How To Protect Yourself From High Deductibles In Car And Health Insurance/how To Protect Yourself From High Deductibles In Car And Health Insurance

How To Protect Yourself From High Deductibles In Car And Health Insurance

In today’s fast-paced, sometimes unpredictable world, the importance of insurance cannot be overstated. Whether it’s safeguarding your health or protecting your vehicle, having a robust insurance policy in place provides much-needed peace of mind. However, as with most things in life, the devil is often in the details. In recent years, one of the most significant pain points for policyholders has become the staggering rise in insurance deductibles. High deductibles can impose a substantial financial burden, transforming an unfortunate accident or health event from a mere inconvenience into a daunting financial obstacle.

But what exactly are deductibles, and how do they affect your policies? In essence, a deductible is the amount you, the insured, agree to pay out of pocket before your insurance provider kicks in to cover the remaining costs. While high deductibles might initially appear to reduce your monthly premium payments, they can result in unexpectedly high expenses during a claim. This paradox leaves many policyholders grappling with the question: how can one effectively cushion themselves from the potentially crippling impact of high deductibles?

This post aims to unravel the complexities surrounding high deductibles in car and health insurance. It offers practical strategies and methods to protect yourself from these financial burdens while maintaining adequate coverage. As we delve deeper, we’ll explore several crucial aspects and shed light on options that could be beneficial for you when choosing policies and planning for future contingencies.

Firstly, understanding your policy’s fine print is essential. It’s crucial to know what you’re getting into before signing any contract. We’ll go through steps to help you scrutinize policy documents, decode insurance jargon, and comprehend where your money and responsibilities truly lie.

Following this, the idea of a Health Savings Account (HSA) or other similar financial buffers will be examined. HSAs can provide a tax-advantaged way to save for medical expenses, offering a safety net for high-deductible health plans. Could such an account make sense for your financial strategy? We’ll investigate how these accounts work and when they might be advantageous.

Moreover, there are alternative insurance options that might align better with your needs. We’ll explore differing choices like supplemental insurance plans, which can sometimes fill the gaps left by high deductibles, and discuss the potential benefits and drawbacks of each.

For car insurance, we’ll discuss gap insurance, along with coverage add-ons that can mitigate the cost implications of high deductible plans. Certain riders or additional protections might be just what you need to feel secure without breaking the bank.

By the end of this guide, you’ll be equipped with a toolkit of knowledge and strategies that can help you navigate the often overwhelming world of insurance deductibles. Through practical advice and straightforward explanations, our goal is to empower you with the confidence and understanding necessary to make informed decisions. Are you ready to discover how to protect yourself from high deductibles in both car and health insurance?

Let’s delve into these topics with actionable insights and pertinent information, so you can refine your insurance strategy to best suit your lifestyle and ensure you’re prepared for whatever life throws your way.

Understanding Insurance Deductibles

Before exploring the ways to reduce the impact of high deductibles, it is crucial to understand what an insurance deductible is. Both car and health insurance policies typically involve a deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible usually means lower monthly premiums, making such plans attractive at first glance. However, unexpected expenses can quickly add up, draining your finances.

Strategies to Minimize the Impact of High Deductibles

Fortunately, there are several strategies that can help you manage and mitigate the financial burden of high insurance deductibles, both for car and health insurance. Implementing these approaches can better prepare you for unforeseen expenses and maintain financial peace of mind.

1. Build an Emergency Fund

An emergency fund acts as a financial cushion, allowing you to cover the deductible without affecting your day-to-day living expenses. Aim to save at least the amount of your highest deductible. For instance, if your car insurance deductible is $1,200, ensure your emergency fund covers this amount. Take a systematic approach to build your fund by setting aside a small percentage of your income every month. Over time, this small amount can grow significantly, offering peace of mind when the unexpected occurs.

2. Review and Adjust Your Coverage

Analyze your current insurance policies to ensure they align with your needs. If your situation changesâfor instance, if you start driving less frequentlyâyou might be eligible for a policy rebate or a lower premium. Assess your risk factors realistically and talk to your insurance provider about the best coverage options for your situation, ensuring a balance between reasonable deductibles and affordable premiums.

