HELOC for Investment Property A Smart Financing Option?

HELOC for investment property, a financing strategy gaining popularity, offers a unique approach to funding real estate ventures. It allows homeowners to leverage the equity in their primary residence to secure a line of credit, providing access to funds for purchasing, renovating, or refinancing investment properties. This approach can be a powerful tool for investors seeking to expand their portfolios or enhance existing properties, but it’s essential to understand the intricacies and potential implications before diving in.

This guide delves into the world of HELOCs for investment property, exploring its advantages, disadvantages, and suitability for various investment scenarios. We’ll examine the key considerations, compare it to traditional financing options, and provide insights into its practical applications. By understanding the nuances of this financing approach, investors can make informed decisions about whether a HELOC aligns with their financial goals and risk tolerance.

HELOC Basics: Heloc For Investment Property

A Home Equity Line of Credit (HELOC) is a type of revolving credit line secured by your home’s equity. It allows you to borrow money against the value of your home, similar to a credit card, but with a lower interest rate.

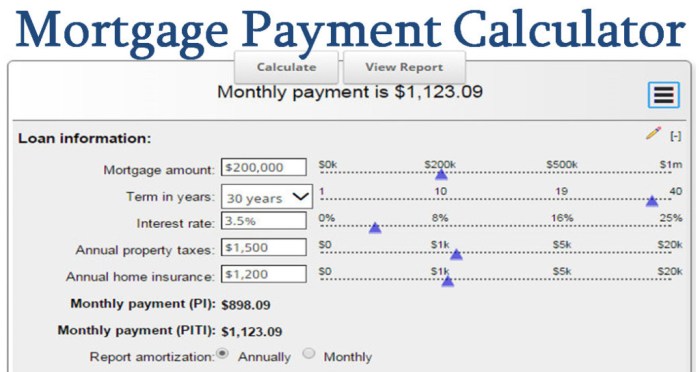

A HELOC works by establishing a credit limit based on your home’s equity. You can draw funds from this line of credit as needed, up to your credit limit, during a specified draw period. This period typically lasts for 10-15 years. Once the draw period ends, you enter a repayment period, where you must repay the outstanding balance, typically over a fixed period of 10-20 years.

Key Features of a HELOC

HELOCs have several key features that distinguish them from other types of loans:

- Variable Interest Rates: HELOCs typically have variable interest rates, meaning the interest rate can fluctuate based on market conditions. This can make it difficult to budget for monthly payments, as your rate could increase unexpectedly.

- Draw Period: This is the period during which you can borrow money from your HELOC. It usually lasts for 10-15 years.

- Repayment Period: After the draw period ends, you enter a repayment period, where you must repay the outstanding balance. This period typically lasts for 10-20 years.

