Managed Investment Accounts A Guide to Professional Portfolio Management

Managed investment accounts are becoming increasingly popular as investors seek professional guidance and hands-on management of their portfolios. These accounts provide a structured approach to investing, with experienced advisors overseeing your assets and making strategic decisions on your behalf. This can be particularly beneficial for individuals who lack the time, expertise, or desire to manage their investments themselves.

The process typically involves a comprehensive assessment of your financial goals, risk tolerance, and investment preferences. Your advisor will then create a customized portfolio tailored to your specific needs, which may include a diverse mix of stocks, bonds, mutual funds, and other asset classes. They will actively monitor your portfolio and make adjustments as necessary to align with market conditions and your evolving financial objectives.

What are Managed Investment Accounts?

Managed investment accounts, also known as discretionary investment accounts, are investment accounts where a professional financial advisor manages your investments on your behalf. They make investment decisions based on your financial goals, risk tolerance, and investment objectives. This hands-off approach can be particularly beneficial for investors who lack the time, expertise, or interest in managing their own portfolios.

Key Features and Benefits of Managed Investment Accounts

Managed investment accounts offer several key features and benefits that can make them an attractive option for investors.

- Professional Expertise: Managed investment accounts leverage the knowledge and experience of professional financial advisors who are trained to analyze market trends, select investments, and manage risk. They have access to a wider range of investment opportunities and tools than individual investors typically do.

- Personalized Investment Strategies: Financial advisors create personalized investment plans tailored to your specific financial goals, risk tolerance, and investment time horizon. This ensures your investments are aligned with your individual needs and objectives.

- Portfolio Diversification: Managed investment accounts typically involve a diversified portfolio of assets, including stocks, bonds, real estate, and other investments. Diversification helps to reduce risk by spreading investments across different asset classes, mitigating the impact of any single investment’s performance.

- Ongoing Monitoring and Management: Financial advisors actively monitor your portfolio and make adjustments as needed based on market conditions, your financial goals, and any changes in your circumstances. This ensures your investments stay on track and adapt to evolving market dynamics.

- Reduced Stress and Time Commitment: Managed investment accounts allow you to delegate the responsibility of managing your investments to a professional, freeing up your time and reducing the stress associated with making investment decisions.

Types of Managed Investment Accounts

There are several types of managed investment accounts, each catering to different investment needs and preferences.

- Robo-Advisors: These are automated platforms that use algorithms to create and manage investment portfolios based on your risk tolerance and financial goals. They typically offer low fees and are accessible to a wide range of investors.

- Traditional Financial Advisors: These are human advisors who provide personalized investment advice and portfolio management services. They typically charge higher fees than robo-advisors but offer more personalized attention and guidance.

- Family Offices: These are private wealth management firms that cater to high-net-worth individuals and families. They offer comprehensive financial services, including investment management, estate planning, and tax advice.

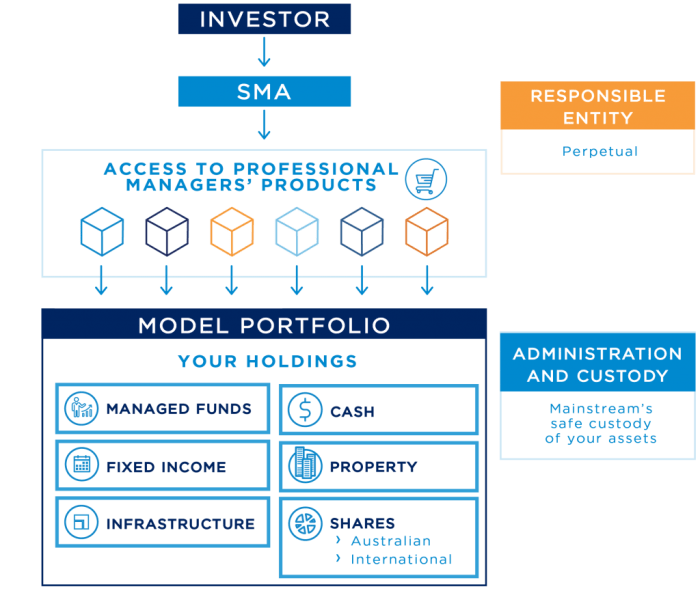

How Managed Investment Accounts Work

Managed investment accounts provide a hands-off approach to investing, allowing individuals to benefit from the expertise of professional investment advisors. The process involves several key steps, from account setup to ongoing management and strategy adjustments.

