Online Real Estate Investing Courses Your Path to Success

Online real estate investing courses have become increasingly popular, offering a convenient and affordable way to learn the intricacies of this lucrative field. This surge in popularity can be attributed to the accessibility and affordability of online learning, making it a viable option for individuals of all backgrounds and experience levels. Compared to traditional in-person programs, online courses provide flexibility, allowing students to learn at their own pace and on their own schedule.

These courses cover a wide range of topics, from the fundamentals of real estate to advanced strategies for property analysis, financing, and legal considerations. Whether you’re a complete beginner or a seasoned investor looking to enhance your skills, online courses can provide valuable insights and practical knowledge to help you navigate the complex world of real estate investing.

The Rise of Online Real Estate Investing Courses

The real estate investing landscape has undergone a significant transformation, with online courses emerging as a dominant force in educating aspiring investors. The growing popularity of these courses is a testament to the evolving needs and preferences of individuals seeking to navigate the complex world of real estate investment.

Reasons for the Popularity of Online Real Estate Investing Courses

The surge in popularity of online real estate investing courses can be attributed to a confluence of factors, including the accessibility and affordability of online learning, the convenience it offers, and the diverse range of knowledge and expertise available.

- Accessibility and Affordability: Online courses have broken down geographical barriers, making real estate investing education accessible to individuals worldwide. The cost of online courses is often significantly lower compared to traditional in-person programs, making it a more financially viable option for many.

- Convenience and Flexibility: Online courses offer unparalleled flexibility, allowing learners to study at their own pace and on their own schedule. This is particularly advantageous for individuals with busy work or family commitments, who may find it difficult to attend traditional in-person classes.

- Diverse Range of Knowledge and Expertise: Online courses feature a wide array of instructors with diverse backgrounds and expertise, catering to different learning styles and interests. Learners can choose courses that align with their specific goals and areas of focus, such as residential, commercial, or international real estate investing.

Benefits of Online Real Estate Investing Courses

Online real estate investing courses offer a range of benefits compared to traditional in-person programs, including personalized learning experiences, interactive learning environments, and access to a wealth of resources.

- Personalized Learning Experiences: Online courses often incorporate interactive features such as quizzes, simulations, and discussion forums, allowing learners to personalize their learning journey. This personalized approach can help learners identify their strengths and weaknesses, leading to a more effective and engaging learning experience.

- Interactive Learning Environments: Many online courses offer interactive learning environments where learners can connect with instructors and fellow students. This fosters a collaborative learning environment, where individuals can share insights, ask questions, and receive feedback from peers and experts.

- Access to a Wealth of Resources: Online courses often provide access to a wealth of resources, including downloadable materials, video tutorials, and case studies. These resources can serve as valuable references and tools for learners, enhancing their understanding of real estate investing principles and strategies.

Types of Online Real Estate Investing Courses

Online real estate investing courses cater to various levels of expertise, offering a structured learning path from beginner to advanced. These courses cover a wide range of topics, from foundational knowledge to specialized strategies, enabling individuals to acquire the necessary skills and knowledge to navigate the world of real estate investing.

Course Levels

Online real estate investing courses are designed for different levels of experience, allowing individuals to progress at their own pace and focus on the areas most relevant to their needs.

- Beginner Courses: These courses provide an introduction to the fundamentals of real estate investing, covering essential concepts such as property types, market analysis, financing options, and legal considerations. They are ideal for individuals with no prior experience in real estate investing, providing a solid foundation for future learning.

- Intermediate Courses: Building upon the foundation laid by beginner courses, intermediate courses delve deeper into specific investment strategies, such as rental property management, flipping houses, or commercial real estate investing. They explore advanced topics like property analysis, market research, and risk management, equipping individuals with the tools to make informed investment decisions.

- Advanced Courses: Advanced courses cater to experienced investors seeking to refine their skills and explore more complex strategies. They often focus on specialized topics like tax optimization, legal structures, and portfolio management. These courses provide insights into advanced strategies and industry trends, helping investors stay ahead of the curve.

