Car Insurance in New York A Comprehensive Guide

Car insurance in New York is not just a legal requirement; it’s a vital safety net for drivers. This comprehensive guide explores the intricacies of car insurance in the Empire State, from mandatory coverage to navigating claims and finding the right policy for your needs.

New York drivers are subject to specific regulations and coverage requirements. Understanding these rules is crucial for staying compliant and ensuring adequate protection in case of an accident. We’ll delve into the types of coverage available, factors influencing premium costs, and tips for navigating the insurance landscape.

Understanding Car Insurance in New York

Navigating the world of car insurance in New York can feel overwhelming, especially with the various requirements and options available. This guide will provide a comprehensive overview of car insurance in New York, covering mandatory requirements, different types of coverage, and factors that influence your premium.

Mandatory Car Insurance Requirements in New York

New York State mandates specific car insurance coverage to ensure financial protection for drivers and their potential victims in case of accidents. Understanding these requirements is crucial for all drivers in the state.

- Liability Coverage: This is the most basic and essential type of car insurance required in New York. It covers damages and injuries you cause to others in an accident, including bodily injury liability and property damage liability.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages following an accident, regardless of who was at fault.

- Uninsured/Underinsured Motorist Coverage: This protection safeguards you in the event of an accident caused by an uninsured or underinsured driver.

Types of Car Insurance Coverage in New York

While the state mandates liability, PIP, and uninsured/underinsured motorist coverage, you have the option to purchase additional coverage based on your individual needs and risk tolerance.

- Collision Coverage: This coverage protects you in case of an accident, regardless of fault. It covers repairs or replacement costs for your vehicle, minus your deductible.

- Comprehensive Coverage: This type of coverage protects you against damages caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Rental Reimbursement Coverage: This coverage helps you pay for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance Coverage: This coverage provides assistance for breakdowns, such as towing, flat tire changes, and jump-starts.

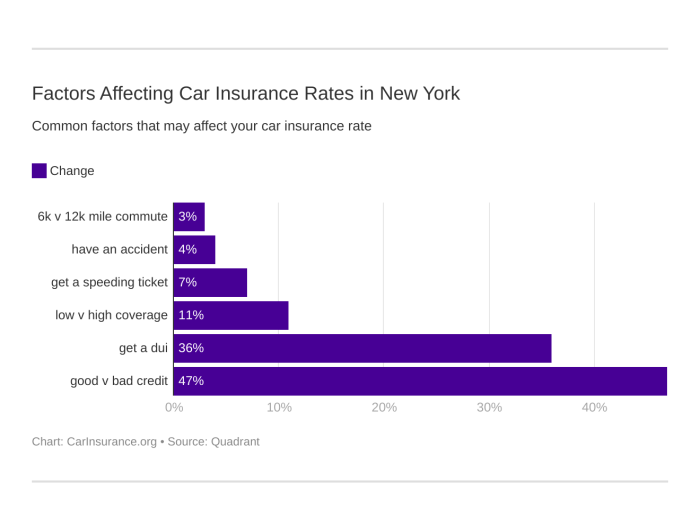

Factors Influencing Car Insurance Premiums in New York

Several factors contribute to the cost of your car insurance premium in New York. Understanding these factors can help you make informed decisions to potentially lower your costs.

- Driving Record: Your driving history plays a significant role in your premium. Accidents, traffic violations, and DUI convictions can increase your rates.

- Vehicle Type: The make, model, and year of your vehicle influence your premium. Luxury or high-performance cars tend to have higher premiums due to their repair costs and potential for higher risks.

- Location: Your geographic location, including the city, county, and zip code, can affect your premium. Areas with higher accident rates or higher crime rates may have higher insurance premiums.

- Age and Gender: Your age and gender can also influence your premium. Younger drivers, especially those under 25, tend to have higher premiums due to their higher risk of accidents.

