Are Fixed Annuities a Good Investment for You?

Are fixed annuities a good investment? This question arises frequently as individuals seek secure and predictable income streams, especially during retirement. Fixed annuities offer a unique blend of guaranteed interest rates and principal protection, making them attractive to risk-averse investors. However, like any investment, fixed annuities come with their own set of advantages and disadvantages that require careful consideration.

This comprehensive guide delves into the intricacies of fixed annuities, examining their core features, comparing them to other investment options, and outlining the factors to consider before making an investment decision. We will explore the potential benefits, risks, and drawbacks of fixed annuities, ultimately helping you determine if they align with your financial goals and risk tolerance.

What are Fixed Annuities?: Are Fixed Annuities A Good Investment

Fixed annuities are insurance contracts that provide a guaranteed stream of income for a specified period. They are a popular option for individuals seeking predictable income and principal protection, especially during retirement.

Fixed annuities offer a guaranteed interest rate for a set period, ensuring that the investment grows at a predictable rate. This feature makes them attractive to risk-averse investors who prioritize stability over potential high returns.

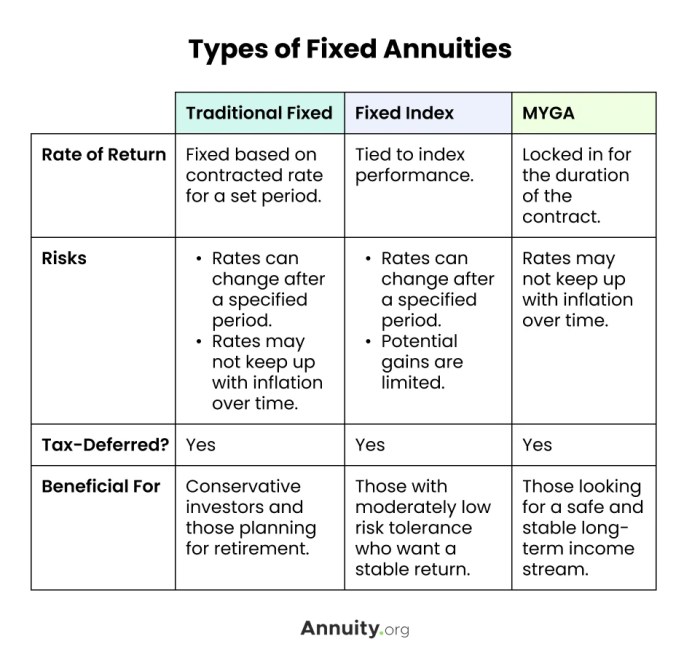

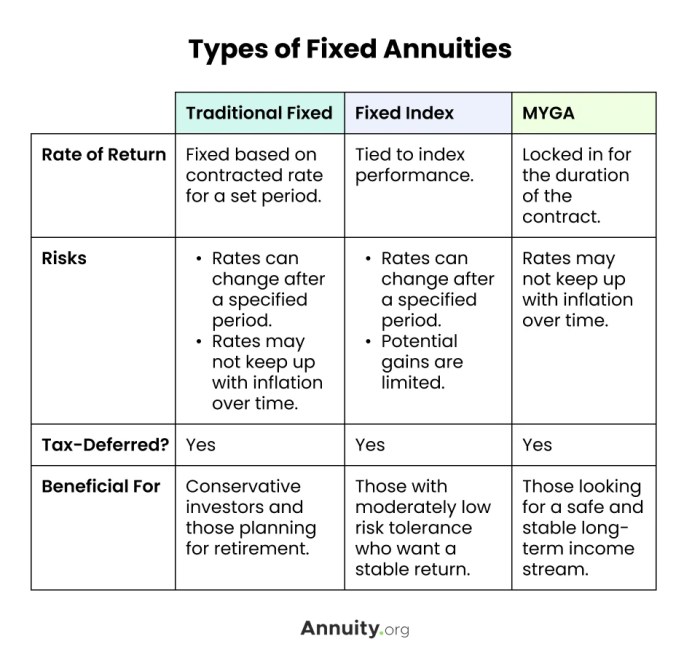

Types of Fixed Annuities

Fixed annuities come in various forms, each with its own set of features and benefits.