Setting Up a Managed Investment Account

Setting up a managed investment account involves a series of steps to ensure a smooth and efficient process.

- Choosing an Investment Advisor: The first step is to select a reputable and qualified investment advisor. This involves researching potential advisors, considering their experience, investment philosophy, and fees.

- Defining Investment Goals: The advisor will work with you to establish your investment objectives, risk tolerance, and time horizon. This helps them create a personalized investment plan aligned with your financial aspirations.

- Funding the Account: Once you have chosen an advisor and defined your goals, you will need to fund the account. This involves transferring funds from your bank account or other investment accounts to the managed investment account.

The Role of the Investment Advisor

Investment advisors play a crucial role in managing your investments and ensuring they align with your financial goals. They are responsible for:

- Developing an Investment Strategy: Based on your goals, risk tolerance, and market conditions, the advisor will create a comprehensive investment strategy. This involves selecting specific assets, such as stocks, bonds, and real estate, and allocating your funds accordingly.

- Monitoring and Adjusting the Portfolio: Investment advisors constantly monitor market conditions and economic trends to ensure your portfolio remains aligned with your goals. They may adjust the asset allocation or make trades to capitalize on opportunities or mitigate risks.

- Providing Financial Advice: Investment advisors offer ongoing guidance and advice on various financial matters, such as tax planning, retirement planning, and estate planning. They act as your trusted financial partner, helping you make informed decisions.

Investment Strategies in Managed Investment Accounts

Investment advisors employ a variety of strategies to manage your investments effectively.

- Active Management: This approach involves actively trading securities to capitalize on market opportunities and outperform market benchmarks. Active managers use their expertise and research to identify undervalued assets and make strategic trades.

- Passive Management: Passive management focuses on tracking a specific market index, such as the S&P 500. This approach aims to replicate the performance of the index without actively trading securities.

- Quantitative Strategies: These strategies rely on mathematical models and algorithms to identify investment opportunities and manage risk. They often use data analysis and statistical techniques to make investment decisions.

Advantages of Managed Investment Accounts

Managed investment accounts offer numerous benefits that can significantly enhance your investment journey. By entrusting your portfolio to experienced professionals, you can gain access to a wide range of advantages that may not be readily available through traditional investment methods.

Professional Portfolio Management

Professional portfolio managers possess extensive knowledge and expertise in financial markets. They constantly monitor market trends, analyze investment opportunities, and make informed decisions to optimize portfolio performance.

- Expertise and Experience: Professional managers have a deep understanding of financial markets, investment strategies, and risk management. They leverage their experience to navigate complex market conditions and identify profitable investment opportunities.

- Objectivity and Discipline: Emotional biases can cloud judgment and lead to impulsive investment decisions. Professional managers bring objectivity and discipline to portfolio management, ensuring that decisions are based on sound financial principles rather than emotions.

- Diversification: A well-diversified portfolio is crucial for mitigating risk. Professional managers understand the importance of diversification and allocate investments across different asset classes, sectors, and geographies to reduce the impact of market volatility.

- Investment Research and Analysis: Professional managers have access to sophisticated research tools and data that enable them to conduct thorough due diligence on potential investments. They analyze company financials, industry trends, and macroeconomic factors to make informed investment decisions.

- Personalized Investment Strategies: Professional managers tailor investment strategies to meet individual investor goals, risk tolerance, and time horizons. They develop personalized investment plans that align with your financial objectives.