Course Topics

Online real estate investing courses offer a comprehensive curriculum covering various aspects of the investment process.

- Real Estate Fundamentals: These courses cover the basics of real estate, including property types, market dynamics, and legal considerations. They provide an understanding of the underlying principles that govern the real estate market.

- Property Analysis: This topic focuses on evaluating properties for investment potential. Courses cover methods for analyzing market trends, identifying undervalued properties, and estimating potential returns on investment.

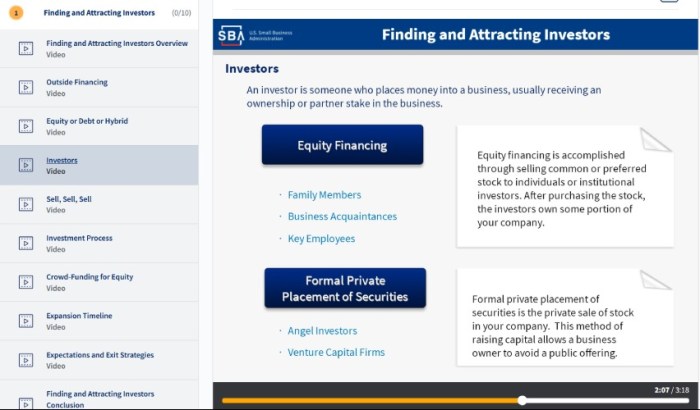

- Financing: These courses delve into the world of real estate financing, covering different loan options, mortgage calculations, and strategies for securing financing. They equip investors with the knowledge to navigate the complexities of real estate financing.

- Legal Aspects: Understanding the legal aspects of real estate investing is crucial. Courses cover topics such as property contracts, landlord-tenant laws, and tax implications, ensuring investors operate within legal boundaries.

- Investment Strategies: Courses on investment strategies explore different approaches to real estate investing, such as buy-and-hold, flipping, and wholesaling. They provide insights into the pros and cons of each strategy, enabling investors to choose the best approach for their goals and risk tolerance.

- Property Management: Courses on property management cover the day-to-day operations of managing rental properties, including tenant screening, rent collection, and maintenance. They equip investors with the skills to manage their properties effectively and maximize returns.

- Real Estate Market Analysis: These courses provide investors with the tools to analyze market trends, identify growth areas, and make informed investment decisions. They cover techniques for researching market data, understanding economic indicators, and forecasting future trends.

- Tax Optimization: Courses on tax optimization explore strategies for minimizing tax liabilities related to real estate investments. They cover topics such as depreciation, deductions, and tax shelters, enabling investors to maximize their after-tax returns.

Course Providers

A wide range of online platforms and educators offer real estate investing courses. Here is a table showcasing some prominent providers and their offerings:

| Provider | Course Type | Key Features | Pricing |

|---|---|---|---|

| BiggerPockets | Beginner, Intermediate, Advanced | Comprehensive curriculum, community forum, real-life case studies | Varies by course |

| The Real Estate Guys | Beginner, Intermediate, Advanced | Expert instructors, practical strategies, real-world examples | Varies by course |

| REI University | Beginner, Intermediate, Advanced | Interactive learning, personalized coaching, mentorship program | Varies by course |

| Real Estate Investing Mastery | Beginner, Intermediate, Advanced | Step-by-step guidance, proven strategies, money-back guarantee | Varies by course |

Choosing the Right Online Real Estate Investing Course

Choosing the right online real estate investing course is crucial for maximizing your learning experience and achieving your investment goals. With numerous options available, carefully evaluating different factors can help you identify a course that aligns with your needs and aspirations.

Factors to Consider When Choosing an Online Real Estate Investing Course

Several key factors should be considered when selecting an online real estate investing course. These factors can help you make an informed decision and ensure that the course you choose is valuable and relevant to your goals.

- Instructor Experience and Expertise: Look for courses taught by experienced real estate professionals with a proven track record of success. Their expertise can provide valuable insights and practical advice based on real-world experience.

