Free Online Bookkeeping Courses Learn QuickBooks

Free online bookkeeping courses quickbooks – Free online bookkeeping courses: Learn QuickBooks, a powerful tool for managing your business finances. Mastering bookkeeping is essential for any successful business, no matter how small. QuickBooks, a leading accounting software, offers a user-friendly interface and comprehensive features to simplify your bookkeeping tasks. Whether you’re a solopreneur or a small business owner, these courses provide valuable insights into the world of bookkeeping and empower you to effectively manage your finances.

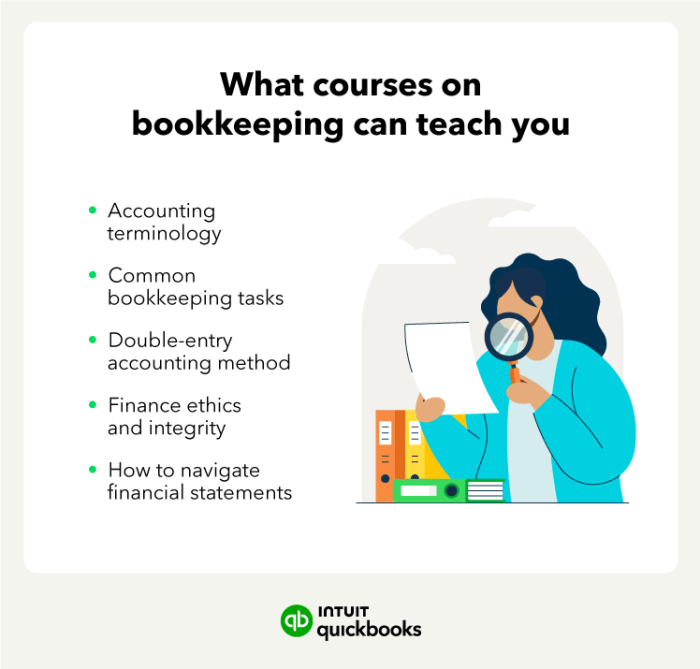

These free online courses cover a wide range of topics, from basic bookkeeping principles to advanced QuickBooks features. You’ll learn how to set up your chart of accounts, record transactions, generate financial reports, and even manage payroll. The courses are designed to be accessible to learners of all levels, with clear explanations and practical examples.

Introduction to Online Bookkeeping

Bookkeeping is the backbone of any successful business, especially for small businesses. It involves meticulously tracking all financial transactions, ensuring accuracy, and providing valuable insights into your business’s financial health. Efficient bookkeeping helps you make informed decisions, manage your finances effectively, and achieve your business goals.

Benefits of Using QuickBooks for Bookkeeping

QuickBooks is a popular and powerful accounting software designed to streamline your bookkeeping process. It offers a range of features that can benefit small businesses, including:

- Simplified Tracking: QuickBooks makes it easy to track income, expenses, invoices, and payments, eliminating the need for manual spreadsheets or complex accounting methods.

- Automated Processes: QuickBooks automates many tasks, such as generating invoices, reconciling bank statements, and creating financial reports, saving you time and effort.

- Real-Time Insights: QuickBooks provides real-time financial data, allowing you to monitor your business’s performance and identify trends quickly. This helps you make timely adjustments and avoid potential financial issues.

- Improved Accuracy: QuickBooks minimizes errors by automating calculations and ensuring data consistency, leading to more accurate financial records.

- Collaboration: QuickBooks allows you to share financial data with your accountant or other stakeholders, fostering seamless collaboration and transparency.

Types of QuickBooks Software

QuickBooks offers various software options to suit different business needs and sizes. The most common types include:

- QuickBooks Self-Employed: Designed for freelancers and solopreneurs, it offers basic accounting features, expense tracking, and invoicing.

- QuickBooks Online: A cloud-based solution accessible from any device, it provides a comprehensive set of features for small businesses, including invoicing, expense tracking, payroll, and reporting.

- QuickBooks Desktop: A traditional desktop software that offers advanced features for larger businesses, including inventory management, job costing, and advanced reporting.

Essential Bookkeeping Concepts

Understanding fundamental bookkeeping concepts is crucial for maintaining accurate financial records and making informed business decisions. This section will delve into key principles and tools that form the foundation of effective bookkeeping.