Access to Alternative Investments

Managed investment accounts often provide access to alternative investments, such as private equity, hedge funds, and real estate, which may not be readily available to individual investors. These investments can offer unique opportunities for diversification and potential higher returns.

- Private Equity: Private equity investments involve investing in privately held companies, often with the goal of improving operations and increasing value before eventually selling the company or taking it public.

- Hedge Funds: Hedge funds use sophisticated investment strategies, including leverage, short-selling, and arbitrage, to generate returns that may not be correlated with traditional market movements.

- Real Estate: Real estate investments can provide diversification and potential income streams through rental properties or appreciation in value.

Convenience and Time Savings

Managing your own investments can be time-consuming and demanding. With a managed investment account, you delegate the responsibility of portfolio management to professionals, freeing up your time for other pursuits.

- Time Efficiency: You can save countless hours by avoiding the need to research, analyze, and execute investment decisions.

- Reduced Stress: Entrusting your investments to experienced professionals can alleviate the stress and anxiety associated with market volatility.

- Simplified Investment Process: Managed investment accounts streamline the investment process, making it easier to manage your portfolio and track your progress.

Tax Optimization

Professional managers can help you optimize your tax liability through strategic investment decisions and tax-efficient strategies.

- Tax-Loss Harvesting: Professional managers can identify and utilize tax-loss harvesting strategies to offset capital gains and reduce your overall tax burden.

- Tax-Efficient Portfolio Construction: Managers can structure your portfolio to minimize tax implications, considering factors such as tax rates and investment holding periods.

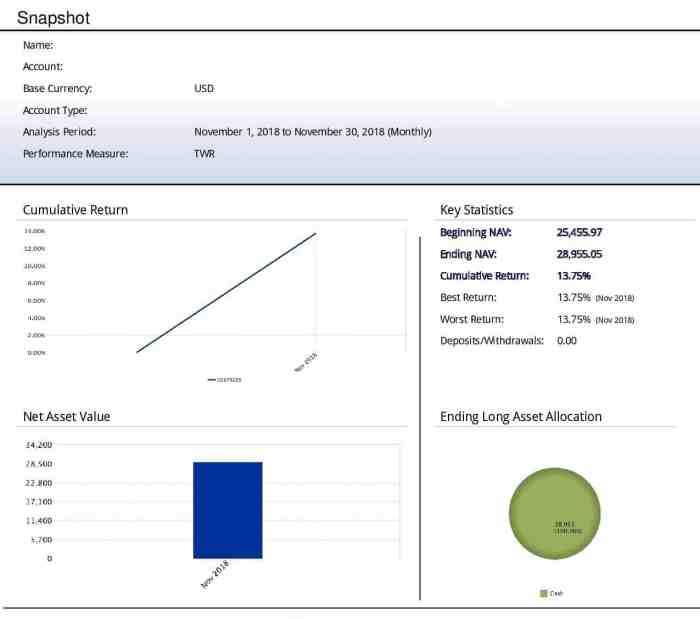

Regular Reporting and Communication

Managed investment accounts typically provide regular reports and communication updates, keeping you informed about your portfolio performance and investment strategy.

- Transparency and Accountability: Regular reports provide transparency into your portfolio holdings, performance metrics, and investment decisions.

- Personalized Communication: You can communicate directly with your portfolio manager to discuss your investment goals, concerns, and any questions you may have.

Disadvantages of Managed Investment Accounts

While managed investment accounts offer various benefits, they also come with certain drawbacks. These accounts involve costs, potential risks, and a lack of complete control over your investments. It’s crucial to weigh these factors carefully before deciding if a managed investment account is right for you.

