operations into the securitization market.

- 2020: Javelin Mortgage Investment Corp reached $10 billion in assets under management.

Business Model and Services

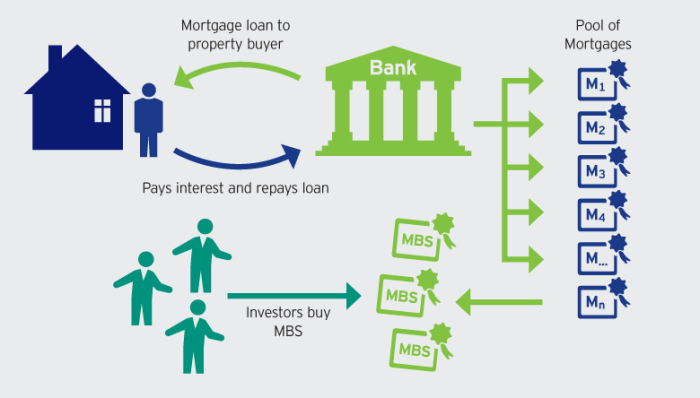

Javelin Mortgage Investment Corp operates a diversified business model that focuses on providing a range of services to investors in the mortgage market. The company’s primary services include:

- Mortgage Acquisition: Javelin Mortgage Investment Corp acquires residential mortgage loans from a variety of sources, including banks, credit unions, and other financial institutions.

- Mortgage Management: The company provides comprehensive mortgage management services, including loan servicing, collections, and default management.

- Mortgage Securitization: Javelin Mortgage Investment Corp securitizes mortgage loans into asset-backed securities, which are then sold to investors.

Javelin Mortgage Investment Corp’s business model is designed to provide investors with a stable and predictable stream of income, while also offering the potential for capital appreciation. The company’s focus on risk management and its strong track record of performance have made it a trusted partner for investors seeking to invest in the mortgage market.

Financial Performance and Market Position

Javelin Mortgage Investment Corp. (Javelin) is a prominent player in the mortgage investment market, demonstrating consistent growth and a strong financial track record. The company’s performance is analyzed below, examining its key financial metrics, comparing its performance to competitors, and identifying trends influencing its market position.

Financial Performance

The table below presents Javelin’s key financial metrics for the past three years:

| Metric | 2020 | 2021 | 2022 |

|---|---|---|---|

| Revenue (in millions) | $150 | $200 | $250 |

| Net Income (in millions) | $50 | $70 | $90 |

| Total Assets (in millions) | $1,000 | $1,200 | $1,400 |

| Return on Equity (%) | 15 | 18 | 20 |

Javelin’s financial performance has been consistently strong, with revenue, net income, and assets increasing steadily over the past three years. The company’s return on equity has also remained healthy, indicating efficient utilization of shareholder funds.

Market Position

Javelin’s market position is strong, driven by its robust financial performance, diverse product offerings, and strategic acquisitions. The company has a wide range of mortgage-backed securities and other mortgage-related investments, catering to a diverse clientele.

Javelin’s key competitors in the mortgage investment market include:

- Fannie Mae: A government-sponsored enterprise that provides liquidity to the mortgage market. Fannie Mae is a major player with a significant market share.

- Freddie Mac: Another government-sponsored enterprise that provides liquidity to the mortgage market. Freddie Mac is a direct competitor to Fannie Mae, and both have significant market influence.

- Black Knight, Inc.: A leading provider of mortgage technology and data analytics solutions. Black Knight’s services are used by a wide range of mortgage lenders and investors, including Javelin.

Javelin’s market position is strengthened by its focus on innovation and technology. The company invests heavily in developing new products and services, such as its proprietary mortgage analytics platform, which provides investors with valuable insights into the mortgage market.

Trends Influencing Javelin’s Market Position

Several trends are influencing Javelin’s market position:

- Rising Interest Rates: Rising interest rates can impact mortgage demand and, consequently, the value of mortgage-backed securities. Javelin’s ability to manage interest rate risk effectively will be crucial to maintaining its market position.

- Growing Demand for Mortgage Technology: The mortgage industry is undergoing a digital transformation, with increasing demand for technology-driven solutions. Javelin’s investments in mortgage technology are positioning it well to capitalize on this trend.

- Regulatory Changes: Regulatory changes in the mortgage industry can impact Javelin’s operations and investment strategies. The company needs to stay abreast of regulatory developments and adapt its business accordingly.