The Accounting Equation

The accounting equation is a fundamental principle that underpins double-entry bookkeeping. It states that the total assets of a business are equal to the sum of its liabilities and equity. This equation can be represented as:

Assets = Liabilities + Equity

Assets represent everything the business owns, such as cash, inventory, and equipment. Liabilities represent the business’s obligations to others, such as loans and accounts payable. Equity represents the owners’ stake in the business, which includes their initial investment and accumulated profits.

Financial Statements

Financial statements provide a snapshot of a business’s financial health and performance. They are essential for making informed decisions about operations, investments, and financing. The three primary financial statements are:

Income Statement

The income statement, also known as the profit and loss statement, summarizes a business’s revenues and expenses over a specific period. It shows the net income or loss generated during that period.

Balance Sheet

The balance sheet provides a snapshot of a business’s assets, liabilities, and equity at a specific point in time. It represents the accounting equation, demonstrating the financial position of the business.

Statement of Cash Flows

The statement of cash flows tracks the movement of cash in and out of a business over a specific period. It categorizes cash flows into operating, investing, and financing activities, providing insights into the sources and uses of cash.

Common Bookkeeping Transactions

Bookkeeping transactions are the daily records of financial activities within a business. These transactions are categorized and recorded in QuickBooks to maintain accurate financial records. Here are some common examples:

Sales Transactions

When a business sells goods or services, it generates revenue. This transaction is recorded as a credit to the sales account and a debit to the accounts receivable account if the customer pays later.

Purchase Transactions

When a business purchases goods or services, it incurs an expense. This transaction is recorded as a debit to the expense account and a credit to the accounts payable account if the business pays later.

Payment Transactions

When a business receives payment from customers, it increases cash. This transaction is recorded as a debit to the cash account and a credit to the accounts receivable account.

Expense Transactions

When a business pays for expenses, it decreases cash. This transaction is recorded as a credit to the cash account and a debit to the expense account.

Setting Up QuickBooks for Your Business

This section will guide you through the initial setup of QuickBooks, a crucial step in managing your business finances effectively. We’ll cover creating a new company file, setting up your chart of accounts, and managing customer and vendor records.

Creating a New QuickBooks Company File

Creating a new QuickBooks company file is the first step in using QuickBooks for your business. This file will contain all your financial data, including transactions, reports, and customer information.

To create a new QuickBooks company file:

- Open QuickBooks and select “Create Company File.”

- Choose the appropriate industry for your business.

- Provide your company information, such as name, address, and phone number.

- Select a method for tracking inventory (if applicable).

- Choose a start date for your company file.

- Review and confirm your information.

- Save your company file to a secure location.

Setting Up Your Chart of Accounts

A chart of accounts is a list of all the financial accounts used by your business. It’s essential to have a well-organized chart of accounts to track your income, expenses, and assets accurately.

To set up your chart of accounts:

- Go to the “Chart of Accounts” section in QuickBooks.

- Review the default accounts provided by QuickBooks.

- Add or modify accounts as needed to reflect your business’s specific needs.

- Categorize accounts into different types, such as assets, liabilities, equity, revenue, and expenses.

- Assign account numbers to each account for easy identification and organization.

It’s important to consult with a qualified accountant or bookkeeper to ensure your chart of accounts is set up correctly for your business.

Creating and Managing Customer and Vendor Records

Customer and vendor records are crucial for managing your business relationships and tracking transactions.

To create and manage customer records:

- Go to the “Customers” section in QuickBooks.

- Click “New Customer” to create a new customer record.

- Enter the customer’s name, address, contact information, and any other relevant details.

- Assign a unique customer ID to each customer.

- Set up payment terms and credit limits as needed.

To create and manage vendor records:

- Go to the “Vendors” section in QuickBooks.

- Click “New Vendor” to create a new vendor record.

- Enter the vendor’s name, address, contact information, and any other relevant details.

- Assign a unique vendor ID to each vendor.

- Set up payment terms and credit limits as needed.

Recording Transactions in QuickBooks

The heart of any bookkeeping system is the accurate recording of financial transactions. QuickBooks makes this process straightforward and efficient, allowing you to track every sale, purchase, and expense. This module will guide you through the process of recording transactions in QuickBooks, including creating invoices, managing payments, and reconciling bank accounts.

