Financial Aid for Online Courses Your Guide to Funding Your Education

Financial aid for online courses has become increasingly crucial as more individuals choose the flexibility and convenience of virtual learning. This guide delves into the diverse avenues for financial assistance, from government programs and scholarships to employer tuition assistance and veteran benefits. We will explore the eligibility criteria, application processes, and essential tips for navigating the world of financial aid for online education.

The availability of financial aid for online courses has dramatically expanded in recent years, offering students a wide range of options to pursue their educational goals. This guide will serve as a comprehensive resource, empowering you with the knowledge and tools necessary to secure the financial support you need to succeed in your online learning journey.

Understanding Financial Aid for Online Courses

Pursuing an online degree or certificate can be a valuable investment in your future, but the cost of tuition can be a significant barrier. Fortunately, there are various financial aid options available to help students pay for online courses. Understanding these options can make your educational journey more accessible and affordable.

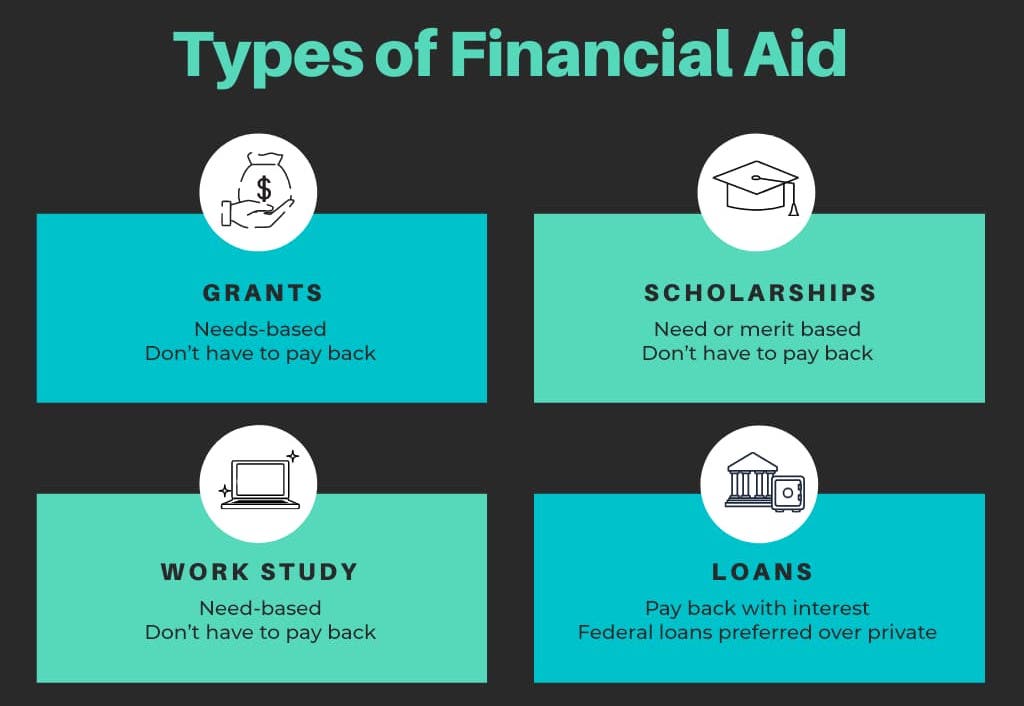

Types of Financial Aid for Online Courses

Financial aid for online courses comes in different forms, each with its unique eligibility criteria and application process. Here are some common types of financial aid:

- Federal Grants: These grants are need-based and do not require repayment. They are available through the Free Application for Federal Student Aid (FAFSA) and include programs like the Pell Grant and the Federal Supplemental Educational Opportunity Grant (FSEOG).

- Federal Loans: These loans require repayment with interest. They are available through the FAFSA and include programs like the Direct Subsidized Loan and the Direct Unsubsidized Loan.

- State Grants: Some states offer grants to residents who are pursuing online courses. These grants may have specific eligibility requirements, such as enrollment in a particular program or institution.