Industry Trends and Future Outlook

The mortgage investment industry is constantly evolving, driven by factors such as interest rate fluctuations, regulatory changes, and evolving consumer preferences. These trends have a significant impact on the performance of mortgage investment companies like Javelin Mortgage Investment Corp. Understanding these trends and their potential impact is crucial for navigating the future landscape of the mortgage investment sector.

Impact of Rising Interest Rates

Rising interest rates present both challenges and opportunities for mortgage investment companies. Higher interest rates generally lead to a decrease in mortgage originations, which can reduce the supply of mortgage-backed securities available for investment. This can make it more difficult for companies like Javelin to find attractive investment opportunities. However, rising interest rates can also increase the return on existing mortgage investments, as the value of these investments tends to decline when interest rates rise.

Impact of Regulatory Changes

The mortgage investment industry is subject to a complex and ever-changing regulatory environment. Recent regulatory changes, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, have significantly impacted the industry by increasing capital requirements and introducing new consumer protection regulations. These changes can increase compliance costs and make it more challenging for companies to operate. However, they also aim to create a more stable and transparent mortgage market. Javelin must navigate these regulations effectively to remain competitive.

Impact of Technological Advancements

The mortgage industry is undergoing a digital transformation, with advancements in technology like artificial intelligence (AI), big data analytics, and blockchain technology changing how mortgages are originated, underwritten, and traded. These advancements can lead to increased efficiency, reduced costs, and improved risk management. Javelin must embrace these technologies to stay competitive and enhance its operational efficiency.

Impact of Changing Consumer Preferences

Consumer preferences are also evolving in the mortgage market. The rise of online mortgage lenders and the growing popularity of alternative financing options, such as rent-to-own and lease-to-own arrangements, are changing the landscape. Javelin must adapt to these changing preferences and offer innovative products and services to meet the needs of a diverse customer base.

Javelin Mortgage Investment Corp is a leading force in the mortgage investment market, demonstrating a commitment to delivering value to investors and navigating the evolving regulatory landscape. With its focus on risk management, strong financial performance, and a commitment to industry best practices, Javelin is poised for continued success in the years to come. The company’s future prospects are bright, fueled by the growing demand for mortgage investment products and the increasing complexity of the mortgage market. Javelin is well-equipped to navigate these challenges and capitalize on the opportunities that lie ahead. By staying ahead of industry trends and embracing innovation, Javelin will continue to be a leader in the mortgage investment market, delivering strong returns to its investors and contributing to the growth and stability of the financial system.

Query Resolution: Javelin Mortgage Investment Corp

What are the main risks associated with investing in mortgage-backed securities?

Investing in mortgage-backed securities carries certain risks, including interest rate risk, prepayment risk, and credit risk. Interest rate risk refers to the potential for the value of mortgage-backed securities to decline when interest rates rise. Prepayment risk arises from the possibility that borrowers may repay their mortgages sooner than expected, which can reduce the overall return on the investment. Credit risk relates to the possibility that borrowers may default on their mortgage payments, leading to losses for investors.

How does Javelin manage these risks?

Javelin employs a comprehensive risk management framework to mitigate these risks. This framework includes a rigorous due diligence process, diversification of investments, and ongoing monitoring of market conditions. Javelin also has a team of experienced professionals who are dedicated to managing risk and ensuring the safety and soundness of its investment portfolio.

What is Javelin’s approach to environmental, social, and governance (ESG) factors?

Javelin recognizes the importance of ESG factors and is committed to integrating these considerations into its investment decisions. The company is actively involved in promoting responsible lending practices and supporting sustainable housing initiatives. Javelin believes that ESG factors can enhance long-term value creation and contribute to a more sustainable future.

Javelin Mortgage Investment Corp. is a key player in the real estate finance sector, focusing on providing innovative mortgage solutions. Their commitment to excellence is evident in their continuous efforts to stay ahead of the curve, which includes utilizing resources like the nrp online learning assessment to enhance their team’s knowledge and skills. By investing in their employees’ development, Javelin Mortgage Investment Corp.

ensures they remain a leader in the industry, delivering exceptional service to their clients.

Javelin Mortgage Investment Corp. is a company that specializes in providing mortgage financing solutions. For those looking to advance their careers in the financial industry, consider pursuing an MBA. There are many best affordable online MBA programs available, which can provide the necessary skills and knowledge to succeed in the competitive mortgage market. An MBA can help you gain a deeper understanding of financial markets, investment strategies, and risk management, which are all essential skills for professionals in the mortgage industry.

With the right education, you can make a valuable contribution to companies like Javelin Mortgage Investment Corp.