Recording Sales in QuickBooks

To record sales in QuickBooks, you will typically use the “Invoice” feature. This feature allows you to create and send invoices to your customers, capturing details like the date of sale, items sold, quantities, prices, and any applicable taxes. Here’s a step-by-step guide:

- Create a New Invoice: Navigate to the “Sales” menu and select “Create Invoice.”

- Enter Customer Information: Select the customer from your existing list or create a new customer profile.

- Add Items: Enter the items sold, quantities, prices, and any applicable discounts. QuickBooks automatically calculates the total amount due.

- Review and Save: Review the invoice details, and save it. You can then choose to print, email, or send the invoice electronically to your customer.

Recording Purchases in QuickBooks

Recording purchases in QuickBooks is similar to recording sales. You will typically use the “Bill” feature to track your expenses. This feature allows you to create and manage bills from your suppliers, capturing details like the date of purchase, items purchased, quantities, prices, and payment terms.

- Create a New Bill: Navigate to the “Expenses” menu and select “Create Bill.”

- Enter Vendor Information: Select the vendor from your existing list or create a new vendor profile.

- Add Items: Enter the items purchased, quantities, prices, and any applicable discounts. QuickBooks automatically calculates the total amount due.

- Review and Save: Review the bill details and save it. You can then choose to print, email, or send the bill electronically to your vendor.

Managing Invoices and Payments

QuickBooks offers several features for managing invoices and payments:

- Tracking Invoice Status: You can easily track the status of your invoices (e.g., unpaid, partially paid, paid) and manage your receivables effectively.

- Recording Payments: When your customers make payments, you can record them against the corresponding invoices, updating the balance due.

- Creating and Managing Credit Memos: If you need to issue a refund or credit to a customer, you can create a credit memo in QuickBooks.

Reconciling Bank Accounts in QuickBooks

Reconciling bank accounts in QuickBooks ensures that your records match your bank’s records. This is a crucial step in maintaining accurate financial information.

- Download Bank Statement: Download a recent bank statement from your online banking portal.

- Open Bank Reconciliation: Navigate to the “Banking” menu and select “Reconcile.” Choose the bank account you want to reconcile.

- Compare Transactions: Compare the transactions listed on your bank statement with the transactions recorded in QuickBooks.

- Mark Transactions: Mark transactions as “cleared” in QuickBooks to indicate they match the bank statement.

- Review and Complete: Review the reconciliation and complete it once all matching transactions have been marked.

Reconciling bank accounts regularly helps you identify any discrepancies, detect potential errors, and maintain accurate financial records.

Generating Financial Reports

Financial reports are essential for understanding your business’s performance and making informed decisions. QuickBooks offers a variety of reports that provide valuable insights into your finances.

Understanding Different Types of Financial Reports

QuickBooks offers a range of reports, each providing a unique perspective on your business’s financial health. Here are some of the most commonly used reports:

- Balance Sheet: This report provides a snapshot of your business’s assets, liabilities, and equity at a specific point in time. It helps you understand your financial position and assess your solvency.

- Income Statement: Also known as a profit and loss statement, this report shows your business’s revenue, expenses, and net income over a specific period. It helps you track your profitability and identify areas for improvement.

- Cash Flow Statement: This report tracks the movement of cash in and out of your business. It helps you understand your cash flow and manage your liquidity.

- Profit and Loss by Class: This report allows you to see the profitability of different aspects of your business, such as product lines or departments. It helps you identify which areas are performing well and which need attention.

- Customer Balance Detail: This report provides detailed information about each customer’s account balance, including outstanding invoices and payments. It helps you manage your receivables and identify potential risks.

- Vendor Balance Detail: This report provides detailed information about each vendor’s account balance, including outstanding invoices and payments. It helps you manage your payables and ensure timely payments.

Generating and Analyzing Key Financial Metrics

Financial reports provide valuable data, but it’s crucial to analyze key financial metrics to gain meaningful insights. Here are some key metrics to consider:

- Gross Profit Margin: This metric measures the percentage of revenue that remains after deducting the cost of goods sold. A higher gross profit margin indicates better profitability.

- Net Profit Margin: This metric measures the percentage of revenue that remains after deducting all expenses. A higher net profit margin indicates better overall profitability.

- Return on Equity (ROE): This metric measures the profitability of your business in relation to the equity invested. A higher ROE indicates better efficiency in using equity to generate profits.

- Current Ratio: This metric measures your business’s ability to meet short-term financial obligations. A higher current ratio indicates a stronger ability to pay bills.