- Scholarships: Scholarships are awarded based on academic merit, financial need, or other criteria. They are offered by various organizations, including colleges and universities, private foundations, and corporations.

- Employer Tuition Assistance: Some employers offer tuition assistance programs to employees who are pursuing online courses. These programs may cover a portion or all of the tuition costs.

Eligibility Criteria for Receiving Financial Aid for Online Courses

To be eligible for financial aid for online courses, you generally need to meet the following criteria:

- Be a U.S. Citizen or Permanent Resident: Most federal financial aid programs require you to be a U.S. citizen or permanent resident.

- Be Enrolled at Least Half-Time: You must be enrolled in a minimum number of credit hours to qualify for most financial aid programs.

- Maintain Satisfactory Academic Progress: You must maintain a certain GPA and pass a minimum number of courses to remain eligible for financial aid.

- Be Registered with Selective Service: Male students between the ages of 18 and 25 must be registered with Selective Service.

Government Programs and Private Organizations Offering Financial Aid for Online Courses

Several government programs and private organizations offer financial aid for online courses. Some examples include:

- Federal Pell Grant: This grant is available to undergraduate students with exceptional financial need. The amount of the grant depends on the student’s financial need and the cost of attendance.

- Federal Supplemental Educational Opportunity Grant (FSEOG): This grant is awarded to undergraduate students with exceptional financial need who are attending participating schools. The amount of the grant is determined by the school.

- Direct Subsidized Loan: This loan is available to undergraduate students with financial need. The government pays the interest on the loan while the student is enrolled in school at least half-time.

- Direct Unsubsidized Loan: This loan is available to undergraduate and graduate students. The student is responsible for paying the interest on the loan, even while enrolled in school.

- The Department of Veterans Affairs (VA): The VA offers educational benefits to veterans, active-duty military personnel, and their dependents. These benefits can be used to pay for online courses.

- The Workforce Innovation and Opportunity Act (WIOA): This act provides funding for training programs, including online courses, for eligible individuals.

- Private Organizations: Many private organizations, such as foundations, corporations, and professional associations, offer scholarships and grants for online courses.

Finding Financial Aid Resources: Financial Aid For Online Courses

Finding financial aid for online courses can seem daunting, but with the right resources and knowledge, it’s achievable. You can find financial aid opportunities for online courses from various sources, both public and private.

Online Resources for Financial Aid

Several online resources can help you search for financial aid opportunities for online courses. Here’s a table summarizing some of the most helpful ones:

| Resource Name | Website URL | Type of Aid Offered | Eligibility Criteria |

|—|—|—|—|

| Federal Student Aid | https://studentaid.gov/ | Grants, loans, work-study | U.S. citizens or eligible non-citizens, enrolled at least half-time |

| FastWeb | https://www.fastweb.com/ | Scholarships, grants, loans | Varies depending on the specific aid opportunity |

| Scholarships.com | https://www.scholarships.com/ | Scholarships, grants | Varies depending on the specific aid opportunity |

| Unigo | https://www.unigo.com/ | Scholarships, grants, loans | Varies depending on the specific aid opportunity |

Applying for Financial Aid

The application process for financial aid for online courses generally involves these steps:

1. Complete the Free Application for Federal Student Aid (FAFSA): The FAFSA is the primary application for federal student aid, including grants, loans, and work-study. You can complete the FAFSA online at the Federal Student Aid website.

2. Complete the CSS Profile (if applicable): Some colleges and universities require students to complete the CSS Profile in addition to the FAFSA. The CSS Profile is a separate application used to determine eligibility for need-based financial aid from private colleges and universities.

3. Submit your application to the school(s) you’re attending: Once you’ve completed the FAFSA and CSS Profile (if applicable), you need to submit your application to the schools you’re attending. The school will then use the information you provided to determine your eligibility for financial aid.

4. Review your financial aid award letter: After you’ve been accepted to a school, you’ll receive a financial aid award letter outlining the types and amounts of financial aid you’re eligible for.