- Course Curriculum: Evaluate the course curriculum to ensure it covers topics that are relevant to your investment goals and experience level. Consider whether the course focuses on specific real estate strategies, such as buy-and-hold, flipping, or rental properties, or offers a broader overview of the real estate market.

- Student Support: Assess the level of student support provided by the course. Consider factors like access to instructors, Q&A forums, and other resources. Adequate support can help you overcome challenges and stay motivated throughout the learning process.

Evaluating Course Quality

To determine the quality of an online real estate investing course, you can employ several strategies. These strategies can help you gather valuable information and make a well-informed decision.

- Read Reviews and Testimonials: Reviews and testimonials from previous students can provide insights into the course’s content, teaching style, and overall value. Look for reviews from reputable sources and consider the overall sentiment expressed.

- Check Course Credentials: Ensure the course is accredited or endorsed by reputable organizations or institutions. This can indicate a higher standard of quality and credibility.

- Look for Money-Back Guarantees: Courses with money-back guarantees demonstrate confidence in their product and can provide peace of mind. However, carefully review the terms and conditions of the guarantee before making a decision.

Aligning Course Content with Investment Goals and Experience Level, Online real estate investing courses

It’s essential to select a course that aligns with your individual investment goals and experience level. Consider the following factors to ensure a suitable match:

- Investment Goals: If you aim to become a passive landlord, a course focusing on buy-and-hold strategies would be appropriate. If you’re interested in flipping properties, a course emphasizing renovation and resale techniques would be more suitable.

- Experience Level: Choose a course that caters to your experience level. Beginners might benefit from a comprehensive course covering fundamental concepts, while experienced investors might prefer specialized courses focusing on advanced strategies.

The Value of Online Real Estate Investing Courses

Online real estate investing courses offer a wealth of knowledge and practical skills that can empower individuals to navigate the complex world of real estate investment. These courses provide a structured and comprehensive approach to learning, equipping students with the tools and insights necessary to make informed decisions and achieve their investment goals.

Practical Knowledge and Skills

Online real estate investing courses provide practical knowledge and skills that are essential for success in the real estate market.

- Property Evaluation: Courses teach students how to analyze property values, identify undervalued properties, and estimate potential returns on investment. This involves understanding various valuation methods, such as comparable market analysis (CMA), income capitalization, and cost approach.

- Market Analysis: Courses equip students with the skills to analyze market trends, identify growth areas, and assess the potential profitability of different investment strategies. This includes understanding supply and demand dynamics, economic indicators, and local market conditions.

- Deal Negotiation: Online courses teach students how to negotiate effectively with sellers, buyers, and other stakeholders. This involves understanding negotiation strategies, developing strong communication skills, and knowing how to structure deals to maximize profitability.

- Financing and Legal Aspects: Courses cover the intricacies of real estate financing, including loan types, interest rates, and mortgage terms. They also provide insights into legal aspects of real estate investing, such as property ownership, contracts, and regulations.

- Property Management: Courses teach students how to manage rental properties effectively, including tenant screening, lease agreements, maintenance, and rent collection. This knowledge is crucial for maximizing rental income and minimizing potential risks.

Building Confidence and a Strong Foundation

Online real estate investing courses can significantly boost confidence and provide a strong foundation for success in the real estate market.

- Structured Learning: Courses provide a structured learning environment, allowing students to acquire knowledge and skills systematically and progressively. This structured approach helps individuals develop a strong understanding of real estate principles and practices.

- Practical Application: Many courses include real-world case studies, simulations, and practical exercises, allowing students to apply their knowledge to real-life scenarios. This hands-on approach helps solidify their understanding and build confidence in their abilities.

- Expert Guidance: Courses are often taught by experienced real estate investors and professionals, providing students with access to valuable insights and industry best practices. This expert guidance can help individuals avoid common pitfalls and make more informed investment decisions.

- Community Support: Online courses often foster a sense of community, allowing students to connect with other investors, share experiences, and learn from each other. This support network can be invaluable for building confidence and navigating the challenges of real estate investing.