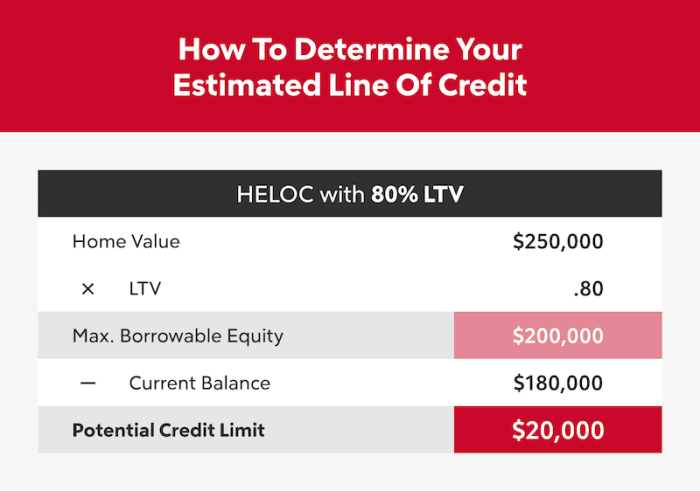

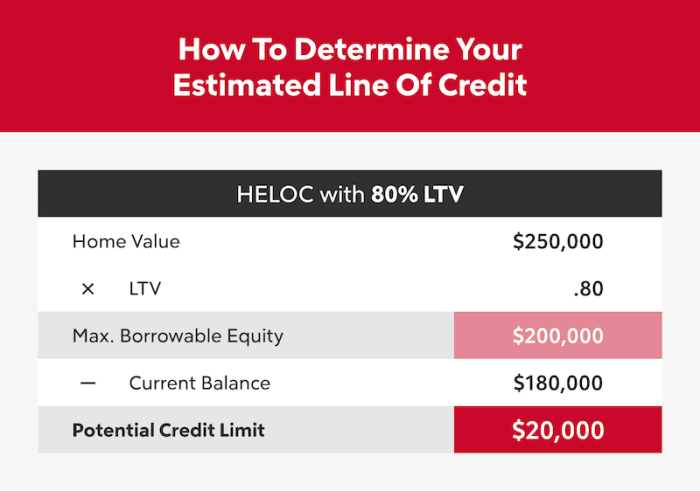

- Credit Limit: The amount of money you can borrow is determined by your home’s equity and your creditworthiness. It is typically 80% of your home’s value, minus any outstanding mortgages.

- Minimum Payments: You are only required to make minimum payments during the draw period, which can be significantly lower than a traditional mortgage payment.

Advantages of Using a HELOC for Investment Property Financing

HELOCs can be a useful tool for financing investment properties, offering several advantages:

- Lower Interest Rates: Compared to other types of loans, such as personal loans or credit cards, HELOCs often have lower interest rates. This can save you money on interest payments over time.

- Flexibility: HELOCs offer flexibility, allowing you to draw funds as needed during the draw period. This can be helpful for covering unexpected expenses or funding renovations.

- Tax Deductibility: Interest paid on a HELOC used for investment property may be tax-deductible, depending on your individual circumstances and tax laws.

Disadvantages of Using a HELOC for Investment Property Financing

While HELOCs offer certain advantages, they also come with some potential drawbacks:

- Variable Interest Rates: As mentioned earlier, HELOCs typically have variable interest rates, which can fluctuate based on market conditions. This can make it difficult to budget for monthly payments, as your rate could increase unexpectedly.

- Risk of Foreclosure: If you fail to make your payments, your investment property could be foreclosed on. This is a significant risk to consider, especially if you are relying on rental income to cover your payments.

- Limited Access to Funds: Your credit limit is based on your home’s equity, which can limit your access to funds. If your property value declines, your credit limit may be reduced.

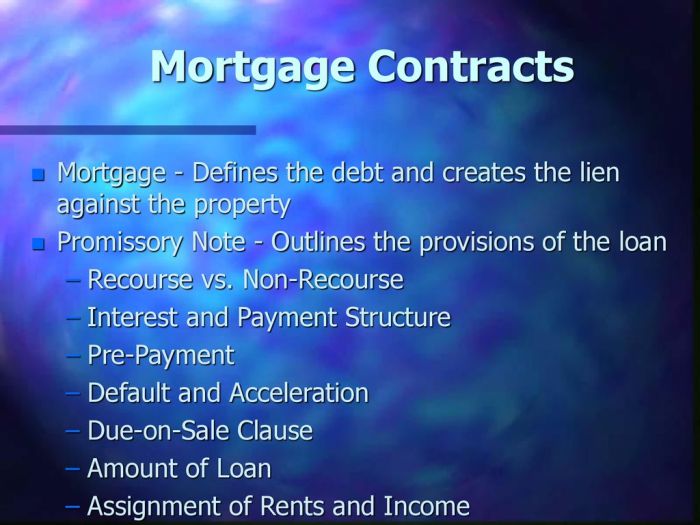

Common HELOC Terms and Conditions, Heloc for investment property

Here are some common HELOC terms and conditions you should be aware of:

- Interest Rate: The interest rate on a HELOC is typically variable and is based on a benchmark rate, such as the prime rate, plus a margin. The margin is the lender’s profit.