Costs Associated with Managed Investment Accounts

Managed investment accounts typically involve various fees, which can significantly impact your returns. These fees can be categorized into two main types:

- Advisory Fees: These fees are charged by the investment advisor for their services, such as portfolio management, research, and financial planning. Advisory fees can be structured as a percentage of your assets under management (AUM), a flat fee, or a combination of both. For example, an advisor might charge a 1% annual fee on your AUM, meaning you’ll pay $1,000 per year if you have $100,000 invested.

- Trading and Transaction Costs: These fees cover the expenses associated with buying and selling securities. They include brokerage commissions, exchange fees, and other trading-related charges. The specific costs will vary depending on the investment advisor and the type of securities traded.

It’s essential to carefully review the fee structure of any managed investment account before making a decision. High fees can eat into your investment returns, so it’s crucial to find an advisor who offers competitive and transparent pricing.

Risks Involved in Managed Investment Accounts

While managed investment accounts aim to mitigate risk, they don’t eliminate it entirely. Some potential risks associated with these accounts include:

- Performance Risk: Even experienced investment advisors can’t guarantee returns. Market fluctuations and other unforeseen events can negatively impact portfolio performance. The advisor’s track record and investment strategy should be carefully considered before entrusting your money.

- Investment Style Mismatch: An investment advisor’s approach may not align with your risk tolerance, investment goals, or time horizon. This mismatch can lead to suboptimal returns or excessive risk exposure. It’s important to find an advisor whose investment philosophy and approach are compatible with your needs.

- Advisor Conflicts of Interest: Investment advisors may have incentives to recommend specific investments that benefit them financially, even if those investments are not in your best interest. Transparency and disclosure of any potential conflicts of interest are crucial considerations.

It’s essential to understand the risks involved and carefully vet any potential investment advisor before entrusting them with your money.

Choosing a Managed Investment Account: Managed Investment Accounts

Selecting the right managed investment account is crucial for achieving your financial goals. It involves carefully considering various factors, understanding the different types of investment advisors, and finding a reputable and qualified professional.

Factors to Consider When Choosing a Managed Investment Account

Before choosing a managed investment account, it’s essential to evaluate several factors to ensure it aligns with your investment objectives, risk tolerance, and financial situation.

- Investment Philosophy and Strategy: Understand the advisor’s approach to investing, including their investment philosophy, asset allocation strategies, and risk management techniques. This ensures their approach is compatible with your investment goals and risk tolerance.

- Fees and Expenses: Compare the fees charged by different advisors, including management fees, performance-based fees, and other expenses. Consider the impact of these fees on your overall returns.

- Experience and Qualifications: Assess the advisor’s experience, qualifications, and track record. Look for professionals with a proven history of success in managing investments similar to yours.

- Client Services and Communication: Evaluate the advisor’s communication style, availability, and responsiveness. Ensure they provide regular updates, clear explanations, and readily address your questions and concerns.

- Transparency and Disclosure: Inquire about the advisor’s investment process, how they select investments, and how they manage conflicts of interest. Look for advisors who are transparent about their strategies and fees.

- References and Testimonials: Request references from previous clients and read online reviews to gain insights into the advisor’s reputation and client satisfaction.

Comparing Investment Advisors and Their Services

Investment advisors offer a range of services and approaches. Understanding the differences can help you choose the right advisor for your needs.

- Robo-Advisors: These automated platforms use algorithms to manage investments based on your risk tolerance and financial goals. They are typically less expensive than traditional advisors but may offer limited customization.

- Traditional Financial Advisors: These professionals provide personalized financial advice and manage your investments based on your individual circumstances. They offer a more hands-on approach but generally charge higher fees.

- Hybrid Advisors: These advisors combine elements of both robo-advisors and traditional advisors, offering technology-driven investment management with personalized financial advice.

Finding a Reputable and Qualified Investment Advisor

Finding a reputable and qualified investment advisor requires research and due diligence.

- Networking and Referrals: Seek recommendations from trusted friends, family members, or colleagues who have experience with investment advisors.