3. Leverage Health Savings Accounts (HSAs)

For health insurance, Health Savings Accounts (HSAs) offer significant advantages. HSAs allow you to save money pre-tax for medical expenses, including deductibles. This can lead to substantial savings over time, as contributions to an HSA can accumulate without taxation, and withdrawals for qualified medical expenses are tax-free. Check if you are eligible for an HSA, especially if you have a high-deductible health plan, and maximize your contribution to make the most out of this benefit.

4. Increase Your Knowledge of Available Discounts

Insurance providers often offer various discounts that can reduce overall costs and help manage deductibles. For car insurance, these could include safe driver discounts, bundling discounts (if you have multiple types of insurance from the same provider), and loyalty discounts. Health insurance might offer wellness incentives that not only reduce premiums but encourage healthier lifestyle choices. Contact your insurer regularly to ensure you are taking advantage of all applicable discounts and programs.

5. Implement Preventive Measures

Engage in activities that reduce risk and, consequently, the likelihood of needing to pay your deductible. For car insurance, participate in a defensive driving course to lower insurance costs and improve your driving skills. Regular vehicle maintenance can prevent costly breakdowns, thereby minimizing out-of-pocket expenses. For health insurance, maintain a healthy lifestyle, including regular check-ups, a balanced diet, and exercise, which can reduce medical emergencies and aid in negotiating lower premiums.

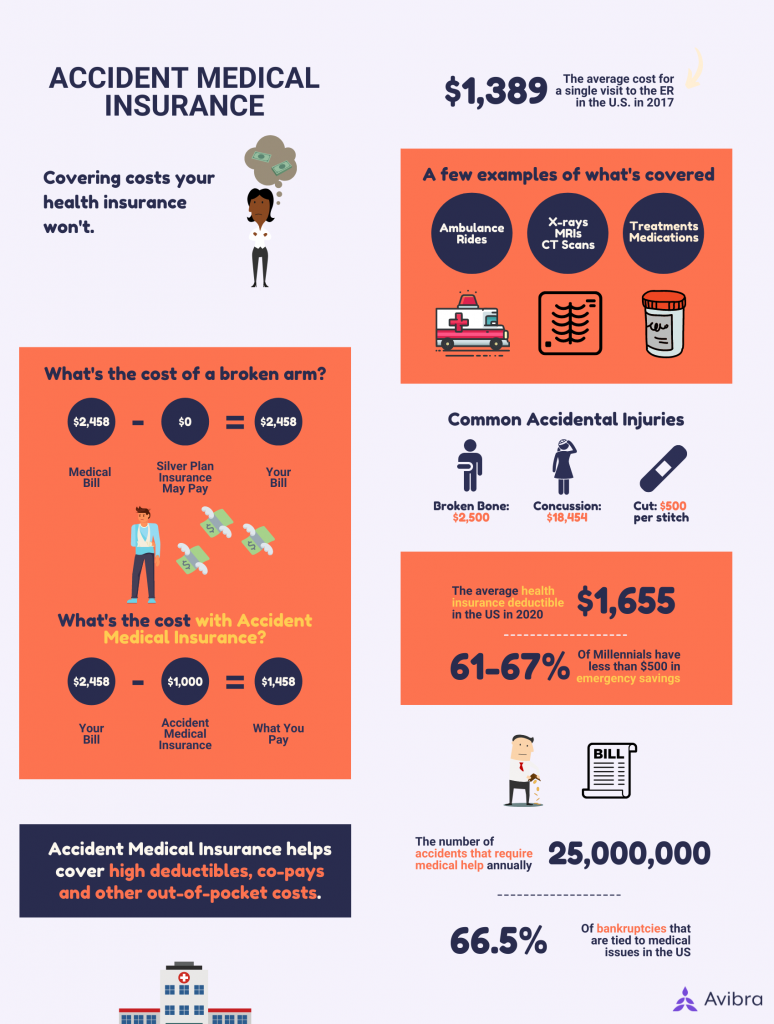

6. Consider Supplemental Insurance

Supplemental insurance can cover gaps left by your primary insurance, including helping with high deductibles. Options such as accident insurance, critical illness insurance, or specific automobile insurance enhancements can reimburse you for out-of-pocket expenses effectively. While an additional monthly premium is required, the benefits can outweigh the costs when you find yourself amid a costly claim or medical emergency.