Scholarships and Grants

Scholarships and grants are a valuable source of financial aid for online students. They are essentially free money that doesn’t need to be repaid. These funds can cover tuition, fees, books, and other expenses associated with your online education.

Types of Scholarships and Grants

The availability of scholarships and grants for online students is increasing. Here are some common types:

- Merit-Based Scholarships: These scholarships are awarded based on academic achievements, such as GPA, test scores, or extracurricular activities.

- Need-Based Grants: These grants are awarded based on financial need, typically determined by the Free Application for Federal Student Aid (FAFSA).

- Specific Field of Study Scholarships: Many scholarships are available for students pursuing specific fields of study, such as technology, healthcare, or business.

- Demographic-Based Scholarships: These scholarships are awarded to students from specific demographic groups, such as women, minorities, or veterans.

- Institution-Specific Scholarships: Many colleges and universities offer scholarships specifically for online students.

Finding Scholarships and Grants

Several resources can help you locate scholarships and grants:

- Your School’s Financial Aid Office: The financial aid office at your school is a great starting point for finding scholarships and grants.

- Online Scholarship Search Engines: Websites like Scholarships.com, Fastweb, and Cappex allow you to search for scholarships based on your criteria.

- Professional Organizations: If you are pursuing a specific field of study, professional organizations often offer scholarships to their members.

- Government Agencies: The federal government offers several grant programs for students, including the Pell Grant and the Federal Supplemental Educational Opportunity Grant (FSEOG).

Applying for Scholarships and Grants

The application process for scholarships and grants varies depending on the specific award. However, there are some general steps you can follow:

- Research the Requirements: Carefully review the eligibility criteria for each scholarship or grant you are interested in.

- Gather Your Documents: You will likely need to provide documents such as your transcripts, test scores, and financial aid information.

- Complete the Application: Fill out the application form completely and accurately.

- Submit Your Application: Submit your application by the deadline.

Tips for Increasing Your Chances of Winning a Scholarship

- Start early: Begin your search for scholarships and grants well in advance of the application deadlines.

- Be specific: Target your search for scholarships that match your academic achievements, field of study, and demographics.

- Write a strong essay: Many scholarship applications require an essay. Take the time to craft a compelling and well-written essay that highlights your achievements and goals.

- Follow up: After submitting your application, follow up with the scholarship provider to ensure they received it.

Federal Student Aid Programs

The Federal Student Aid (FSA) program, managed by the U.S. Department of Education, plays a vital role in making higher education accessible to millions of Americans, including online students. FSA offers a variety of financial aid options, including grants, loans, and work-study programs, to help students cover the costs of tuition, fees, books, and living expenses.

Federal Student Loans

Federal student loans are a common way for students to finance their education. Unlike private loans, federal loans offer numerous benefits, such as flexible repayment options, lower interest rates, and income-driven repayment plans.

- Direct Subsidized Loans: These loans are available to undergraduate students with financial need. The government pays the interest on these loans while you’re in school, during grace periods, and during deferment periods. You won’t have to start making payments until after you graduate or leave school.

- Direct Unsubsidized Loans: These loans are available to both undergraduate and graduate students. Interest starts accruing as soon as the loan is disbursed, and you’re responsible for paying it.

- Direct PLUS Loans: These loans are available to graduate students and parents of dependent undergraduate students. They have higher interest rates than subsidized and unsubsidized loans.

State and Local Financial Aid Programs

State and local governments often offer financial aid programs to support students pursuing online education. These programs can be a valuable resource for students who may not qualify for federal aid or need additional financial assistance.

These programs are designed to help students cover the cost of tuition, fees, and other educational expenses. They can be particularly helpful for students who are residents of the state or local area where the program is offered.

Eligibility Criteria and Application Process

Each state and local financial aid program has its own eligibility criteria and application process. Typically, these programs require applicants to be residents of the state or local area, be enrolled in an eligible online program, and meet certain academic requirements.

The application process usually involves submitting a financial aid application, such as the Free Application for Federal Student Aid (FAFSA), along with any required supporting documentation. Some programs may have additional requirements, such as submitting a personal essay or providing proof of enrollment.