- Professional Organizations: Look for advisors who are members of reputable professional organizations, such as the Certified Financial Planner Board of Standards (CFP Board) or the Chartered Financial Analyst Institute (CFA Institute).

- Online Resources: Use online resources, such as the Securities and Exchange Commission (SEC) Investor.gov website or FINRA BrokerCheck, to verify an advisor’s credentials and check for any regulatory actions or complaints.

- Initial Consultations: Schedule initial consultations with several advisors to discuss your financial goals, investment preferences, and the advisor’s approach.

Managed Investment Accounts for Different Investors

Managed investment accounts can be a valuable tool for a wide range of investors, from those just starting out to seasoned professionals. The key is to understand how these accounts can be tailored to meet specific needs and goals.

Suitability for Different Investor Profiles

Managed investment accounts can be beneficial for various investor profiles. Here’s a breakdown of how these accounts can cater to different investment needs:

| Investor Profile | Benefits of Managed Investment Accounts |

|---|---|

| Beginner Investors | Managed investment accounts can provide guidance and support, especially for those new to investing. They can help build a diversified portfolio and avoid common pitfalls. |

| Busy Professionals | These accounts offer a hands-off approach, allowing professionals to focus on their careers while their investments are managed by experts. |

| Retirement Savers | Managed investment accounts can be used to create a personalized retirement portfolio, tailored to individual risk tolerance and time horizons. |

| High-Net-Worth Individuals | For individuals with substantial assets, managed investment accounts can provide access to sophisticated investment strategies and personalized wealth management services. |

Examples of Using Managed Investment Accounts for Specific Financial Goals

Managed investment accounts can be tailored to achieve various financial goals:

- Retirement Planning: A managed investment account can be used to create a diversified portfolio that aligns with your retirement goals, risk tolerance, and time horizon. The account manager can adjust the portfolio allocation as you approach retirement, potentially shifting to more conservative investments.

- College Savings: Managed investment accounts can be used to fund college education. The account manager can create a portfolio with a longer-term investment horizon, potentially taking on more risk to maximize returns over time.

- Real Estate Investing: Some managed investment accounts offer real estate investment opportunities. These accounts can provide access to professionally managed real estate investments, diversifying your portfolio and potentially generating passive income.

- Estate Planning: Managed investment accounts can be used as part of estate planning strategies. The account manager can help ensure that assets are managed effectively and distributed according to your wishes.

Managed Investment Accounts and Taxes

Investing in a managed investment account can have significant tax implications. It’s crucial to understand how your investments are taxed and how you can manage your tax liability effectively.

Tax Treatment of Investment Gains and Losses

The tax treatment of investment gains and losses in a managed investment account depends on the type of account and the specific investments held.

- Capital Gains: When you sell an investment for a profit, you realize a capital gain. Capital gains are typically taxed at a lower rate than ordinary income. The specific tax rate depends on your income level and the holding period of the investment. Short-term capital gains (held for less than a year) are taxed at your ordinary income tax rate, while long-term capital gains (held for a year or more) are taxed at preferential rates.

- Capital Losses: If you sell an investment for a loss, you realize a capital loss. Capital losses can be used to offset capital gains, reducing your tax liability. If your losses exceed your gains, you can deduct up to $3,000 in capital losses against your ordinary income each year. Any remaining losses can be carried forward to future years.

- Dividends: Dividends paid by companies are typically taxed at preferential rates. The specific tax rate depends on the type of dividend (qualified or non-qualified) and your income level. However, some managed investment accounts may offer tax-efficient strategies to minimize dividend taxes.

- Interest Income: Interest earned on investments, such as bonds, is generally taxed as ordinary income. The tax rate on interest income depends on your income level.

Managing Taxes Related to Managed Investment Accounts

Here are some strategies for managing taxes related to managed investment accounts:

- Tax-Loss Harvesting: This strategy involves selling losing investments to offset capital gains. This can help reduce your overall tax liability. However, it’s important to consult with a tax advisor to ensure you are following the rules and regulations.