Examples of Success

- [Name of investor], a successful real estate investor who started with limited experience, credits an online course for providing the foundational knowledge and skills he needed to launch his career. The course taught him how to analyze properties, negotiate deals, and manage rental properties, enabling him to build a profitable portfolio.

- [Name of investor], a busy professional who wanted to diversify her investments, enrolled in an online real estate investing course to learn about different investment strategies. The course helped her identify profitable opportunities and navigate the complexities of real estate financing, allowing her to successfully acquire her first rental property.

Future Trends in Online Real Estate Investing Education

The landscape of online real estate investing education is constantly evolving, driven by advancements in technology and the changing needs of learners. Emerging technologies and trends are poised to revolutionize how individuals acquire knowledge and skills in this field, making it more accessible, engaging, and effective.

Impact of Virtual Reality and Gamification

Virtual reality (VR) and gamification are two prominent trends shaping the future of online real estate investing education. VR offers immersive experiences that simulate real-world scenarios, allowing learners to practice their skills in a safe and controlled environment. Gamification, on the other hand, leverages game mechanics to enhance engagement and motivation, making learning more enjoyable and rewarding.

- VR can be used to create realistic simulations of property walkthroughs, allowing learners to experience the layout, features, and ambiance of different properties without physically being present.

- Gamified learning platforms can incorporate interactive elements like quizzes, challenges, and leaderboards to make learning more engaging and competitive.

- These technologies can also be integrated to create immersive VR games that teach real estate investing concepts through interactive scenarios and challenges.

Hypothetical Online Course Incorporating Innovative Learning Methods and Technologies

Imagine an online real estate investing course that combines the best of VR, gamification, and traditional learning methods. The course could begin with an introductory module that uses VR to simulate a real estate market. Learners could explore virtual properties, interact with virtual agents, and learn about different types of investments.

- The course could then transition to interactive modules that use gamification to teach key concepts such as market analysis, property valuation, and financing.

- Learners could participate in virtual property auctions, negotiate with virtual investors, and manage virtual portfolios.

- The course could also incorporate traditional learning methods like video lectures, case studies, and expert interviews to provide a comprehensive learning experience.

Investing in online real estate investing courses can be a wise decision for anyone looking to embark on a successful journey in the real estate market. These courses offer a comprehensive learning experience, equipping individuals with the knowledge, skills, and confidence needed to make informed decisions and achieve their investment goals. With the right course and dedication, you can unlock the potential of real estate investing and build a secure financial future.

Popular Questions

What are the prerequisites for taking an online real estate investing course?

There are typically no strict prerequisites for taking online real estate investing courses. However, a basic understanding of financial concepts and a willingness to learn are essential. Some courses may require prior experience in real estate or investing, but many cater to beginners.

How long do online real estate investing courses usually last?

The duration of online real estate investing courses varies depending on the course provider and the depth of coverage. Some courses can be completed in a few weeks, while others may span several months. It’s important to choose a course that aligns with your available time and learning pace.

Are online real estate investing courses accredited?

Accreditation is not a standard requirement for online real estate investing courses. However, some courses may be accredited by professional organizations or educational institutions. It’s advisable to check the course provider’s accreditation status to ensure the quality and legitimacy of the program.

How can I find reputable online real estate investing courses?

To find reputable online real estate investing courses, it’s essential to conduct thorough research. Look for courses offered by well-established organizations with a proven track record. Read reviews and testimonials from previous students to gain insights into the course content, instructor quality, and overall value.

Online real estate investing courses can equip you with the knowledge and skills to navigate the complex world of property investment. Just like understanding the different types of car insurance, such as 3rd party car insurance , is crucial for responsible vehicle ownership, these courses can help you make informed decisions about your real estate ventures.

Online real estate investing courses can teach you everything from finding the right properties to managing your investments. While you’re learning about investing, it’s also a good idea to consider the financial implications of owning a car, especially if you’re planning to use it for property inspections or commuting to meetings. Make sure you’re covered with the right used car insurance , and then you can confidently focus on building your real estate portfolio.