Investment Property HELOC A Guide to Financing

Investment property HELOCs, or Home Equity Lines of Credit, offer a unique way to finance real estate investments. Unlike traditional mortgages, HELOCs provide a flexible line of credit that you can draw from as needed, making them a valuable tool for managing and improving your investment properties.

This guide will explore the intricacies of using a HELOC for investment property financing, including its benefits, drawbacks, and important considerations. We’ll compare HELOCs to other financing options, discuss qualification requirements, and delve into the terms and conditions associated with these loans. We’ll also examine the tax implications and potential risks involved, providing you with a comprehensive understanding of this powerful financing tool.

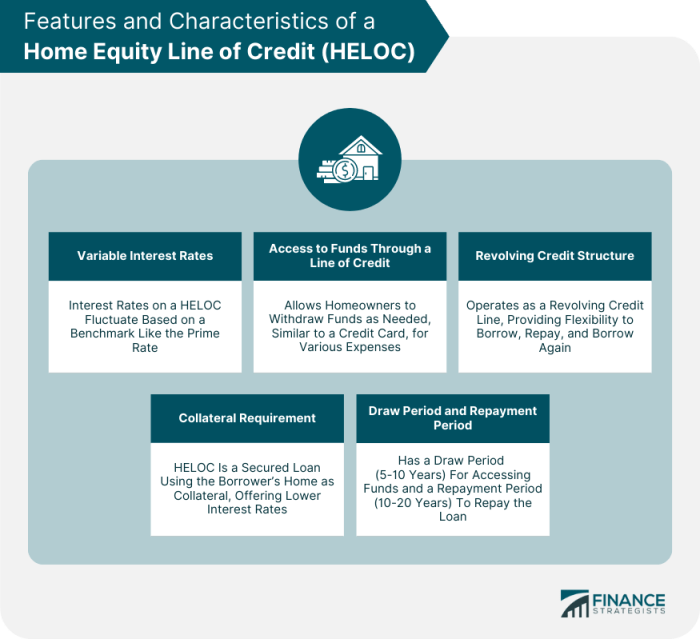

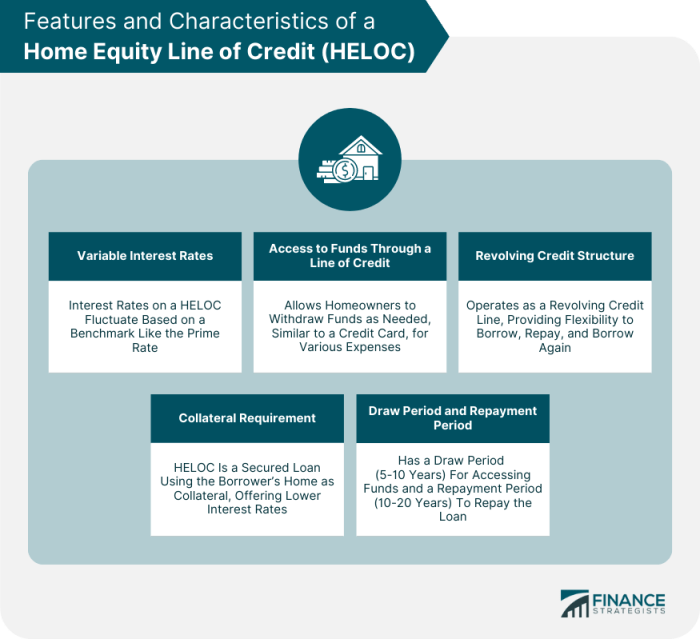

Understanding HELOCs

A Home Equity Line of Credit (HELOC) is a type of loan that allows you to borrow money against the equity you have built up in your home. It works similarly to a credit card, where you can withdraw funds as needed, up to a certain limit, and then pay interest on the amount you borrow.

HELOCs are different from traditional mortgages in several key ways. First, they are typically variable-rate loans, meaning the interest rate can fluctuate over time. Second, they usually have a draw period, during which you can borrow money, and a repayment period, during which you must make regular payments.

Benefits of HELOCs for Investment Property Financing

HELOCs can be a valuable tool for financing investment properties. They offer several benefits, including:

- Lower Interest Rates: HELOCs often have lower interest rates than personal loans or credit cards, making them a more affordable way to borrow money.

- Flexibility: HELOCs allow you to access funds as needed, giving you the flexibility to make repairs, renovations, or purchase additional properties.

- Tax Deductibility: Interest paid on HELOCs used for investment properties may be tax deductible, depending on your specific circumstances.

Using HELOCs for Investment Property Purposes

HELOCs can be used for a variety of investment property purposes, such as:

- Renovations and Repairs: HELOCs can provide the funds necessary to upgrade or repair an investment property, increasing its value and rental income.