- Quick Ratio: This metric is similar to the current ratio but excludes inventory from current assets. It provides a more conservative measure of liquidity.

Using Financial Reports to Make Informed Business Decisions

Financial reports provide valuable insights into your business’s performance, but it’s essential to use them to make informed decisions. Here are some tips:

- Compare reports over time: Track your financial performance over different periods to identify trends and patterns.

- Analyze trends and patterns: Identify areas of improvement and potential risks based on the trends observed in your financial reports.

- Set realistic goals and benchmarks: Use financial reports to set realistic goals for your business and track your progress toward achieving them.

- Seek professional advice: Consult with a financial advisor or accountant to interpret your financial reports and develop effective strategies.

Using QuickBooks for Payroll

QuickBooks can simplify your payroll process, helping you accurately calculate and process employee pay, manage payroll taxes, and generate necessary reports. This section will guide you through the process of setting up and using QuickBooks for payroll.

Setting Up Payroll in QuickBooks

To begin, you’ll need to set up your company’s payroll information within QuickBooks. This involves defining employee details, setting up payroll items like salaries and deductions, and configuring tax settings.

- Employee Information: Add each employee’s details, including their name, address, Social Security number, and pay rate. QuickBooks allows you to track various payroll items like salary, hourly wages, commissions, and bonuses.

- Payroll Items: Define payroll items like salaries, hourly wages, commissions, and bonuses. You can also set up deductions, such as federal, state, and local taxes, health insurance premiums, and retirement contributions.

- Tax Settings: Configure your tax settings, including federal, state, and local tax rates, as well as any required withholdings. QuickBooks helps you stay compliant with tax regulations.

Calculating and Processing Payroll

Once your payroll setup is complete, you can begin calculating and processing payroll for your employees. QuickBooks offers a straightforward process to ensure accuracy and efficiency.

- Entering Time and Attendance: If you have hourly employees, you’ll need to enter their time and attendance data. QuickBooks can automatically calculate regular and overtime hours based on the information provided.

- Reviewing Payroll: Before finalizing payroll, review the calculated amounts for each employee, including gross pay, deductions, and net pay. Ensure accuracy and make any necessary adjustments.

- Processing Payroll: Once you’ve verified the payroll data, you can process it through QuickBooks. The software automatically generates paychecks, tax payments, and relevant reports.

Managing Payroll Taxes and Withholdings

Payroll taxes and withholdings are a crucial aspect of payroll management. QuickBooks provides tools to help you manage these effectively.

- Tax Liability: Keep track of your tax liability throughout the year. QuickBooks helps you calculate and track federal, state, and local taxes.

- Tax Payments: Use QuickBooks to make timely tax payments to the appropriate authorities. The software can assist with calculating and filing your payroll tax returns.

- Withholdings: Manage employee withholdings, including federal, state, and local income taxes, Social Security and Medicare taxes, and other deductions. QuickBooks ensures compliance with relevant tax regulations.

Advanced QuickBooks Features: Free Online Bookkeeping Courses Quickbooks

QuickBooks offers a wide range of advanced features that can help you streamline your business operations and gain valuable insights into your financial performance. These features are designed to cater to the needs of businesses of all sizes, from small startups to large enterprises.

QuickBooks Online vs. QuickBooks Desktop, Free online bookkeeping courses quickbooks

QuickBooks Online and QuickBooks Desktop are two popular versions of the software, each with its own set of features and advantages.

- QuickBooks Online is a cloud-based accounting software that allows you to access your data from anywhere with an internet connection. This makes it an ideal choice for businesses with remote employees or those who frequently travel. It also offers automatic updates, ensuring you always have the latest version of the software.

- QuickBooks Desktop is a traditional accounting software that is installed on your computer. It offers a more comprehensive set of features than QuickBooks Online, including the ability to customize reports and create custom fields. However, it requires regular updates and can be more challenging to use for businesses with multiple users.

Inventory Management

QuickBooks can help you effectively manage your inventory, from tracking stock levels to generating purchase orders.

- Inventory Tracking: QuickBooks allows you to create an inventory list and track the quantity of each item in stock. You can also set up reorder points to ensure you never run out of inventory.

- Purchase Orders: QuickBooks makes it easy to create and manage purchase orders for your suppliers. You can track the status of each order and receive automatic notifications when items are due to arrive.