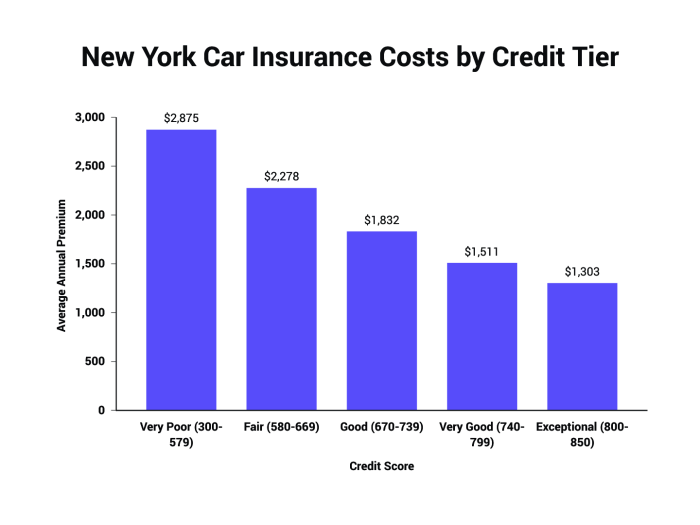

- Credit History: In some states, including New York, insurance companies can use your credit history to assess your risk. A good credit score can lead to lower premiums.

- Coverage Levels: The amount of coverage you choose, such as higher liability limits or comprehensive coverage, will affect your premium.

- Deductibles: Your deductible is the amount you pay out of pocket before your insurance kicks in. A higher deductible generally leads to lower premiums.

Finding the Right Car Insurance Policy

Finding the right car insurance policy in New York can be a daunting task, given the numerous providers and diverse policy options available. It’s essential to compare quotes from multiple insurers and carefully analyze the coverage offered to ensure you get the best value for your money.

Comparing Car Insurance Quotes

Comparing car insurance quotes is crucial to finding the best deal. To effectively compare quotes, you need to consider factors such as:

- Your driving history: This includes your driving record, accidents, and violations. Insurers assess your risk based on your driving history, which directly impacts your premium.

- Your vehicle: The make, model, and year of your vehicle play a significant role in determining your insurance premium. Newer, more expensive cars generally have higher premiums due to their value and potential repair costs.

- Your coverage needs: The type and amount of coverage you require will influence your premium. For example, comprehensive and collision coverage are typically more expensive than liability coverage.

- Your location: Your zip code and the overall risk in your area can affect your premium. Areas with higher crime rates or more traffic accidents tend to have higher insurance rates.

- Your age and gender: Younger drivers, particularly males, often have higher premiums due to their statistically higher risk of accidents. Older drivers, on the other hand, may benefit from lower premiums as they are generally considered to be more experienced drivers.

Once you have gathered information about your driving history, vehicle, and coverage needs, you can start comparing quotes from different insurers. You can use online comparison websites or contact insurers directly.