- Purchasing Additional Properties: HELOCs can be used as a down payment or to cover closing costs when purchasing additional investment properties.

- Bridging Financing: HELOCs can provide temporary financing while you wait for a permanent mortgage on a new investment property.

Example: Imagine you own a rental property that needs a new roof. You could use a HELOC to finance the repairs, which would increase the property’s value and potentially attract higher-paying tenants.

HELOCs vs. Other Investment Property Financing Options

When financing an investment property, you have several options beyond a traditional mortgage. Home equity lines of credit (HELOCs) are one such option, but they aren’t the only one. It’s essential to understand the pros and cons of various financing options to make an informed decision.

Comparison of HELOCs and Other Investment Property Financing Options

This section will compare HELOCs with other common investment property financing options, including conventional loans, private loans, and hard money loans. We’ll discuss the pros and cons of each option, including interest rates, loan terms, and eligibility requirements.

Conventional Loans

Conventional loans are traditional mortgages offered by banks and credit unions. They are typically fixed-rate loans with terms of 15 or 30 years.

- Pros:

- Lower interest rates compared to other options

- Longer repayment terms

- More readily available

- Cons:

- Stricter eligibility requirements, including credit score and debt-to-income ratio

- Longer approval process

- May require a larger down payment

Private Loans

Private loans are offered by individuals or private lenders, often through online platforms. These loans can be more flexible in terms of loan terms and eligibility requirements, but they typically come with higher interest rates.

- Pros:

- More flexible loan terms

- Less stringent eligibility requirements

- Faster approval process

- Cons:

- Higher interest rates

- Less regulation, which can lead to potential risks

- Limited availability

Hard Money Loans

Hard money loans are short-term loans offered by private lenders, typically to investors who need to close a deal quickly. They are often used for properties that are considered risky or have a short turnaround time.

- Pros:

- Faster approval process

- Available for properties that may not qualify for conventional financing

- Flexible loan terms

- Cons:

- Higher interest rates

- Shorter loan terms

- Higher fees

Situations Where a HELOC Might Be Suitable

A HELOC can be a suitable financing option for investment properties in certain situations. For example:

- Short-Term Financing: If you need financing for a short period, a HELOC’s flexible draw period can be beneficial. You can draw funds as needed and repay them over time.

- Renovations or Improvements: HELOCs can be used to finance renovations or improvements that can increase the value of your investment property. This can be a good option if you don’t want to take out a separate loan for renovations.

- Bridging Financing: A HELOC can be used as bridging financing while you wait for a permanent mortgage to be approved. This can be helpful if you need to close a deal quickly.

Qualifying for a HELOC on an Investment Property

Securing a HELOC for an investment property involves meeting specific eligibility criteria set by lenders. Understanding these requirements is crucial to increase your chances of approval.

Lender Eligibility Requirements

Lenders typically assess several factors when considering your application for a HELOC on an investment property. These factors are designed to gauge your financial stability and ability to repay the loan.

- Credit Score: A strong credit score is a fundamental requirement for obtaining a HELOC. Lenders generally prefer applicants with a credit score of at least 680, as this indicates a history of responsible borrowing. A higher credit score often translates to more favorable loan terms, such as lower interest rates.

- Debt-to-Income Ratio (DTI): Lenders evaluate your DTI, which represents the percentage of your monthly income that goes towards debt payments. A lower DTI indicates a greater ability to manage debt obligations. Lenders typically prefer a DTI below 43%, although this can vary depending on your individual circumstances.

- Income Verification: To ensure you can afford the loan payments, lenders require documentation of your income. This might include pay stubs, tax returns, or bank statements. A stable income history demonstrates your ability to meet financial obligations consistently.

- Property Appraisal: Lenders will conduct an appraisal of the investment property to determine its market value. This helps them assess the loan-to-value (LTV) ratio, which is the percentage of the property’s value that the loan represents. A lower LTV generally leads to more favorable terms.

- Rental History: If you plan to rent out the investment property, lenders may require information about your rental history. This includes details about your tenants, rental income, and any past eviction records. A positive rental history indicates your ability to manage a rental property effectively.

- Investment Property Type: Lenders may have specific guidelines for different types of investment properties. For instance, they may have different requirements for single-family homes, multi-family units, or commercial properties. Understanding these guidelines is crucial for choosing the right type of investment property for your HELOC.

Factors Affecting Creditworthiness

Your creditworthiness plays a vital role in qualifying for a HELOC. Lenders use various factors to assess your credit history and determine your risk level.

- Payment History: Your payment history on existing loans and credit cards is a key factor. A consistent record of timely payments demonstrates responsible financial management and increases your chances of approval.

- Credit Utilization Ratio: This ratio measures the amount of credit you’re using compared to your available credit limit. A lower utilization ratio, typically below 30%, suggests responsible credit management and improves your creditworthiness.