- Cost of Goods Sold (COGS): QuickBooks automatically calculates your cost of goods sold, which is essential for determining your profit margin.

Reporting and Analysis

QuickBooks provides a wide range of reporting and analysis tools that can help you understand your financial performance and make informed business decisions.

- Financial Statements: QuickBooks can generate standard financial statements, such as balance sheets, income statements, and cash flow statements. These reports provide a snapshot of your business’s financial health.

- Custom Reports: QuickBooks allows you to create custom reports that meet your specific needs. You can filter reports by date, customer, product, or other criteria to gain deeper insights into your business data.

- Data Visualization: QuickBooks provides tools for visualizing your data, such as charts and graphs. This can help you identify trends and patterns in your business performance.

Best Practices for Online Bookkeeping

Maintaining accurate and organized bookkeeping records is crucial for any business, especially when using online tools like QuickBooks. Implementing best practices ensures you have a reliable financial picture, make informed decisions, and minimize the risk of errors.

Data Security and Regular Backups

Regular backups and data security measures are essential for protecting your valuable bookkeeping data. This is particularly important with online bookkeeping, as you rely on a third-party service for data storage and access.

- Regular Backups: Set up automatic backups of your QuickBooks data to a separate location, such as an external hard drive or cloud storage service. This creates a copy of your data that you can restore if your primary data is lost or corrupted.

- Strong Passwords: Use strong and unique passwords for your QuickBooks account and any other related services, such as cloud storage. Avoid using common passwords and consider using a password manager to keep track of your credentials.

- Two-Factor Authentication: Enable two-factor authentication (2FA) for your QuickBooks account and other online services. This adds an extra layer of security by requiring you to enter a code sent to your phone or email in addition to your password.

- Data Encryption: Ensure that your QuickBooks data is encrypted both in transit and at rest. This means that your data is scrambled and unreadable to unauthorized individuals.

- Secure Internet Connection: Always use a secure internet connection (HTTPS) when accessing your QuickBooks account. Avoid using public Wi-Fi networks, which can be vulnerable to security breaches.

By taking advantage of these free online bookkeeping courses, you can gain the knowledge and skills needed to streamline your financial processes, make informed business decisions, and ultimately, achieve greater financial success. With a solid understanding of bookkeeping and QuickBooks, you’ll be well-equipped to manage your business finances with confidence and efficiency.

Essential Questionnaire

What are the prerequisites for these free online bookkeeping courses?

Most free online bookkeeping courses are designed for beginners and don’t require any prior experience. However, basic computer skills and a general understanding of business finances are helpful.

How long does it take to complete a free online bookkeeping course?

The duration of these courses varies depending on the course content and your learning pace. Some courses can be completed in a few hours, while others may take several weeks.

Are these courses recognized by any professional organizations?

While free online bookkeeping courses are not typically accredited, they can provide a solid foundation for further learning. You can consider pursuing certifications or professional development programs from organizations like the American Institute of Professional Bookkeepers (AIPB) or the National Association of Certified Public Bookkeepers (NACPB) to enhance your credentials.

Free online bookkeeping courses for QuickBooks can help you manage your finances effectively, including your car insurance premiums. If you’re looking for the best car insurance rates in San Diego, check out this resource: car insurance san diego. Once you’ve got your finances in order, you can focus on other important aspects of your business, like expanding your client base or developing new products or services.

Mastering QuickBooks can be a game-changer for your business, and luckily, there are many free online bookkeeping courses available to help you get started. While you’re learning about financial management, it’s also smart to consider securing your assets, like your car. Did you know that Sam’s Club offers car insurance through their partner insurance providers ? Once you’ve got your finances in order and your car protected, you’ll be ready to take your business to the next level.

Learning how to manage your finances effectively is crucial, especially if you’re facing a situation like needing dui car insurance , which can significantly impact your budget. Free online bookkeeping courses using QuickBooks can help you gain the skills to track your expenses, manage your income, and stay on top of your finances, even during challenging times.

Free online bookkeeping courses for QuickBooks can help you manage your finances, including tracking expenses related to your car. However, it’s crucial to understand what your car insurance covers in case of an accident. You can find out if your car insurance covers repairs by visiting this helpful resource: does car insurance cover repairs. By understanding your coverage, you can budget for potential repairs and avoid unexpected financial burdens, allowing you to focus on your bookkeeping skills and keeping your business on track.