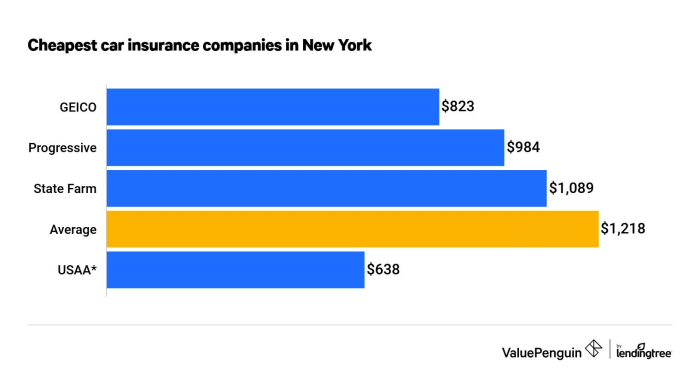

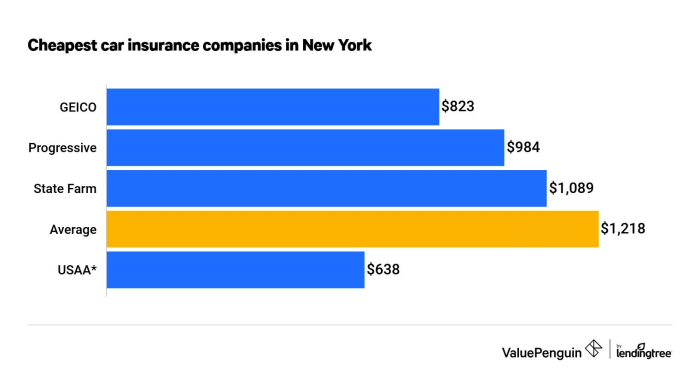

Popular Car Insurance Companies in New York

| Company | Key Features | Pricing |

|---|---|---|

| Geico | Known for its competitive rates and comprehensive coverage options. | Generally offers lower premiums compared to some competitors. |

| State Farm | Offers a wide range of coverage options, including discounts for good drivers and safe driving practices. | Premiums vary depending on individual factors, but are generally competitive. |

| Progressive | Offers a variety of discounts, including for bundling insurance policies and safe driving practices. | Prices are generally competitive, with options for customization based on individual needs. |

| Allstate | Known for its strong customer service and a variety of discounts. | Premiums tend to be higher compared to some competitors. |

| Liberty Mutual | Offers a variety of coverage options and discounts, including for good drivers and multiple policies. | Prices are generally competitive, with options for customization based on individual needs. |

Benefits and Drawbacks of Different Car Insurance Policies

Understanding the benefits and drawbacks of different car insurance policies is essential for making informed decisions.

- Liability Coverage: This is the minimum required coverage in New York. It covers damages to other people’s property or injuries sustained by others in an accident caused by you.

- Benefits: This coverage is essential for protecting yourself financially in case you are at fault in an accident.

- Drawbacks: It does not cover damages to your own vehicle.

- Collision Coverage: This coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault.

- Benefits: Provides financial protection for repairs or replacement of your vehicle in case of an accident.

- Drawbacks: Can be expensive, especially for newer or more expensive vehicles. You may have to pay a deductible before your insurer covers the rest.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by events other than a collision, such as theft, vandalism, or natural disasters.

- Benefits: Provides protection against a wide range of risks that can damage your vehicle.

- Drawbacks: Can be expensive, especially if you live in an area with high risk of theft or vandalism.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Benefits: Provides financial protection in case you are injured by an uninsured or underinsured driver.

- Drawbacks: It is not mandatory in New York, but it is highly recommended.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related expenses for you and your passengers in case of an accident, regardless of fault.

- Benefits: Provides financial protection for medical expenses and lost wages following an accident.

- Drawbacks: It is mandatory in New York, but you can choose to opt out of certain benefits, such as lost wages.

Driving Safely in New York

Driving safely in New York is crucial for protecting yourself and others on the road. Understanding the state’s traffic laws, recognizing common accident causes, and seeking driver education opportunities can significantly enhance your driving skills and reduce the risk of accidents.

Traffic Laws and Regulations in New York

New York has a comprehensive set of traffic laws and regulations designed to ensure safe and efficient road use. Here are some key aspects:

- Speed Limits: Speed limits vary depending on the type of road and location. It’s essential to adhere to posted speed limits and adjust your speed based on road conditions, traffic, and weather.

- Right of Way: New York follows the “right of way” rules, where drivers approaching an intersection must yield to traffic already in the intersection or turning left. Pedestrians have the right of way at crosswalks, and drivers must stop for pedestrians crossing the street.

- Seat Belts: All drivers and passengers must wear seat belts, regardless of their age or seating position. Children under the age of 16 must be properly restrained in a car seat or booster seat, depending on their age and weight.

- Driving Under the Influence (DUI): New York has strict laws against driving under the influence of alcohol or drugs. A blood alcohol content (BAC) of 0.08% or higher is considered legally intoxicated. Driving under the influence can result in severe penalties, including fines, license suspension, and even jail time.

- Cell Phone Use: It is illegal to use a handheld cell phone while driving in New York. Drivers are allowed to use hands-free devices, but it’s always best to avoid distractions while driving.

- Parking Regulations: Parking regulations in New York can be complex and vary depending on the location. It’s important to be aware of signs and regulations regarding parking times, zones, and restrictions.