- Credit Mix: Lenders consider the diversity of your credit accounts, such as credit cards, mortgages, and installment loans. A balanced mix indicates a well-rounded credit history and can enhance your credit score.

- Recent Credit Inquiries: Too many recent credit inquiries can negatively impact your credit score. Each inquiry represents a potential loan application, which can signal to lenders that you may be struggling financially.

HELOC Terms and Conditions

HELOCs for investment properties come with specific terms and conditions that borrowers need to understand before committing to a loan. These terms dictate the loan’s structure, repayment obligations, and potential costs associated with the loan.

Draw Period and Repayment Period

The draw period and repayment period are two crucial aspects of a HELOC. The draw period is the initial phase of the loan where you can access the credit line. This period typically lasts for 10 years, but it can vary depending on the lender. During this time, you can borrow funds as needed, up to the approved credit limit. The repayment period follows the draw period and is the time when you are obligated to repay the borrowed funds. This period typically lasts for 15-20 years, but it can vary based on the lender’s terms.

Interest Rates, Fees, and Repayment Options

HELOCs for investment properties generally have variable interest rates that fluctuate based on market conditions. This means that your monthly payments can change over time, making it essential to factor in potential rate increases when budgeting.

- Interest Rates: HELOC interest rates are usually based on a benchmark index, such as the prime rate or LIBOR, plus a margin set by the lender. This margin is typically fixed for the duration of the loan. For example, if the prime rate is 7% and the margin is 2%, the interest rate on your HELOC would be 9%.

- Fees: HELOCs can come with various fees, including origination fees, annual fees, and closing costs. These fees can vary significantly depending on the lender, so it’s crucial to compare different options and factor these costs into your overall budget.

- Repayment Options: HELOCs typically offer flexible repayment options, such as fixed monthly payments, interest-only payments, or a combination of both. Fixed monthly payments provide a predictable budget, while interest-only payments can be more affordable initially, but you will end up paying more interest over the long term. It’s important to choose a repayment option that aligns with your financial goals and risk tolerance.

Using a HELOC for Investment Property Management: Investment Property Heloc

A HELOC can be a valuable tool for managing and improving an investment property. It provides access to funds that can be used for a variety of purposes, from covering ongoing expenses to making significant upgrades.

Using a HELOC for Ongoing Expenses

A HELOC can be a convenient way to finance ongoing expenses associated with your investment property, such as property taxes, insurance premiums, and routine maintenance. This can be particularly helpful when unexpected costs arise or when you need to budget for regular expenses.

- Property Taxes: Property taxes can vary significantly depending on the location and value of your property. A HELOC can provide the necessary funds to cover these taxes, ensuring you avoid late penalties or potential foreclosure.

- Insurance Premiums: Maintaining adequate insurance coverage is crucial for protecting your investment. A HELOC can help you pay for insurance premiums, including homeowners, liability, and rental property insurance.

- Maintenance and Repairs: Investment properties require regular maintenance and occasional repairs. A HELOC can provide the funds to address these needs promptly, preventing minor issues from escalating into major problems.

Using a HELOC to Enhance the Value of an Investment Property

A HELOC can be used strategically to improve the value of your investment property, making it more attractive to tenants and potentially increasing its resale value.

- Renovations and Upgrades: Investing in renovations and upgrades can significantly enhance the value of your property. A HELOC can provide the capital to remodel kitchens and bathrooms, upgrade appliances, improve landscaping, or add new features like a deck or patio.

- Energy Efficiency Improvements: Energy-efficient upgrades, such as installing new windows, insulation, or solar panels, can reduce operating costs and make your property more appealing to environmentally conscious renters. A HELOC can fund these improvements, leading to long-term cost savings.

- Marketing and Advertising: A HELOC can be used to finance marketing and advertising campaigns to attract tenants and increase occupancy rates. This could involve creating professional listings, utilizing online platforms, or running targeted advertisements.

Tax Considerations for HELOCs on Investment Properties

Understanding the tax implications of using a HELOC for an investment property is crucial for maximizing your financial benefits. While a HELOC can provide flexible financing for your investment, it’s important to be aware of how interest payments and other related expenses may affect your tax liability.

Interest Deductibility, Investment property heloc

The interest paid on a HELOC used to acquire, improve, or maintain an investment property may be deductible for tax purposes. However, there are specific rules and limitations that apply.

- Investment Property Usage: The interest deduction is generally allowed for HELOCs used for investment properties that generate rental income. This includes properties rented out for residential or commercial purposes.

- Debt Limit: The amount of interest you can deduct is limited to the debt incurred for the investment property, up to a certain threshold. The maximum amount of debt eligible for interest deduction is typically based on the fair market value of the property.