- Draw Period: This is the period during which you can borrow money from your HELOC. It usually lasts for 10-15 years.

- Repayment Period: After the draw period ends, you enter a repayment period, where you must repay the outstanding balance. This period typically lasts for 10-20 years.

- Closing Costs: Like most loans, HELOCs come with closing costs, which can include fees for appraisal, title insurance, and legal services.

- Annual Percentage Rate (APR): The APR is the total cost of borrowing, including the interest rate and any fees. It is expressed as a percentage.

“It is important to carefully consider all the terms and conditions of a HELOC before you apply, as they can vary significantly from lender to lender.”

Investment Property Considerations

When considering a HELOC for an investment property, it’s crucial to weigh the potential benefits against the risks and evaluate the tax implications. A HELOC can be a valuable tool for financing investment properties, but it’s essential to understand the factors involved to make an informed decision.

Potential Risks and Rewards

Using a HELOC for investment property financing comes with both potential risks and rewards. It’s essential to carefully assess these factors before making a decision.

- Potential Rewards:

- Increased Cash Flow: A HELOC can provide additional funds to purchase or improve an investment property, potentially increasing rental income or property value.

- Tax Advantages: Interest paid on a HELOC used for investment property may be deductible, potentially lowering your tax liability.

- Flexibility: A HELOC offers a revolving line of credit, providing flexibility to access funds as needed for repairs, renovations, or other expenses.

- Potential Risks:

- Variable Interest Rates: HELOCs typically have variable interest rates, which can fluctuate over time, potentially increasing your monthly payments.

- Debt Burden: Taking on additional debt can increase your financial obligations and may impact your ability to manage other expenses.

- Property Value Fluctuations: If the value of your investment property decreases, you may find yourself underwater on your loan, owing more than the property is worth.

- Interest Rate Risk: If interest rates rise significantly, your monthly payments could increase, potentially impacting your cash flow.

Tax Implications

Understanding the tax implications of using a HELOC for investment property is crucial.

- Deductible Interest: Interest paid on a HELOC used for investment property may be deductible as an expense on your tax return. This can potentially reduce your tax liability.

- Depreciation: You may be able to deduct depreciation on your investment property, which can further reduce your taxable income. However, depreciation is a non-cash expense, meaning it doesn’t directly reduce your tax liability but can offset other income.

- Capital Gains Tax: When you sell an investment property, you may be subject to capital gains tax on any profit realized. The amount of capital gains tax you owe will depend on your holding period and the applicable tax rates.

HELOC vs. Traditional Loans

Choosing the right financing option for your investment property is crucial. While a HELOC and a traditional loan both offer access to funds, they have distinct features and suitability for different investment scenarios.

Interest Rates and Flexibility

Interest rates and flexibility are key factors when comparing HELOCs and traditional loans.

- HELOCs typically have variable interest rates that fluctuate based on market conditions. This means your monthly payments can change over time, potentially increasing your costs. However, HELOCs often offer lower initial interest rates compared to traditional loans.

- Traditional loans generally have fixed interest rates, providing predictable monthly payments for the duration of the loan term. This offers stability and budgeting certainty, but the initial interest rate may be higher than a HELOC.

HELOCs provide more flexibility in terms of drawing funds, allowing you to borrow only what you need, when you need it. This can be advantageous for projects with uncertain costs or when you require funds for multiple investments. Traditional loans, on the other hand, offer a fixed amount of financing with a predetermined repayment schedule.

Repayment Terms

HELOCs and traditional loans have different repayment terms, impacting your overall financing costs.

- HELOCs typically have a draw period, during which you can access the available funds, followed by a repayment period. During the draw period, you only pay interest on the amount you’ve borrowed. Once the draw period ends, you enter the repayment period, where you make regular payments that include both principal and interest. The repayment period can be as long as 30 years, providing a longer-term solution for financing your investment property.