- Single Premium Fixed Annuities: These annuities require a lump-sum payment upfront, and the interest earned is credited to the account annually. They are ideal for individuals with a significant sum to invest and who want to lock in a guaranteed return for a specified period.

- Deferred Fixed Annuities: These annuities allow investors to make periodic payments over time. The accumulated value grows at a fixed interest rate, and the payout begins at a later date, typically during retirement. Deferred annuities are suitable for individuals who want to save for retirement gradually.

- Immediate Fixed Annuities: These annuities provide immediate income payments upon purchase. They are suitable for individuals who need a steady stream of income immediately, such as retirees or those who have recently received a lump-sum payment.

Benefits of Fixed Annuities

Fixed annuities offer several benefits, making them an attractive investment option for many individuals.

- Guaranteed Income Stream: Fixed annuities provide a predictable and guaranteed income stream, offering financial security and peace of mind. This feature is particularly valuable for retirees who need a reliable source of income.

- Principal Protection: The principal invested in a fixed annuity is protected from market fluctuations, meaning the investor is guaranteed to receive at least the original amount invested. This feature makes fixed annuities an attractive option for risk-averse investors who prioritize preserving their capital.

- Tax Advantages: In some cases, the interest earned on fixed annuities may be tax-deferred until the income is withdrawn. This can help investors reduce their overall tax liability over time.

Fixed Annuities vs. Other Investments

Fixed annuities are a type of insurance product that guarantees a specific rate of return for a set period. They are often compared to other investments like bonds, CDs, and stocks. Understanding the key differences between these options can help you decide if a fixed annuity is the right choice for you.

Risk, Return Potential, and Liquidity

Fixed annuities, bonds, CDs, and stocks all have different risk, return potential, and liquidity characteristics.

- Fixed Annuities: Offer a guaranteed rate of return, making them relatively low-risk investments. However, they also have limited growth potential compared to other options. Additionally, you might face penalties for withdrawing your money before a certain period.

- Bonds: Bonds are considered a safer investment than stocks, but they carry more risk than fixed annuities. They offer a fixed interest rate and are less liquid than CDs.

- CDs: CDs provide a fixed interest rate for a specific period. They are less risky than stocks but have lower potential returns than bonds. They are generally more liquid than fixed annuities.

- Stocks: Stocks offer the potential for higher returns but also carry the highest risk. They are not guaranteed to generate income and are subject to market fluctuations.

Factors to Consider Before Investing

Before you decide whether a fixed annuity is right for you, it’s crucial to understand your financial goals and risk tolerance. Fixed annuities are not a one-size-fits-all solution and may not be suitable for everyone.

Investment Goals and Risk Tolerance

It’s important to consider your financial goals and risk tolerance before investing in a fixed annuity. For example, if you’re looking for a guaranteed return on your investment, a fixed annuity may be a good option. However, if you’re willing to take on more risk in the hopes of earning a higher return, you may want to consider other investment options.

Key Factors to Consider When Choosing a Fixed Annuity

- Interest Rates: Fixed annuities offer a guaranteed interest rate for a set period. This rate can vary depending on the annuity provider and the length of the contract. When choosing a fixed annuity, it’s important to compare interest rates from different providers to ensure you’re getting the best possible return.

- Surrender Charges: Surrender charges are fees that you may have to pay if you withdraw your money from the annuity before the end of the contract term. These charges can be substantial, so it’s important to understand the surrender charge schedule before investing in a fixed annuity.

- Fees: Fixed annuities may have various fees, such as administrative fees, mortality and expense charges, and riders. These fees can impact your overall return, so it’s important to carefully review the fee schedule before investing.