Benefits of State and Local Programs

State and local financial aid programs offer several benefits to online students, including:

- Lower Interest Rates: Some state and local programs offer loans with lower interest rates than federal loans. This can save students money in the long run.

- More Flexible Repayment Options: State and local programs may have more flexible repayment options than federal programs, such as income-based repayment or forgiveness programs. This can make it easier for students to manage their debt.

- Targeted Funding: Some state and local programs are targeted towards specific populations, such as students from low-income families, students with disabilities, or students pursuing specific fields of study. This can provide additional financial support for students who may have limited access to other aid options.

Examples of State and Local Financial Aid Programs

Several states and local governments offer financial aid programs for online students. Here are a few examples:

- California: The California Dream Act provides financial assistance to undocumented students attending college in California.

- Texas: The Texas B-On-Time program provides financial assistance to students who complete their degrees on time.

- New York: The New York State Tuition Assistance Program (TAP) provides financial assistance to eligible students attending college in New York State.

- Chicago: The Chicago Scholars program provides financial assistance and mentorship to Chicago residents pursuing higher education.

Private Loans

Private loans can be a valuable resource for students seeking to finance their online education. These loans are offered by private lenders, such as banks, credit unions, and online lenders, and can provide an alternative funding option when federal loans are insufficient or unavailable.

Private loans are often used to fill the gap between the cost of online courses and the amount of federal financial aid a student receives. They can also be helpful for students who do not qualify for federal loans due to credit history or other factors.

Advantages and Disadvantages of Private Loans

Private loans offer several advantages, such as:

- Flexible Loan Terms: Private lenders often offer more flexible loan terms than federal lenders, such as longer repayment periods or lower interest rates. This can be beneficial for students with limited income or those who need more time to repay their loans.

- Higher Loan Limits: Private loans typically have higher loan limits than federal loans, which can be helpful for students with high tuition costs or other expenses.

- Cosigner Options: Private loans often allow students to have a cosigner, which can help them qualify for a lower interest rate or a larger loan amount. A cosigner is someone who agrees to be responsible for repaying the loan if the student defaults.

However, private loans also come with some disadvantages:

- Higher Interest Rates: Private loans generally have higher interest rates than federal loans, which can result in a higher total cost of borrowing.

- Fewer Borrower Protections: Private loans typically offer fewer borrower protections than federal loans, such as deferment or forbearance options. This means that students may be required to start making payments on their loans sooner and may face penalties for missing payments.

- Variable Interest Rates: Some private loans have variable interest rates, which means that the interest rate can fluctuate over time. This can make it difficult to budget for loan repayments.

Choosing the Right Private Loan

When choosing a private loan, it is important to carefully consider the following factors:

- Interest Rate: Look for a loan with the lowest possible interest rate. Compare interest rates from multiple lenders to find the best deal.

- Loan Terms: Consider the loan term, which is the length of time you have to repay the loan. A longer loan term can result in lower monthly payments, but you will pay more interest over the life of the loan.

- Fees: Private loans often have fees, such as origination fees or late payment fees. Make sure to factor these fees into the total cost of borrowing.

- Borrower Protections: Look for a loan that offers borrower protections, such as deferment or forbearance options. This can help you manage your loan payments if you experience financial hardship.

- Lender Reputation: Choose a lender with a good reputation and a track record of providing excellent customer service.

It is important to research and compare different private loan options before making a decision. Consider your financial situation, the cost of your online courses, and your repayment capacity.

Employer Tuition Assistance

Many employers recognize the value of continuing education and offer tuition assistance programs to help their employees further their education. These programs can significantly reduce the cost of online courses, making them more accessible to working professionals.

Eligibility Criteria and Application Process

To be eligible for employer tuition assistance, employees typically need to meet specific criteria. These criteria can vary depending on the employer, but common requirements include:

- Full-time employment status

- Good performance record

- Completion of a minimum period of employment

- Enrollment in an approved program

The application process for employer tuition assistance usually involves submitting a request form along with supporting documentation, such as course descriptions, program syllabuses, and acceptance letters from the educational institution. Some employers may also require employees to provide a written proposal outlining the benefits of pursuing the program.