Common Causes of Car Accidents in New York

Understanding the most frequent causes of car accidents in New York can help drivers take proactive steps to prevent them.

- Distracted Driving: Distracted driving, including texting, talking on the phone, eating, or adjusting the radio, is a leading cause of accidents. Focusing on the road and avoiding distractions is crucial for safe driving.

- Speeding: Speeding reduces reaction time and increases the severity of crashes. Adhering to speed limits and adjusting speed for road conditions can significantly reduce the risk of accidents.

- Driving Under the Influence (DUI): Driving under the influence of alcohol or drugs impairs judgment, reaction time, and coordination, significantly increasing the risk of accidents.

- Aggressive Driving: Aggressive driving behaviors, such as tailgating, speeding, and cutting off other drivers, contribute to a higher risk of accidents. Maintaining a calm and defensive driving approach is essential.

- Drowsy Driving: Drowsy driving can be as dangerous as driving under the influence. If you’re feeling tired, pull over to a safe location and rest before continuing your journey.

- Adverse Weather Conditions: Rain, snow, and ice can significantly reduce road visibility and traction, increasing the risk of accidents. Adjusting your driving speed and using caution in adverse weather conditions is crucial.

Driver Education and Training Resources in New York

New York offers various driver education and training resources to enhance driving skills and promote safe driving practices.

- New York State Department of Motor Vehicles (DMV): The DMV provides driver education courses, including defensive driving courses, to help drivers improve their skills and knowledge.

- Local Driving Schools: Many private driving schools offer driver education programs, including behind-the-wheel training, for both new and experienced drivers.

- Automobile Clubs: Automobile clubs like AAA often offer driver training courses and safety tips for members.

- Online Resources: Several online resources provide driver education materials, including videos, quizzes, and interactive simulations, to enhance driving knowledge and skills.

Car Insurance Claims in New York

Filing a car insurance claim in New York can be a stressful experience, but understanding the process can make it smoother. This section will guide you through the steps involved, explain different claim types, and provide tips for maximizing your chances of a successful claim.

Filing a Car Insurance Claim

When you’re involved in an accident, it’s crucial to act quickly and follow the correct procedures to ensure your claim is processed smoothly.

- Report the Accident: Contact your insurance company immediately to report the accident. Provide them with all the necessary details, including the date, time, location, and any injuries involved.

- Gather Information: Collect information from all parties involved, including names, contact details, insurance information, and license plate numbers. Take pictures of the damage to your vehicle and the accident scene.

- File a Claim: Complete and submit a claim form to your insurance company, providing all the required information and supporting documentation.

- Cooperate with Your Insurer: Be prepared to provide additional information or documentation as requested by your insurance company. Respond to any inquiries promptly and be truthful and transparent.

- Seek Medical Attention: If you’ve sustained injuries, seek medical attention immediately and keep a record of all medical expenses.

Types of Car Insurance Claims

Car insurance claims in New York can be categorized into different types, each with its own specific process and requirements.

- Collision Claims: These claims cover damage to your vehicle resulting from a collision with another vehicle or object.

- Comprehensive Claims: These claims cover damage to your vehicle caused by events other than a collision, such as theft, vandalism, fire, or natural disasters.

- Liability Claims: These claims are filed against the other driver’s insurance company if they are at fault for the accident. They cover damages and injuries to you and your passengers.

- Uninsured/Underinsured Motorist Claims: These claims are filed when the other driver is uninsured or underinsured and cannot cover the full extent of your damages and injuries.

Tips for Maximizing Claim Success

To increase your chances of a successful car insurance claim, consider these tips:

- Document Everything: Keep detailed records of all communication with your insurance company, including dates, times, and the content of any conversations or correspondence.

- Be Honest and Transparent: Provide accurate and complete information to your insurance company. Avoid exaggerating or fabricating details, as this could jeopardize your claim.

- Seek Professional Help: If you’re dealing with a complex claim or have questions about your rights, consult with an experienced car accident attorney.

- Follow Your Insurance Company’s Guidelines: Familiarize yourself with your insurance policy and follow all the procedures and deadlines Artikeld by your insurance company.