Comparing Fixed Annuity Products

Here’s a table comparing different fixed annuity products from various providers, highlighting key features and costs:

| Provider | Interest Rate | Surrender Charge | Fees | Other Features |

|—|—|—|—|—|

| Provider A | 3.00% | 7% in year 1, decreasing annually | $25 per year | Death benefit rider |

| Provider B | 2.75% | 8% in year 1, decreasing annually | $30 per year | Living benefit rider |

| Provider C | 3.25% | 6% in year 1, decreasing annually | $15 per year | Long-term care rider |

It’s important to note that this is just a sample table and actual interest rates, surrender charges, and fees may vary depending on the specific annuity product and the provider.

Risks and Drawbacks of Fixed Annuities

Fixed annuities, while offering guaranteed income and principal protection, aren’t without their drawbacks. It’s essential to understand these potential downsides before committing to a fixed annuity, as they can significantly impact your investment strategy.

Limited Growth Potential

Fixed annuities provide a fixed interest rate, which means your returns are predetermined and unlikely to exceed the rate specified in your contract. This can be a significant drawback, especially during periods of economic growth when other investments may yield higher returns.

For example, if you invest in a fixed annuity with a 3% annual interest rate, your returns will be limited to 3% regardless of how well the stock market performs. In contrast, investing in a stock mutual fund could potentially yield much higher returns, especially during periods of economic growth.

Potential for Inflation Erosion

The fixed interest rate offered by fixed annuities may not keep pace with inflation, eroding the purchasing power of your investment over time.

Imagine you invest $100,000 in a fixed annuity with a 3% interest rate. After 10 years, your investment will have grown to $134,392. However, if inflation averages 2% during that period, the purchasing power of your investment will have declined to $109,542.

Surrender Charges

Many fixed annuities include surrender charges, which are fees imposed if you withdraw your money before a specific period. These charges can be significant, especially during the early years of the contract, and can deter you from accessing your funds when you need them.

Surrender charges are typically highest in the first few years of the contract and gradually decrease over time. For example, a surrender charge might be 10% in the first year, 8% in the second year, and so on.

Market Volatility

While fixed annuities offer principal protection, they are not immune to market volatility. If interest rates rise, the value of your annuity may decrease, potentially impacting your future income stream.

For example, if you invest in a fixed annuity with a 3% interest rate and interest rates rise to 5%, the value of your annuity may decrease, as investors will be seeking higher returns elsewhere.

Comparison Table

| Factor | Fixed Annuities | Other Investment Options (e.g., Stocks, Bonds) |

|---|---|---|

| Growth Potential | Limited, fixed interest rate | Potentially higher, but also more volatile |

| Inflation Risk | Fixed interest rate may not keep pace with inflation | Potentially higher returns can outpace inflation |

| Liquidity | Surrender charges may apply for early withdrawals | Generally more liquid, but subject to market fluctuations |

| Risk | Lower risk, but limited growth potential | Higher risk, but potentially higher returns |

Fixed Annuities and Retirement Planning

Fixed annuities can play a significant role in retirement planning, particularly for individuals seeking guaranteed income streams and protection against market volatility. They offer a stable foundation for retirement income, providing peace of mind during a time when financial security is paramount.

Guaranteed Income Streams, Are fixed annuities a good investment

Fixed annuities provide a guaranteed stream of income for a specified period, typically for life or a set number of years. This predictable income source can be crucial for retirees, ensuring they have a steady flow of funds to cover essential expenses, such as housing, healthcare, and utilities. The guaranteed nature of these payments eliminates the risk of investment losses and provides financial stability during retirement.

“Fixed annuities provide a guaranteed income stream, which can be a valuable tool for retirement planning, especially for those seeking predictable income and protection against market volatility.”