Periodic Review and Adjustment

Insurance needs are not static, and your strategy for handling deductibles should evolve accordingly. Life events such as marriage, having children, or changes in employment can alter your financial landscape and insurance requirements. Schedule regular reviews of your policies, and consult with your insurance advisor or broker to make necessary adjustments. This proactive approach ensures that you always have the most suitable and cost-effective insurance coverage.

Employing Professional Advice

Finally, consider enlisting the help of a financial advisor or an insurance broker. These professionals can provide insights into which insurance products may best suit your needs and help compile a strategy that mitigates the financial burdens of high deductibles. They carry industry experience that can greatly assist in navigating through complex policy details and identifying potential savings or protection mechanisms.

Practical Approaches for Managing High Insurance Deductibles

As we reach the end of our discussion on how to protect yourself from high deductibles in car and health insurance, it’s vital to reflect on the comprehensive strategies and preventive measures we’ve explored. At the heart of our exploration were insights aimed at empowering you to take control of your financial liabilities while maintaining essential coverage.

Understanding Your Policy: We revealed the significance of thoroughly analyzing your insurance policies. Knowledge is power, and by understanding the nuances of your plan, particularly what your deductible entails, you have the leverage to effectively manage and anticipate expenses. Rest assured, familiarity with policy specifics provides the foundation for informed decision-making and plan optimization.

Exploring Policy Options: Customization was a key theme, encouraging you to assess various policy options. By considering plans with lower deductibles, albeit at potentially higher premiums, you ensure that the financial impact of an unexpected event doesn’t derail your economic stability. Evaluating options aligns with a proactive mindset that prioritizes long-term stability.

Setting Up a Deductible Fund: A practical measure we discussed was the establishment of a deductible fund. By setting aside a portion of your income regularly, you can cultivate a safety net that makes meeting high deductibles feasible, minimizing stress during emergencies. This approach emulates a disciplined financial strategy that mitigates risks effectively.

Embracing Preventive Measures: Particularly in health insurance, taking preventive steps can drastically reduce the likelihood of incurring high expenses. Regular check-ups, maintaining a healthy lifestyle, and utilizing preventive care benefits are key strategies. Similarly, safe driving habits reduce the occurrences of auto claims, directly impacting your deductible obligations.

Leveraging Health Savings Accounts (HSAs): For those with high-deductible health plans, leveraging a Health Savings Account is invaluable. These tax-advantaged accounts offer a dual benefit: growing your savings while preparing for potential health-related costs. This strategic tool stands as a testament to the synergy between financial planning and health security.

Evaluating Alternatives: Sometimes, alternatives like telemedicine for healthcare or usage-based insurance for automobiles can provide flexibility and cost-effectiveness, reducing the direct burden of high deductibles. These alternatives exemplify the need for innovative thinking in today’s dynamic insurance landscape.

Our journey has been one of empowerment — equipping you with the knowledge and strategies necessary to navigate the sometimes daunting world of high deductibles. What remains essential is your commitment to applying these insights consistently and adjusting as your individual circumstances evolve.

Call to Action

Empowered with these strategies, it’s time to take deliberate actions toward securing your financial future against the uncertainties of high deductibles. Begin by reviewing your current policies, scheduling consultations with financial advisors if necessary, and initiating steps to set up your dedicated funds.

Furthermore, engage with the broader community on these topics. Discussing experiences and sharing strategies on platforms like social media or insurance forums can provide additional insights and foster a supportive environment. Learning from others’ experiences can unveil novel strategies and enhance your approach.

Be proactive, not reactive. Initiate conversations with your insurance provider, explore available resources, and continuously educate yourself about industry trends and changes. By taking these steps, you not only safeguard yourself from high deductibles but also command greater control over your financial landscape.

Every action you take is a step towards greater peace of mind and financial security. Begin today to embrace these strategies and make informed decisions that will fortify your resilience against high deductibles in both car and health insurance scenarios. Your future self will thank you for the foresight and planning invested today.

We invite you to subscribe to our blog for more insights and updates on navigating insurance challenges. Stay informed, stay empowered, and be ready to face the unexpected with confidence and strategic preparedness.