- Home Equity Debt: If you use a HELOC for both investment property and personal expenses, you need to allocate the interest expense based on the portion of the debt used for each purpose. Only the portion allocated to the investment property qualifies for deduction.

The interest deduction for investment property HELOCs is subject to various rules and limitations. It’s essential to consult with a tax professional for specific guidance tailored to your circumstances.

Tax Benefits and Considerations

The tax implications of using a HELOC for an investment property can vary depending on your individual circumstances and the specific rules in your jurisdiction. Here are some key factors to consider:

- Tax Brackets: The tax benefit of interest deductions is more significant for individuals in higher tax brackets, as they save more on their tax liability.

- Rental Income: The interest deduction can offset rental income, reducing your taxable income and potentially lowering your overall tax burden.

- Depreciation: You may be able to claim depreciation on your investment property, which can further reduce your taxable income. This depreciation expense can be offset against rental income and other expenses, including interest paid on the HELOC.

- Capital Gains: When you sell your investment property, any capital gains realized are generally taxable. However, the interest deduction you claimed over the years can help reduce the taxable capital gains.

Risks and Considerations

While HELOCs can be a valuable tool for financing investment properties, it’s crucial to understand the associated risks and carefully consider their implications. This section will Artikel potential risks, the importance of financial planning, and the consequences of defaulting on a HELOC loan.

Financial Planning and Budgeting

Careful budgeting and financial planning are essential when using a HELOC for investment properties. Failing to plan adequately can lead to unforeseen financial burdens and potentially jeopardize your investment.

- Accurate Income and Expense Projections: Develop realistic income and expense projections for your investment property, considering factors like rental income, property taxes, insurance, maintenance, and vacancy rates. This helps you estimate your monthly payments and ensure you can afford them.

- Emergency Fund: Having an emergency fund dedicated to covering unexpected expenses related to your investment property is crucial. Unforeseen repairs, tenant issues, or market fluctuations can arise, and a financial buffer can help you avoid defaulting on your HELOC.

- Interest Rate Fluctuations: HELOC interest rates are variable, meaning they can change over time. Factor in potential interest rate increases when budgeting, and consider the impact on your monthly payments.

Consequences of Defaulting

Defaulting on a HELOC loan can have severe consequences, potentially impacting your credit score, financial stability, and ownership of your investment property.

- Foreclosure: If you fail to make payments on your HELOC, the lender may initiate foreclosure proceedings, leading to the loss of your investment property.

- Credit Score Damage: Defaulting on a HELOC will significantly damage your credit score, making it challenging to obtain future loans or financing.

- Legal Action: Lenders may pursue legal action to recover the outstanding debt, potentially resulting in additional financial burdens and legal fees.

Understanding the nuances of investment property HELOCs is crucial for any investor seeking to leverage their existing equity for growth. By carefully considering the benefits, drawbacks, and potential risks, you can make informed decisions that align with your investment goals. Whether you’re planning renovations, purchasing additional properties, or simply managing ongoing expenses, a HELOC can be a valuable tool in your investment portfolio.

FAQ Section

What are the main differences between a HELOC and a traditional mortgage?

A HELOC is a revolving line of credit secured by your home’s equity, allowing you to borrow funds as needed up to a pre-approved limit. Traditional mortgages, on the other hand, provide a fixed loan amount with a set repayment schedule. HELOCs offer flexibility and potential tax benefits but come with variable interest rates and a draw period.

Can I use a HELOC to purchase an investment property in a different state?

While it’s possible to use a HELOC to purchase an investment property in a different state, lenders may have specific requirements or restrictions. It’s essential to consult with a mortgage lender to determine eligibility and any potential limitations.

What happens if I default on my HELOC loan?

Defaulting on a HELOC loan can have serious consequences, including foreclosure on your primary residence. Lenders may also pursue legal action to recover the outstanding debt. It’s crucial to carefully manage your finances and ensure you can make timely payments.

A HELOC on an investment property can be a powerful tool for financing renovations or acquiring additional properties. It’s worth noting that some investors also explore options like obtaining a green card through property investment , which could offer long-term benefits. However, before making any decisions, it’s crucial to carefully analyze the financial implications and potential risks associated with both strategies, ensuring they align with your investment goals.

An investment property HELOC can be a great way to finance your next real estate venture, especially if you’re considering a property in a location with high potential for appreciation. If you’re looking for a strong market to invest in, you might want to check out portugal property investment , which has seen consistent growth in recent years.

Once you’ve found your ideal property, an HELOC can help you leverage your existing equity to secure the necessary funds for your investment.

An investment property HELOC can be a powerful tool for acquiring and improving your real estate portfolio. If you’re considering a property in a thriving market like Orlando investment property , a HELOC can provide the flexibility to make necessary renovations or upgrades that increase your property’s value and rental income potential. This strategy can help you maximize your return on investment and build a solid real estate portfolio over time.