Where to Buy Investment Property in 2024 A Guide for Success

Where to buy investment property 2024 – Where to buy investment property in 2024 is a question on the minds of many aspiring real estate investors. With the real estate market in a constant state of flux, it’s more important than ever to understand the current trends and make informed decisions. This guide will equip you with the knowledge and strategies you need to navigate the market, identify promising locations, and ultimately, find the perfect investment property for your goals.

The journey to becoming a successful real estate investor begins with a clear understanding of your objectives and the market landscape. Whether you’re seeking long-term appreciation, steady rental income, or a blend of both, this guide will provide you with the tools to create a well-defined investment strategy. From researching potential markets and evaluating properties to securing financing and managing your investment, we’ll cover every step of the process, empowering you to make confident decisions and achieve your investment goals.

Understanding the Investment Property Market in 2024

The real estate market is constantly evolving, and 2024 presents both challenges and opportunities for investors. To make informed decisions, it’s crucial to understand the current market dynamics and anticipate potential trends. This section will delve into the key factors influencing investment property values and explore potential risks and opportunities for the year ahead.

Current State of the Real Estate Market, Where to buy investment property 2024

The real estate market is characterized by a complex interplay of economic factors. In 2023, rising interest rates, inflation, and economic uncertainty significantly impacted market activity. While these factors are expected to persist into 2024, their influence on investment property values will depend on various factors, including the pace of economic growth, government policies, and consumer sentiment.

Factors Influencing Investment Property Values

Several key factors will influence investment property values in 2024. These include:

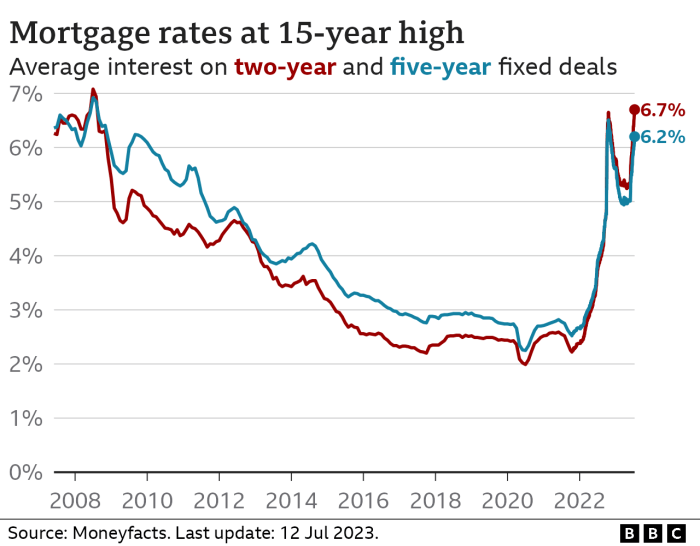

- Interest Rates: Rising interest rates make borrowing more expensive, impacting affordability and demand for investment properties. Higher rates can lead to slower appreciation and potentially lower rental yields.

- Inflation: Persistent inflation erodes purchasing power and increases the cost of construction and maintenance, impacting property values. However, it can also drive up rental rates, potentially offsetting the impact on investment returns.

- Economic Growth: A strong economy typically translates to higher employment and increased consumer spending, boosting demand for housing and potentially driving up property values. Conversely, economic slowdowns can lead to decreased demand and lower prices.

- Government Policies: Government policies, such as tax incentives or regulations, can significantly influence the investment property market. For instance, changes in mortgage lending rules or tax deductions for rental income can impact investor behavior and market dynamics.

Potential Risks and Opportunities

Understanding the potential risks and opportunities in the investment property market is essential for making informed decisions. Here are some key considerations for 2024:

- Rising Interest Rates: Rising interest rates can make financing more expensive, potentially reducing demand for investment properties and slowing down appreciation. However, this can also create opportunities for investors with cash on hand to acquire properties at potentially lower prices.

- Inflationary Pressures: Inflation can impact the cost of owning and managing investment properties, but it can also lead to higher rental income. Investors need to carefully analyze the balance between rising costs and potential rental income growth.

- Economic Uncertainty: Economic uncertainty can make it challenging to predict future market trends. Investors should consider diversifying their portfolio across different property types and locations to mitigate risk.

- Emerging Markets: Certain emerging markets may offer higher potential returns, but they also come with increased risks. Investors need to carefully assess the risks and opportunities associated with investing in these markets.

The real estate market is dynamic, and finding the right investment property in 2024 requires a combination of research, strategic planning, and informed decision-making. By carefully considering your investment goals, thoroughly researching potential markets, and diligently evaluating properties, you can position yourself for success. Remember, the key to maximizing your returns lies in understanding the market, managing your investments wisely, and adapting to changing conditions. With a proactive approach and a commitment to continuous learning, you can unlock the potential of real estate investing and build a profitable portfolio.

Detailed FAQs: Where To Buy Investment Property 2024

What are some of the best resources for finding investment properties?

There are several resources available to help you find investment properties, including online real estate portals, working with experienced real estate agents, attending property auctions, and networking with other investors.

How do I calculate the potential return on investment for a property?

To calculate potential ROI, you need to factor in the purchase price, estimated rental income, expenses (mortgage payments, property taxes, insurance, maintenance), and any potential appreciation. You can use online calculators or consult with a financial advisor to determine your projected ROI.

What are the most common mistakes investors make when buying investment property?

Common mistakes include failing to conduct thorough due diligence, overpaying for a property, neglecting to factor in ongoing expenses, and not having a comprehensive property management plan.

What are the tax implications of owning investment property?

Tax implications vary depending on your location and the specific type of investment property. It’s essential to consult with a tax professional to understand your tax obligations and potential deductions.

When deciding where to buy investment property in 2024, consider factors like local market trends and potential for growth. For those looking to enhance their business acumen, exploring an accredited online MBA program without the GMAT requirement, like those listed on this resource , could provide valuable insights into financial management and real estate investment strategies.

Determining the best places to invest in real estate in 2024 requires careful research and analysis. It’s also wise to consider the potential impact of your investment on your career trajectory, especially if you’re looking to enhance your business acumen. A strong MBA can be a valuable asset, and if you’re considering this route, there are some excellent online programs available, like those listed on this blog.

Regardless of your investment strategy, understanding market trends and identifying undervalued properties will be key to success in 2024.

Choosing the right location for an investment property in 2024 requires careful research and consideration of market trends. To make informed decisions, you might want to explore resources like best value online MBA programs, which can provide you with the financial and analytical skills to assess investment opportunities. By understanding market dynamics and applying sound financial strategies, you can make informed choices when deciding where to buy investment property in 2024.

When deciding where to buy investment property in 2024, consider factors like local economic growth and rental demand. A strong understanding of real estate market trends can be gained through a solid education, like an MBA. If you’re looking to enhance your business acumen, check out affordable online MBA degree programs , which can equip you with the knowledge needed to make informed investment decisions.

This knowledge will be invaluable as you navigate the intricacies of the real estate market and pinpoint the best locations for your investment goals.