- Traditional loans have a fixed repayment schedule from the start, with monthly payments that cover both principal and interest. The repayment period can range from 15 to 30 years, depending on the loan terms.

Scenarios for Choosing a HELOC or Traditional Loan

- HELOC: A HELOC can be a good choice for investors who need flexible access to funds, anticipate fluctuating project costs, or plan to make significant improvements to their investment property. It can also be suitable for short-term financing needs, as the initial interest rate may be lower than a traditional loan.

- Traditional Loan: A traditional loan is a better option for investors who prefer predictable monthly payments, require a fixed amount of financing, or plan to hold their investment property for a longer term. It offers stability and budgeting certainty, making it ideal for long-term investment strategies.

HELOC Applications

A HELOC can be a versatile financial tool for investment property owners, offering flexibility and potential for growth. It allows you to access a line of credit secured by your property, providing funds for various investment property needs.

Purchasing an Investment Property

A HELOC can be used to finance the purchase of an investment property, especially if you lack the necessary funds for a traditional mortgage. It can act as a bridge loan, allowing you to buy a property while you wait for a more permanent financing solution.

Renovating an Investment Property

Renovations can significantly increase the value of an investment property, attracting tenants and commanding higher rental rates. A HELOC can provide the necessary funds for upgrades like kitchen and bathroom remodeling, flooring, painting, or landscaping.

Refinancing an Investment Property

HELOCs can be used to refinance an existing investment property loan, potentially securing a lower interest rate or consolidating multiple loans into one. This can help reduce monthly payments and free up cash flow for other investments.

Hypothetical Scenario: Financing a Rental Property Purchase

Imagine you have a primary residence with significant equity. You’ve been considering purchasing a rental property but lack the necessary funds for a down payment. A HELOC can be a viable option.

You can use the equity in your primary residence to secure a HELOC with a credit limit of $100,000. You use this line of credit to cover the down payment and closing costs for a $200,000 rental property. The rental income from the property can then be used to make the HELOC payments, offsetting the interest expense.

Strategies for Maximizing Returns

Using a HELOC to Acquire Multiple Properties

A HELOC can be used to acquire multiple investment properties, leveraging the equity from one property to finance the purchase of another. This strategy can help you build a diversified portfolio and increase your overall rental income.

Using a HELOC for Property Improvements

A HELOC can be used to finance property improvements that increase the value of your investment property. By strategically investing in upgrades, you can attract higher-paying tenants and command higher rental rates.

Using a HELOC for Short-Term Investments

HELOCs can be used for short-term investments, such as purchasing a fixer-upper property, renovating it, and then selling it for a profit. This strategy can generate quick returns on your investment.

HELOC Qualification and Approval

Securing a HELOC for an investment property involves a rigorous qualification process, ensuring borrowers meet specific financial criteria. Lenders assess your financial health and the property’s value to determine your eligibility.

HELOC Qualification Requirements

Lenders evaluate several factors to determine your eligibility for a HELOC. These requirements are typically more stringent for investment properties compared to primary residences. Here’s a breakdown of the key criteria:

- Credit Score: A strong credit score is crucial. Lenders typically require a minimum credit score of 620 to 680 for investment property HELOCs, but scores above 700 are often preferred. This score reflects your ability to manage debt responsibly.

- Debt-to-Income Ratio (DTI): Your DTI represents the percentage of your monthly income dedicated to debt payments. Lenders usually prefer a DTI below 43% for investment property HELOCs, indicating your ability to handle additional debt.

- Loan-to-Value (LTV) Ratio: This ratio compares the loan amount to the property’s appraised value. Lenders typically set maximum LTV ratios for investment property HELOCs, often around 75% to 80%. This means you can borrow up to 75% to 80% of the property’s appraised value.

- Income Verification: Lenders verify your income to ensure you can afford the monthly payments. You may be required to provide recent pay stubs, tax returns, or bank statements.

- Property Appraisal: An appraisal is essential to determine the current market value of the investment property. This appraisal ensures the property is worth enough to secure the loan and serves as collateral.