Protecting Against Market Downturns

Fixed annuities offer a safe haven for retirement savings, protecting them from market downturns. Unlike stocks or mutual funds, which can fluctuate in value, fixed annuities guarantee a specific rate of return, shielding your principal from market volatility. This feature is particularly appealing to risk-averse retirees who prioritize preserving their savings and ensuring a consistent income stream.

Meeting Specific Retirement Income Needs

Fixed annuities can be tailored to meet specific retirement income needs, such as:

- Covering Essential Expenses: Fixed annuities can provide a steady stream of income to cover essential living expenses, ensuring a comfortable standard of living in retirement.

- Supplementing Social Security: Fixed annuities can supplement Social Security benefits, providing additional income to enhance retirement lifestyle and financial security.

- Funding Long-Term Care: Fixed annuities can be used to fund long-term care expenses, providing financial protection against the rising costs of assisted living or nursing home care.

Hypothetical Scenario

Let’s consider a hypothetical scenario: Sarah, a 65-year-old retiree, wants to ensure a consistent income stream to cover her essential expenses and supplement her Social Security benefits. She decides to purchase a fixed annuity with a guaranteed annual return of 3%. Sarah invests $100,000 in the annuity, and she receives a guaranteed annual income of $3,000 for the rest of her life. This predictable income stream provides Sarah with financial security and peace of mind, allowing her to enjoy her retirement without worrying about market fluctuations.

“Fixed annuities can provide a guaranteed income stream to cover essential living expenses and supplement Social Security benefits, ensuring financial security and peace of mind in retirement.”

Ultimately, the decision of whether fixed annuities are a good investment for you depends on your individual circumstances, financial goals, and risk tolerance. While they offer the allure of guaranteed income and principal protection, it’s crucial to weigh these benefits against the potential drawbacks, such as limited growth potential and surrender charges. By carefully considering all aspects of fixed annuities and comparing them to other investment options, you can make an informed decision that aligns with your financial aspirations.

Question Bank

What is the minimum amount I need to invest in a fixed annuity?

The minimum investment amount for a fixed annuity varies depending on the provider and the specific annuity product. Some annuities may have minimum investment requirements of a few thousand dollars, while others may have lower thresholds. It’s essential to check with the annuity provider for their specific requirements.

Can I withdraw my money from a fixed annuity before the maturity date?

You can typically withdraw your money from a fixed annuity before the maturity date, but you may incur surrender charges. These charges are designed to compensate the provider for the loss of potential future earnings on the annuity. The surrender charges generally decrease over time, eventually reaching zero. It’s crucial to understand the surrender charge structure before withdrawing your money early.

Are fixed annuities subject to taxes?

Yes, fixed annuities are subject to taxes. The interest earned on a fixed annuity is typically taxed as ordinary income. However, there may be tax advantages associated with certain types of annuities, such as qualified longevity annuity contracts (QLACs). It’s essential to consult with a tax advisor to understand the tax implications of fixed annuities.

While fixed annuities offer guaranteed returns and protection against market fluctuations, they can also be less flexible than other investment options. If you’re looking for potential for higher returns, exploring other avenues like real estate might be a better fit. Investing in investment properties in California could offer significant capital appreciation and rental income, though it requires more hands-on management.

Ultimately, the best investment strategy depends on your individual financial goals and risk tolerance.

Whether fixed annuities are a good investment depends on your individual financial goals and risk tolerance. If you’re seeking steady, guaranteed income, a fixed annuity might be worth considering. However, if you’re looking for potential growth, you might want to explore other options like investing in investment properties in Colorado , which can offer long-term appreciation and rental income.

Ultimately, the best investment strategy is one that aligns with your unique circumstances and objectives.

Whether fixed annuities are a good investment depends on your individual financial goals and risk tolerance. If you’re looking for a steady stream of income, particularly during retirement, fixed annuities can be a good option. However, if you’re seeking higher potential returns, consider investing in real estate, such as Atlanta investment properties , which can offer long-term growth and passive income.

Ultimately, the best investment strategy is one that aligns with your individual circumstances and financial objectives.