Examples of Companies Offering Tuition Assistance, Financial aid for online courses

Many companies offer tuition assistance programs to their employees. Here are some examples:

- Amazon: Amazon offers a tuition assistance program called “Amazon Career Choice,” which covers up to 95% of tuition costs for eligible employees. The program covers a wide range of degree and certificate programs, including online courses.

- Apple: Apple offers a tuition reimbursement program that covers up to $10,000 per year for eligible employees. The program covers a variety of degree programs, including online courses.

- Google: Google offers a tuition assistance program that covers up to $10,000 per year for eligible employees. The program covers a wide range of degree and certificate programs, including online courses.

- Walmart: Walmart offers a tuition assistance program called “Live Better U,” which covers 100% of tuition costs for eligible employees. The program covers a wide range of degree and certificate programs, including online courses.

Financial Aid for Veterans

Veterans who are pursuing online courses are eligible for various financial aid programs designed to support their education. These programs can help veterans pay for tuition, fees, books, and other expenses associated with their online studies.

Eligibility Criteria and Benefits

Veterans who are eligible for financial aid programs must meet specific criteria, such as:

- Having served in the U.S. Armed Forces

- Meeting the minimum service requirements

- Being honorably discharged

- Enrolling in an eligible online program

The benefits of these programs can include:

- Full or partial tuition coverage

- Monthly stipends for living expenses

- Book allowances

- Access to career counseling and job placement services

Types of Financial Aid Programs

There are several financial aid programs available to veterans pursuing online courses. Some of the most common programs include:

- Post-9/11 GI Bill (Chapter 33): This program provides veterans with financial assistance for tuition, fees, and living expenses. It also offers a monthly housing allowance, a book stipend, and a one-time payment for a laptop or other educational supplies.

- Montgomery GI Bill (Chapter 30): This program provides veterans with financial assistance for tuition and fees, as well as a monthly housing allowance.

- Veterans Educational Assistance Program (VEAP): This program provides veterans with a monthly stipend for tuition and fees.

- Yellow Ribbon Program: This program provides veterans with financial assistance for tuition and fees that exceed the amount covered by the Post-9/11 GI Bill.

- Tuition Assistance (TA): This program provides active-duty military personnel with financial assistance for tuition and fees.

Applying for Financial Aid

To apply for financial aid as a veteran, you will need to complete the Free Application for Federal Student Aid (FAFSA) and submit it to the VA. You will also need to provide the VA with documentation of your military service, such as a DD Form 214.

- FAFSA: The FAFSA is a free application that determines your eligibility for federal financial aid, including Pell Grants and student loans. It is important to complete the FAFSA early in the year to ensure that you receive the maximum amount of financial aid possible.

- VA Form 22-1990e: This form is used to apply for benefits under the Post-9/11 GI Bill. You will need to provide information about your military service, your educational goals, and your enrollment status.

Budgeting and Financial Planning

Managing your finances is essential for success in online education. Creating a budget and planning for your financial needs can help you stay on track and avoid unnecessary stress. This section will guide you through the process of budgeting for your online education and provide strategies for managing student loan debt.

Creating a Budget for Online Education

A budget is a roadmap for your finances. It helps you track your income and expenses, ensuring that you spend within your means and prioritize your financial goals. Here’s a step-by-step guide to creating a budget for your online education:

- Track Your Income: List all sources of income, including scholarships, grants, part-time jobs, or financial aid. This will give you a clear picture of your financial resources.

- List Your Expenses: Identify all your monthly expenses, including tuition, fees, books, technology, housing, food, transportation, and entertainment. Categorize these expenses to understand where your money is going.

- Calculate Your Net Income: Subtract your total expenses from your total income. This will show you how much money you have left over each month.

- Allocate Your Budget: Allocate your net income to different categories based on your priorities. Prioritize essential expenses like tuition and housing, followed by other expenses like groceries, transportation, and entertainment. Allocate a portion of your budget for savings and unexpected expenses.