- Rental History: If you’re using the property as a rental, lenders may require proof of consistent rental income and a good tenant history. This demonstrates the property’s ability to generate income and cover the loan payments.

HELOC Application Process

The application process for a HELOC typically involves the following steps:

- Pre-Qualification: You can get pre-qualified online or by contacting a lender to get an estimate of your potential borrowing power. This pre-qualification process is usually informal and doesn’t require a credit check.

- Formal Application: Once you decide to proceed, you’ll need to submit a formal application with detailed financial information, including your income, assets, debts, and credit history.

- Credit Check: Lenders will pull your credit report to verify your credit score and history.

- Income Verification: You’ll need to provide documentation to verify your income, such as pay stubs, tax returns, or bank statements.

- Property Appraisal: A licensed appraiser will assess the property’s current market value.

- Loan Approval: Based on your financial information and the property’s appraisal, the lender will decide whether to approve your HELOC application.

- Loan Closing: If approved, you’ll sign the loan documents and finalize the terms of your HELOC.

Tips for Improving HELOC Approval Chances

Improving your financial profile can significantly increase your chances of getting approved for a HELOC. Here are some tips:

- Build a Strong Credit Score: Pay your bills on time, keep your credit utilization low, and avoid opening too many new credit accounts. Aim for a credit score above 700 for the best possible rates and terms.

- Lower Your Debt-to-Income Ratio: Reduce your existing debt by paying down credit cards, personal loans, or other obligations. This improves your ability to handle additional debt.

- Increase Your Income: Boosting your income can improve your DTI and demonstrate your ability to manage loan payments. Consider seeking a promotion, taking on a side hustle, or negotiating a salary increase.

- Shop Around for Rates: Compare HELOC rates from multiple lenders to find the best terms. Don’t settle for the first offer you receive.

In conclusion, HELOCs for investment property can be a valuable tool for savvy investors seeking to leverage existing equity for strategic real estate ventures. However, it’s crucial to carefully weigh the potential benefits against the inherent risks and understand the complexities involved. By thoroughly researching the terms, conditions, and suitability of a HELOC for their specific investment goals, investors can make informed decisions that align with their financial objectives and risk appetite.

FAQ Insights

What are the typical interest rates for HELOCs for investment property?

Interest rates for HELOCs for investment property are generally higher than those for primary residences. They fluctuate based on market conditions and your creditworthiness. You can find current HELOC rates online or by contacting lenders directly.

Can I use a HELOC to purchase an investment property in a different state?

Yes, you can use a HELOC to purchase an investment property in a different state, but lenders may have specific requirements and restrictions. Be sure to discuss this with your lender during the application process.

What are the tax implications of using a HELOC for investment property?

Interest paid on a HELOC used for investment property may be deductible as an expense, but it’s subject to certain limitations. Consult with a tax advisor to understand the specific rules and implications for your situation.

A HELOC can be a powerful tool for financing an investment property, but it’s crucial to understand the terms and conditions before committing. Working with an experienced investment property buyers agent can help you navigate the process and ensure you’re getting the best possible deal. They can advise on the most suitable financing options, including HELOCs, and guide you through the complexities of investment property ownership.

A HELOC can be a powerful tool for financing an investment property, especially when considering the potential for long-term returns. Investing in multi-family investment properties can offer a steady stream of rental income, which can help offset the cost of the loan. The flexibility of a HELOC can allow you to access funds as needed for renovations, repairs, or even additional acquisitions, giving you the financial agility to capitalize on opportunities in the real estate market.

A HELOC for an investment property can be a powerful tool, but it’s important to research thoroughly before taking the plunge. You’ll want to consider factors like your credit score, the property’s potential rental income, and the current market conditions. For helpful resources on navigating the world of property investment, check out some of the great property investment websites available online.

With careful planning and a solid understanding of the market, a HELOC can be a valuable asset in your investment property portfolio.