- Tax-Efficient Investing: Choosing investments that are tax-efficient can help minimize your tax burden. For example, investing in index funds or ETFs can often result in lower capital gains taxes compared to actively managed funds.

- Tax-Advantaged Accounts: Consider using tax-advantaged accounts, such as traditional or Roth IRAs, to shelter your investments from taxes. These accounts can offer significant tax benefits, depending on your individual circumstances.

- Consult a Tax Advisor: It’s always a good idea to consult with a qualified tax advisor to understand the tax implications of your specific investment strategy. They can help you develop a plan to minimize your tax liability and maximize your investment returns.

The Future of Managed Investment Accounts

The managed investment account industry is constantly evolving, driven by technological advancements and changing investor preferences. As a result, the future of managed investment accounts looks bright, with several emerging trends and innovations poised to shape the industry landscape.

Impact of Technology

Technology is playing a transformative role in the managed investment account industry, leading to increased efficiency, personalization, and accessibility.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms are being used to automate tasks, analyze market data, and personalize investment strategies. For example, robo-advisors leverage AI to create automated investment portfolios based on individual investor risk tolerance and financial goals.

- Big Data Analytics: Big data analytics enables investment managers to gain deeper insights into market trends, investor behavior, and portfolio performance. This allows them to make more informed investment decisions and provide tailored advice.

- Blockchain Technology: Blockchain technology offers enhanced security and transparency in financial transactions. This could lead to more efficient and secure managed investment account platforms in the future.

Managed investment accounts offer a compelling solution for investors seeking professional guidance and a personalized approach to wealth management. By entrusting your assets to experienced advisors, you can potentially benefit from their expertise, market insights, and dedicated oversight. While costs and potential risks should be carefully considered, the advantages of professional portfolio management can be significant, especially for individuals seeking a more hands-off and potentially rewarding investment experience.

Key Questions Answered

What are the typical fees associated with managed investment accounts?

Fees can vary depending on the advisor, account size, and investment strategy. Common fee structures include a percentage of assets under management (AUM), hourly rates, or a combination of both. It’s crucial to understand the fee structure before engaging with an advisor.

How can I find a reputable and qualified investment advisor?

Start by seeking recommendations from trusted sources, such as financial professionals, friends, or family. You can also check online directories and professional organizations, such as the Certified Financial Planner Board of Standards (CFP Board) or the National Association of Personal Financial Advisors (NAPFA). It’s essential to conduct thorough due diligence, including checking credentials, experience, and regulatory history.

Are managed investment accounts suitable for all investors?

While managed investment accounts can be beneficial for many, they may not be the best fit for everyone. Consider your investment goals, risk tolerance, and financial resources. If you have a high net worth, complex financial needs, or prefer a hands-off approach to investing, managed investment accounts may be a good option. However, if you are comfortable managing your own investments and have the time and expertise to do so, traditional investing methods might be more suitable.

Managed investment accounts offer a hands-off approach to growing your wealth, often employing strategies like diversification and asset allocation. If you’re considering real estate as part of your portfolio, Atlanta, GA is a popular market with potential for growth. You can learn more about investment properties Atlanta GA and see if it aligns with your investment goals. Whether you choose real estate or other asset classes, managed investment accounts can help you navigate the complexities of the market and work towards your financial goals.

Managed investment accounts can offer a hands-off approach to building wealth, but for those looking for more direct control, exploring alternative strategies might be appealing. One such option is learning how to buy an investment property with no money, which can be achieved through creative financing methods. This article explores various strategies that can help you achieve this goal.

While these methods might require more effort, they can potentially lead to greater returns and provide a more personalized investment experience compared to managed accounts.

Managed investment accounts can be a great way to diversify your portfolio and achieve your financial goals. If you’re looking for a tangible asset to invest in, consider exploring the potential of property investment near me. Real estate can provide consistent income and long-term appreciation, complementing the growth potential of your managed investment account.