Additional Considerations: Car Insurance In New York

In addition to the fundamental aspects of car insurance in New York, there are several crucial considerations that can significantly impact your driving experience and financial well-being. Understanding these aspects can help you make informed decisions and navigate the complexities of car insurance in the state.

Driving Without Car Insurance in New York

Driving without car insurance in New York is strictly prohibited and carries severe consequences. The state mandates that all vehicle owners and drivers maintain at least the minimum required liability insurance coverage. This requirement is enforced through a combination of legal penalties and administrative actions.

- Fines and Penalties: Driving without insurance can result in substantial fines, ranging from hundreds to thousands of dollars. These penalties can be imposed by law enforcement officers during traffic stops or through administrative processes by the DMV.

- License Suspension: The DMV can suspend your driver’s license for failing to maintain insurance. This suspension can prevent you from legally operating a vehicle in New York.

- Vehicle Impoundment: Your vehicle may be impounded if it is found to be uninsured. You will be responsible for the cost of retrieving your vehicle from the impound lot, which can add to your financial burden.

- Financial Liability: If you are involved in an accident without insurance, you will be personally responsible for all damages and injuries caused, potentially leading to significant financial losses.

The Role of the New York State Department of Motor Vehicles (DMV), Car insurance in new york

The New York State Department of Motor Vehicles (DMV) plays a crucial role in regulating and enforcing car insurance requirements. The DMV is responsible for:

- Issuing Driver’s Licenses: The DMV ensures that all licensed drivers in New York meet the minimum insurance requirements before issuing or renewing their licenses.

- Maintaining Insurance Records: The DMV maintains a database of insurance information for all registered vehicles in the state. This database helps enforce insurance requirements and track insurance coverage.

- Investigating Insurance Violations: The DMV investigates reports of drivers operating vehicles without insurance and takes appropriate action, such as issuing fines, suspending licenses, or impounding vehicles.

- Providing Information and Resources: The DMV provides information and resources to drivers regarding insurance requirements, available coverage options, and dispute resolution processes.

Resolving Car Insurance Disputes in New York

Disputes regarding car insurance coverage or claims can arise, requiring effective methods for resolution. New York provides various avenues for addressing such disputes:

- Direct Negotiation: The first step in resolving a dispute is typically direct communication with your insurance company. Attempt to negotiate a fair settlement through phone calls, emails, or written correspondence.

- Mediation: If direct negotiations fail, consider seeking mediation through a neutral third party. A mediator can facilitate communication between you and your insurance company, helping to reach a mutually agreeable solution.

- Small Claims Court: For smaller disputes, filing a claim in small claims court can be an option. This process allows you to present your case to a judge who can make a binding decision.

- New York State Department of Financial Services (DFS): The DFS is the state agency responsible for regulating insurance companies. You can file a complaint with the DFS if you believe your insurance company is not acting in good faith or is violating state laws.

- Legal Representation: For complex disputes or situations involving significant financial losses, seeking legal representation from an experienced car insurance attorney can be beneficial.

Navigating the world of car insurance in New York can seem daunting, but with the right information and resources, it becomes manageable. By understanding the state’s requirements, comparing quotes, and driving safely, you can secure the protection you need while keeping your premiums in check. Remember, car insurance is not just a legal obligation; it’s a crucial investment in your safety and financial well-being.

FAQ Summary

What are the penalties for driving without car insurance in New York?

Driving without the required minimum car insurance in New York can result in fines, license suspension, and even vehicle impoundment.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever you experience a significant life change, such as a new vehicle, address change, or change in driving habits.

What are some tips for getting the best car insurance rates in New York?

To get the best rates, compare quotes from multiple insurers, maintain a good driving record, consider increasing your deductible, and explore discounts offered for safety features, bundling policies, or being a good student.

What are some common car insurance scams to be aware of?

Be wary of scams involving fake insurance companies, fraudulent claims, and unsolicited offers for “free” insurance. Always verify the legitimacy of any insurance provider and be cautious about sharing personal information.