- Monitor and Adjust: Regularly review your budget to ensure you are staying within your allocated amounts. Make adjustments as needed to accommodate changes in income or expenses.

Managing Student Loan Debt

Student loans can be a significant financial burden, but there are strategies to manage them effectively. Here are some tips for minimizing your debt and maximizing your financial well-being:

- Borrow Only What You Need: Avoid borrowing more than necessary. Explore scholarships, grants, and other financial aid options to minimize your loan amount.

- Start Repaying Early: If possible, start making payments on your loans while you are still in school. This can help reduce the total interest you pay over the life of the loan.

- Consider Consolidation: If you have multiple loans, consider consolidating them into a single loan with a lower interest rate. This can simplify your payments and potentially save you money on interest.

- Explore Repayment Plans: The federal government offers several income-driven repayment plans that adjust your monthly payments based on your income. This can make your loans more manageable, especially during periods of low income.

- Look for Forgiveness Programs: Some professions or public service jobs qualify for loan forgiveness programs. Research these programs to see if you are eligible.

Financial Planning and Counseling Resources

Many resources are available to help online students with financial planning and counseling. These resources can provide valuable guidance on budgeting, debt management, and other financial matters.

- Your School’s Financial Aid Office: Your school’s financial aid office can provide personalized advice on financial aid options, budgeting, and debt management.

- Federal Student Aid: The Federal Student Aid website offers information on financial aid programs, loan repayment options, and other financial resources for students.

- Nonprofit Credit Counseling Agencies: Nonprofit credit counseling agencies provide free or low-cost financial counseling services, including budgeting, debt management, and credit counseling.

- Financial Planning Professionals: If you need more personalized financial advice, consider consulting with a certified financial planner (CFP) or a registered investment advisor (RIA).

Securing financial aid for online courses can be a rewarding and empowering experience. By carefully researching your options, understanding the eligibility criteria, and diligently pursuing available resources, you can unlock the financial support you need to achieve your educational aspirations. Remember to plan ahead, manage your finances wisely, and seek guidance from trusted sources to ensure a smooth and successful journey toward your online educational goals.

Questions Often Asked

What are the most common types of financial aid available for online courses?

The most common types of financial aid for online courses include scholarships, grants, federal loans, state and local programs, employer tuition assistance, and veteran benefits.

Can I use federal financial aid for online courses?

Yes, federal financial aid is generally available for online courses offered by eligible institutions. Make sure to check the specific requirements and eligibility criteria for each program.

How do I find scholarships specifically for online students?

You can find scholarships for online students through websites like Fastweb, Scholarships.com, and Unigo. Additionally, many universities and colleges offer scholarships specifically for online students.

What are the best resources for managing student loan debt?

Excellent resources for managing student loan debt include the Federal Student Aid website, the National Foundation for Credit Counseling, and the Consumer Financial Protection Bureau.

Financial aid for online courses can be a lifesaver for those looking to upgrade their skills or pursue higher education. Just like understanding whether your car insurance covers the car or the driver, does car insurance cover the car or the driver , it’s crucial to carefully read the fine print and understand the terms of any financial aid package.

This way, you can confidently invest in your future, knowing exactly what’s covered and how to make the most of the opportunities available.

Finding financial aid for online courses can be a great way to invest in your future. Of course, you’ll also want to consider your other expenses, like car insurance, especially if you live in a city like NYC. Car insurance in NYC can be expensive, so make sure you’re getting the best rates possible. Once you have a handle on your finances, you can confidently explore those online courses and take the next step in your career journey.

Financial aid for online courses can help you afford your education, just as finding cheap car insurance for new drivers can help you save money on your transportation costs. While both are important for your future, remember that the financial aid available for online courses can also help you pay for other essential expenses, like textbooks and technology.

While financial aid for online courses can help you afford your education, it’s important to remember that you’re still responsible for covering everyday expenses. For example, if you’re planning a road trip during your break, you might want to look into capital one rental car insurance to protect yourself financially. This can free up some of your budget, allowing you to focus on your studies and future career goals.